July 8, 2020

The CFO Survey and Firms’ Expectations for the Path Forward

Article by: Brent Meyer, Roisin McCord, and Sonya Ravindranath Waddell

Our inaugural survey saw firms grappling to get their bearings in the midst of the largest shock to economic activity since the Great Depression and heightened uncertainty around the progression of the pandemic. Amid this uncertainty, policymakers are working hard to understand the issues that firms are struggling with and the expectations they hold for the trajectory of the recovery.

The CFO Survey, which was in the field from June 15-26, can provide valuable insight into how the COVID-19 pandemic has impacted firms and what they anticipate over the next 18 months.

For example, take firms’ responses to the open text question of their most pressing concerns. Overwhelmingly, we see firms concerned with flagging demand and declining sales revenue. This concern, combined with unease around the health of the economy, far outweighs concerns about supply chains. This suggests that, on net, firms see COVID-19 as more of a demand shock than a supply shock.

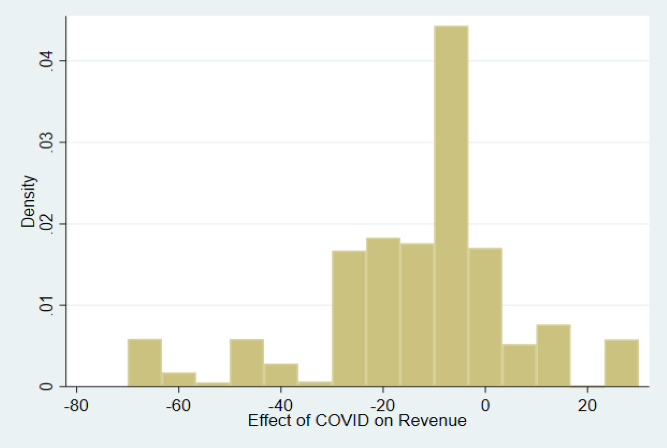

Firms’ concerns about revenue appear well-founded. In a special question we asked this quarter, the average firm expected the COVID-19 pandemic to lower their 2020 sales revenue by nearly 15 percent. As the histogram below shows, these expectations are somewhat diffuse but clearly skewed toward a negative impact. Nearly 10 percent of respondents anticipated the coronavirus pandemic would cut their 2020 sales revenue in half. That said, almost 15 percent of firms anticipated that the coronavirus will boost their sales revenue this year.

For 2020 as a whole, firms anticipated a moderate decline in sales revenue, followed by a sharp rebound in 2021. Digging into the cross-section reveals that nearly 40 percent of firms expected negative revenue growth for 2020, compared with roughly 15 percent in 2021. In fact, firms’ expectations for the calendar year 2020 are dour across a variety of dimensions. However, most firms anticipated that 2021 will be a much better year.

Whether firms anticipate ramping up hiring sharply over the second half of the year is of particular interest to understanding the likely path of the recovery. Should firms aggressively ramp up hiring, the recovery could take something of a “v-shaped” path. Conversely, a slow slog back to pre-COVID employment levels would suggest a more prolonged recovery with more significant labor market disruption.

To gain some insight into firms’ expected employment trajectories, we augmented our standard questionnaire around employment expectations and added extra questions to gauge firms’ employment levels on March 1 (“pre-COVID”) and their current employment levels. The results are shown in the figure below.

Relative to the pre-COVID period, firms’ employment levels are a little more than 5 percent lower on average. Firms anticipate hiring modestly over the second half of the year and then hiring at a stronger pace in 2021. However, these survey results suggest that the pace of hiring over the next 18 months is insufficient to bring the average firm back to its pre-COVID employment level by the end of 2021. As indicated by the interquartile range, there is diversity among our panel but a definite downside tilt. Despite the strong gains we saw in recent employment reports, these results suggest that the path forward for employment is going to be more of a slog than a snap back.

In the future, the unique design of The CFO Survey, which elicits calendar-year expectations rather than rolling 12-month-ahead expectations, will allow us to track how near-term developments and changes in business sentiment alter firms’ expectations over a consistent time period. In other words, should economic conditions deteriorate over the third quarter, we will be able to track changes in firms’ expectations for 2021 as a whole and gain some insight into whether firms see near-term developments as having a lasting impact.

Stay tuned.

Have a question or comment about this article? We'd love to hear from you!

Views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive an email notification when The CFO Survey updates are posted online.