July 14, 2021

Will Recent Cost and Price Increases Persist?

Sonya Ravindranath Waddell, John Graham, Roisin McCord, Brent Meyer, Emil Mihaylov, and Nicholas Parker

With the economy reopening, a combination of increased demand, supply chain disruptions, and reduced labor availability has put upward pressure on firms’ costs to produce goods and provide services. The recent pressure on raw materials costs, particularly, has raised questions around when the consumer-facing prices that the Fed targets will rise. There is evidence of increased price growth in national metrics such as producer price indices, the consumer price index, and the personal consumption expenditures price index. The cost and price pressures are also evident in surveys, such as those from the Federal Reserve Bank of Richmond Surveys of Business Activity and the Federal Reserve Bank of Atlanta Business Inflation Expectations Survey. Yet, as we will document below, even in the current environment, price increases are often seen by businesses as hard to enact and potentially costly and thus price hikes are not typically entered into lightly. A key question, then, when considering price hikes is: how long does a firm expect the elevated cost increases to persist? And what might firms’ expectations of growth and persistence mean for spillovers into the prices that they charge and expect to charge? We find that on average firms expect their cost increases to persist until spring 2022, and although not all firms can pass their cost increases to customers, reported cost and price growth are, in aggregate, highly correlated.

Companies across the nation have been referring to increased costs for months. Responses to The CFO Survey, fielded from June 21 to July 2, were no different. In a special question about input cost increases, about 80 percent of companies say that their input cost increases have recently been larger than normal.

It would be hard to imagine a world in which input cost increases did not translate, at least to some extent, into the prices that firms charge their customers. But, of course, it is not always easy for firms to fully pass cost increases to their customers. When asked, almost 25 percent of firms reported not passing cost increases through to customers. Nonetheless, it is also true that nearly 25 percent reported passing through almost all of these cost increases. In our data, we see that this varies by firm size: Smaller firms appear to have less pricing power than larger firms and thus are less likely to be able to pass through cost increases.

Returning to persistence, the majority of firms anticipate this unusual cost environment to persist for at least seven months with roughly 1 in 4 respondents expecting elevated cost growth to last through most of 2022. The persistence of the expected cost increases varies little by the share that firms report they are passing through to customers. Whether or not they are passing through, companies expect abnormally high cost increases to persist for around eight to 10 months. (See column 2 in the table below.) However, those that are passing through more than 50 percent of the cost increase expect much higher average price changes in 2021 and 2022, and those expected price changes are much more variable. (See columns 3 and 4.)

| Extent of Cost Pass-Through | Expected Persistence of Cost Increases | Average Price Change Expectation (2021) | Average Price Change Expectation (2022) | Number of Respondents (approximate) |

|---|---|---|---|---|

| Not passing through | 9.7 months (4.7) | 3.1% (5.8) | 4.1% (7.0) | 53 |

| Passing less than 25% | 8.5 months (4.8) | 4.6% (3.7) | 4.9% (3.4) | 56 |

| Passing 26-50% | 9.7 months (4.3) | 2.9% (4.2) | 3.5% (5.7) | 35 |

| Passing 51-75% | 9.7 months (4.1) | 26.7% (34.6) | 21.4% (30.8) | 28 |

| Passing 76-100% | 9.2 months (4.7) | 12.1% (16.5) | 4.9% (6.2) | 56 |

The extent to which prices are passing through varies by the firm’s primary customer type. Businesses whose customers are other businesses appear more aggressive in passing through input cost increases. In contrast, firms’ hesitancy to fully pass on costs directly to households/consumers may dampen their overall impact on the aggregate retail prices that define the inflation of direct interest to the Fed.

| Extent of Cost Pass-Through, and Primary Customers |

Consumers/ Households Percent of Firms |

Businesses Percent of Firms |

Government/ Institutions Percent of Firms |

|---|---|---|---|

| Not passing through | 27% | 19% | 17% |

| Passing less than 25% | 18% | 11% | 67% |

| Passing 26-50% | 9% | 15% | 0% |

| Passing 51-75% | 27% | 22% | 0% |

| Passing 76-100% | 18% | 33% | 17% |

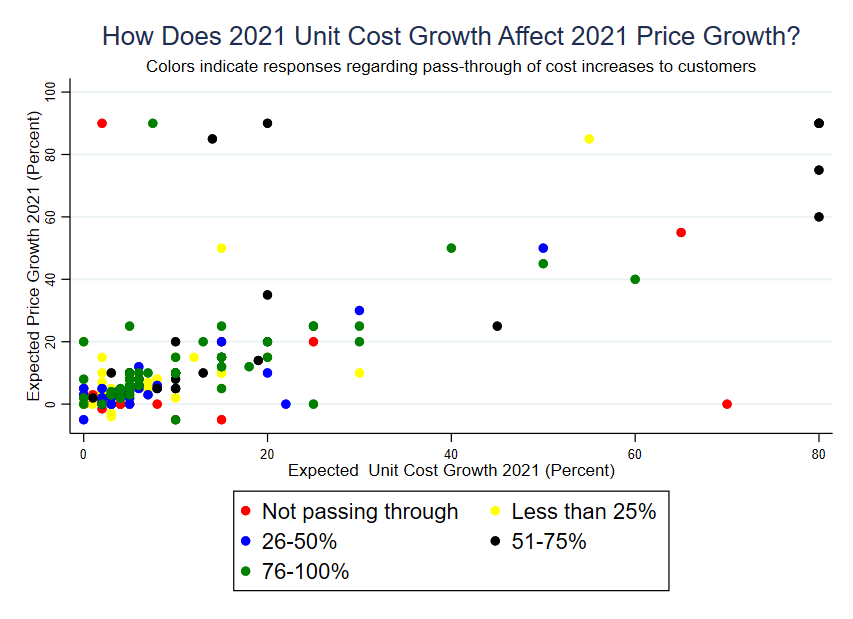

CFO price growth expectations for 2021 have gone up steadily from the first joint fielding of The CFO Survey in the second quarter of 2020 through the second quarter of 2021. One year ago (in the second quarter of 2020), firms did not anticipate much growth in the prices of their primary products in 2021. By the second quarter of 2021, the expected percentage price increase is much higher — with a median of 3.8 percent. Beginning this quarter, The CFO Survey also asked participants about their expected percentage growth in input costs over the calendar years 2021 and 2022. Not surprisingly, input cost and output price growth expectations are highly correlated, with a correlation coefficient of about 80 percent.

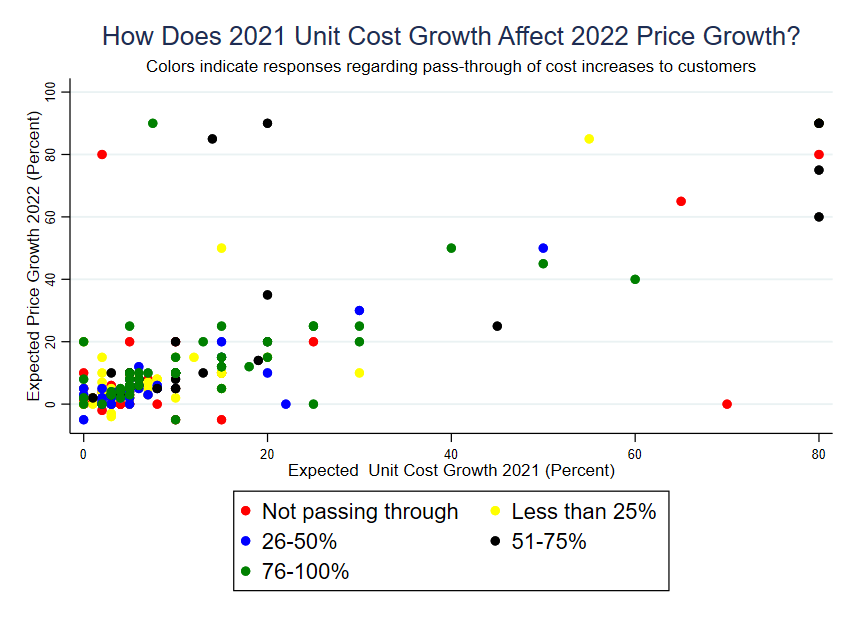

What is more, the correlation between 2021 unit cost growth and 2022 price growth is quite similar to the correlation between 2021 unit cost growth and 2021 price growth. What does this mean? This year’s cost increases are likely to translate into price increases both this year and next year.

The second quarter 2021 CFO Survey shows that the costs firms face often quite quickly affect the prices they charge. What is more, firms anticipate those cost increases to last for months, not weeks; however, firms do not anticipate the increases to last forever.

Receive an email notification when The CFO Survey updates are posted online.