What Do Tariff Concerns Mean for CFOs' Outlooks?

Introduction

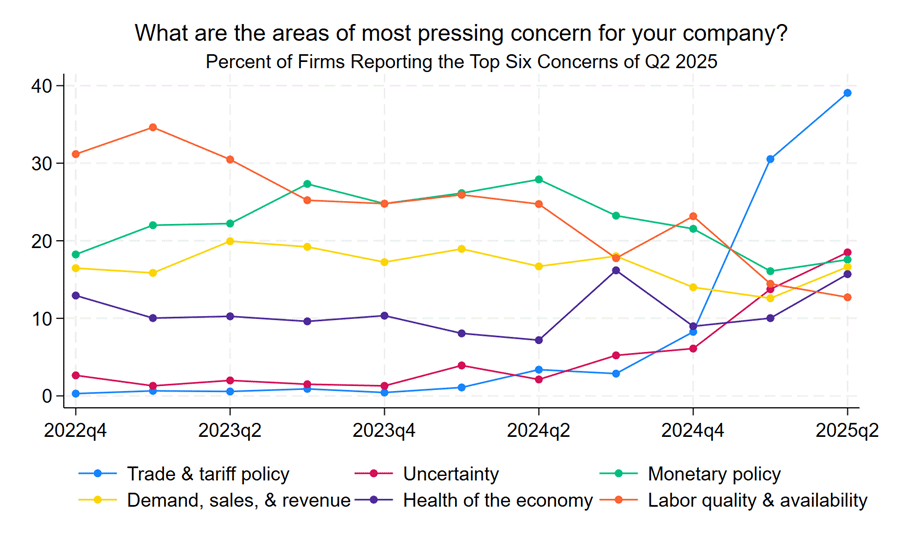

Trade policy has been a central focus of financial markets during 2025, and it remains top of mind among financial decision-makers. When asked for the most pressing concerns facing their firms, nearly 40 percent of respondents to the Q2 CFO Survey cited tariffs or trade policy — compared to 30 percent last quarter (Figure 1). In both surveys, CFOs cited trade policy at least twice as often as any other concern. Last quarter, we examined how firms' sourcing of inputs/supplies from tariff-hit countries impacted their macroeconomic and own-firm expectations. This quarter, we analyze the expectations of tariff-affected firms (the 40 percent citing tariffs as a top concern) and compare them to non-tariff-affected firms (those that do not list tariffs as a top concern).

Tariff-Affected Firms Less Optimistic, Expect Slower GDP Growth

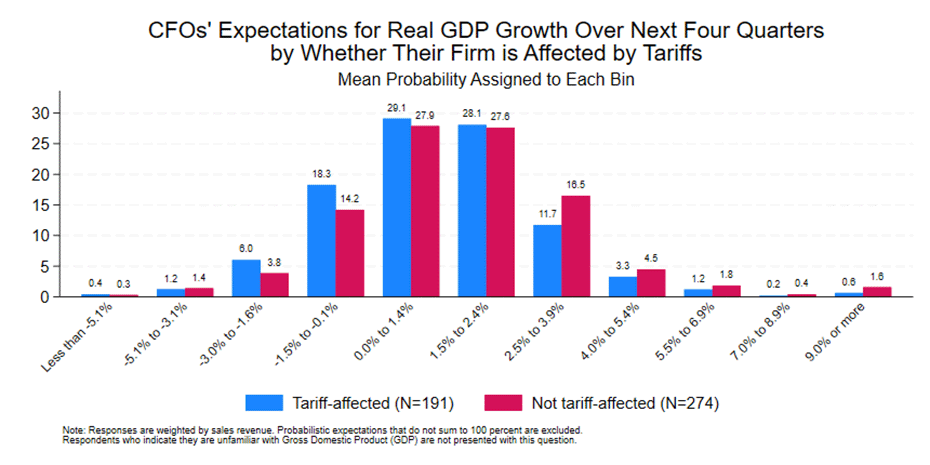

Financial decision-makers' outlooks deteriorated in the second quarter of 2025, and this was particularly the case for CFOs whose firms are affected by trade and tariff policy. Economy-wide optimism for tariff-affected firms averaged 57.5 (versus 63.2 for those not affected), and own-firm optimism averaged 66.2 (versus 69.4). Similarly, while CFOs' expectations for real GDP growth declined overall from last quarter, tariff-affected firms expect GDP to grow by 1.1 percent over the next four quarters, compared to 1.6 percent among non-affected firms. Affected firms also report a 26 percent chance of real GDP contraction (compared to a 20 percent chance among their peers), as shown in Figure 2. This suggests that firms' economic outlooks vary notably depending on whether they are affected by tariffs.

Tariffs Weigh Heavily on Expected Firm Performance

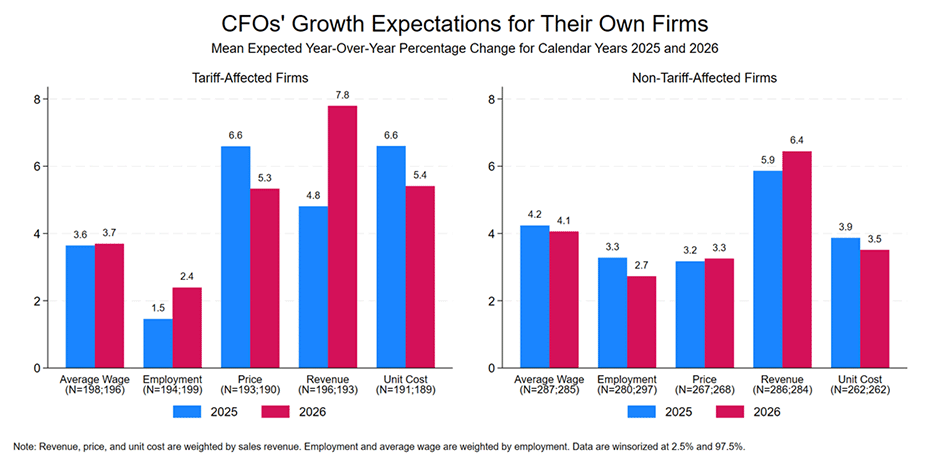

In addition to being less optimistic about the economy and expecting lower real GDP growth, CFOs whose firms are affected by tariffs also report starkly dimmer outlooks for their own firms. Compared to non-affected respondents, tariff-affected firms expect higher input cost growth (6.6 percent growth in unit costs in 2025 vs. 3.9 percent for non-tariff-affected firms) and higher growth in prices for their products and services (6.6 percent vs. 3.2 percent) in 2025. CFOs of affected firms also anticipate growth in costs and prices to remain elevated through 2026. Meanwhile, they anticipate lower revenue growth (4.8 percent vs. 5.9 percent) and employment growth (1.5 percent vs. 3.3 percent) in 2025 (Figure 3). These responses imply that tariff-affected firms expect real revenue growth to shrink in 2025, as expected price growth outpaces projected nominal revenue growth.

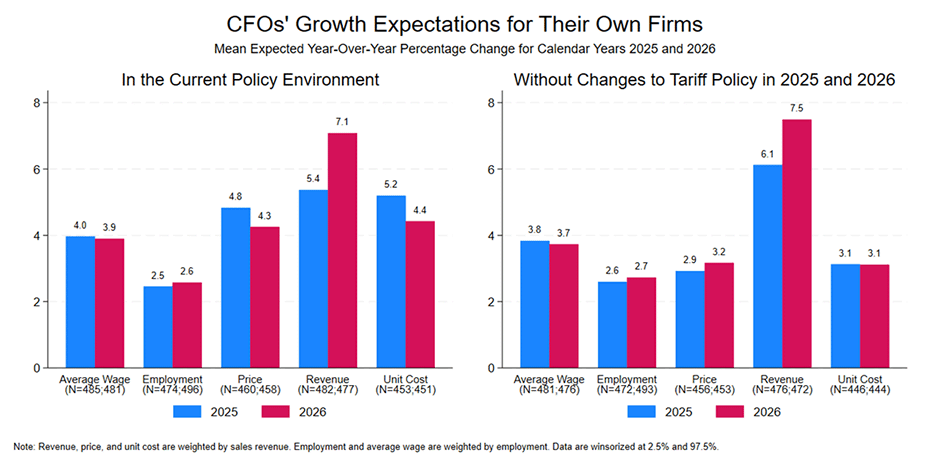

In a special question, we asked firms what their forecasts would have been in the absence of changes to tariff policy in 2025 and 2026. Perhaps unsurprisingly, firms reported that their expected cost and price growth would have been notably lower and their revenue growth somewhat higher absent changes to trade policy. Meanwhile, employment growth projections would have remained nearly unchanged (Figure 4). Firms' expectations for current-year growth in these variables absent changes to trade policy are mostly consistent with their 2025 growth forecasts in last year's Q4 survey.

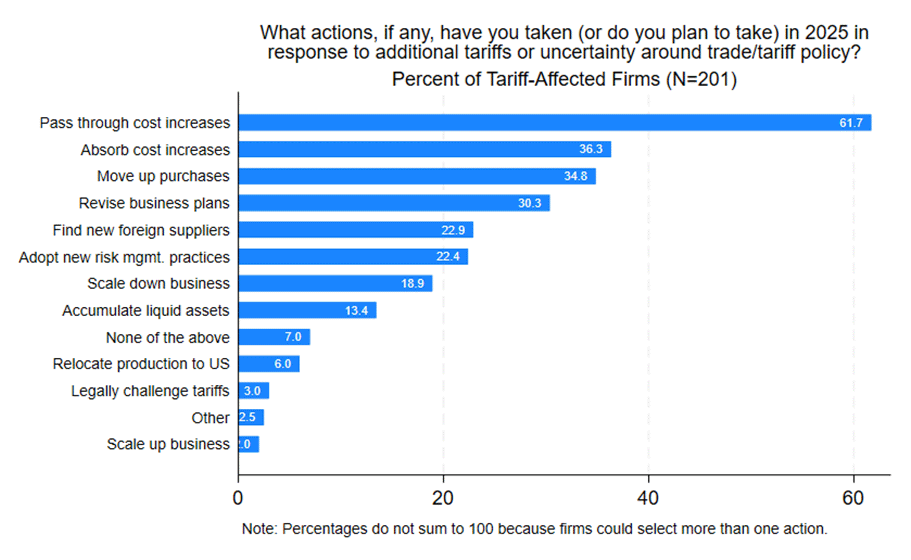

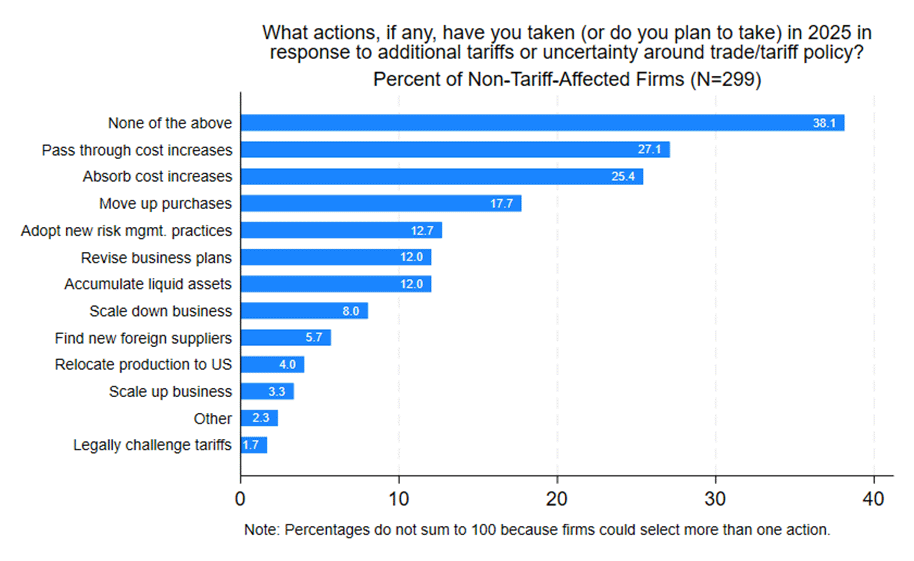

Many Affected Firms Have Taken Action to Mitigate Tariff Impacts

Firms' actions in response to tariffs and trade policy uncertainty differ notably by whether they listed trade as a top concern, as shown in Figures 5 and 6. Around 62 percent of tariff-affected firms have or expect to pass associated cost increases on to their customers, versus 27 percent of non-affected firms. Firms passing through these costs expect to pass much of the price increases on to customers (the median expected pass-through was 100 percent). Additionally, over 30 percent of tariff-affected firms have or expect to absorb some cost increases, move up purchases, and revise their 2025 business plans in response to trade developments. Meanwhile, nearly 40 percent of those not affected by tariffs indicate they would take none of the actions listed in response to trade developments, compared to only 7 percent of tariff-affected firms.

Conclusion

In the Q2 CFO Survey, the largest proportion of respondents (40 percent) report that tariffs and trade policy are among their top concerns. Though firms' economic and own-firm outlooks deteriorated overall, the outlooks of tariff-affected firms are more pessimistic than their non-affected peers. This suggests that while trade policy may affect business conditions broadly, the impact is most substantial among the subset of firms directly affected by tariffs.

Receive an email notification when The CFO Survey updates are posted online.