Anna Kovner, director of research at the Federal Reserve Bank of Richmond, reviews the significant, rapid changes in trade policy, immigration policy, and the size of the federal workforce in 2025. She also discusses how the Richmond Fed has assessed the economic impact of these changes through its research and outreach programs.

Trade and International Economics

Learn about our research and analysis into immigration and migration, trade flows, exchange rates of money and more factors influencing the global economy.

Updating Results

Updating Results

As of October, the average effective tariff rate for the U.S. stood at 11.4 percent, which would be the highest rate since 1943.

Firms' economic outlooks and tariff concerns improved somewhat in the recent CFO Survey, but higher costs and price growth are still expected by firms who import from abroad.

Though tariff uncertainty persists, most Fifth District businesses that are directly affected by tariffs have raised prices, and many plan to raise prices in the coming months.

Zach Edwards and Felipe Schwartzman share what they have learned about how much businesses have been passing along higher prices for their inputs — especially due to higher tariffs in 2025 — to the prices they charge their customers. They also discuss how this cost pass-through could affect overall inflation. Edwards is a research analyst and Schwartzman is a senior economist, both at the Federal Reserve Bank of Richmond.

We are learning from businesses that there are several factors that can delay both the incurring of tariffs and the impact of incurred tariffs on pricing decisions.

Despite the dramatic changes in trade policy, core import prices have risen so far this year, though this growth is lower than during the pandemic period.

John O'Trakoun

Senior Policy Economist

The predicted average effective tariff rate for May was 17.5 percent, but the actual rate turned out to be 8.7 percent.

Marina Azzimonti discusses the complexities of measuring the regional and sectoral impacts of tariffs and reviews the rapid series of changes to U.S. trade policy since the beginning of 2025. Azzimonti is a senior economist and research advisor at the Federal Reserve Bank of Richmond.

Driven by the auto industry, the Palmetto State is a global economic player. How will tariff uncertainty impact its businesses?

Economist Carmen Reinhart discusses the twin financial and currency crises, the future of the dollar, sovereign debt, and more.

Global interconnectedness has been present for decades, as seen by how countries' GDP growth and inflation tend to move together.

Katherine Anderson, Paul Ho and Nathan Robino

Results from the CFO Survey suggest that while trade policy may affect business conditions broadly, firms directly affected by tariffs are impacted most.

An "impact factor" may help estimate how tariffs affect the cost of intermediate inputs used in production.

Marina Azzimonti and Acacia Wyckoff

Once lauded as a model of fiscal discipline, Germany's debt brake now stands at the center of a growing debate over its broader economic consequences.

According to our May business surveys, most firms are responding to tariffs in a variety of ways, including planning and implementing price increases, delaying capital expenditures, and changing hiring plans.

Situations where tariffs provide overall benefits are theoretically possible but appear to be practically limited.

As supply chains respond to shifts in global tariff and trade policies, measurements on the constraints they face could provide clues on how inflation might react.

John O'Trakoun

Senior Policy Economist

Nicolas Morales, Horacio Sapriza, and Chen Yeh take listeners behind the scenes on how they work with detailed, confidential datasets about businesses and individuals. They also discuss how they gain insights on topics like immigration, credit markets, and labor productivity while safeguarding privacy rights. Morales is an economist, Sapriza is a senior economist and policy advisor, and Yeh is a senior economist at the Federal Reserve Bank of Richmond.

Zach Edwards and Daniel Weitz discuss the concerns that chief financial officers across the country reported about their own companies and the national economy in the latest CFO Survey. Edwards is a research analyst on the Regional and Community Analysis team at the Federal Reserve Bank of Richmond and Weitz is survey director at the Federal Reserve Bank of Atlanta.

Firms may source inputs from a variety of suppliers to help avoid weather disrupting their supply chains.

Juanma Castro-Vincenzi, Simon Farbman, Gaurav Khanna, Nicolas Morales and Nitya Pandalai-Nayar

The recent tariff announcement implies that the average effective tariff rate would rise further compared to our previous analysis.

Marina Azzimonti, Zach Edwards, Sonya Ravindranath Waddell and Acacia Wyckoff

Data from the automotive industry seems to suggest car buyers could feel the effects of tariffs sooner rather than later.

John O'Trakoun

Senior Policy Economist

When all 2025 tariff measures are included, the total average effective tariff rate for 2025 reaches 22.2 percent.

Marina Azzimonti, Zach Edwards, Sonya Ravindranath Waddell and Acacia Wyckoff

Calculating the average effective tariff rate can help assess the impact of the proposed tariffs.

Marina Azzimonti, Zach Edwards, Sonya Ravindranath Waddell and Acacia Wyckoff

Our first CFO Survey of 2025 explored the extent to which firms' supplies are imported from countries facing tariffs and how this exposure impacts firms' expectations.

Zach Edwards, Lauren Taylor and Daniel Weitz

In March, we asked Fifth District businesses about the impacts of tariffs. Most expected to be impacted negatively and anticipated passing through some of the additional costs to customers.

Marina Azzimonti, Zach Edwards, Sonya Ravindranath Waddell and Acacia Wyckoff

Fifth District businesses are concerned about tariffs, especially those that source inputs or sell outputs abroad. However, data from our December business surveys suggests little relationship between tariff concerns and firms' 2025 price and cost growth expectations.

Marina Azzimonti discusses the rise in the cost of borrowing for countries following the COVID-19 pandemic and the broader implications of this trend for emerging markets, especially those that don't have strong governmental institutions. Azzimonti is a senior economist and research advisor at the Federal Reserve Bank of Richmond.

Economic shocks can be amplified through supply chains. In response, many firms and policies are aiming to increase supply chain resilience.

Research shows the H-1B program induced Indians to switch to computer science occupations and helped drive the shift in IT production from the United States to India.

Gaurav Khanna and Nicolas Morales

The topics presented included unconventional monetary and fiscal policy, global inflation patterns and worker responses to labor shocks.

Laura Alfaro, a Harvard Business School professor and former Costa Rica cabinet minister, on global supply chains, sentiment about trade, and what the U.S. can learn from Latin America.

David A. Price

Jason Kosakow and Adam Scavette review the economic effects of the collapse of the Francis Scott Key Bridge in Baltimore on the national, regional, and local level. Kosakow is the Richmond Fed's survey director and Scavette is a regional economist at the Bank's branch office in Baltimore.

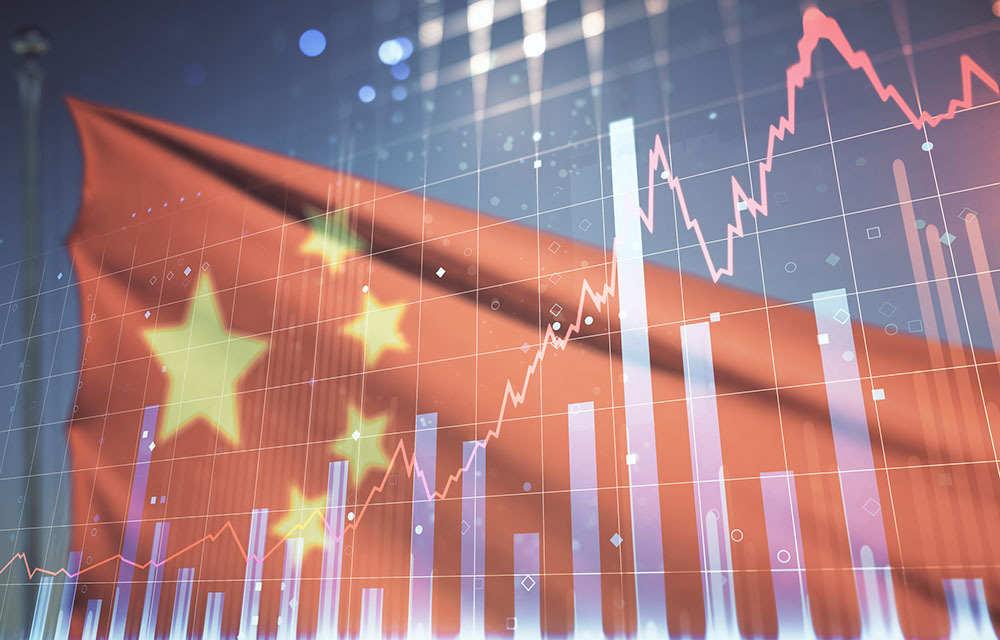

Some think such a trap for China is imminent, due to factors such as a surge in deposits, mounting deflationary pressures and high youth unemployment rates.

Temporary losses look to be severe after the collapse of the Francis Scott Key Bridge and closure of the Port of Baltimore, but there are several reasons to be optimistic about recovery.

Adam Scavette

Regional Economist

While diversification mitigates climate risk, it exacerbates the distributional consequences of climate change by reducing wages in regions prone to frequent shocks.

Juanma Castro-Vincenzi, Gaurav Khanna, Nicolas Morales and Nitya Pandalai-Nayar

We find that technology adoption greatly amplifies the multipliers' magnitudes, and it changes the ranking of priority sectors for industrial policy.

The pattern of r* paths for other countries seem more alike to each other than they are to the U.S.

Thomas A. Lubik, Brennan Merone and Nathan Robino

Had U.S. immigration been more restrictive, the IT sectors in both the U.S. and India might have been worse off.

Gaurav Khanna and Nicolas Morales

Paul Ho talks about how countries are connected to each other through international trade and how these connections help spread economic shocks across the globe. Ho is an economist at the Federal Reserve Bank of Richmond.

Our supply-side explanation for trade policy reveals district and industry-level patterns of winners and losers, central to understanding the political consequences of trade and the backlash against globalization.

Kishore Gawande, Pablo M. Pinto and Santiago Pinto

Researchers covered topics including digital advertising, R&D allocation, production networks, and knowledge creation and diffusion.

John Mullin and Matthew Wells

We analyze the relationship between climate-related disasters and sovereign debt crises using a model with capital accumulation, sovereign default, and disaster risk.

How do credit default swaps (CDS) affect sovereign debt markets? Our baseline specification predicts trading frictions and an inability to short sell bonds significantly improves sovereign debt prices, but policies that restrict CDS trading have small effects.

Gaston Chaumont, Grey Gordon, Bruno Sultanum and Elliot Tobin

Economic disturbances are not confined within the country where they originate; they propagate throughout that country's trading network as both its immediate trading partners and trading partners of trading partners react.

Aubrey George

Improving such restructurings have garnered additional attention as sovereign debt has increased significantly in the past couple of years.

Kushal Patel and Horacio Sapriza

Seemingly small international trade linkages can lead to substantial spillovers across countries, helping explain global comovement in GDP growth and inflation across countries.

In this paper, we use new data on daily firm-to-firm transactions from India, coupled with a large exogenous shock that disrupted supply chains to varying degrees.

Gaurav Khanna, Nicolas Morales and Nitya Pandalai-Nayar

We study how international linkages and nominal price rigidities jointly shape the dynamics of inflation and output across multiple large economies.

In recent weeks, government debt and foreign exchange markets in the U.K. were roiled by a remarkable amount of volatility.

Tariffs, property rights and producing inputs versus buying them: These were among the topics discussed at our recent conference.

As central banks around the world tighten their monetary policies, the U.S. dollar has appreciated significantly compared to other currencies.

John O'Trakoun

Senior Policy Economist

Hard (or large) sovereign defaults have been associated with larger negative economic responses than soft defaults.

Brandon Fuller, Grey Gordon and Pablo Guerron-Quintana

Chang-Tai Hsieh and Tao Zha share their research on China's economy and financial system, and discuss the country's growth during the last decade as well as its recent regulation of private firms and banks. Hsieh teaches at the University of Chicago, while Zha works at the Federal Reserve Bank of Atlanta and Emory University.

Columbia University economist on inflation, capital controls, and finding research topics.

David A. Price

The dollar has been the global currency of choice for nearly a century, but in light of recent U.S.-led financial sanctions, some wonder whether that status will endure.

The wave of sovereign defaults in the early 1980s and the string of debt crises in subsequent decades have fostered proposals involving policy interventions in sovereign debt restructurings. The global financial crisis and the recent global pandemic have further reignited this discussion among academics and policymakers.

Maximiliano Dvorkin, Juan M. Sanchez, Horacio Sapriza and Emircan Yurdagul

Consumers who would benefit from lower tariffs on a good tend to matter more when setting trade policy than producers who want higher tariffs.

Crude oil prices spiked following Russia's invasion of Ukraine, adding to the pricing pressures that were already affecting energy markets. Filling any supply gaps won't be easy.

John O'Trakoun

Senior Policy Economist

The recent removal of several Russian banks from SWIFT has sparked questions about unintended consequences.

Yale University economist on developing countries, measuring economies by satellite, and the learning crisis.

David A. Price

How do financial crises affecting banks in one part of the world ripple through the global economy?

The emergence of a new COVID-19 variant poses risks to next year's economic outlook, especially if a spike in cases leads to supply disruptions in China and higher prices for Chinese imports.

John O'Trakoun

Senior Policy Economist

The authors document significant heterogeneity in immigrant share across employers in Germany, with large firms spending a higher share of their wage bill on immigrants than small firms.

Agostina Brinatti and Nicolas Morales

His Pax Mongolica connected Europe and China, leading to exchanges of technology and culture.

John Mullin

The policies were gradually phased out in many advanced and emerging economies. Will they come back?

John Mullin

Economists at the Richmond Fed analyze the role of dealer-provided liquidity in sovereign credit default swap markets.

John Mullin and Bruno Sultanum

What caused the housing boom and bust of the early 2000s?

Daisuke Ikeda, Toan Phan and Tim Sablik

Trade imbalances are a perennial concern for policymakers and the public. But what does it mean for a country to have a trade surplus or deficit?

While increased global integration required painful adjustments for some workers and communities as well as companies and even entire industries, there have also been significant benefits to this global interconnectedness, including in the Carolinas.

Harvard University economist on risks of financial globalization in developing countries, the role of the nation-state, and local culture in economics

Aaron Steelman

Publications Director

Richmond Fed President Jeffrey M. Lacker discussed workforce development during his speech to Charlotte business leaders on Nov. 5.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

President Jeff Lacker addresses the Global Interdependence Center in Philadelphia, which named him its 2013 Global Citizen.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

In recent years, large positive and negative balances have arisen in TARGET2, the interbank settlement and payments system of the Eurozone. These balances show that the Deutsche Bundesbank, the central bank of Germany, has become a large net creditor to the European Central Bank (ECB).

Thomas A. Lubik and Karl Rhodes