London Calling: Is Turmoil in U.K. Debt Markets the Shape of Things to Come?

Over the course of the last several weeks, government debt and foreign exchange markets in the U.K. were roiled by a remarkable amount of volatility. What caused such turmoil, and is more on the way?

During the week of Sept. 23, the British pound lost 10 percent of its value against the U.S. dollar, then regained it after a few days, as seen in Figure 1 below.

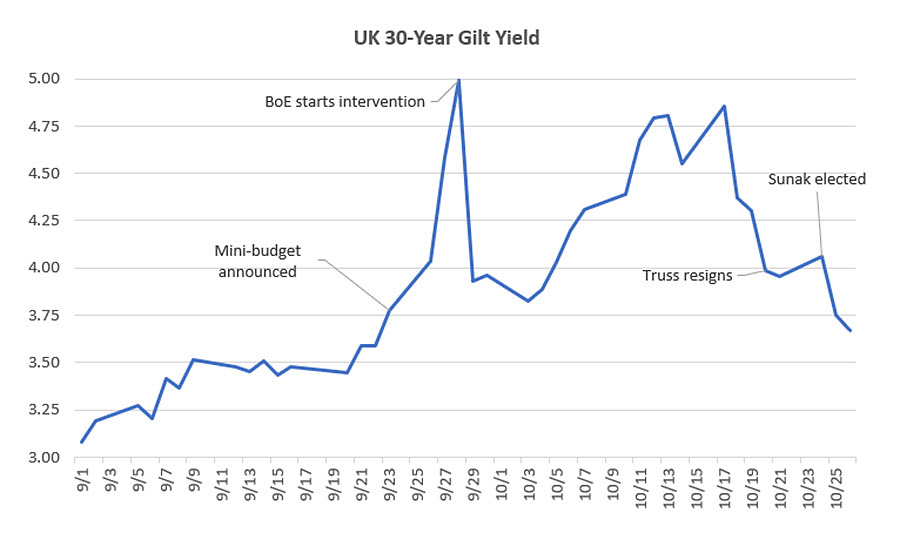

At the beginning of that week, a sell-off of U.K. government bonds (or "gilts") led to spiking interest rates across the maturity structure (as seen in Figure 2 below for the 30-year gilt). However, interest rates largely reverted to their prior levels once British Prime Minister Liz Truss resigned on Oct. 20 and Rishi Sunak succeeded her a few days later.

Some calm had already returned to the bond markets by the time Truss resigned, after the Bank of England announced on Sept. 28 that it would buy gilts to support market functioning. The Bank ended this support on Oct. 14, seemingly without further disruptions in the market.

Nevertheless, investors, policymakers, commentators and economists seem concerned this may not be the last near-term economic turmoil in the U.K. financial markets, especially against a background of energy supply challenges, rising government indebtedness and inflation at 10.1 percent.

Do these events carry significance for the policy and economic environment outside of the U.K.? The proximate cause of the market turmoil was the presentation of a mini-budget by the then-new British government under Truss. It included a combination of tax cuts, additional spending and regulatory measures aimed at improving competitiveness.

None of these measures were entirely unexpected, as Truss campaigned on just such a budget. In this sense, the budget proposal did not constitute news that would imply repricing of assets. However, an alternative interpretation is the occurrence of a sunspot or belief shock, which led market participants to coordinate on actions that weren't necessarily fully warranted by changed economic fundamentals. In this narrative, the temporary measures by the Bank of England prevented validation of such beliefs.

The events of the last few weeks highlighted a structural problem at the heart of the British pension system. Defined benefit pension funds dumped gilts to raise funds to satisfy demand for additional liquidity (so-called margin calls) from their lenders, which triggered the gilt sell-off.

During the extended period of close-to-zero interest rates, pensions funds used leverage — or short-term borrowing for long-term investing — to generate higher returns. As policy rates rose, short-term borrowing became more expensive, and lenders required additional collateral to be posted. The mini-budget was the seeming push that started this downward spiral, as investors became concerned about macroeconomic and fiscal management. But the underlying problem is that the defined-benefit pension plans are underfunded, which monetary and financial policies cannot truly solve.

Another issue is a macroeconomic environment that can generously be described as difficult. Inflation is above 10 percent, while the Bank of England’s policy rates are still far below this level. The pound has been depreciating for several years, putting pressure on import prices. While the recent dollar appreciation is a contributing factor, the weakening currency reflects longer and deep-seated structural problems, such as low productivity growth, an aging population and trade distortions in the wake of Brexit. In combination with a growing debt burden, this volatile mix seemingly spooked financial markets.

These events in the U.K. may hold lessons for other countries in the current environment. Given weakening fundamentals — such as rising indebtedness, political instability and a softening economic outlook — seemingly minor shocks can reveal or trigger financial market vulnerabilities. In turn, financial turmoil feeds back on the economic and political situation, perhaps accelerating the effects of the shock. In the case of the U.K., the Bank of England swiftly stepped in and by all accounts calmed the deteriorating financial outlook. Nevertheless, these vulnerabilities exist in other countries as well, including the U.S.

The coda to this episode is that the recently appointed Chancellor of the Exchequer, Kwasi Kwarteng, was fired on Oct. 14, while Truss stepped down as prime minister on Oct. 22, both arguably victims of the fabled bond market vigilantes. With a new prime minister, foreign exchange and financial markets have now returned to where they were before this episode, as if nothing had happened. The episode has certainly created additional uncertainty for the policy environment and raised the specter of a more difficult path ahead.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.