Scatterplot of Inflation and the Share of Relative Price Increases

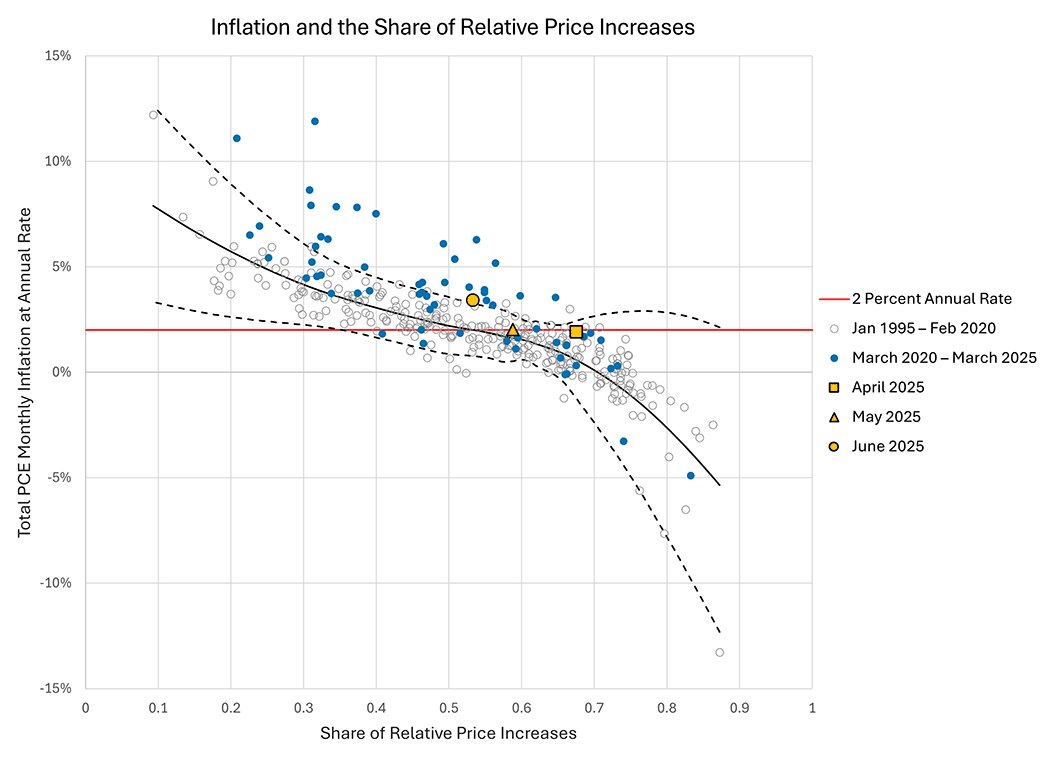

Monthly inflation fluctuates even in the most successful inflation-targeting regime, and we rely on a range of indicators to infer whether monthly inflation is deviating fundamentally from the FOMC's two percent target. The scatterplot of inflation and the share of relative price increases provides one such indicator, because prior to the pandemic — when inflation was generally stable — there was a systematic relationship between inflation and the share of relative price increases. In months when inflation was high, the share of relative price increases was typically low: there were large price increases for items accounting for a small share of expenditures. The inverse was true in months with low inflation.

The Scatterplot of Inflation and the Share of Relative Price Increases indicator was initially developed by economists Andreas Hornstein and Alex Wolman of the Richmond Fed. It has subsequently been expanded in the work cited below in collaboration with Francisco Ruge Murcia of McGill University and Simon Smith of the Federal Reserve Board.

Latest Reading

Last updated on

PCE inflation in December was 4.4% at an annual rate. The share of relative price increases was 0.31. The inflation rate for December was close to its predicted value conditional on the share of relative price increases and the pre-COVID relationship.

Note: Because October CPI data was not collected, the BEA estimated the October price index for each expenditure category as the geometric mean of the September and November indexes. The reported October and November price changes are therefore likely to be smoother than the actual price changes, which were unobserved. This induced smoothness is a reason to take less signal than usual from the October and November data.

How Should I Interpret the Scatterplot of Inflation with the Share of Relative Price Increases?

The scatterplot of monthly inflation and the share of relative price increases provides a simple benchmark for assessing whether monthly inflation is behaving in a manner consistent with the 25 years before the pandemic.

The black solid line in the figure is the predicted inflation rate conditional on the share of relative price increases, estimated by local polynomial regression, using data from January 1995 through February 2020. The dashed lines represent a two-standard-deviation prediction interval. We interpret monthly readings within this interval as suggesting that inflation is behaving as it did prior to the pandemic, in a manner broadly consistent with — or slightly below — the Fed's 2 percent target.

Additional Resources

Hornstein, Andreas, Francisco Ruge-Murcia, and Alexander L. Wolman. "The Relationship Between Inflation and the Distribution of Relative Price Changes." Federal Reserve Bank of Richmond Working Paper No. 24-15, December 2024.

Smith, Simon C., and Alexander L. Wolman. "New Tools to Monitor Inflation in Real Time." Federal Reserve Board of Governors FEDS Notes, Dec. 20, 2024.

Wolman, Alexander L. "Detecting Inflation Instability." Federal Reserve Bank of Richmond Economic Brief No. 23-11, April 2023.

Wolman, Alexander L. "Inflation and Relative Price Changes Since the Onset of the Pandemic." Federal Reserve Bank of Richmond Economic Brief No. 24-09, March 2024.

Wolman, Alexander L. and Francisco Ruge-Murcia. "A Model-Based Perspective on Inflation and the Distribution of Relative Price Changes." Federal Reserve Bank of Richmond Economic Brief No. 24-30, September 2024.

Suggested Citation

Scatterplot of Inflation and the Share of Relative Price Increases, Federal Reserve Bank of Richmond, last modified February 20, 2026, https://www.richmondfed.com/research/national_economy/inflation_share_of_relative_price_increases