Sovereign CDS Dealers as Market Stabilizers

Economists at the Richmond Fed analyze the role of dealer-provided liquidity in sovereign credit default swap markets. Using newly available data from the Depository Trust and Clearing Corporation, they track the positions held by large dealers during crises in Ukraine, Venezuela, and Argentina. The researchers find that large dealers tended to increase their provision of insurance as risk increased during those episodes — a finding that is consistent with the notion that they tend to act as market stabilizers during times of turmoil.

A credit default swap (CDS) is a credit derivative that can be used to insure against the credit risk of a corporate or government bond issuer. It is a contract between an insurance buyer (who takes what is called a "long" CDS position) and an insurance seller (who takes the corresponding "short" CDS position). The insurance buyer agrees to pay the seller a periodic premium, and the insurance seller agrees to compensate the insurance buyer if the bond issuer is determined to have had a "credit event." Credit events are triggered by bankruptcies, failures to pay, and restructurings, among other things.

As a result of their roles in the 2008 financial crisis and subsequent debt crises in Europe, credit default swaps are among the most controversial derivative instruments. CDS proponents attest to the contracts' benefits in both corporate and sovereign contexts. The CDS market allows lenders in the bond market to reduce credit concentrations and meet regulatory goals while maintaining customer relationships. The market also allows for the reallocation of credit risk and liquidity during times of stress. Critics, however, often view the contracts as speculative and potentially destabilizing. They emphasize that CDS contracts are different from ordinary insurance policies covering property. Unlike these common types of insurance, CDS contracts allow their buyers to obtain insurance protection in excess of their exposure to the underlying assets (sovereign bonds in this case). Indeed, CDS contracts allow market participants with pessimistic views about a bond issuer to buy "naked" long CDS positions — meaning that they can take bets against an issuer's creditworthiness without having any underlying exposure to the issuer's bonds.

Policymakers and academics have shown much concern about the effects of sovereign CDS markets on the underlying markets for sovereign bonds. Since CDS markets tend to be more liquid and larger than their corresponding bond markets, some observers have argued that speculative bets from large CDS traders can create unduly negative signals about countries' creditworthiness that spill over into the underlying markets for sovereign bonds. Through this mechanism, speculation in the CDS market may increase borrowing costs for sovereign entities, possibly to the point of effectively shutting off their access to credit during periods of extreme market stress. In these cases, substantial harm can be done to countries' growth prospects and the living standards of their citizens.1 Responding to these concerns, the European Union banned entities from entering into naked sovereign CDS contracts in 2011.2

But large dealers may play a stabilizing role in CDS markets, according to Richmond Fed research by Lawrence Jia, Bruno Sultanum, and Elliot Tobin. They have broken new ground in the literature by exploring the role of dealer-provided liquidity in CDS markets, using data that have only recently become available via the Depository Trust and Clearing Corporation (DTCC) under the Dodd-Frank Wall Street Reform and Consumer Protection Act.3 They employed a case study approach that examined how the positions of major CDS dealers changed around three crises. Specifically, they analyzed the cases of Ukraine, Venezuela, and Argentina — all of which have experienced credit events that triggered CDS payouts since 2008.

In all three case studies, dealers tended to provide liquidity during periods of increasing risk by selling CDS protection. Specifically, as sovereign spreads increased, dealers tended to decrease their net CDS positions, thus becoming bigger net providers of insurance. By acting as classical market makers and taking the opposite position of the market during times of distress, large CDS dealers may have mitigated market volatility.

Data and Methodology

To observe the behavior of large CDS dealers during periods of crisis, Jia, Sultanum, and Tobin built a database of dealer positions and sovereign risk spreads. The researchers obtained data on dealer CDS positions from the DTCC. The Dodd-Frank Act requires real-time reporting of all swap contracts to a registered swap data repository (SDR), and the DTCC operates a registered SDR for credit default swaps. The Dodd-Frank Act also requires SDRs to make all reported data available to appropriate prudential regulators.4 As prudential regulators, Reserve Banks have access to the transactions and position data of CDS market participants that are regulated by the Federal Reserve.

Using the DTCC data, the researchers constructed time series of the average CDS positions of the top ten dealers in the CDS markets for Ukraine, Venezuela, and Argentina from 2013 through early 2018. They identified the top ten dealers based on their trading volumes during the case study periods,5 and they detrended the position data to account for changes in the regulatory landscape that occurred during the periods of analysis.6

To measure risk, the researchers used CDS spreads as proxies for sovereign bond spreads because bond-spread data were unavailable in Ukraine. The researchers were comfortable with using CDS spreads as proxies for bond spreads because of the nearly 100 percent correlation that generally exists between countries' sovereign bond spreads and CDS spreads. The researchers also detrended each country's sovereign bond-spread data.

Case Study: Ukraine

In 2013, new Russian trade restrictions and stagnant industrial production caused a substantial deterioration in Ukraine's creditworthiness, making implied CDS default probabilities to climb to approximately 50 percent. Rising political instability, with the ousting of President Viktor Yanukovych in 2014 and the annexation of Crimea by Russia, coincided with GDP declines of 6.8 percent and 10.4 percent in 2014 and 2015, respectively. In December 2015, Ukraine missed interest payments on a $3 billion loan to Russia, which the International Swaps and Derivatives Association (ISDA) determined was a credit event.

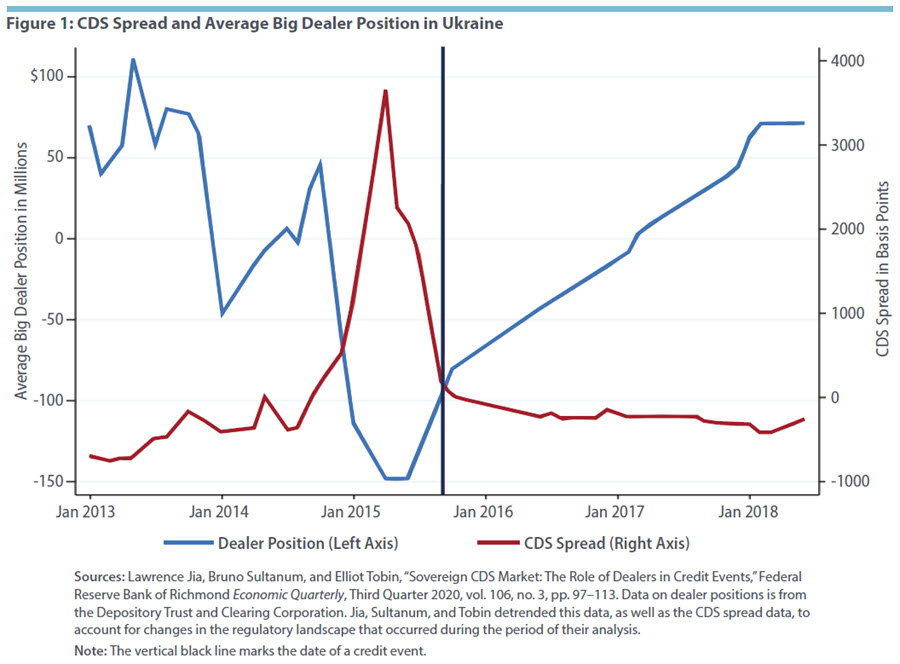

During this period of increasing turmoil in Ukraine, CDS spreads and dealer positions showed a very clear inverse relationship. (See Figure 1.) From January 2013 to March 2015, CDS spreads increased by 4,500 basis points, while the net position of big CDS dealers decreased from a $75 million long position to a $150 million short position. In other words, dealers became providers of CDS insurance as the crisis intensified.

In 2016, the International Monetary Fund (IMF) provided a $17.5 billion, four-year loan program that helped stabilize Ukraine's economy. After that, Ukraine began to experience positive economic growth, supported by positive global economic growth, a recovery in oil prices, stronger worker productivity, and a government corruption reform program.

As Ukraine's outlook became more positive following the IMF deal, the country's risk spread declined, and net dealer positions became more positive. From March 2015 to March 2018, CDS spreads decreased by 4,000 basis points. During the same period, the net CDS position of big CDS dealers increased by $230 million. In other words, dealers' provision of CDS insurance declined as risk abated.

Case Study: Venezuela

Venezuela has the world's largest proven oil reserves, and its economy's heavy reliance on petroleum exports makes its economic growth and prosperity largely dependent on oil prices. Venezuela's economy began experiencing distress in early 2014 as global crude oil prices declined. The price per barrel of Venezuelan oil fell from more than $100 in 2012 to approximately $30 in 2015. As a result, almost half a decade of steady economic growth ended, and GDP declined by almost 5 percent in the first quarter of 2014. The National Assembly of Venezuela reported inflation to be approximately 4,000 percent in 2017. On December 30, 2017, the ISDA declared a credit event after the Venezuelan government missed two interest payments totaling $200 million. Following the selective default, Venezuela eventually defaulted on eighteen other sovereign bonds.

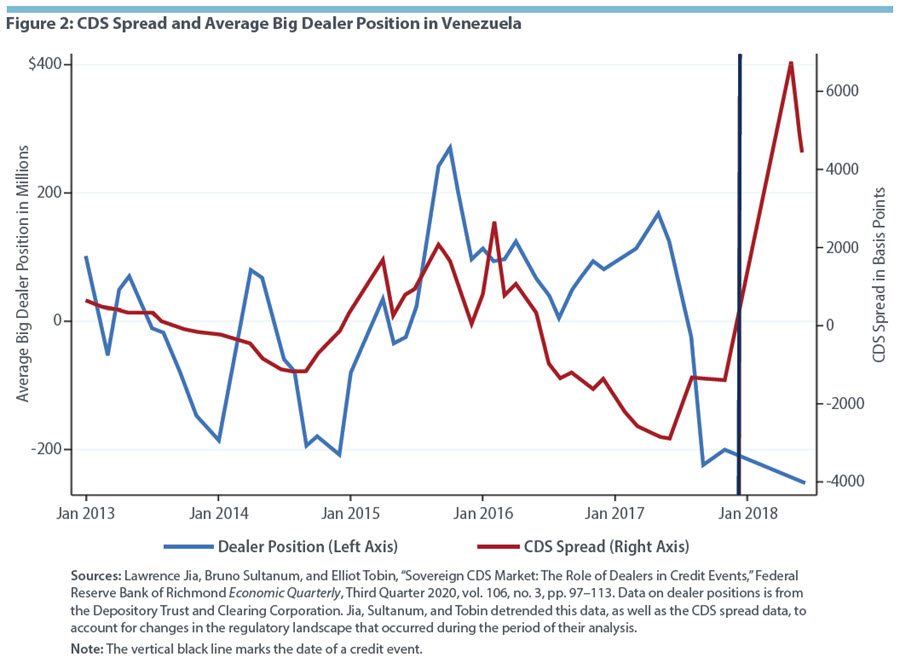

In Venezuela, data from early 2017 to mid-2018 support the hypothesis that big dealers tend to reduce their net CDS positions as risk increases. The right side (post January 1, 2017) of Figure 2 depicts CDS dealer positions and spreads during this time. After the selective default, the CDS spread increased significantly to over 6,000 basis points. As the CDS spread gradually increased in mid-2017 (but prior to the sharp increase in spread), large dealers sold $400 million of CDS in just a few months, switching from a net long position to a net short position. This is the opposite response expected from speculators. The shorting of CDS as risk increased suggests that dealers were providing liquidity to the market and not speculating.

Case Study: Argentina

Within thirteen years, Argentina has experienced two different types of default. In 2001, amid a struggling economy and political riots, Argentina defaulted on $83 billion in debt. The vast majority of the country's bond holders subsequently agreed to restructuring terms, most notably a 70 percent haircut on repayment, but 7 percent of the bond holders held out for more.

In 2014, Argentina defaulted again. Although the country's export-dominated economy had grown reasonably well between 2002 and 2013, it was struggling again by 2014 in the context of a sluggish world economy. Around this time, the 7 percent of investors who did not accept the restructuring agreement in 2001 demanded to be repaid in full. They sued in U.S. courts, and following a lengthy series of legal battles, the U.S. Supreme Court upheld a lower court ruling that obligated Argentina to pay off $132 billion in debt. Following the ruling, the Argentinian government declared it would imminently be in default. On July 30, 2014, Argentina missed a $529 million interest payment, and Standard and Poor's subsequently declared Argentina to be in selective default.

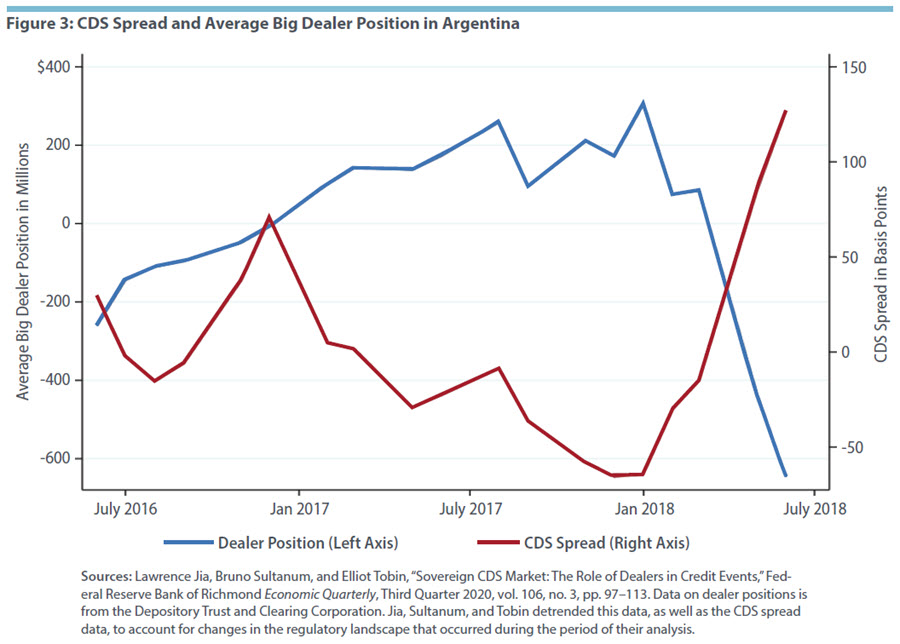

For Argentina, the researchers focused on CDS spreads and dealer positions after July 2016, when Argentina finally began to emerge from its crisis-induced legal entanglements. In the period from June 2016 to December 2017 (see Figure 3), Argentina's CDS spread decreased by approximately 50 basis points. During the same period, the average position of big dealers increased from a net short position of approximately $275 million to a net long position of approximately $300 million. That is, the dealers bought CDS as risk decreased.

The data show the converse relationship from January 2018 to June 2018 (see Figure 3), when the CDS spread increased by approximately 150 basis points. During the same period, the positions of big CDS dealers decreased by $875 million — from a net long position of approximately $275 million to a net short position of more than $600 million. Over the entire period of analysis, there was a strong negative correlation between the CDS spread and the average dealer position. In other words, as risk increased, dealers sold CDS contracts and vice versa.

Conclusion

Using newly available data from the DTCC under the Dodd-Frank Act, the researchers found support for the notion that dealers tend to provide liquidity to CDS markets by providing additional insurance during periods of heightened risk. This finding was supported by the observed negative correlation between the net long positions of CDS dealers and sovereign risk spreads in Ukraine, Venezuela, and Argentina.

The researchers' findings are echoed in recent work by Gaston Chaumont of the University of Rochester and Grey Gordon, Bruno Sultanum, and Elliot Tobin of the Richmond Fed, who find a negative cross-country relationship between dealer CDS positions and risk spreads.7 This evidence appears to provide some additional support for the hypothesis that dealers tend to act as stabilizing influences in sovereign CDS markets during times of market stress.

John Mullin is a senior economics writer and Bruno Sultanum is an economist in the Research Department at the Federal Reserve Bank of Richmond.

This point has been made by Richard Portes at the London Business School among others. See: Richard Portes, "Ban Naked CDS," Eurointelligence, March 2010.

Darrell Duffie, "Is There a Case for Banning Short Speculation in Sovereign Bond Markets?" Bank of France Financial Stability Review, July 2010, no. 14, pp. 55–59. Also see: International Monetary Fund, "A New Look at the Role of Sovereign Credit Default Swaps," in Global Financial Stability Report, April 2013, pp. 57–92.

Lawrence Jia, Bruno Sultanum, and Elliot Tobin, "Sovereign CDS Market: The Role of Dealers in Credit Events," Federal Reserve Bank of Richmond Economic Quarterly, Third Quarter 2020, vol. 106, no. 3, pp. 97–113.

See Sections 727 and 728 of the Dodd-Frank Act.

They also conducted their analysis using the average positions of the top five dealers, but their results did not change significantly.

They found that their results were robust with respect to their detrending methodology.

Gaston Chaumont, Grey Gordon, Bruno Sultanum, and Elliot Tobin, "Sovereign Default and Credit Default Swaps: The Role of Dealers' Liquidity Provision," Manuscript (Federal Reserve Bank of Richmond, 2020).

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.