The 2025 H.R.1 extended three tax credit programs designed to increase development and investment in underserved places. This post explores these programs and how community lenders use them.

Financial Institutions and Regulation

We promote financial stability by supervising and regulating financial institutions, as well as studying their role in the economy.

Updating Results

Updating Results

Huberto Ennis provides an updated view of the Federal Reserve's management of its balance sheet and the flow of reserves between banks, which were the focus of a recent conference held at the Federal Reserve Bank of Richmond. Ennis is group vice president for micro, macro and financial economics at the Richmond Fed.

The structure and regulation of OTC markets can help maximize the social benefit that they provide.

Alexander Wolman discusses the Federal Reserve's recent unveiling of its revised Statement on Longer-Run Goals and Monetary Policy Strategy, highlighting what has changed and what has remained consistent with past statements. Wolman is vice president for monetary and macroeconomic research at the Federal Reserve Bank of Richmond.

This post will examine loan fund responses to the 2025 CDFI Survey: the business lines and top funding sources, as well as how many have leveraged secondary markets as a funding strategy.

During the last nonfinancial recession, negative credit supply shocks reduced firms' employment and increased their exit probability.

Alex Rivadeneira, Carlo Alcaraz, Nicolas Amoroso, Rodolfo Oviedo, Brenda Samaniego de la Parra and Horacio Sapriza

Supervisors anticipate most bank failures with a high degree of accuracy.

Surekha Carpenter and Taylor Pessin share their initial learnings about community development financial institutions that responded to the 2025 CDFI Survey, which is conducted every other year by the Federal Reserve. Carpenter is a senior research analyst and Pessin is an intermediate research analyst, both on the Regional and Community Analysis team at the Federal Reserve Bank of Richmond.

This post explores the experiences of rural CDFIs using data from the most recent CDFI Survey, including funding challenges and reliance on federal funding.

This post uses a major central bank announcement, the "whatever it takes" speech, to determine how a credible announcement of an unconventional monetary policy intervention affects bank lending standards during crises.

Carlo Alcaraz, Stijn Claessens, Gabriel Cuadra, David Marques-Ibanez and Horacio Sapriza

This post summarizes the 2025 Federal Reserve CDFI Survey and reviews past results to shed light on how the CDFI industry has changed over time.

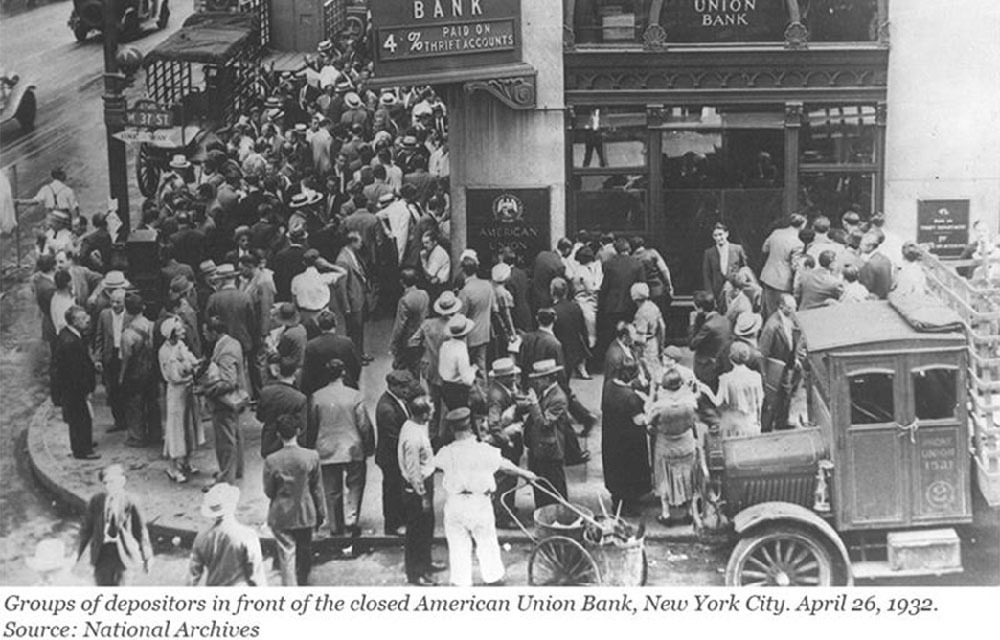

Bank runs are often cited as a major cause for bank failures, but researchers found poor bank fundamentals tend to be the underlying cause.

Key takeaways and supporting data from nearly 450 community development financial institutions across the country.

From stolen checks to "deepfake" scams, fraudsters are costing businesses, banks, and individuals billions every year.

This post provides an early look into some of our findings from the 2025 CDFI Survey before we release a full key findings report on Sept. 19.

Sergio Correia discusses his research on the causes of bank failures and his use of a novel set of historical data to evaluate two different but intertwined potential causes — insolvency of the bank and a run on deposits. Correia recently joined the Federal Reserve Bank of Richmond as a senior economist.

Economist Carmen Reinhart discusses the twin financial and currency crises, the future of the dollar, sovereign debt, and more.

Why do banks fail? The authors create a panel covering most commercial banks from 1863 through 2024 to study the history of failing banks in the United States.

This paper's authors study the spatial expansion of banks in response to the banking deregulation of the 1980s and '90s in order to develop a spatial theory of banking.

Grey Gordon and Felipe Schwartzman discuss the creation and evolution of the Federal Reserve's monetary policy framework and the Fed's current review of the framework. Gordon and Schwartzman are senior economists at the Federal Reserve Bank of Richmond.

A new measure suggests reserve balances are more distributed than originally thought.

Russell Wong and Mengbo Zhang

Examining the history of Community Development Credit Unions shows the evolving role they played in helping to expand banking access to underserved individuals.

As we gear up for the 2025 Federal Reserve CDFI Survey, this post paints a picture of the current state of CDFIs and seeks to understand what might differ from our 2023 survey results.

Prior to deregulation, banks were essentially confined to the borders of their home states.

Lindsay Li and Nicholas Trachter

What was different about the banks that experienced runs during the March 2023 banking crisis, such as Silicon Valley Bank?

Nathan Robino

Ricardo Reis discusses how swap lines have supported the flow of US currency into global financial markets to meet their liquidity needs and the dollar's prominence in those markets, especially during the 2007-08 financial crisis and the COVID-19 pandemic. Reis is an economics professor at the London School of Economics and a long-term consultant at the Federal Reserve Bank of Richmond.

What impact could "buy now, pay later" have on other payment forms and on financial stability as a whole?

The authors propose an approach for generating financial market scenarios for stress testing financial firms' market risk exposures.

Azamat Abdymomunov, Zheng Duan, Anne Lundgaard Hansen and Ulas Misirli

The runs lasted two days and were driven mainly by a relatively small number of large depositors, though it affected many other banks.

The ideal regulatory structure for stablecoins, a type of cryptocurrency backed by existing assets, has been a contentious question among members of Congress, especially in deciding the primary regulator.

For our 150th episode, Anna Kovner reviews her career path to becoming the research director at the Federal Reserve Bank of Richmond and reflects on the work of the Bank's Research department. Kovner also offers her views on various topics — including the banking turmoil of 2023, the Fed's "lender of last resort" role, current risks to the financial system, and the "neutral rate" of interest — as well as the current state of the national economy.

Alaina Barca and Surekha Carpenter examine the decline in the number of bank branches in certain communities and the economic effects of that trend. They also share data from the Banking Deserts Dashboard developed for the Fed Communities website. Barca is a community development research analyst at the Philadelphia Fed and Carpenter is a research analyst at the Richmond Fed.

Toan Phan reviews the risks faced by banks from the increased frequency and intensity of floods and other extreme weather events, and how banks and financial markets have responded to those risks. Phan is a senior economist at the Federal Reserve Bank of Richmond.

Strong economic growth has helped to mitigate risks to banks from commercial real estate, but bank supervisors will be closely monitoring those risks in loan portfolios.

Anna Kovner

Executive Vice President and Director of Research

Anne Davlin discusses the current state of lending to the commercial real estate sector in the Fifth District, including the challenges faced by office building and multiunit housing developers and the ensuing risks posed to their lenders. Davlin is a senior quantitative analyst in the Richmond Fed's Supervision, Regulation and Credit department.

This paper offers novel insights on modern bank runs using confidential data on wholesale and retail payments to detail the bank runs of March 2023.

The authors find evidence that bank capital matters for the tails of future GDP growth, with a relationship that is particularly strong in reducing the probability of the worst GDP outcomes. The relationship between bank capital and growth, however, is not strong for its central tendency.

Nina Boyarchenko, Domenico Giannone and Anna Kovner

Data from Fed Communities' Banking Deserts Dashboard show how in-person banking access changed in the Fifth District from 2019 to 2023.

Surekha Carpenter, Disha Dureja and Avani Pradhan

The authors study how changes in banks' lending standards affect economic activity, inflation, and interest rates to gain a better understanding of the macroeconomic effect that banks can have.

Elijah Broadbent, Huberto M. Ennis, Tyler J. Pike and Horacio Sapriza

The Fed moved quickly to support the financial system during a banking panic last spring. Now, policymakers are evaluating what they learned.

The authors shed light on the role of competitive forces in how banks manage emerging risks and relevant supervisory challenges.

Dasol Kim, Luke M. Olson and Toan Phan

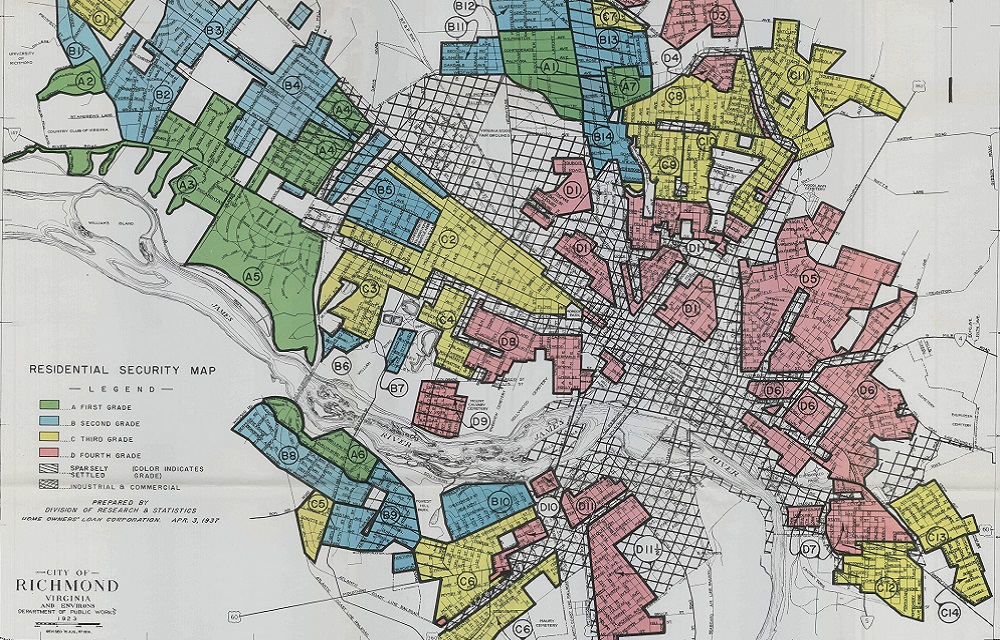

The effects of classifying neighborhoods by riskiness of home lending in the 1930s may still have modest effects on interest rates and fees today.

Andrew Ellul, David Marques-Ibanez, Horacio Sapriza, Alex Sclip and Jack Taylor

Daniel Weitzner, an information security expert at MIT, discusses the cyber threats to the financial services industry and the challenges of measuring and modeling those risks. He also shares learnings from a recent conference co-hosted by MIT, the Federal Reserve Bank of Richmond, and the Federal Reserve System Board of Governors.

The Supreme Court recently heard arguments in two cases that could overturn a long-standing precedent for how agencies should implement laws passed by Congress.

It depends on their respective competitive landscapes.

The second Conference on Measuring Cyber Risk in the Financial Services Sector continued the important discussion around cyber data needs to help financial services firms better manage cyber risk. Hosted by the Richmond Fed, the Federal Reserve Board and MIT, the conference was held in January 2024 on the MIT campus in Cambridge, Massachusetts.

What do various economic schools of thought say about the use of money?

The Reserve Bank boards of directors are a key link between the Federal Reserve System and the communities it serves, working to achieve the dual mandate and formulate monetary policy.

Leaders within the Senate have arrived at a bipartisan proposal, known as the Recovering Executive Compensation Obtained from Unaccountable Practices (RECOUP) Act, that would claw back compensation from some executives of failed banks.

This model explains how an increase in intermediation costs leads to structural changes in the corporate bond market

Lucas B. Dyskant, André C. Silva and Bruno Sultanum

The Federal Reserve Bank of Richmond, Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation are sponsoring a training on the Community Reinvestment Act (CRA) 101 for bankers only. The workshop will cover CRA Basics designed for new and less experienced CRA bank officers.

Tom Bilston and Tony Murray of the Richmond Fed's bank supervision team discuss how banks use machine learning, chat bots and other forms of AI as well as what these technological innovations mean for bank examiners, both in terms of the risks they monitor and how they do their job.

A lot of factors influenced the banking turmoil of 2023. This article provides perspectives on some of those factors.

In July, the Fed launched its first new payment service in more than 40 years. FedNow enables money to move instantaneously from sender to recipient 24 hours a day, seven days a week — weekends and holidays included.

The Consumer Financial Protection Bureau has been a source of debate since its creation in 2010. A case currently before the U.S. Supreme Court challenges the constitutionality of its funding structure.

Borys Grochulski and John O'Trakoun share the latest data on the market for office buildings and commercial real estate in general. They also discuss the current state of lending to office developers and whether the rise in office vacancies poses risks to the broader economy. Grochulski is a senior economist and O'Trakoun is a senior policy economist at the Federal Reserve Bank of Richmond.

On the 100th episode of the podcast, three leaders of the Richmond Fed 's Research department — Kartik Athreya, Huberto Ennis and Ann Macheras — share the research paper that had a major impact on their careers and the economics profession in general. Paper topics range from bank runs to insuring against risks to knowledge spillovers.

As the news is unsettling, it's worth taking some time to understand how bank runs happen. Nobel Prize winners Doug Diamond and Philip Dybvig developed a model that sheds light on this question.

Financial institutions have approached AI with cautious optimism, developing and implementing AI-based applications for things like customer service chatbots, detecting fraud, and evaluating creditworthiness. Bank supervisors are learning how to adapt.

John Mullin

The recent bank failures at Silicon Valley Bank, Signature Bank, and First Republic Bank have brought banking policy back into the forefront of the national policy debate.

The persistence of hybrid work has left many wondering about the future of offices. With workers coming in less often, some companies have decided that they need less space. What does that mean for the banks that finance commercial real estate?

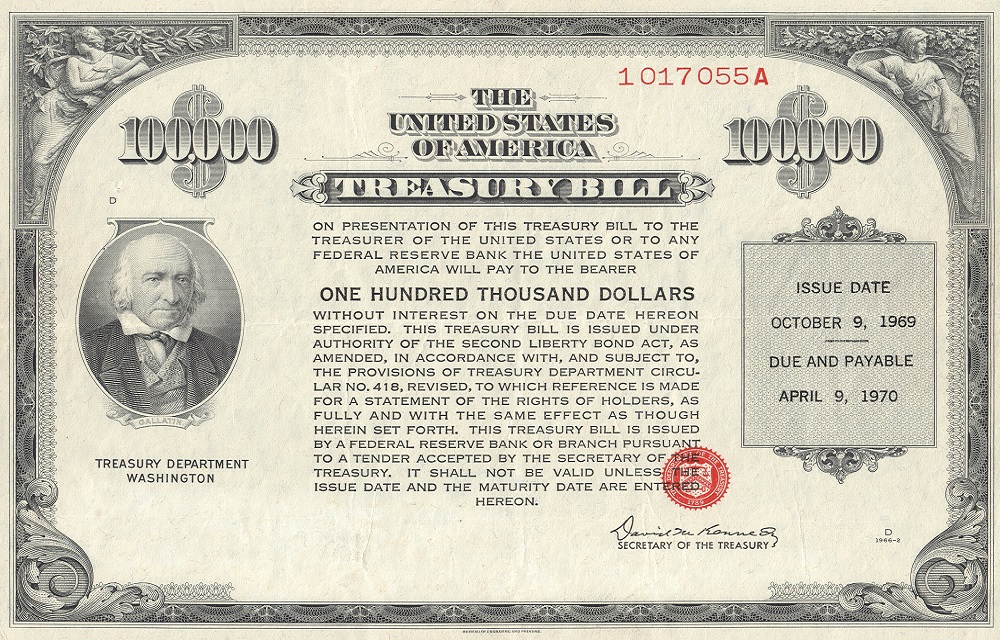

In his July 1832 veto message of the bill rechartering the Second Bank of the United States, President Andrew Jackson triggered the demise of America's second central bank with a stroke of his veto pen.

With negotiations still underway, some unconventional ideas are being suggested in case a U.S. spending deal can't be made. Today, we'll look at one such suggestion: minting a high-dollar platinum coin.

Surekha Carpenter discusses why adequate access to credit is important for individuals and the economy overall, what contributes to gaps in access, and how community development financial institutions have addressed those gaps. Carpenter is a research analyst on the Regional and Community Analysis team at the Federal Reserve Bank of Richmond.

Gadi Barlevy discusses recent research on the potential tension between the Fed's roles in maintaining low, stable prices and providing liquidity when financial markets are in trouble. Barlevy is a senior economist and economic advisor at the Federal Reserve Bank of Chicago. He was interviewed on Feb. 8, 2023, before the spate of bank failures that occurred in March 2023.

FTX and its affiliated arms seemed to create a risky situation that ultimately fell apart.

Jonathan Chiu and Russell Wong

The Treasury bond market suffered a liquidity crisis at the start of the COVID-19 pandemic. What reforms are needed to make sure it doesn't happen again?

Ethan Bullard tells the story of Maggie L. Walker, focusing on her legacy as a bank executive, entrepreneur and activist who worked against systemic discrimination against women and blacks. Bullard is curator at the Maggie L. Walker National Historic Site in Richmond, Va.

Some believe declines in physical-asset prices prior to recessions make the recessions worse, but recent literature challenges the strength of that connection.

Marios Karabarbounis and Kushal Patel

We construct a novel signal of bank expectations utilizing confidential data and a regulatory constraint imposed on bank internal capital markets during the 2008 crisis that made internal equity injections to commercial bank subsidiaries difficult to reverse.

Results from a recent national Fed survey show that community development financial institutions (CDFIs) and the communities they serve are facing less severe disruptions than last year. Still, staffing and other challenges are preventing CDFIs from fully meeting growing demand for their products and services.

Hailey Phelps

Maggie Lena Walker built the St. Luke Penny Savings Bank to last. When it opened its doors in Richmond's Jackson Ward district in 1903, Walker became the first Black woman to establish a bank in the United States.

John Mullin

Properly regulating stablecoins could achieve the same objectives as issuing a central bank digital currency.

Perhaps history can be a guide on whether central banks should issue digital currencies.

Even exploring a CBDC without ultimately issuing one can provide significant benefits.

Our paper studies the role of the collateral channel for bank credit using confidential bank-firm-loan data.

Arun Gupta, Horacio Sapriza and Vladimir Yankov

This essay discusses the ideas and contributions in Marvin Goodfriend and Robert G. King's 1988 paper and relates it to some of Goodfriend's other research on banking and monetary policy.

Vanity McDaniel and Zhu Wang review the Federal Reserve's important role in the payments system, from cash and check processing to supporting innovations in electronic payments. McDaniel is a senior payments business analyst in the Payments Outreach group and Wang is vice president for research in financial and payments systems in the Research Department at the Richmond Fed.

How the Standing Repo Facility interacts with resolution planning at large banking corporations will depend in part on guidance provided by regulators.

Huberto M. Ennis, Arantxa Jarque and Hoossam Malek

After regulations were implemented, dealer capital commitment, trade frequency and size decreased, while dealer bid-ask spread increased.

Lucas B. Dyskant, André C. Silva and Bruno Sultanum

Is money essential? How do self-interested parties bargain to achieve mutually beneficial outcomes? These were among questions addressed at a recent research conference.

Do payday loan regulations help or harm consumer welfare? How many firms close due to financial market inefficiencies? These were among questions addressed at a recent research workshop.

John Mullin

The Fed's relatively new repo facilities may create greater price certainty, but the Fed's intervention may mute valuable market signals regarding economic efficiency and stability.

Huberto M. Ennis and Jeff Huther

Facebook and Amazon are examining creating digital currencies, like Alibaba has. What drives platforms to develop these currencies, and should central banks be worried?

Jonathan Chiu, Tim Sablik and Russell Wong

The policies were gradually phased out in many advanced and emerging economies. Will they come back?

John Mullin

Newly available data show that larger and less liquid banks use the discount window more actively and that holdings of bank reserves are negatively correlated with discount window borrowing. Access to the discount window affects bank portfolio decisions, in particular holdings of reserves, in subtle ways.

We study new transaction-level data of discount window borrowing in the U.S. from 2010–17, merged with quarterly data on bank financial conditions (balance sheet and revenue).

Huberto M. Ennis and Elizabeth Klee

Recently, the Dodd-Frank Act has arguably played an important role during the coronavirus crisis. It's a good time to take another look.

In Taming the Megabanks, Arthur Wilmarth Jr. of George Washington University Law School explores the implications of the gradual erosion and ultimate repeal of the Glass-Steagall Act's banking restrictions.

John Mullin

Economists at the Richmond Fed analyze the role of dealer-provided liquidity in sovereign credit default swap markets.

John Mullin and Bruno Sultanum

We construct and calibrate a monetary model of corporate finance with endogenous formation of lending relationships. The equilibrium features money demands by firms that depend on their access to credit and a pecking order of financing means.

Zachary Bethune, Guillaume Rocheteau, Russell Wong and Cathy Zhang

The Federal Reserve developed and fielded a survey of community-based organizations to better understand the impacts of COVID-19 on their operations and the communities they serve. Fifth District respondents in April and June expressed that while organizations and communities are experiencing significant disruptions, effects are expected to be longer-lasting for the latter.

The market for repurchase agreements has repeatedly adapted to changing circumstances.

John Mullin

Recent Richmond Fed research has shed new light on the functioning of the discount window and the role that stigma may play in achieving desirable outcomes.

Huberto M. Ennis and David A. Price

Banks in the United States have long had choices between state and federal banking authorities.

John Mullin

The technology behind cryptocurrencies shows promise for raising capital but has also drawn scrutiny from regulators.

Prior to the advent of modern home mortgage markets in the United States, markets in which mortgage-backed securities and government-sponsored enterprises now play significant roles, prospective homebuyers had to rely on other mechanisms of home finance.

David A. Price and John R. Walter

The choice between bankruptcy or bailout trades off different sets of costs on the economy. This Economic Brief presents a new tool that could assist policymakers with this evaluation, potentially helping to curb the "too big to fail" problem, serving as a useful complement to the "living wills" process, and making the resolution process more transparent.

This Economic Brief reviews the intuition and theory behind bank runs and the most popular proposed solutions.

A tax exemption has helped credit unions since the 1930s, but some argue they should be treated more like banks

Liz Marshall and Sabrina R. Pellerin

Central banks play strong roles in domestic financial stability policy, but the full scopes of their financial stability mandates are ambiguous.

There are 12 Federal Reserve Banks across the country: How did one land in Richmond, Virginia?

Sonya Ravindranath Waddell

Vice President

As a way to understand the origins of this expectation, in this Economic Brief we look at the relationship between the federal funds rate and the average net interest margin for U.S. banks since the mid-1980s. We find that the relationship is not as clear-cut as one might suspect.

Huberto M. Ennis, Helen Fessenden and John R. Walter

The rate of new-bank formation has fallen from an average of about 100 per year since 1990 to an average of about three per year since 2010. If this change persists, it will have a large impact on the composition of the banking sector as well as the flow of credit in the economy.

Roisin McCord, Edward S. Prescott and Tim Sablik

The most recent study published by the Association of Statisticians of American Religious Bodies estimates that Islam was the fastest-growing religion in the United States between 2000 and 2010. Yet there are relatively few financial products available here for those followers who require their financial contracts to comply with Islamic laws and moral codes, called Sharia law.

Renee Haltom

Vice President and Regional Executive

Richmond Fed president Jeffrey M. Lacker spoke about the use of the Bankruptcy Code to resolve large complex financial institutions.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

I study firm characteristics that justify the use of options or refresher grants in the optimal compensation packages for CEOs in the presence of moral hazard.

Are we losing the fight against next-gen bank robbers? The Fed's study found that payment cards were used in 92 percent of fraudulent transactions, with checks and electronic check transfers making up the remainder.

Richmond Fed President Jeffrey M. Lacker addressed business leaders during a luncheon hosted by the Rotary Club of Charlotte in Charlotte, N.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

One suggested hypothesis for the dramatic rise in household borrowing that preceded the financial crisis is that low-income households increased their demand for credit to finance higher consumption expenditures in order to "keep up" with higher-income households.

Olivier Coibion, Yuriy Gorodnichenko, Marianna Kudlyak and John Mondragon

Recent research suggests that young borrowers are actually among the least likely to experience a serious credit card default. One reason why people obtain credit cards early in life may be to build a strong credit history.

Peter Debbaut, Andra C. Ghent, Marianna Kudlyak and Jessie Romero

Jeffrey Lacker, president of the Federal Reserve Bank of Richmond, testified Dec. 3 about bankruptcy and financial institution insolvency to a subcommitee of the U.S. House of Representatives Committee on the Judiciary.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Many merchants have complained that the fees far exceed issuers' costs for processing such transactions. In response to those complaints, Congress directed the Federal Reserve to impose a cap on debit card interchange fees.

Tim Sablik and Zhu Wang

Young borrowers are the least experienced financially and, conventionally, thought to be most prone to financial mistakes. We study the relationship between age and financial problems related to credit cards.

Peter Debbaut, Andra C. Ghent and Marianna Kudlyak

This paper studies intended and unintended consequences of price cap regulation in the two-sided payment card market.

Jeffrey Lacker, president of the Federal Reserve Bank of Richmond, addressed the Council on Foreign Relations on May, 9, 2013, as part of the C. Peter McColough Series on International Economics.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey Lacker discussed the "too big to fail" issue during the Global Society of Fellows conference held April 9 at the University of Richmond in Richmond, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey Lacker speaks with students and faculty at Franklin & Marshall College in Lancaster, Pa.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

This paper provides a new theory for two-sided payment card markets. Adopting payment cards requires consumers and merchants to pay a fixed cost, but yields a lower marginal cost of making payments.

James McAndrews and Zhu Wang

In recent years, large positive and negative balances have arisen in TARGET2, the interbank settlement and payments system of the Eurozone. These balances show that the Deutsche Bundesbank, the central bank of Germany, has become a large net creditor to the European Central Bank (ECB).

Thomas A. Lubik and Karl Rhodes

This Economic Brief explores the need for and challenges facing the small-dollar loan market in the United States.

Tammie Hoy, Jessie Romero and Kimberly Zeuli

This paper examines the optimality of fiscal rules and measures their aggregate effects using a baseline sovereign default framework.

Juan Carlos Hatchondo, Leonardo Martinez and Francisco Roch

Lacker on Understanding the Interventionist Impulse of the Modern Central Bank,CATO Institute Monetary Conference

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker Addresses Business, Community and Economic Development Leaders in Salisbury, Md.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker Addresses Northern Virginia Business and Community Leaders

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Rising interchange fees, along with the growing dominance of card transactions in the payments system, have brought increasing scrutiny from regulators on the appropriate level of interchange fees and the competitive aspects of card networks.

Tim Mead, Renee Haltom and Margaretta Blackwell

Richmond Fed’s Jeff Lacker addresses the Oversight and Investigations Subcommittee of the Committee on Financial Services

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker speaks in New York, NY -- Feb. 25

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Since the recession started in 2007, there has been a growing concern that small businesses may lack adequate access to credit. This Economic Brief examines the complexity of small business credit issues.

Betty Joyce Nash and Kimberly Zeuli

Lacker addresses RMA -- Richmond Chapter, Jan. 14

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Allen C. Goodman and Brent C Smith

Sabrina R. Pellerin, John R. Walter and Patricia E. Wescott

Reviews the Bank's operations and includes the article entitled "The Financial Crisis: Toward an Explanation and Policy Response"

Cover Story: Downtown is Dead. Long Live Downtown.

America is busy rebuilding its downtowns. But these are not the downtowns of yesterday.

Cover Story: Academic Alternatives

The theory of school choice sounds great, but it remains controversial. Now, evidence from programs like the one in Milwaukee is beginning to move the discussion from the theoretical to the practical.

Cover Story: Charged by the Market.

Electricity deregulation is finally starting to stir up retail competition in Maryland.

Rosalind L. Bennett, Mark D. Vaughan and Timothy J. Yeager

Cover Story: Homeward Bound

Housing markets work just fine for most people. But certain markets in the Fifth District aren't producing homes and apartments that working families can afford.

It is a pleasure to be with you this morning. The theme of this session is “How Banks Compete.” I want to develop a variation on this theme and consider how the intensity of competition in banking has increased over the years, and some of the challenges this change presents.

J. Alfred Broaddus

President

Reviews the Bank's operations and includes the article entitled "The Economics of Financial Privacy"

It's a pleasure to be with you tonight. Bryce has welcomed you on behalf of the Powell Endowment.

J. Alfred Broaddus

President

I'm delighted to be here today to talk with you about the wave of bank mergers that is sweeping across our country-our hometown included.

J. Alfred Broaddus

President