Who Borrows From the Discount Window in "Normal" Times?

New rules mandate the release of transaction-level data on loans at the Federal Reserve's discount window. This higher level of transparency has created an opportunity to learn more about the role of the discount window outside of crisis periods. These data show that larger and less liquid banks use the discount window more actively and that holdings of bank reserves are negatively correlated with discount window borrowing. Access to the discount window affects bank portfolio decisions, in particular holdings of reserves, in subtle ways.

The Federal Reserve's discount window acts as a backup source of funding for banks that are unable, for some reason, to use the market to satisfy an urgent need for liquidity. Banks pledge the required collateral in advance so a loan can be granted on short notice. The idea of the central bank acting as a lender of last resort during crises has a long tradition. However, the Fed's discount window is not just a crisis-oriented institution; it is open at all times.

During a crisis, market frictions, such as imperfect information about the financial health of would-be borrowers, increase the time and cost of finding viable counterparties for banks that need liquidity. The central bank can use its access to detailed bank information and its ready availability of loanable funds to ameliorate the impact of those frictions. While these frictions may persist outside of crisis periods, they are likely attenuated.

In general, banks use the discount window less during normal times. There are still, however, a significant number of discount window loans being granted in those times. Many of those loans are small "test" loans sought by banks to verify that all the processes and systems involved are working smoothly. But many of the loans are real loans, not tests. For example, between July 2010 and December 2017, the Fed granted more than 5,000 loans of $1 million or more — amounts that seem unlikely to represent testing. Who took those loans and why?

Old Questions and a New Opportunity

There are multiple reasons to try to better understand the use of the discount window during "normal" times. Most directly, such an understanding can inform program design: Is the current discount window best suited for the function that it serves during normal times? At a more general level, understanding this activity at the discount window can help answer an important long-standing question: Do we need the discount window to be open at all times? If the main goal is to provide backup liquidity during crises, should policymakers consider replacing the discount window with a system that can be quickly and effectively scaled up and down? (An example of such a system would be one resembling the Term Auction Facility, which the Fed created during the 2007–08 financial crisis.)1 Answering these questions definitively is difficult, of course, but careful analysis of the data is a critical step.

For a long time, data availability was a barrier to such an analysis. Until 2010, the Fed published only aggregate weekly data on the total amount borrowed at the discount window. This practice reflected a tension between confidentiality and accountability. The case for confidentiality was based on the idea that banks might otherwise not be willing to use the discount window even in situations when their needs justified it. If discount window loans were made public immediately, they could be interpreted as signals of financial difficulty, possibly creating confidence crises for the banks.2 On the other side of the tradeoff, accountability requires that the central bank provide information to the public regarding its activities.

With the significant interventions that the Fed undertook in financial markets during the 2007–08 crisis, demands for accountability increased. As a result, the Dodd-Frank Act of 2010 included a requirement that the Fed publish transaction-level data on all loans made at the discount window with a two-year delay. Several years of data are now publicly available, making a thorough study of discount window activity possible. In a recent Richmond Fed working paper with Elizabeth Klee of the Board of Governors of the Federal Reserve System, we take advantage of this new opportunity.3

A First Pass at the Data

We combine the transaction-level data for loans at the discount window (as provided on the Board of Governors public website) with quarterly supervisory information collected by regulators about each individual bank (known as Call Reports).4 The transactions data include all discount window loans to commercial banks, foreign banking organizations and credit unions. Commercial banks take most of these loans. Since the available balance sheet information for foreign banks and credit unions has some limitations, the focus of our paper is mostly on lending to commercial banks.

There are multiple credit programs at the discount window, and the transactions data include activity in all those programs. The Fed relies on supervisory information to determine the eligibility of banks looking to borrow from the different programs. The primary credit program is available to banks in sound financial condition and is the most commonly used, both by number of loans and by dollar volume.5 This program is organized as a standing facility in the sense that an eligible bank can borrow from it, as long as it has pledged enough collateral, with no questions asked. The Fed grants primary credit loans at a penalty rate to position them as a backup source of funding, with the market being the first alternative for a bank looking to borrow.

A bank that is not eligible to borrow from the primary credit program can request a loan from the secondary credit program, but those loans receive more scrutiny before being approved. Furthermore, the Fed grants secondary credit loans at an interest rate even higher than the primary credit rate. The third avenue is the seasonal credit program, which is intended to satisfy seasonal liquidity needs of a certain group of banks in a more systematic and predictable way. Institutions eligible for seasonal credit are usually located in agricultural or tourist areas.

When studying emergency lending by the central bank, one challenge is discerning whether a loan is intended to deal with a temporary liquidity need or a more serious solvency problem. In other words, is the bank having a solvency issue that is shutting it out of regular funding markets? Such concerns arise mostly in secondary credit loans. There are only a few secondary credit loans in the data, and they are not the focus of our research.6

The data do not provide information on which loans are tests and which ones are not. Therefore, we use a threshold amount to distinguish between those loans most likely to be tests and those that are not. In particular, we focus on loans of $1 million or more on the assumption that such loans are unlikely to be test loans.

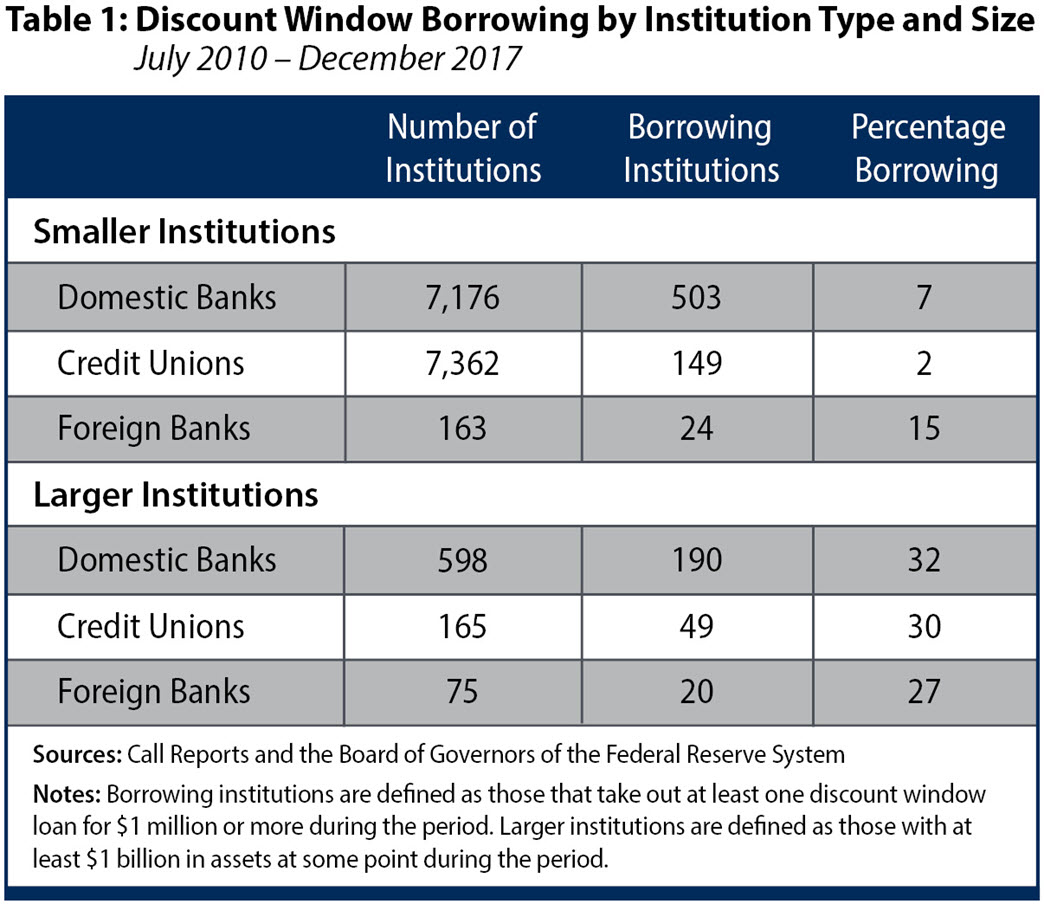

The data show that most of the loans at the discount window are taken by smaller banks (those with less than $1 billion in assets). This is the case mainly because smaller banks are more numerous. In fact, as a percentage of the number of institutions in each size category, larger domestic banks are the most likely to borrow from the discount window. (See Table 1.)

The data further show that banks borrowing at the discount window tend to hold fewer reserves at the Fed as a percentage of assets. These banks also have higher shares of risky loans and hold a smaller proportion of their assets in ultrasafe Treasury securities. Overall, then, borrowing banks have more illiquid balance sheets. On the liability side, borrowing banks tend to have lower shares of transaction deposits and rely more on wholesale funding sources.

Without further analysis, however, we cannot fully discern the influence that confounding factors may be having on a bank's decision to borrow at the discount window. For the characteristics considered, borrower banks appear to be more similar to larger banks than non-borrowers are. The question, then, is how much of the borrowing is driven by bank size relative to other bank characteristics. It could be that larger banks have a higher level of financial sophistication that better positions them to use the discount window. Or it could be that characteristics more common in large banks are also more likely to drive a bank to borrow from the discount window.

What Theory Tells Us

Banks' balance sheets have multiple components that interact with each other and determine the banks' portfolio decisions, exposure to shocks and, ultimately, discount window usage. To clarify these interactions and effects, our paper introduces a model of the decision-making process of a bank with a complex balance sheet and general exposure to liquidity shocks.

In the model, when a bank has access to the interbank market, discount window loans are never used to respond to shocks because their penalty rate makes them more costly. In other words, banks use the discount window only if they can no longer access the interbank market after a liquidity shock occurs. This is a stark representation of the frictions we mentioned before, which limit the ability of banks to borrow from the market in some circumstances and, in that way, play an important role in explaining discount window activity (in the model and in reality).7

When a bank cannot borrow from the market, it will follow a "pecking order" to cover the liquidity need triggered by a shock. First, it will exhaust its holdings of reserves. If the liquidity need is greater than that, the bank will tap the discount window. The amount that the bank can borrow from the discount window is limited by the amount of collateral available, which the bank pledges prior to the shock. So, when the liquidity shock is large enough, relative to the amount of collateral, the bank may not be able to borrow enough from the discount window and will need to incur an expensive overnight overdraft at the central bank to fully cover its liquidity need.

The model also allows us to study how the bank's portfolio decisions depend on the prospects of being able to use the discount window. Accounting for this dependence is important to better understand the nature of possible causal relationships in the data. As an example, a bank that is exposed to a more dispersed distribution of shocks will choose to hold higher levels of reserves. Yet, depending on the properties of the distribution of shocks, it may also happen that such a bank ends up borrowing more frequently from the discount window. In this case, the link between reserves and discount window borrowing responds to deeper, more indirect causes.

The way reserves and discount window borrowing interact is particularly relevant during the period we study. As a result of its actions during the financial crisis, the Fed's balance sheet grew significantly. On the liability side, this increase in size was reflected in an increase in outstanding reserves. Banks, on the other side, held those reserves as assets. Hence, between 2010 and 2017, a large proportion of banks had significant amounts of excess reserves. The model suggests that those banks would be unlikely to need the discount window. Yet many banks did indeed tap the discount window, and the transaction data give us a chance to observe whether those banks were holding relatively low levels of reserves.8

Insights From a Multivariate Analysis

To disentangle the effect of bank size from the effects of other bank characteristics — and the relative importance of those various characteristics in banks' propensity to borrow from the discount window — we conduct a detailed multivariate analysis of the data. We start by estimating the probability that a bank would borrow from the discount window as a function of its level of reserves as a percent of assets and a set of other bank characteristics and controls including size. We restrict the sample to those banks that have demonstrated access to the discount window (that is, banks that have tested or borrowed at some point during the sample period), which makes them more comparable.

This analysis leads to five main findings. First, it confirms that banks holding fewer reserves (at the quarterly frequency) are more likely to borrow from the discount window. Second, banks with more illiquid assets and liabilities also are more likely to borrow from the discount window. This is the case even after controlling for bank size (measured by total assets), the level of reserves as a percent of assets and other relevant factors. Most notably, banks using more repo funding and Federal Home Loan Bank advances are more likely to borrow from the discount window.

Third, even after taking into account various other bank characteristics, the size of banks remains a significant predictor of the probability of borrowing from the discount window. This finding suggests that unobserved variations in banks' business models or in banks' levels of sophistication play meaningful roles in driving activity at the discount window during "normal" times.

Fourth, the location of the bank across Federal Reserve districts, in some cases, is associated with differences in the probability of borrowing. In particular, banks located in the Boston district are less likely to borrow from the discount window, and banks in the San Francisco district are more likely to borrow, even after controlling for size and various other bank characteristics. Of course, this finding may still reflect unaccounted-for variations in bank types across districts, or it may reflect differences in lending behavior across Reserve Banks.

Finally, quarterly changes in real GDP do not appear to have any predictive power on the probability of banks borrowing at the discount window.

We also study the role of collateral in discount window activity. While a bank's total amount of collateral (as a percentage of total assets) does not play a clear role in predicting the probability of borrowing from the discount window, the composition of collateral does appear to matter. Banks with higher proportions of liquid collateral (such as Treasury securities) are less likely to borrow from the discount window, and banks with higher proportions of illiquid collateral (such as loans) are more likely to borrow. Availability of liquid collateral is probably an indication that the bank can also readily tap secured short-term markets for funding (such as the repo market) and in that way avoid borrowing at the discount window.

The last topic we study concerns the balance sheet implications of banks having access to the discount window. As suggested by the model, banks will choose to hold a different asset portfolio when they have access to the discount window. Furthermore, the reasons that drive banks to enter into a lending agreement with their corresponding Reserve Bank, pledge collateral, and in that way gain access to the discount window can also influence other bank decisions directly. We investigate these issues empirically, focusing mainly on the impact of access to the discount window on a bank's holdings of reserves. In the cross-sectional data, the relationship between access and reserves as a percent of assets is tenuous and, if anything, negative. This perhaps suggests that banks with access to the discount window use that access to substitute for holding extra reserves that would serve as a highly liquid buffer. This interpretation is supported also by the observed negative correlation between reserves and Treasury holdings: Banks with access to the discount window tend to hold less reserves and more Treasury securities.

Estimating the effect of discount window access on banks' level of reserves as a percent of assets is delicate. The decision to gain access (and to be ready to borrow) and the decision to hold reserves presumably respond to some extent to common factors; that is, access is endogenous. When we adjust for endogeneity using an instrumental variable approach, the relationship between reserves and access turns positive. A possible explanation for this finding could be that banks that expect to be exposed to large and variable liquidity shocks hold more reserves and, simultaneously, gain access to the discount window — just in case the shock happens to be unexpectedly large.

Conclusion

Understanding how banks use the discount window during normal times is important for assessing the value of this longstanding institution. New data provide a window into this largely unexplored matter. The U.S. banking industry is large and highly heterogeneous, and the resulting data reflect idiosyncratic behavior across institutions, which makes the task of extracting patterns particularly difficult. Even so, some tendencies are clear. Banks holding more liquid assets and banks less reliant on short-term funding are less likely to borrow from the discount window during normal times. Reserves, being the ultimate liquid asset, are a strong substitute for discount window liquidity. Yet even after controlling for various other characteristics, larger banks are more likely to tap the discount window. Unobserved financial sophistication, positively correlated with bank size, may be driving this result.

Huberto M. Ennis is group vice president for macro and financial economics in the Research Department at the Federal Reserve Bank of Richmond.

Olivier Armantier, Sandra Krieger and James McAndrews, "The Federal Reserve's Term Auction Facility," Federal Reserve Bank of New York Current Issues in Economics and Finance, July 2008, vol. 14, no. 5.

For a recent discussion of these issues, see Huberto M. Ennis and David A. Price, "Understanding Discount Window Stigma," Federal Reserve Bank of Richmond Economic Brief 20-04, April 2020.

Huberto M. Ennis and Elizabeth Klee, "The Fed's Discount Window in 'Normal' Times," Federal Reserve Bank of Richmond Working Paper No. 21-01, January 2021.

Quarterly discount window data are available on the Board of Governors website. The Federal Financial Institutions Examination Council compiles Call Reports and posts them on its website.

For more details, see Felix P. Ackon and Huberto M. Ennis, "The Fed's Discount Window: An Overview of Recent Data," Federal Reserve Bank of Richmond Economic Quarterly, First–Fourth Quarter 2017, vol. 103, nos. 1–4, pp. 37–79.

For a more detailed investigation of some of the secondary credit loans that were made during this period, see Huberto M. Ennis, Sara Ho and Elliot Tobin, "Recent Borrowing from the U.S. Discount Window: Some Cases," Federal Reserve Bank of Richmond Economic Quarterly, Fourth Quarter 2019, vol. 105, no. 4, pp. 251–271.

The presumption here, of course, is that solvency issues are well-managed at the supervisory level so that no bank with a significant risk of failure has access to the primary credit program.

An important consideration here is the timing of the decision relative to the periodicity of the data. The quarterly data on balance sheets cannot confirm that a bank's level of reserves on the day of borrowing had been exhausted. However, it seems reasonable to assume that those banks with low reserves at the quarterly frequency are also the most likely to be constrained by their availability of reserves on any given day.

This article may be photocopied or reprinted in its entirety. Please credit the author, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.