"In a normal financial setting, there doesn't seem to be any advantage to using an ICO instead of traditional equity funding," says Joshua Gans, an economist at the University of Toronto who studies technological innovations and industrial organization.

In a paper with Christian Catalini of the Massachusetts Institute of Technology, Gans examined where the value of tokens sold in ICOs comes from. Unlike traditional securities, the value of which is tied to the profitability of the firm over its lifetime, tokens are only worth what someone would be willing to pay for the underlying good or service they represent. To be sure, investors may inflate that value by overestimating how much the good or service will ultimately be worth. Token issuers face a tension between raising more money upfront by making the tokens an attractive store of value for investors and keeping the price stable so the tokens can actually function as a medium of exchange on the platform for customers.

"That limits how much money an ICO can really raise," says Gans. "That suggests that if we are seeing ICOs, it may be because there are constraints on the ability of entrepreneurs to access traditional equity markets."

Expanding the Market

Open access to funding is one of the benefits often attributed to ICOs. Startups typically have a harder time obtaining funding than established firms. Their ideas are untested, making them a risky bet for banks and investors alike. Angel investors and venture capital firms specialize in taking on greater risks to give entrepreneurs a chance, but research indicates that such investors are geographically concentrated in places like the San Francisco Bay area or New York, and most venture capital investments are made locally. This could limit the startups that are able to obtain such funding. In concept, ICOs expand the venture finance market to the entire world, allowing anyone with an internet connection to invest in a new idea.

Another advantage of ICOs is that they allow developers to presell their ideas to gauge market interest before actually investing in their product or service. ICOs are similar to crowdfunding in this respect. For example, Eric Migicovsky initially tried to raise money for his Pebble smartwatch from angel investors. When he fell short of his goal, he turned to crowdfunding platform Kickstarter to sell the idea directly to consumers. His crowdfunding campaign raised more than $10 million — more than 100 times the amount he needed. Like crowdfunding, ICOs could help bring ideas to market that institutional investors might pass on. And for firms attempting to build an online platform, the ability to gauge demand and establish a network of users before doing any work may be even more valuable than the money they raise.

"One of the benefits of an ICO is that you can see how many people take up the offer and that gives you an idea of how aggressively to build out your product or service," says David Yermack, a business economist at New York University.

Cost is another factor that may limit entrepreneurs' access to traditional financing.

"The cost of raising money in an IPO is severe," says Yermack. "You typically pay a 7 percent underwriting spread and then usually have your shares discounted by 10 percent or more by the underwriter before they sell them on the market. So right there you are at a 17 percent discount, and that is not counting the overhead cost of regulatory compliance, delays, and the legal liability you expose yourself to."

Proponents of ICOs have argued that they are an easier source of startup funding, which could enable more entrepreneurs to bring their ideas to market. But critics allege that the savings touted by ICO champions, particularly during the market's high point, stemmed largely from avoidance of important regulatory safeguards, making the ICO market ripe for fraud.

Wild, Wild West?

Whether entrepreneurs are trying to raise money via traditional channels or ICOs, the process suffers from the same problem: asymmetric information. Simply put, the sellers know more about the project, and its likely chances of success, than the investors.

One response to this problem is to require sellers of corporate securities to disclose information to investors, as the SEC does in the United States. Firms looking to go public through an IPO must disclose information similar to what public companies are required to include in their annual reports to the SEC, such as financial statements and a description of the business. To determine whether something a company is selling to the public is a security, the SEC uses criteria established in a 1946 U.S. Supreme Court case involving the sale of Florida orange groves. According to this so-called Howey test, sale of a security involves "an investment of money in a common enterprise with profits to come solely from the efforts of others."

In arguing that ICO tokens were not securities, many issuers focused on the last part of the test. They have argued that ICO tokens are just a way of preselling goods or services to customers, not investment vehicles. Some have also maintained that the decentralized nature of blockchain companies means that their success, and the ultimate value of the tokens, is not dependent on the efforts of organizers.

But in a series of reports, enforcement actions, and the detailed framework it released in April, the SEC has made it clear that virtually any involvement by an "active participant" (such as a promoter or organizer) in the ICO process that contributes to the value of the tokens would be enough to qualify those tokens as securities. For example, the Decentralized Autonomous Organization (DAO), which launched its ICO in 2016, claimed to be a decentralized corporate finance network that would allow token holders to vote on future projects to fund using the money raised in the ICO. In 2017, the SEC published a report on the DAO and argued that it was not as decentralized as it claimed. The parent group that created the DAO remained heavily involved in its governance by appointing "curators" to select the proposals that DAO token holders could vote on. This and other factors led the SEC to conclude that the DAO's tokens should have been registered as securities.

Regulation is not the only solution to reduce asymmetric information in security markets, however. ICO organizers also have market incentives to be transparent with investors. In a paper with Sabrina Howell of New York University and Marina Niessner of AQR Capital Management, Yermack found that groups that published white papers describing their proposal or the underlying code of their platform were more likely to have a successful ICO. Previous venture capital investment in the project was also highly correlated with ICO success.

To be sure, market incentives were not enough to prevent widespread ICO fraud. According to a 2018 study by the Satis Group, a token advisory firm, nearly 80 percent of ICOs were determined to be scams, meaning there was evidence that the project leaders had no intention of actually developing their project with the proceeds from the token sales. But those scams accounted for just 11 percent (roughly $1.3 billion) of funds raised in the ICO market. In contrast, the 15 percent of ICOs that succeeded and issued tokens that went on to trade on exchanges accounted for about 70 percent of the total funds raised.

Looking closer, Satis Group found that just three projects accounted for most of the money raised by ICO scams, which suggests that while there was no shortage of frauds in the market, investors largely avoided them. In fact, two researchers have argued that investors may have even been too conservative. Hugo Benedetti and Leonard Kostovetsky of Boston College studied more than 4,000 ICOs and found that, if anything, they seemed underpriced given the average performance of tokens, even after accounting for the presence of frauds and failures.

It remains to be seen whether evading regulations or exuberance over cryptocurrencies in general were the main drivers of ICO growth or if entrepreneurs will still be drawn to ICOs over traditional fundraising for other reasons.

"There is definitely some regulatory arbitrage and quite a bit of fraud that has happened," says Howell. "But I think ICOs also open the possibility for some exciting new business models."

New Possibilities

Through the blockchain and smart contracts, ICOs could be used to fund the development of decentralized platforms. Examples of such platforms include Wikipedia and Linux. Both are maintained by volunteers rather than an owner or group of owners.

"That is appealing to some people because you can avoid a single point of failure, and you can potentially have a more democratic form of governance for the platform," says Howell.

The challenge is that it can be hard to motivate people to work for free. Relying on volunteers may result in few decentralized platforms being built. Through an ICO, however, it is possible to raise money to pay for the development of a platform without necessarily giving the developers control over it.

"You could remunerate the people who actually create a platform's value rather than the person or people who built it," explains Howell. "For example, you could imagine a decentralized version of Uber where the drivers actually have control over the platform and are earning a larger share of the rents from that service."

Still, it isn't clear how easy it would be to create such a platform in practice, even with an ICO. As the SEC found, one such attempt — the DAO — was not as decentralized as it claimed.

Smart contracts present other interesting possibilities beyond decentralization, however. For example, they could potentially solve long-standing problems with corporate governance and share management.

"It's surprising, but most companies today don't know who their shareholders are," says Yermack. The existing share registration system makes it challenging to conduct accurate shareholder votes, hampering the effectiveness of shareholder oversight over public companies. The blockchain could make it easier to see who owns shares and make it easier to conduct votes, potentially bringing along some other benefits as well.

"You could have much more transparency into things like shareholder activist purchases, executive compensation, and managers' trading of shares for compensation or investment purposes," says Yermack.

Of course, it is possible to use smart contracts and reap these benefits without ICOs, but the fact that token sales already utilize the blockchain may make them a natural candidate for testing these theories.

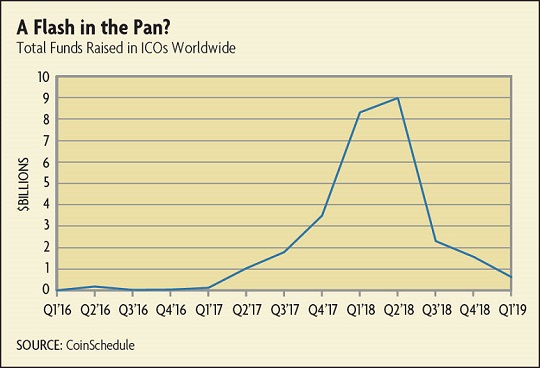

A Flash in the Pan?

With the recent slowdown in ICO activity, some observers think that the market may disappear as quickly as it came. At the same time, the SEC has made it clear that it doesn't intend to treat all ICOs as security offerings. It recently ruled that tokens issued by TurnKey Jet Inc., which would allow holders to charter a jet, did not need to be registered as securities because they were only tradeable among members of the program. Some countries, such as China and South Korea, have taken a stronger stance and chosen to ban ICOs entirely. Others, such as Singapore and Switzerland, have been more permissive. Worldwide, this suggests that the ICO experiment could continue, at least for now. But it may take more time to fully determine the benefits of ICOs, if any.

"The people who are interested in token offerings now tend not to view them as a way to reduce the regulatory cost of raising money," says Morgan. "Rather, they believe the technology offers them some benefits for the business enterprise they are trying to get off the ground."

The benefit of raising money in advance for a project while establishing a base of eager customers has proven useful throughout history. The Royal Albert Hall in the 19th century and the Centre Court of Wimbledon in the early 20th century were both funded in part by preselling seats. Digital tokens open up the opportunity to conduct such presales for many more types of goods or services, but it remains to be seen whether firms engaging in ICOs can deliver on their promises.

"We've seen a lot of ICOs, but very few products actually come to market," says Gans. "So it's very much a question whether they'll be around in the long term."

Readings

Benedetti, Hugo, and Leonard Kostovetsky. "Digital Tulips? Returns to Investors in Initial Coin Offerings." Manuscript, May 20, 2018. (Article available with subscription.)

Catalini, Christian, and Joshua S. Gans. "Initial Coin Offerings and the Value of Crypto Tokens." National Bureau of Economic Research Working Paper No. 24418, March 2019.

Howell, Sabrina T., Marina Niessner, and David Yermack. "Initial Coin Offerings: Financing Growth with Cryptocurrency Token Sales." Manuscript, April 5, 2019.

Li, Jiasun, and William Mann. "Initial Coin Offerings and Platform Building." Manuscript, Oct. 1, 2018.

"Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: The DAO." Securities and Exchange Commission, July 25, 2017.

Yermack, David. "Corporate Governance and Blockchains." Review of Finance, March 2017, vol. 21, no. 1, pp. 7-31.