Opportunity Zones: More Money, More Problems?

The promise and pitfalls of a new financing model for distressed communities

Businesses and jobs are few and far between in the St. Paul's neighborhood of Norfolk, Va., a 200-acre area north of the Elizabeth River. Most of the residents live in three public housing complexes that were built in the 1950s, and the poverty rate is as high as 72 percent in some areas. In January 2018, after 13 years of planning and debate, the city council approved a resolution to demolish Tidewater Gardens, Young Terrace, and Calvert Square and replace them with mixed-use, mixed-income developments. In the resolution, the council noted that the residents' current housing left them "isolated, economically challenged and vulnerable to recurrent flooding."

The project won't be cheap. Merely tearing down the 618-unit Tidewater Gardens community will cost more than $7 million, and over the next decade the total redevelopment could top $1 billion. Norfolk and the Norfolk Redevelopment and Housing Authority have been awarded a $30 million grant from the Department of Housing and Urban Development, but it remains an open question how the remainder of the development will be financed. So city officials are excited about a provision in the Tax Cuts and Jobs Act of 2017 that is designed to draw long-term investment to struggling communities by offering tax advantages to investors who finance projects in "opportunity zones."

All of St. Paul's has been designated an opportunity zone, and the city is in serious talks with a number of potential investors. "Opportunity zones could really be the answer to help move the needle in the areas of the project where the city may not be able to leverage some of its traditional financing mechanisms" says Sean Washington, senior business development manager for the City of Norfolk and the city's designated opportunity zone lead.

Norfolk isn't the only city that's excited about the potential influx of opportunity zone investment; the program has generated enthusiasm nationwide and enjoys broad bipartisan support. But economics and past experience suggest it might be necessary to temper that enthusiasm with caution and patience.

Planning for Opportunity

"Rethinking Detroit," Working Paper No. 17-04, February 2017.

"Understanding Urban Decline," 2016 Annual Report.

The concept grew out of a 2015 white paper by Jared Bernstein, a senior fellow at the Center on Budget and Policy Priorities who also served as an adviser to Vice President Joe Biden, and Kevin Hassett, the current chair of the Council of Economic Advisers and a former scholar at the American Enterprise Institute. At the time, both Bernstein and Hassett were serving as advisers to the Economic Innovation Group (EIG), a bipartisan policy group that had just been founded to study entrepreneurship and innovative investment strategies. "We wanted to think about policy solutions that could address the geographic divides that have come to define outcomes in the U.S. economy," says Kenan Fikri, director for research and policy development at EIG. "How could we move capital at a scale commensurate with the problem?"

Bernstein and Hassett's paper was short on details, but EIG sought out congressional partners who could flesh out the idea and develop legislation. Sen. Tim Scott, a Republican from South Carolina, was especially interested, and in 2017 he introduced the "Investing in Opportunity Act" with 14 co-sponsors from both sides of the aisle. The bill stalled in the Senate Finance Committee, but Scott continued to advocate for opportunity zones and eventually secured their inclusion in the 2017 tax bill.

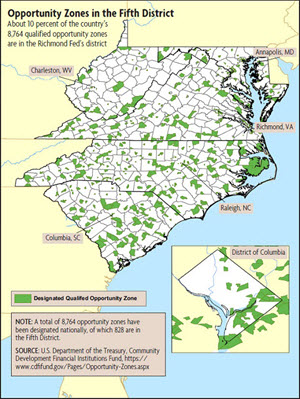

Once the law was passed, states had until April 2018 to designate their opportunity zones from among a pool of eligible low-income census tracts, subject to certification by the Treasury Department. A census tract is a statistical area of between 1,200 and 8,000 residents. More than 8,700 opportunity zones, covering about 11 percent of the country, have now been designated across all 50 states, Washington, D.C., and five U.S. territories. About 10 percent of them are in the Fifth District. (See map below.) In Norfolk, 13 census tracts in addition to the three tracts in the St. Paul's area are opportunity zones. On average, according to an analysis by EIG, the poverty rate in census tracts that received the designation is around 30 percent, compared with just over 12 percent across the United States as a whole. More than one-fifth of adults in opportunity zones lack a high school diploma, and median family income in the zones is about $25,000 below the U.S. median.

Opportunity Zones: The Nitty Gritty

Opportunity zones were selected from among a pool of low-income high-poverty census tracts, with input from state and local leaders.

An opportunity zone investment has to be made through a special fund known as a qualified opportunity fund (QOF). QOFs are required to hold at least 90 percent of their assets in opportunity zone properties or businesses. Grubb Properties started a QOF in early 2019; it has raised about $25 million to date and has two active projects in North Carolina. Nationwide, around 134 opportunity funds have been created, representing more than $29 billion in capacity, according to data gathered by the professional services firm Novogradac. But they haven't done much actual investing yet — largely because they've been waiting for the Treasury and the Internal Revenue Service to clarify the rules of the game. With the release of a second set of proposed regulations in April 2019, many observers are hopeful that the money is about to start flowing. "We've gotten a lot more phone calls since the second tranche of regulations was released," says Washington. "Investors feel a lot more comfortable now."

Will This Time Be Different?

Since the early 1990s, the federal government had made a variety of attempts to stimulate investment in economically distressed areas. These programs, including empowerment zones, renewal communities, enterprise communities, and the New Market Tax Credit (NMTC), varied in their particulars, but in general they offered tax deductions or credits to businesses that open or expand in a designated area or that employ the area's residents. (Empowerment zone and enterprise and renewal community incentives have expired. The NMTC is slated to expire at the end of 2019, but legislation has been introduced to make it permanent.) One economic rationale is the need to solve the "first-mover" problem, in which the first person to invest in a new area has to do a lot of initial research and vetting that later investors can capitalize on — not to mention take on higher risk. As a result, there's less incentive for anyone to go first, even if there are profitable opportunities on the table. Empowerment zones and their ilk are intended to provide that incentive, with the hope of kick-starting investment and economic activity.

The evidence on the effectiveness of these programs is quite mixed. According to a 2013 article in the American Economic Review by Matias Busso of the Inter-American Development Bank, Jesse Gregory of the University of Wisconsin-Madison, and Patrick Kline of the University of California, Berkeley, the first round of federal empowerment zones in 1993 substantially increased employment and wages without increasing the cost of living. But other research has found insignificant effects or has found that positive effects are accompanied by rising rents and housing prices that displace current residents. There's also research suggesting that empowerment zones and similar policies simply shift economic activity from one place to another without any net gain.

In their white paper, Bernstein and Hassett described some factors that could limit the impact of previous tax-based policies. First, they concluded that the policies were overly complex, which both made it costly for businesses to comply and curtailed the activities they could undertake. They also argued that the incentives were generally too small to make a meaningful difference in firms' decisions and that they were poorly targeted to communities' needs. Perhaps most important, according to Bernstein and Hassett, was that the programs didn't facilitate any involvement by financial intermediaries such as banks or hedge funds.

So what's different about opportunity zones? Proponents point to several features that might make them more effective than past policies. One is that the zones were designated by state governors with considerable input from local leaders, who presumably know more about the needs and growth potential of their communities than do federal authorities. In addition, the opportunity zone program pools the resources of multiple individual and institutional investors, increasing the potential funds available and limiting the risk to any one person or firm. And depending on the size and profitability of the opportunity zone investment, the tax benefits are potentially quite large. "Rather than reward specific projects," says Fikri, "the goal of opportunity zones is to change investor behavior, to change the risk profile, and encourage investors who aren't the usual suspects in these communities. It's trying to change how the market itself behaves."

The Feature Is a Bug

These features of opportunity zones could also prove to be bugs, however. For example, the size of the potential tax break is what could lure new investment, but it depends on how profitable the investment is — which depends in part on rising property values and rents. So some observers fear that in many places, the opportunity zone designation will create or hasten a process of gentrification to the detriment of lower-income residents who don't own their homes and instead are forced out by rising rents. Lending weight to this concern, researchers at the Urban Institute found that since 2000, the designated tracts had experienced greater increases in median family income, housing costs, and the share of residents with at least a bachelor's degree — all proxies for gentrification — than eligible tracts that were not designated. An analysis by Zillow found that after the final opportunity zones were announced, real estate sale prices increased 25 percent year over year in designated zones versus 8 percent in tracts that were eligible but not designated. Before the final zones were announced, prices in all the eligible areas had increased at about the same pace.

"Gentrification is a legitimate concern, and it will probably happen in some places," says Bonds. "But there are controls that can be put in place, for example, through a city's zoning and permitting process. If cities are planning ahead and sharing information with the community, it lowers the odds it will happen."

That planning is part of Sean Washington's job. "We're working on the guardrails," he says. "What can we do to ensure that the purpose of opportunity zones — to help people — is actually accomplished?"

Local leaders know their communities, but they also face local political considerations. So zones might have been chosen not based on how many people would be helped but rather on satisfying particular constituents. Leaders also might have wanted to choose areas that they knew would attract a lot of investment to their cities, which means it's likely the investment would have occurred without the benefit of government involvement. Skeptics view the designation of areas like Long Island City in Queens (already home to JetBlue and Ralph Lauren); essentially all of Portland, Ore. (seen by many as ground zero for hipster culture); and North Miami (where a $4 billion luxury condo development is already underway) as evidence that many opportunity zones are likely to benefit investors more than low-income Americans. These areas aren't representative of all opportunity zones; the Urban Institute also found that designated tracts did have higher poverty and unemployment rates than eligible tracts that weren't designated. At the same time, they did not have less access to capital as measured by existing commercial and residential lending.

Finally, it's possible that a lot of QOF money could flow to cities that already have "shovel-ready" projects (and might have attracted investors anyway). "That's certainly a hazard in this first year," says Fikri. "When something is totally new, it's easier if something is already in the pipeline and can be repurposed to fit the program. But we're optimistic that as the second wave of investments comes, the incentive will be meaningful on the margin at unlocking new capital." Fikri also notes, however, that opportunity zone projects will be most likely to help the zones' residents when they're paired with workforce development and educational programs. "More adults in opportunity zones don't have high school diplomas than do have college degrees," he says. "There's a lot more work to be done to ensure that the most disadvantaged people can take advantage of the opportunities."

Readings

Bernstein, Jared, and Kevin A. Hassett. "Unlocking Private Capital to Facilitate Growth in Economically Distressed Areas." Economic Innovation Group, April 2015.

Busso, Matias, Jesse Gregory, and Patrick Kline. "Assessing the Incidence and Efficiency of a Prominent Place Based Policy." American Economic Review, April 2013, vol. 103, no. 2, pp. 897-947.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.