Assessing Large Financial Firm Resolvability

A large financial institution may be said to be "resolvable" if, in the event of failure, policymakers would allow it to go through bankruptcy without financial assistance from the government. The choice between bankruptcy or bailout trades off different sets of costs on the economy. This Economic Brief presents a new tool that could assist policymakers with this evaluation, potentially helping to curb the "too big to fail" problem, serving as a useful complement to the "living wills" process, and making the resolution process more transparent.

How should policymakers respond when a large financial firm fails? During the 2008–09 crisis, financial troubles at large, critical financial institutions — along with the government's response to each troubled firm — garnered significant public attention. The U.S. government's decision to intervene in the financial system to prevent the collapse of troubled firms is commonly attributed to the fear that the failure of such firms could be very damaging to financial stability and the real economy. However, these types of interventions raise important concerns about the implications for redistribution, as well as the fact that the prospect of emergency lending provides incentive for firms to engage in excessive risk-taking. The latter problem, known as "moral hazard," arises when shareholders and creditors expect public support in the event of financial distress, creating an implicit safety net that they expect will protect them from losses.1

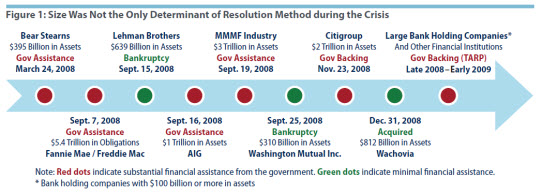

As described in Figure 1, the government chose an array of resolution methods during the financial crisis. Some failing firms were allowed to go through bankruptcy or be acquired with minimal government assistance, while some firms were deemed too big or systemic (important to the financial system) to fail and received sizable emergency lending or "bailouts."

As Figure 1 shows, size was not the only determinant of how the government dealt with each firm. Rather, the differential treatment by policymakers suggests that these firms had different characteristics or failed under different circumstances, which policymakers believed implied different effects on the economy in the event of bankruptcy. In essence, a resolution method is a cleanup technology. Bankruptcy may leave a substantial mess, which may include disruptions in the provision of key services (such as payments, asset custody, lending relationships, brokerage, counterparty provision of derivatives, or hedging), as well as contagion to other financial institutions. Contagion to other firms may occur either because they are direct creditors of the failing firm or because the values of certain classes of their assets are depressed due to a sudden flooding of the market when the firm fails (so-called "fire sales"). By contrast, bailouts make things exceptionally clean but potentially with more messes to clean up in the future due to the increased risk-taking that bailouts may encourage. The choice between resolution methods trades off these costs.

The above facts give rise to some questions: How are resolution decisions made by policymakers? What information do they have when making the call? Is it possible to anticipate and influence whether firms will be "resolvable" in the sense that the government would allow them to go through bankruptcy without government financial support? The 2010 Dodd-Frank Act responded to these questions in three key ways. First, it stated that unassisted bankruptcy should be the preferred method — that is, the default decision — for resolving firms in financial trouble. Second, it created the Orderly Liquidation Authority (OLA) with some access to government funds to assist particularly difficult resolutions and reduce bailouts. Third, it mandated that large firms craft "resolution plans," also called "living wills," which would provide information on how they would be resolved through the bankruptcy process. The idea is for living wills to help regulators anticipate the consequences of unassisted bankruptcy and influence those consequences — that is, to change the structure of the firm if necessary, such as through divestiture and other prudential measures, to make bankruptcy the preferred resolution method.

In practice, however, living wills are lengthy, hard to digest, and opaque. They include significant amounts of qualitative information and nonstandardized content across firms, and only a small portion of the information is made public.2

This Economic Brief discusses a recent paper by Richmond Fed economists Arantxa Jarque and John Walter and former research associate Jackson Evert that addresses these concerns.3 They present a framework to help clarify what makes a firm resolvable. In particular, they model the decision-making process of policymakers who are trying to evaluate the links between a firm's structure and the impact on the economy from its failure. Their research introduces the idea of an "impact score" that is intended to capture the severity of outcomes should a given firm fail. One can then compare the impact score resulting from the bankruptcy process versus the impact score for resolution involving various levels of government support to determine whether a firm is resolvable.

The score developed by these researchers takes objective measurements of firm characteristics, such as size and reliance on short-term funding, and adds them together using subjective weights that reflect how problematic a high level of each characteristic may be in the event of failure. Inevitably, because there have not been a large number of bank failures from which to form empirical estimates, there is room for disagreement as to what these weights should be. Yet, the task of choosing a resolution method implicitly forces policymakers to take a stand on such matters.

The weights assigned to each characteristic typically will vary with the resolution method being evaluated since different alternatives may be better or worse at "cleaning up the mess" implied by a given characteristic.4 For example, if a failing firm relies heavily on short-term debt, the fact that resolution through the OLA allows access to government funds may permit the continued functioning of a "bridge" company, hence the repayment to those debt holders. This implies a lower level of contagion than resolution through bankruptcy, which would put many short-term debt holders in line with other creditors.

The weights also may vary depending on the crisis scenario being considered. For example, a widespread crisis may be more likely to encourage the international coordination of regulatory authorities to deal with a failing firm doing business in several countries. A policymaker with such a view may assign a lower weight to a firm's measure of cross-jurisdictional activity in an aggregate shock compared to a case in which the failure is an isolated episode and coordination is less likely to happen. On the other hand, the potential for disruption due to the failure of a key provider of payment services is likely to be larger in a widespread crisis, when no other financial firm may be able to make the investments necessary to absorb the business in a timely manner.

A broader benefit of an impact score is that it could support accountability in the living wills process. Many aspects of living wills are inherently qualitative and confidential, but an impact score could help clarify the many aspects of firm structure that are measureable and nonconfidential. The impact score determinations could then be compared to the resolvability determinations made by the Federal Deposit Insurance Corporation and the Board of Governors of the Federal Reserve System, informing the public discussion on resolution policy. Thus, an impact score along the lines proposed by Jarque, Walter, and Evert can both serve as a tool for policymakers in the resolution decision as well as increase transparency about resolution policy.

Firm Characteristics and the Impact of Failure

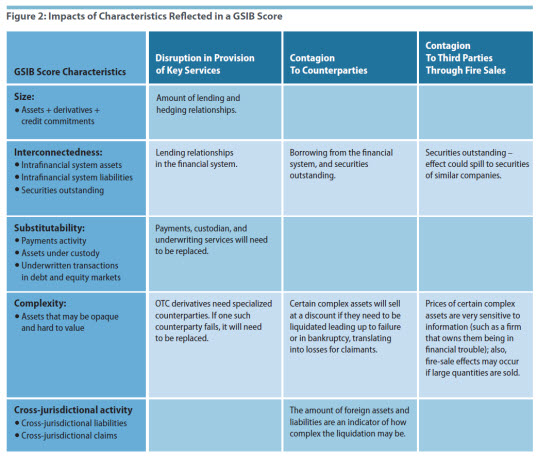

The first step in constructing an impact score is to select firm characteristics that are informative about costs of failure. The authors propose to start with those used by international regulatory authorities in the designation of global systemically important banks (GSIBs) and add a few new characteristics pertaining to the financing structure of firms.5 The "GSIB score" collects information on firm characteristics that are thought to be correlated with economy-wide disruptions in the event of failure. These characteristics fall into five conceptual categories:

- Size: a measure of total exposures, reflecting the firm's importance or value to the economy

- Interconnectedness: amounts borrowed from (and lent to) other firms in the financial sector, which are informative about the magnitudes of likely fire-sale and contagion effects

- Substitutability: captures the financial services the firm provides to other firms

- Complexity: captures the amount of loans and other assets owned by the firm that may be hard to value on short notice by outsiders

- Cross-jurisdictional activity: amounts owed to and from foreigners

Figure 2 lists how each of these characteristics is measured and the costs to the economy that may be associated with each characteristic in the event of a firm's failure. Ranking the firms by any of these five categories yields a different order than ranking them by size, suggesting that each item yields additional information on the firm's structure not captured by size alone.6

In addition to these baseline characteristics from the GSIB score, the authors propose to include in their impact score five new firm characteristics that may capture valuable information about impact. The five new items all relate to additional aspects of the structure of a firm's short-term debt:7

- Amount of qualified financial contracts (QFCs): this captures the borrowing that the firm does using contracts exempt from bankruptcy's "automatic stay." The stay prevents most creditors from attempting to collect on their claims upon a debtor's bankruptcy filing.8 QFCs include repo loans, commodity contracts, forward contracts, and swap agreements. If, instead, the failing firm is resolved through the OLA, regulators can impose a two-business-day stay on QFCs that would make it possible to sell those debt contracts instead of liquidating them and hence would avoid the need for debt holders to sell the collateral backing the QFCs.

- QFCs/assets: the proportion of assets that is financed with these special contracts is informative about the risk of inefficient liquidation of assets backing these QFCs under the exemption, which would translate into lower recovery rates for other claimants subject to the stay.

- Non-QFC short-term borrowing: if any of this debt gets caught in bankruptcy's automatic stay, it would have an impact on counterparty liquidity. This is also debt that would be likely to run in the days leading to insolvency, prompting liquidation of assets in the troubled firm.

- Non-QFC short-term borrowing/assets: the proportion of assets financed with this type of debt is informative about the potential impact of failure on the value of the firm's assets due to rushed liquidation to meet non-QFC short-term debt obligations that are not being rolled over.

- Short-term debt/liquid assets: liquid assets can be sold quickly without suffering losses. If short-term debt, which is prone to run in the event of financial turmoil, is high relative to liquid assets that can be used to pay off that debt, worse outcomes likely would occur for counterparties of the firm that are subject to the automatic stay.

These new measures are presented in Figure 3, which also describes ways in which they may be expected to influence the costs of a firm's failure. Importantly, differing resolution methods (bankruptcy, OLA, or bailout) likely would influence the impact that each of these firm characteristics would have on the economy in the event of bank failure, as discussed next.

Using the Score to Evaluate Firm Resolvability

As discussed, the impact score could be used to determine whether a firm's structure is acceptable for resolution in bankruptcy. Jarque, Walter, and Evert say that a firm is "resolvable" if its impact score under bankruptcy is equal to or less than its impact score under resolution involving bailouts or some other degree of government support in all crisis scenarios being considered. Put differently, a firm is resolvable if the anticipated costs to the economy stemming from bankruptcy are less than the costs stemming from a method featuring government support.

For a given list of firm characteristics being analyzed, weights need to be assigned to each of them to create a summary impact score. This is no easy task. Selecting weights under different resolution methods and scenarios requires not only quantifying the impact associated with each firm characteristic, but also the costs of government intervention.

The costs of government intervention include both "outrage" costs tied to distributional concerns and moral hazard costs. The authors argue that these costs may be greater when a firm is bailed out after a firm-specific shock than if the bailout follows an aggregate shock.9

Resolution under the OLA also may carry these costs, although to a lesser extent since the OLA provides some degree of protection for creditors. If a firm instead goes through bankruptcy, the authors assume that the moral hazard cost is zero given that no government assistance is provided.

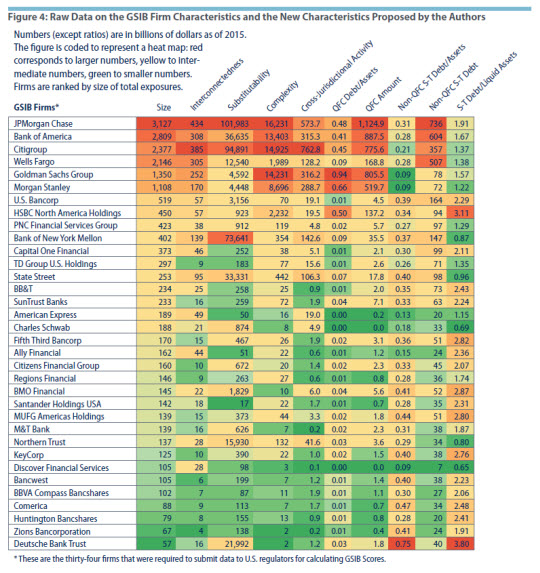

The authors illustrate how policymakers' different beliefs about the impact associated with each firm characteristic would translate into different resolvability determinations by combining raw firm data for a sample of large firms in 2015 with different sets of weights chosen to represent different views to produce different sets of scores.10

These score calculations illustrate, for example, the consequences of disagreements among policymakers about the importance of fire sales. In the impact score, such a difference of opinion would translate into different weights on interconnectedness, complexity, and on the five new characteristics related to short-term debt. (See explanations in Figures 2 and 3.)

The authors provide weights that would lead to disagreements between a policymaker who worries about fire sales and a policymaker who does not. Given such weights, the policymaker who is concerned about fire sales would choose OLA for U.S. Bancorp, PNC Financial Services, and Capital One Financial, while the policymaker who is unconcerned about fire sales would choose bankruptcy. This is the case for these firms because, for the characteristics for which policymakers agree on weights, the measured values are low enough that a disagreement on other weights — specifically, on the interconnectedness, complexity, and new debt-related terms — tilts the comparison between costs of bankruptcy and costs of OLA. The policymaker not concerned with fire sales gives these three firms much lower partial scores based on their interconnectedness, complexity, and debt structure in bankruptcy, and this makes the bankruptcy score the lowest and the firms resolvable. For the largest six companies, on the other hand, their high numbers on size, substitutability, and cross-jurisdictional activity drive the comparison of the scores, even for the policymaker who discounts the fire-sale effect from the rest of the characteristics. This can also be understood by focusing on HSBC and Bank of New York Mellon (BoNY), which are similar in size to PNC. While the partial score attached to short-term debt items is also low for these two firms when fire sales are not considered, their measures of complexity (HSBC) and substitutability (BoNY) are at least one order of magnitude higher than those of PNC and hence the advantages of OLA for dealing with complexity and substitutability end up implying that these firms are not resolvable.

The authors also illustrate how looking beyond size can affect resolvability determinations. For this purpose, they compare determinations based on their full impact score with those of a score based only on size. This is reminiscent of the fact that much systemic risk regulation is size-based, indicating that the simplicity of such straightforward cutoffs can be attractive to policymakers. Naturally, for policymakers who only consider size, the preferred resolution method is bankruptcy for smaller firms (which are assigned a fairly low impact from failure), OLA for middle-sized firms (that benefit enough from the better cleanup technology of the OLA to compensate for the moral hazard cost), and bailout for the largest firms (for which the impact under bankruptcy or the OLA is the largest). Such a policymaker would not consider TD Group resolvable, while a policymaker who evaluates all firm characteristics would think of TD Group as resolvable. This disagreement can be tracked to the fact that while this is a fairly large firm, it has fairly low readings on nonsize characteristics (such as interconnectedness, substitutability, and non-QFC short-term debt/assets, values that are shaded green in Figure 4).

More generally, Figure 4 displays raw data on how firms differ across the key characteristics in the impact score. This can provide further insight into how a policymaker's choice of weights may influence resolvability determinations. For example, while the amount of QFC debt is fairly proportional to size, this is less true for QFC debt as a proportion of assets. Even more markedly, while the amount of non-QFC debt is proportional to size, the ratio of this type of debt to assets displays an almost inverse relationship to size. An inverse relationship is also somewhat present in the illiquidity measure. A policymaker who weighs heavily any of these characteristics that are inversely related to size may have different resolvability determinations from a policymaker focused more intensely on size.

Conclusion

Policymakers need to weigh choices that make the failure of a firm less disruptive against choices that make the firm efficient and useful to society in good times.11 An important starting point for understanding these issues is to study the firm choices that make resolution through bankruptcy disruptive.

Naturally, any method for quantifying the impact of firm choices on the ease of resolution has limitations. Quantitative tools can't easily capture relevant information about firm choices that is not measurable or verifiable by regulators. In addition, it would be hard for any tool to capture all possible failure scenarios that may influence the impact in an important way or include all characteristics relevant to the costs of a firm's failure.

However, the 2008–09 crisis demonstrated that if policymakers want to prevent future bailouts and curb the "too big to fail" problem, they need some way of anticipating and influencing the costs that a firm's structure may pose to the economy in the event of failure. The impact score discussed in this Economic Brief proposes a tool for a baseline evaluation of resolvability that could be used on an ongoing basis to complement the living will review process. It also may enhance policymakers' ability to communicate to financial market participants and the public about likely actions in the event of financial distress.

Renee Haltom is the editorial content manager, Arantxa Jarque is an economist, and John R. Walter is a senior economist and policy advisor in the Research Department at the Federal Reserve Bank of Richmond.

See Borys Grochulski, "Financial Firm Resolution Policy as a Time-Consistency Problem," Federal Reserve Bank of Richmond Economic Quarterly, Second Quarter 2011, vol. 97, no. 2, pp. 133–152.

There have been calls to make more information public regarding either the evaluation framework or the results of the living will process. For example, see Thomas Hoenig, "Financial Supervision: Basic Principles," Remarks presented to the Institute of International Bankers Annual Washington Conference, Washington, D.C., March 2, 2015; and U.S. Government Accountability Office, "Resolution Plans: Regulators Have Refined Their Review Processes but Could Improve Transparency and Timeliness," April 2016.

See Arantxa Jarque, John R. Walter, and Jackson Evert, "On the Measurement of Large Financial Firm Resolvability," Federal Reserve Bank of Richmond Working Paper No. 18-06, March 2018.

In the authors' analysis, the main relevant dimensions in which resolution methods differ are the expected duration of the wind-down, the availability of funds to finance a bridge company, the possibility of delaying the exemptions to the automatic stay for QFCs, the possibilities for international coordination among the authorities involved in the wind-down, or the adherence to bankruptcy's established debt priorities.

The Federal Register notice containing a description of the quantitative score used by regulators for the designation of GSIBs can be found at: https://www.gpo.gov/fdsys/pkg/FR-2015-08-14/pdf/2015-18702.pdf.

See Jarque, Walter, and Evert (2018) for comparisons of these rankings.

A revised version of the GSIB score being phased out also collects information on the importance of short-term debt, though the exact measurement of this item differs from the one proposed by the authors. See Jarque, Walter, and Evert (2018) for details.

QFCs are exempt from bankruptcy's stay so that counterparties can keep assets used as collateral and in this way be spared from contagion, while, at the same time, said collateral is such that it can be removed from the failing firm without largely affecting its liquidation value.

The authors consider a set of crisis and resolution scenarios, but the framework is flexible enough to accommodate many others not explicitly considered.

The sample consists of thirty-four firms based in the United States with assets over $50 billion at the end of 2015. These firms were required to submit the data needed for U.S. regulators to calculate GSIB scores. The data obtained for these firms are displayed in Figure 4. See Jarque, Walter, and Evert (2018) for extensive examples of how different assumptions may change resolvability considerations for each of the thirty-four firms.

A broader framework for how living wills can help evaluate this trade-off can be found in "Understanding Living Wills," by Arantxa Jarque and Kartik B. Athreya, Federal Reserve Bank of Richmond Economic Quarterly, Third Quarter 2015, vol. 101, no. 3, pp. 193–223.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.