Does the Fed Have a Financial Stability Mandate?

Governments around the world have devoted increasing attention to maintaining overall financial system stability. Central banks play strong roles in domestic financial stability policy, but the full scopes of their financial stability mandates are ambiguous. The Federal Reserve appeared to embrace a stronger role in financial system stability starting in the late 1960s and accelerating with its unprecedented actions during the 2007–08 financial crisis. Questions remain, however, about the proper scope and design of a central bank’s financial stability mandate.

The 2007–08 financial crisis and the Fed's unprecedented response raised new questions about the Fed's role in maintaining the stability of the U.S. financial system.

Central banks have a natural role in financial stability for several reasons. First, monetary policy affects financial conditions in ways that can contribute to either stability or instability; erratic policy or volatile inflation could be destabilizing, for instance. Second, they obtain and develop insights useful for financial stability policy through the course of their other functions. Third, financial conditions are among the broad set of factors considered by central banks in assessing the state of the economy and the appropriate stance of monetary policy.

But for many central banks, the full scope of what they're expected to do in support of financial stability — the extent to which they have an explicit or implicit financial stability mandate — is ambiguous. This is important because a central bank's policy actions and its responses to developments in the economy and financial markets are shaped by its understanding of its mandate. So the nature of the mandate matters for economic outcomes, market expectations (the ex ante "rules of the game"), and accountability.

One reason this issue is inherently challenging is that there is no single definition of "financial stability." Most recent discussions focus on banking crises like the 2007–08 financial crisis, which tend to feature failures of large or many financial institutions, cascading losses, and government interventions. But central banks also have played a role in other types of financial market disturbances, for example, sharp asset price declines (like the Fed's liquidity assurances after the 1987 stock market crash), sovereign debt crises (like the European Central Bank's role in the recent eurozone crisis), and currency crises (like the Fed's role in Mexico's 1994 bailout).

This challenge is clear in the breadth of a definition for financial stability offered in the latest Purposes and Functions publication from the Board of Governors of the Federal Reserve System: "A financial system is considered stable when financial institutions — banks, savings and loans, and other financial product and service providers — and financial markets are able to provide households, communities, and businesses with the resources, services, and products they need to invest, grow, and participate in a well-functioning economy." The publication further states that a financial system ought to have the ability to do so "even in an otherwise stressed economic environment."1

This Economic Brief takes a descriptive look at the Fed's role in financial stability, including how that role has changed over time, and raises some fundamental questions.

What's in the Law?

In U.S. law, no single agency has sole responsibility for ensuring financial stability. Rather, different agencies have various responsibilities that support financial stability.

Certain laws give the Fed, typically in conjunction with other regulators, specific financial stability responsibilities. This is a relatively new development. Before the 2007–08 crisis, the supervision and regulation of financial institutions was focused on microprudential risks (those within individual institutions). Since then, risks concerning the financial system as a whole — so-called systemic risks — have received increased focus. This broader view includes the risk that one institution's failure will affect another, as well as the risk that events (such as a market dysfunction) might affect the financial system broadly.

The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act codified this macroprudential perspective (without ever using the term macroprudential) for all financial regulators while giving the Fed a unique role. First, the law added requirements that regulators consider risks to financial stability in the course of certain regulatory functions, for example, that the Board consider financial stability in approving financial institution mergers and acquisitions.2 Second, the law created the Financial Stability Oversight Council (FSOC), with representation from all of the regulatory agencies, including the Fed. The FSOC comes perhaps closest to an agency responsible for financial stability, but the law does not go that far: FSOC is formally charged with identifying risks to financial stability, promoting market discipline by reducing the expectation of government bailouts, and responding to emerging threats to the financial system (emphasis added). The FSOC also must identify "systemically important financial institutions" (SIFIs) whose failure or distress could threaten the financial system. Third, the law made SIFIs, along with bank holding companies (BHCs) with total assets of $50 billion or more, subject to regulation by the Fed. Prudential standards applied to SIFIs and these large BHCs must be tighter than for other institutions. Fourth, the law required the Fed, along with the Federal Deposit Insurance Corporation, to evaluate the credibility of SIFIs' living wills (plans the firms must create explaining how their operations can be wound down in bankruptcy with minimal disruption to the financial system).3

Dodd-Frank almost made the Fed legally and singularly responsible for the nation's financial stability. A near-final version of the Act indicated that, "the Board of Governors shall identify, measure, monitor, and mitigate risks to the financial stability of the United States." This language was dropped in conference between House and Senate members.4 But its earlier inclusion suggests that at least some lawmakers believe financial stability should be the Fed's responsibility.

The Fed's primary mandated functions — monetary policy, payments system operations, and banking supervision, often called the "three legs of the stool" — inherently play a role in financial stability. So it is perhaps unsurprising that the Board of Governors formally acknowledged a role in overall financial stability despite the absence of an explicit mandate, even before the 2007–08 financial crisis brought increased attention to the issue. Its first public strategic plan, which covered the 1997–2002 period, included relevant language under sections describing the Fed's supervisory role.5 This language was relatively strong, indicating a responsibility for "maintaining the stability of the financial system." More recently, financial stability has been its own independently listed function. For example, the Board's 2005 Annual Report and language added late that year to the "mission" listed on its website describe financial stability separately from other functions. In these broader contexts, the language is typically more general, referring to a role in "promoting" financial stability. The current mission statement on the Board's website includes five bullet points: one for each leg of the stool, one for consumer protection, and one saying that the Fed "promotes the stability of the financial system and seeks to minimize and contain systemic risks through active monitoring and engagement in the U.S. and abroad."6

What's in the Air?

In practice, the Fed has adopted an increasingly broad financial stability role. Financial stability was part of the Fed's initial purpose but in a limited and specific way. The Fed was created to provide a currency supply that could expand and contract quickly with the needs of commerce. The lack of such a supply before the Fed led to frequent currency shortages, which fueled banking panics and seasonal spikes in interest rates (the cost of borrowing money).7

The Fed's ability to address broader financial stability concerns was fairly circumscribed in the original Federal Reserve Act. Fed credit could be extended only to member banks. (A member bank could route Fed credit to a nonmember bank, but this required special Board approval.) In particular, the Fed could not lend directly to many of the institutions at the heart of previous panics, such as trusts. Eligible collateral was limited to what today is akin to highly rated commercial paper, that is, very safe short-term obligations secured by goods already in transit.

This collateral structure reflected the "real bills doctrine," the guiding principle of the day, which sought to limit money creation to the amount needed to fund commerce, as opposed to speculation or long-term investment.8 This approach suggests that central bank lending was envisioned primarily as a means to adapt the supply of currency to the needs of commerce, as opposed to a tool for responding to panics. Indeed, it was widely believed that the Fed's structure would prevent panics to begin with. As H.P. Willis, the Fed's first secretary, described: the "illustration so often used during the banking reform struggle wherein a central reserve bank was likened to a reservoir of water used to put out fire, was thoroughly misleading and erroneous. [Properly designed central banks] are not comparable to reservoirs suddenly drawn upon to put out fire; they are far more nearly to be compared to fireproof construction whose purpose it is to prevent combustion."

This structure did not last long, however. Fed lending powers expanded in the Great Depression. Specifically (emphasis added):

- In February 1932, the Glass-Steagall Act added paragraph 10(b) to the Federal Reserve Act temporarily authorizing lending to member banks on otherwise ineligible collateral.

- In July 1932, the Emergency Relief and Construction Act added paragraph 13(3) opening the discount window to nonbanks "in unusual and exigent circumstances."

- In March 1933, the Emergency Banking Relief Act added paragraph 13(13) authorizing lending beyond member banks (to individuals, partnerships, and corporations, the latter including nonmember banks) for 90 days against broader collateral (that is, obligations of the U.S. government).

- In 1934, the Industrial Advances Act added paragraph 13(b) allowing advances of working capital to established businesses if they were unable to find it "from usual sources."

The objective of these expansions was to provide credit to two specific groups: nonmember banks and industry. The former didn't have regular access to the discount window until 1980. For the latter, inclusion was motivated by a desire to provide capital for business production; as it was envisioned, the Fed would begin to operate the nation's industrial lending policy, a role that did not materialize.9

Over time, the Fed system more strongly recognized the ability of central bank credit to not just support industry, but to influence credit conditions more broadly. The Banking Act of 1935 marked a permanent shift away from the real bills doctrine, which by then had been discredited. First, the Act made the relaxed collateral conditions of 10(b) permanent. Though the Senate preferred to retain some restrictions, some parties — including the Board, as noted in its 1937 Annual Report and amendments that year to Regulation A, which governs the discount window — interpreted that Congress intended to allow the Fed to lend against any sound assets. Second, the Act directed the use of open market operations with consideration to "the general credit situation in the country," not just narrowly to the needs of banks. This marked the beginning of both the process and the macroeconomic focus behind monetary policy as it stands today.

With the 1951 Fed-Treasury Accord, the Fed stopped purchasing government bonds to suppress government borrowing rates. As noted in a 1973 history of Fed lending by Howard Hackley, then the Board's general counsel, central bank lending through the discount window became subservient to open market operations (the buying and selling of government securities in a market for government debt that had become competitive with the Accord) as the primary tool of monetary policy. Central bank lending became a tool for allocating credit.10

These policy and intellectual shifts regarding the role of central bank credit arguably did not mark the Fed's adoption of a broader financial stability role, however. That adoption started to emerge in the late 1960s. In 1968, the Federal Reserve System published a report by a committee appointed to reappraise the discount window, in part a recognition that strains in the banking system's ability to adjust reserves could hamper monetary control. The committee's report included what is perhaps the Fed's first formal articulation of a "lender of last resort" role in the context of systemic distress, noting:

The role of the Federal Reserve as the "lender of last resort" to other financial sectors of the economy may, under justifiable circumstances, require loans to institutions other than member banks. … In contrast to the case of member banks, however, justification for Federal Reserve assistance to nonmember institutions must be in terms of the probable impact of failure on the economy's financial structure. It would be most unusual for the failure of a single institution or small group of institutions to have such significant repercussions as to justify Federal Reserve action.11

This represented another shift in attitude, Hackley argued.12 The 1968 report described in detail how existing laws could enable emergency lending beyond member banks, though specifying the role was not intended as a "bail-out operation" that might prevent firms from bearing the costs of their risk-taking. A 1973 amendment to Regulation A also noted for the first time a role in extending credit to nonmember institutions on an emergency basis, that is, when "credit is not practically available from other sources and failure to obtain such credit would adversely affect the economy."

Whether by coincidence or design, the Fed soon began acting on this stance, taking unprecedented actions in the name of broader financial stability. After the $82 million default of Penn Central railroad in 1970, the Fed supported commercial paper markets by encouraging banks to borrow and use the proceeds to lend to other commercial paper issuers. In 1974, the Fed supported domestic certificate of deposit and eurodollar markets by lending $1.7 billion to Franklin National Bank, assuming $725 million in its foreign exchange positions, and accepting deposits from its foreign branch as collateral. Policymakers later stated they knew the bank was likely to fail, thus the support was about protecting broader markets. The bank Continental Illinois also received substantial support from the discount window in 1984, even as it was receiving emergency capital from the FDIC due to concerns that its failure could call into question the health of other large banks. After the 1987 stock market crash, the Fed made credit available to banks supporting broker dealers, among other actions. When hedge fund Long-Term Capital Management (LTCM) faced mounting losses in 1998, the Fed coordinated private lenders to provide emergency funding in order to avoid the large losses policymakers feared would have spread through the financial system had LTCM failed. And during the 2007–08 financial crisis, the Fed extended unprecedented emergency loans to investment banks and created liquidity facilities to support entire markets for specific assets.

Comparing Central Banks

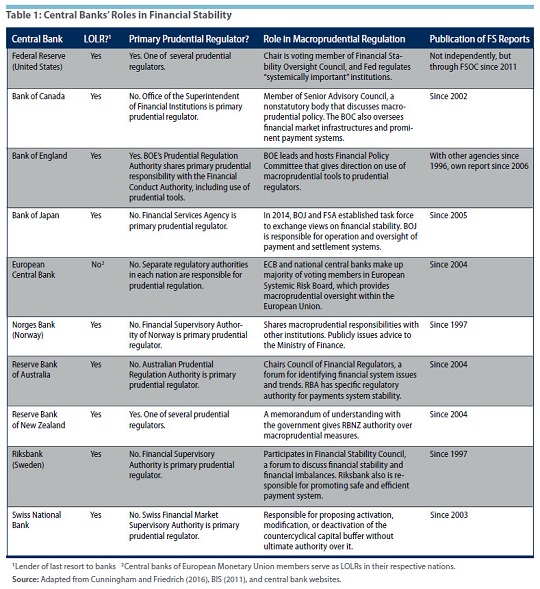

The Fed is not alone among central banks in having a financial stability mandate that is largely implicit in law or based in tradition. Several recent studies compare financial stability roles across central banks, including a 2011 Bank for International Settlements study based on a 2009 survey of thirteen central banks and a 2016 Bank of Canada working paper.13 Before the crisis, few central banks had explicit financial stability mandates distinct from their mandates for other functions, and the most explicit financial stability mandates existed under the payments umbrella. (See Table 1.) To the extent that central banks have responsibilities related to overall financial stability, they are typically less codified than mandates for banking or payments, perhaps reflecting that financial stability is a less-developed area of study and a less easily defined goal. In the majority of cases, the mandate is directional and not easily measureable, including language such as a responsibility to "promote" or "support" financial stability. Financial stability mandates that cover the broader financial system as a whole are not necessarily clearer in their objectives. Mandates for crisis response — that is, the lender of last resort function, whether standing facilities or emergency assistance — tend to be codified firmly in law but with significant differences in rules and how they have been used.

Central banks do not always play a major role in banking supervision, but mandates to potentially support banks in times of crisis via lender of last resort practices are widespread. Banks with greater regulatory responsibilities are more likely to see themselves as having broader financial stability responsibilities, even when the latter are not formalized. They are also more likely to deploy macroprudential instruments, though in the BIS study the use of macroprudential instruments correlated more strongly with an emerging market economy status than with having major regulatory responsibilities.

In the BIS survey, only Thailand came close to including financial stability explicitly as part of its monetary policy mandate, though all central banks reported having analytical frameworks for monetary policy that considered financial market developments. In some cases these frameworks are explicit: both the European Central Bank and the Bank of Japan formally identify longer-term risks to monetary policy that provide a channel through which financial stability concerns may enter monetary policy analysis. A 2015 Bank of Canada study of ten central banks found that those that have a stronger financial stability mandate but less influence over regulatory and macroprudential tools (such as countercyclical capital surcharges, asset concentration limits, and limits on interbank exposures, among others) were more likely to use monetary policy tools to address financial stability risks. That is, they were more likely to raise interest rates to lean against credit expansions viewed as excessive.14

Like the 2010 Dodd-Frank Act in the United States, many countries enacted financial reform legislation after the crisis, with a trend toward greater macroprudential regulation and analytics, often with special roles for the central bank. Some countries have created new financial stability oversight entities, such as FSOC in the United States, but some (like FSOC) focus on institutions while others focus only on overall risks. The United States is unique in that the formal analytic function (assigned to the Office of Financial Research in the U.S. Treasury) is not primarily housed in and does not directly involve the central bank. To the authors' knowledge, in no case has reform made traditional monetary policy objectives subservient to financial stability.

In most cases, the financial stability accountability framework is similar to monetary policy in that it happens largely through transparency, though with steps that are less explicit. Most central banks publish information on financial stability actions with discretion and historically have not released the recipients of emergency lending (at least not immediately) due to stigma considerations. Financial stability reports tend to be less frequent than monetary policy reports, and less information tends to be provided on financial stability actions than on monetary policy actions, perhaps because objectives and metrics of success for financial stability are less well-defined and may be based in counterfactuals (such as a crisis that didn't occur). Reforms since the crisis, such as those in the United States and the United Kingdom, have tended to enhance disclosures of the recipients of emergency lending. Many of the newly developed financial stability oversight groups, which are typically housed in central banks, must report periodically to lawmakers.

Overall, the objectives of financial stability responsibilities remain unclear. Financial market variables can and should fluctuate, sometimes rapidly, with underlying fundamentals. Does stability refer to the resilience of the system to such fluctuations or minimizing the costs that follow? The absence of broad crises? Managing the credit cycle? These questions have critical implications for the design, governance, and accountability of financial stability policymaking institutions.15 Moreover, achieving any of these objectives could require the use of tools designed for other purposes, potentially creating conflicts among goals. How central banks and other agencies should weigh these trade-offs remains for the most part an open question.

Some Implications for Monetary Policy

Many studies have explored outstanding issues concerning how financial stability policy, whether or not it is housed in the central bank, may affect the central bank's other functions.16 Despite relatively vague financial stability deliverables, it is very likely that lawmakers and financial market participants expect the Fed to take strong actions to achieve financial stability. This raises some potential problems that remain unresolved.

An expectation that the Fed will provide emergency lending could breed moral hazard. The central bank's stance regarding financial stability affects beliefs about how the central bank will respond to crises, and these beliefs affect the extent to which financial market participants engage in risky behavior in the first place. Ambiguity in the mandate is less problematic if markets place zero probability on financial rescues, but that is unlikely to be the case now given past actions. Measures to reduce that probability must carry legal or reputational weight to be effective.17

Lack of clarity over the Fed's role could leave room for political pressure that would jeopardize monetary policy goals. Monetary policy and financial stability concerns often will have consistent implications for monetary policy settings, but at times they may be in opposition, as might be the case if inflation were contained but asset prices were rising. But if the central bank believes it will be held accountable for asset bubbles, it may feel obligated to divert from standard monetary policy objectives. Monetary policy tools are easier and faster to implement than some regulatory tools and may have wider-ranging effects. They "get in all the cracks," as former Fed Governor Jeremy Stein has noted — a sentiment echoed by the Conference of Presidents in a recent tabletop exercise — even though monetary policy tools are blunt and not necessarily well-suited to addressing specific risks.18 And to the extent that reconciling trade-offs involves the political process, monetary policy objectives are likely to be compromised for time-inconsistency reasons.

Similarly, the central bank could face pressure to use its lending powers too liberally, especially if bailouts are politically expedient or if the central bank perceives it would be criticized later for not acting. The latter may be more likely when the mandate is vague since it provides wider scope for interpretation over perceived failures in financial stability goals. Since emergency lending powers overlap some with traditional monetary policy tools, backlash could threaten monetary policy independence — either overtly through legislation or through political pressures. There is indeed evidence that the Fed has factored congressional scrutiny into its monetary policy decisions.19

These are by no means the only issues concerning how a financial stability mandate may affect monetary policy. Overall, there remains a lot to learn about the role of the central bank in financial stability. The economics profession spent much of the last half of the twentieth century developing the scientific components of monetary policy, and that work is just beginning for financial stability policy.

Renee Haltom is the editorial content manager and John A. Weinberg is a senior vice president and special advisor to the president at the Federal Reserve Bank of Richmond.

Board of Governors of the Federal Reserve System, Purposes and Functions, 10th Edition, March 2017.

Section 163 of the Act states that "the Board of Governors shall consider the extent to which the proposed acquisition would result in greater or more concentrated risks to global or United States financial stability or the United States economy."

Section 165 of the Act states that the Board of Governors and FDIC must determine whether the resolution plan "is not credible or would not facilitate an orderly resolution of the company under title 11, United States Code." For more on living wills, see Arantxa Jarque and Kartik B. Athreya, "Understanding Living Wills," Federal Reserve Bank of Richmond Economic Quarterly, Third Quarter 2015, vol. 101, no. 3, pp. 193–223.

This text is visible in what was then section 1108(b) of the bill.

The Board's strategic plans are available on its website along with associated performance plans and reports.

Board of Governors of the Federal Reserve System, "About the Fed," accessed on May 31, 2017.

One interpretation is that the Fed's purpose was monetary stability as opposed to financial stability. See Renee Haltom and Jeffrey M. Lacker, "Should the Fed Have a Financial Stability Mandate?" Federal Reserve Bank of Richmond 2013 Annual Report, pp. 4–25.

For additional background, see Robert L. Hetzel, "The Real Bills Views of the Founders of the Fed," Federal Reserve Bank of Richmond Economic Quarterly, Second Quarter 2014, vol. 100, no. 2, pp. 159–181.

See Tim Sablik, "Fed Credit Policy during the Great Depression," Federal Reserve Bank of Richmond Economic Brief No. 13-03, March 2013.

Howard H. Hackley, Lending Functions of the Federal Reserve Banks: A History, Washington, D.C.: Board of Governors of the Federal Reserve System,1973, pp. 185–188.

Board of Governors of the Federal Reserve System, "Reappraisal of the Federal Reserve Discount Mechanism," Report of a System Committee, 1968.

Hackley 1973, pp. 194–195.

Bank for International Settlements, "Central Bank Governance and Financial Stability: A Report by a Study Group," May 2011; and Rose Cunningham and Christian Friedrich, "The Role of Central Banks in Promoting Financial Stability: An International Perspective," Bank of Canada Staff Discussion Paper No. 2016-15, July 2016.

Christian Friedrich, Kristina Hess, and Rose Cunningham, "Monetary Policy and Financial Stability: Cross-Country Evidence," Bank of Canada Staff Working Paper No. 2015-41, November 2015.

For a brief overview of some of these issues, see Paul Tucker, "The Objectives of Financial Stability Policy," Vox, September 28, 2016.

In addition to BIS 2011 and Bank of Canada 2016, see Viral Acharya, "Financial Stability in the Broader Mandate for Central Banks: A Political Economy Perspective," Hutchins Center on Fiscal and Monetary Policy at Brookings, Working Paper No. 11, April 2015; and International Monetary Fund, "Monetary Policy and Financial Stability," Staff Report, September 2015.

The Dodd-Frank Act attempted to limit bailouts by requiring that 13(3) lending be made broadly available and not extended only to one firm, but many observers have noted that this requirement would not prevent the Fed from creating a broad lending facility with the intention of rescuing specific firms.

Tobias Adrian, Patrick de Fontnouvelle, Emily Yant, and Andrei Zlate, "Macroprudential Policy: Case Study from a Tabletop Exercise," Federal Reserve Bank of New York Staff Report No. 742, Revised December 2015.

For example, see Gregory D. Hess and Cameron A. Shelton, "Congress and the Federal Reserve," Journal of Money, Credit, and Banking, June 2016, vol. 48, no. 4, pp. 603–633 (article available with subscription); and Charles L. Weise, "Political Pressures on Monetary Policy during the US Great Inflation," American Economic Journal: Macroeconomics, April 2012, vol. 4, no. 2, pp. 33–64 (article available with subscription).

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.