Appreciating Dollar Appreciation

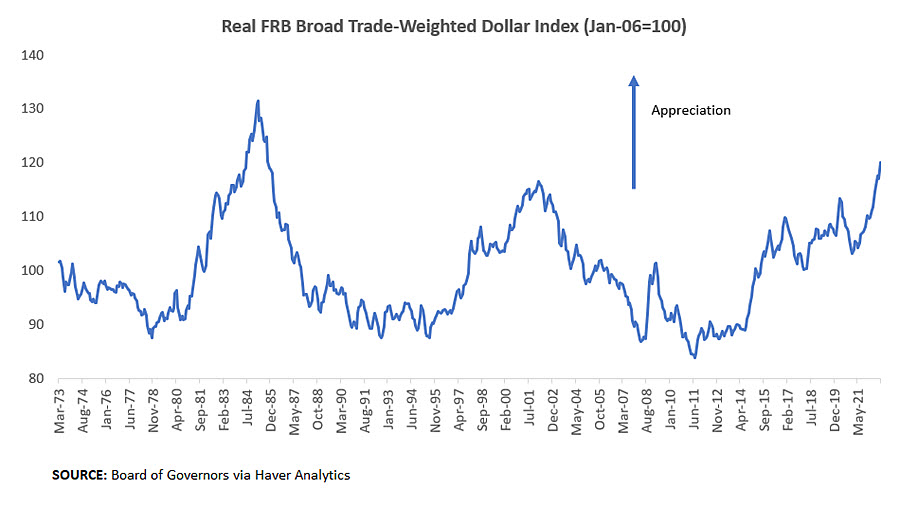

Exchange rates are on the move as central banks around the world tighten policy. Rising interest rates have contributed to an 11.4 percent year-over-year appreciation in the U.S. dollar versus a broad basket of currencies as of the end of September. As shown in Figure 1 below, the trade-weighted dollar index is at its strongest level since 1985.

The U.S. dollar appreciates when demand for the currency rises relative to demand for other currencies. This might happen in times of weaker growth prospects outside of the U.S. or in times of increased global uncertainty, as U.S. government assets benefit from being perceived as a safe haven. To buy Treasury bills, notes and bonds, foreign investors accumulate dollars, pushing up the dollar's price (that is, the exchange rate). With Russia's invasion of Ukraine, subsequent EU sanctions and shortages in the European energy market, the current environment of weaker growth and elevated uncertainty may be strengthening flight-to-safety currency flows to the U.S.

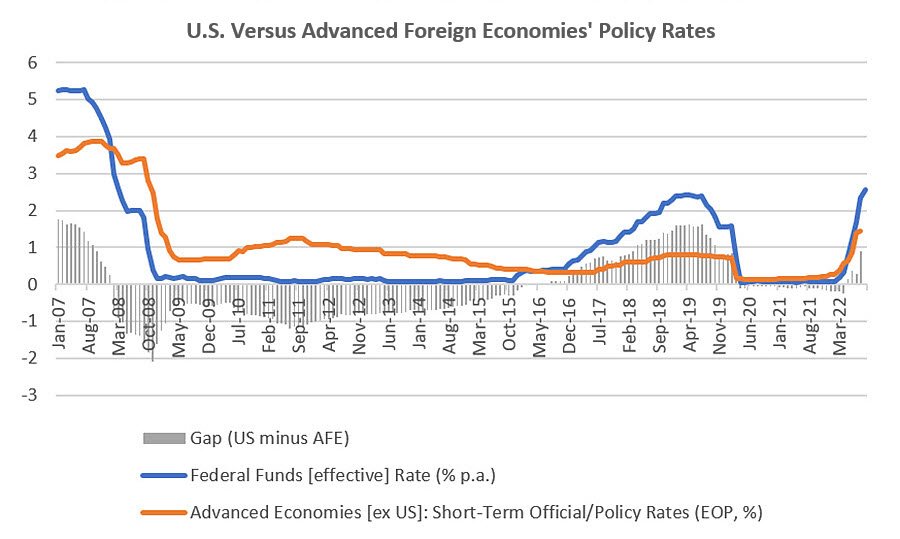

But regardless of the state of growth prospects abroad, U.S. Treasuries tend to become more attractive investments when interest rates rise in the U.S., and this can lead to dollar appreciation. As shown in Figure 2, the rapid pace of increases in the fed funds rate has led to a positive gap between policy rates in the U.S. and rates in other advanced economies, after being negative for two years after the onset of the COVID-19 pandemic.

A stronger dollar might help the FOMC achieve its inflation goals in two ways. By making U.S. goods more expensive and subsequently cooling foreign demand for them, a stronger dollar may ease pressure on supply-chain constrained factories that are having difficulties keeping up with the pace of new orders.

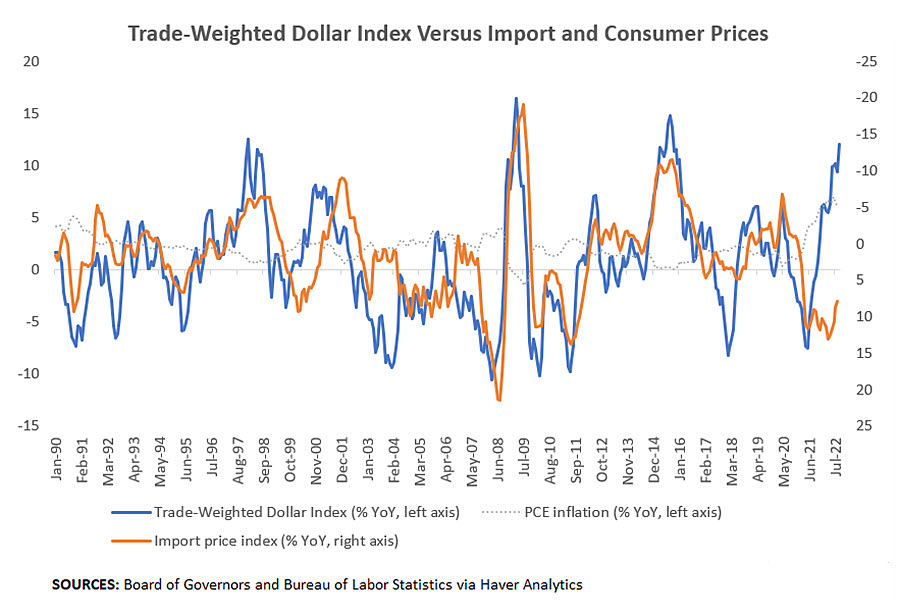

The stronger U.S. dollar also makes imports cheaper, which contributes to lowering consumer price inflation both by lowering the cost of imported final goods and by lowering costs for imported intermediate goods (assuming producers pass on those cost savings to consumers). Figure 3 below shows a strong negative correlation between year-over-year changes in the trade-weighted dollar index (on the left axis) and year-over-year changes in the price index for imported commodities (on the right axis, which has an inverted scale). The dotted grey line in Figure 3 shows how these series have been more volatile than overall PCE inflation.

The historical correlation between import prices and the exchange rate index suggests we should see further declines in import prices, which are still in positive year-over-year growth territory as of September. Additional adjustment is likely, which could be welcome news for inflation.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.