Uncertainty Declines, Tariffs Persist: Measuring the Impact of Tariffs on CFOs' Price and Cost Growth Forecasts

Introduction

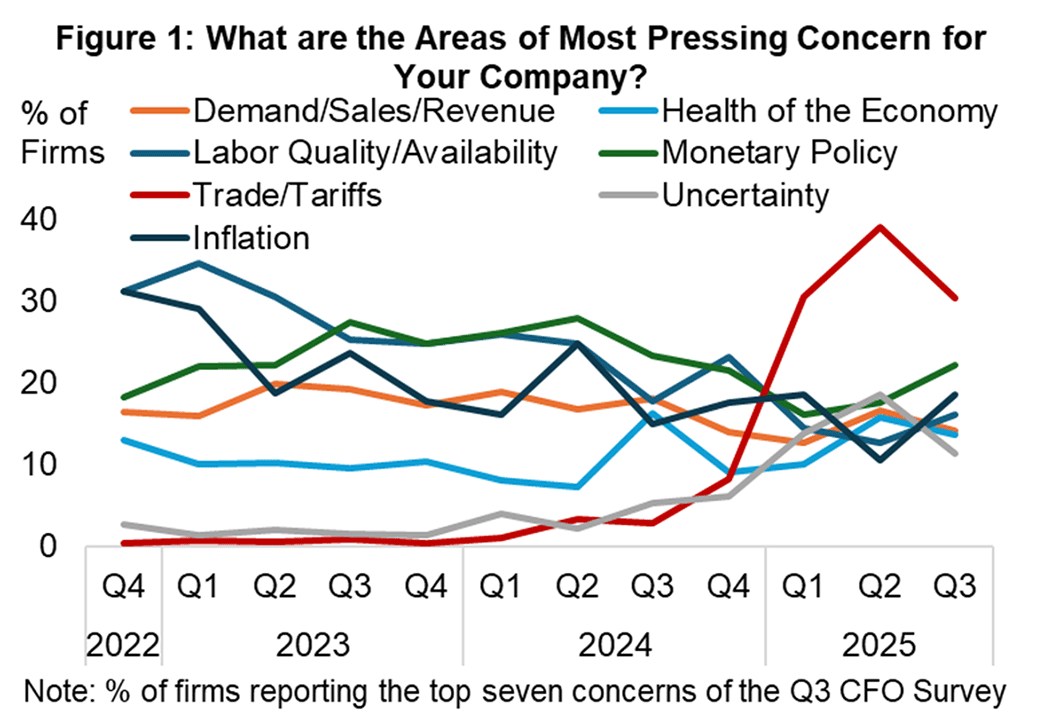

Financial decision-makers' concern over trade and tariff policy subsided somewhat in the most recent CFO survey, yet it remains higher than in prior years. When asked for the most pressing concerns facing their firms, 30 percent of respondents cited tariffs or trade policy. On the one hand, this was down from nearly 40 percent of respondents who reported concerns around tariffs last quarter. On the other hand, it remains the largest single concern cited by CFOs (Figure 1). The percent of respondents citing uncertainty also declined, from 19 percent last quarter to 11 percent in the Q3 survey. The combination of these results is consistent with broader measures of trade policy uncertainty, which have declined.

The relative decline in concern over tariffs coincides with an improvement in CFOs' economic outlooks. However, we find that firms that import from abroad still expect a significant impact from tariffs on their unit costs and prices, both in 2025 and 2026.

Importing Firms Slightly Moderated Their 2025 Price and Unit Cost Expectations

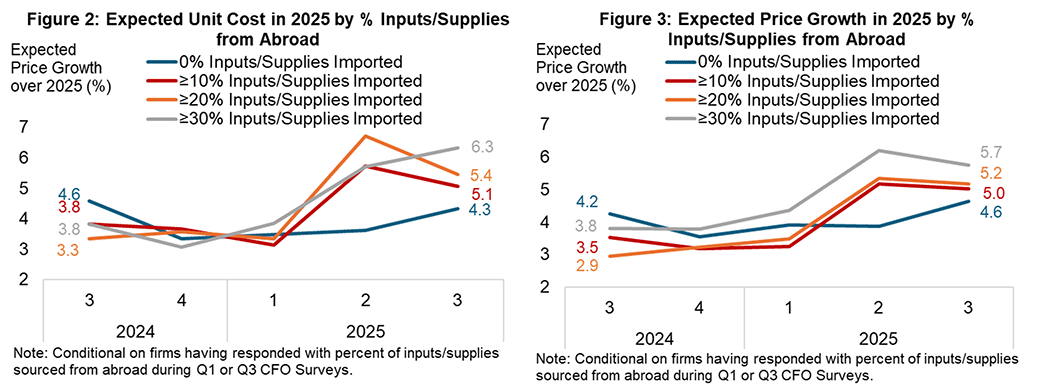

In the Q3 survey, most firms importing inputs/supplies from abroad expected unit cost and price growth this year to be slower on average relative to last quarter. That said, importing firms continue to expect significantly higher price and unit cost growth than they did in 2024 and Q1 2025, and they expect higher growth in these categories compared to their non-importing peers (Figures 2 and 3).

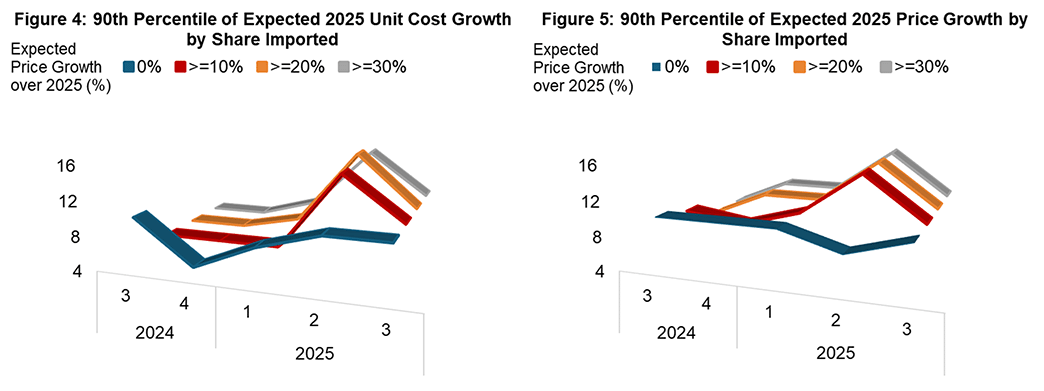

One possible explanation for the modest reduction in expected unit cost and price growth among tariff-exposed firms is that, compared to last quarter, firms are less uncertain about tariffs and are subsequently less worried about the most extreme outcomes manifesting. In Q2, historically high uncertainty over tariff policy coincided with a noticeable move higher in the 90th percentile of expectations for unit cost and price growth, which subsequently abated in the Q3 survey (Figures 4 and 5). The reduction in cost and price growth forecasts among firms in the 90th percentiles may indicate that these firms have yet to see the types of extreme impacts from tariffs that they expected and have thus softened their forecasts for price and cost growth slightly.

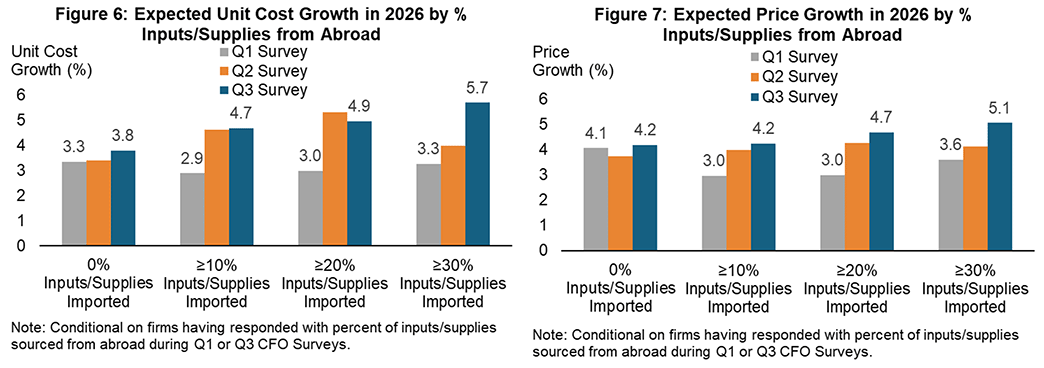

Importing Firms Ratchet Up Their 2026 Expectations for Price and Unit Cost Growth

Another possible explanation for the slight reduction in 2025 price and cost growth we saw this quarter is that some firms may now expect increases in costs and prices to manifest in 2026. Since the first quarter, firms importing inputs/supplies from abroad have steadily increased their expectations for unit cost and price growth in 2026, to a greater extent than non-importing firms (Figures 6 and 7) This suggests that some of the modest reduction in unit cost and price growth expectations this year may instead reflect growth that will materialize next year. This further supports the notion that a reduction in uncertainty over tariffs should not be conflated with expectations for a meaningfully smaller impact of tariffs on firm costs or prices.

One-Third of Expected Price Growth in 2025 Driven by Tariffs

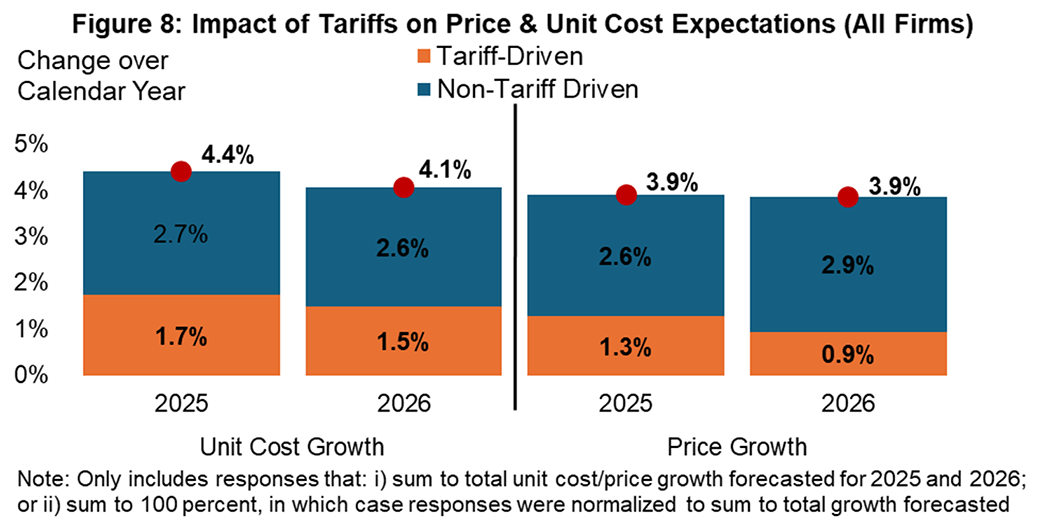

In a special question, we asked firms whether their price or unit cost expectations for 2025 or 2026 have been affected by the implementation of tariffs or uncertainty around trade/tariff policy. If they answered affirmatively, we asked how much of their expected price and/or unit cost growth is attributable to the implementation of tariffs or tariff-related uncertainty. On average across all respondents, firms assign just under 40 percent of their total unit cost growth in 2025 and 2026 to tariffs. Firms also assign one-third of their price growth this year to tariffs and around one-quarter of next year's price growth to tariffs (Figure 8).

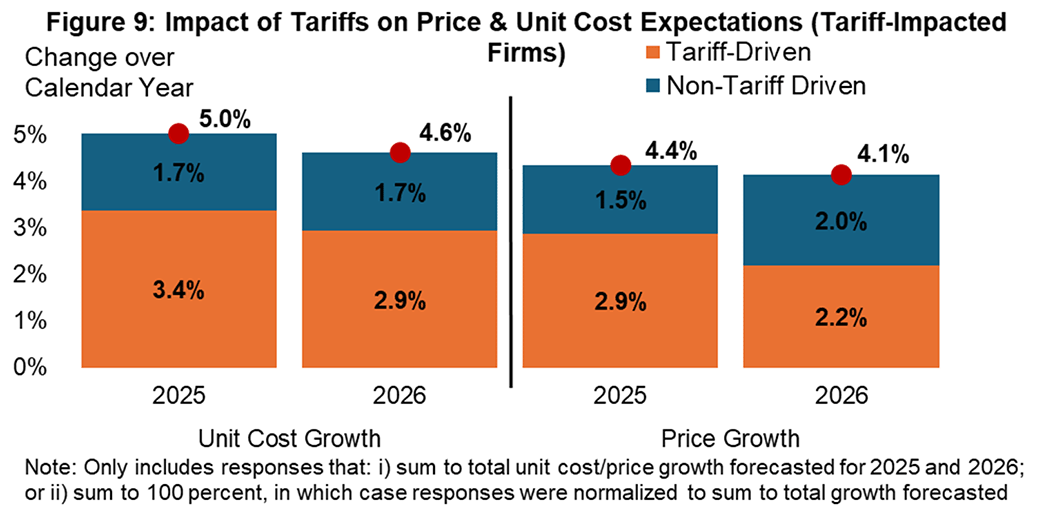

Impacted Firms Expect to Pass Through Most of the Tariff-Driven Increase in Unit Costs

The above chart includes all firms; we see a far great tariff impact by looking only at the half of firms whose costs or prices are affected by tariffs. Among affected firms, around two-thirds of unit cost forecasts are tariff-driven, and two-thirds of price growth forecasts for 2025 are tariff-driven as well (declining to around one-half of price growth in 2026). Absent tariff-driven changes, the average expected price growth in 2025 and 2026 among affected firms is at or below 2 percent. These responses confirm that even if the broader economic outlook has improved, firms' own forecasts continue to assign a significant impact to tariffs (Figure 9).

Conclusion

Firms' economic outlooks improved somewhat in the third quarter, and their concern over tariffs came down. However, respondents to The CFO Survey that source inputs and supplies from abroad expect higher cost and price growth during 2025 and 2026 compared to earlier this year and compared to their non-importing peers. Additionally, impacted firms attribute the majority of price and cost growth to tariffs. As before, trade policy remains fluid, and we will continue to monitor whether — and to what extent — firms expect tariffs to impact the economy and their own performance.

Receive an email notification when The CFO Survey updates are posted online.