How Did the U.S. Elections Impact Firms' Outlook for the Economy?

In the most recent CFO Survey, we explored how the economic outlook of financial executives changed following the 2024 U.S. presidential and congressional elections. To isolate this impact, we conducted two separate surveys, with about half of the CFOs receiving a survey that closed Nov. 4 (252 respondents) and the other half receiving a survey that ran from Nov. 6-19 (263 respondents). In addition, we polled respondents to the pre-election survey again following the election to gauge whether their views changed, and around half responded (131 respondents).

The Election Prompted Most CFOs to Upgrade their Economic Outlook

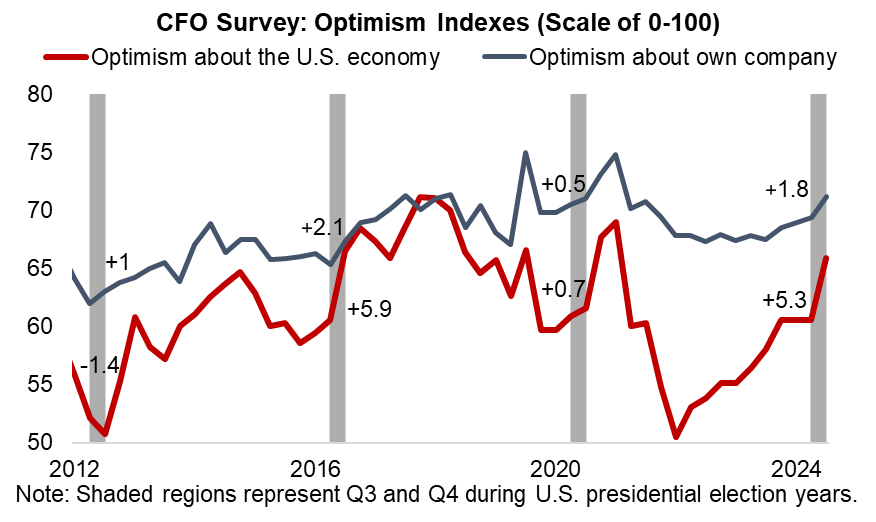

CFOs' optimism about the overall economy increased sharply and broadly in Q4 relative to Q3. Averaged across all respondents, on a scale of 0-100, optimism about the economy increased 5.3 points while own-firm optimism increased 1.8 points since last quarter — both strikingly similar to the increases observed after the 2016 U.S. elections.

This increase was starkest among smaller firms (<500 employees). Between the pre- and post-election surveys, smaller firms increased their economy-wide optimism by 6.7 points, compared to 4.2 points for larger firms. Economy-wide optimism is now roughly equal across these two firm size categories for the first time since 2022.

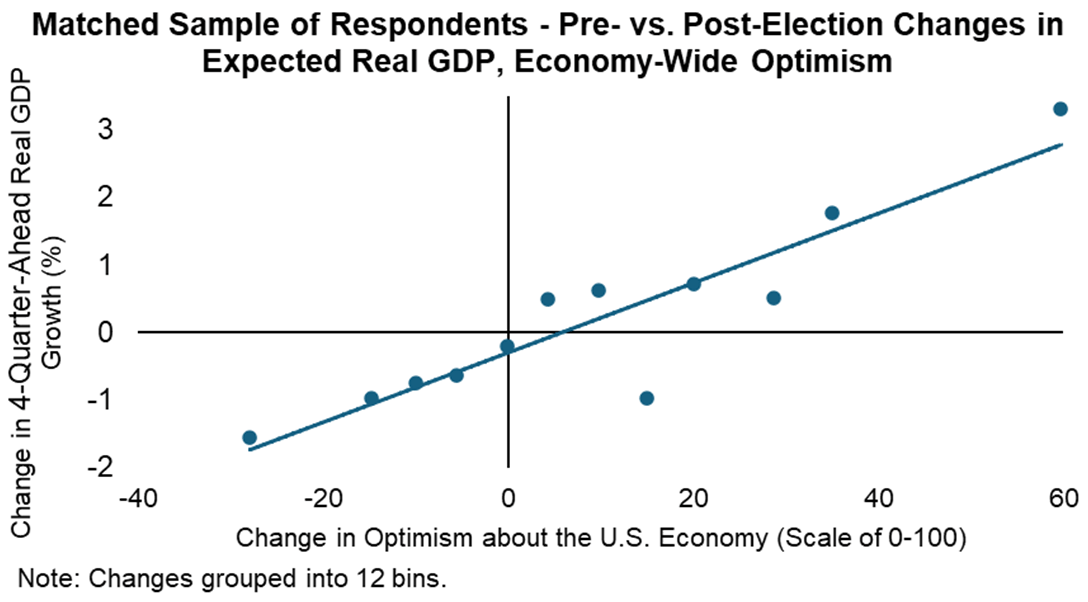

In addition to becoming more optimistic, financial executives upgraded their expectations for near-term economic growth, with the mean four-quarter-ahead real GDP forecast increasing from 1.91 percent last quarter to 2.16 percent in the pre-election survey and 2.33 percent after the election. Over the same period, the probability assigned to negative real GDP growth declined from 12.6 percent to 8.3 percent, its lowest level since 2021. Increases in optimism and anticipated economic growth were broad-based across all major industry types; nonetheless, companies' expectations of their own revenue and employment growth held relatively steady between the pre- and post-election surveys.

Among firms responding to the pre-election survey and updating their views after election day, changes to economy-wide optimism and expected real GDP growth were significantly positively correlated. (See next chart.)

Firms Remain Most Focused on Regulatory and Tax Policy; Trade/Tariff Concerns Increase

In both the pre- and post-election surveys, CFOs were asked to rank the three policy topics most important to their firms, in order of importance, from a fixed list of options. The resulting CFO Survey Policy Importance Index orders topics based on how many first, second, and third rankings they received. See the footnote in the chart below for additional information about how we calculated Index scores.

Following the election, regulatory policy replaced monetary policy as the most important policy topic for firms. U.S. corporate tax policy remained the second-ranked topic post-election, though its relative importance fell from 99 to 86. This was followed by monetary policy (83), fiscal spending (65), U.S. individual tax (50), health care (43), energy (33), and trade (32). In a separate, open-ended question asking CFOs to describe the top concerns facing their firms, the top mentions from the post-election survey were monetary policy, labor quality and availability, inflation, and the political climate. Among the concerns mentioned by firms, the largest change was in trade/tariffs. In the pre-election survey, 3 percent of firms mentioned this topic, compared to 14 percent of firms in the post-election survey.

Amid Tariff Worries, Firms Most Concerned with Trade Policy Downgrade their Economic Outlook

When comparing respondents by their highest-ranked policy topic, in nearly all cases, optimism levels increased between the pre-election and post-election surveys. One notable exception was trade policy. Firms ranking this topic highest in the post-election survey reported economy- and own-firm optimism levels that were lower by 6 and 8 points, respectively, relative to firms ranking trade policy highest in the pre-election survey. These post-election firms also forecasted year-ahead real GDP growth that was 1.2 percentage points slower than their pre-election counterparts. While only about 5 percent of our sample ranked trade as their top policy concern, one possible implication is that these firms view the prospect of escalating tariffs and trade wars as bad for their own firms and the overall economy. As one CFO remarked, "Looming tariff[s] (trade agreements) may have [an] impact on our growth and earnings!"

Conclusion

The conclusion of the U.S. election coincided with financial executives expressing greater economy-wide and own-firm optimism and higher real growth forecasts for the U.S. economy. One notable exception is the small cohort of CFOs ranking trade as the most important policy topic facing their firms; these companies generally downgraded their economic outlook following the election. As new policies are announced and implemented, analyzing changes in firms' outlooks may provide useful insight into how CFOs expect them to impact the economy.

Receive an email notification when The CFO Survey updates are posted online.