A new approach addresses the dynamics of negotiations involving a single proposer and the inherent delays in reaching agreements.

Production and Investment

We study the production of goods and services in the economy, including how firms make investment decisions.

Updating Results

Updating Results

How does Fifth District manufacturing activity vary by size? The Richmond Fed Manufacturing Survey found that large firms are more optimistic, including about the impact of recent tariffs, compared to small and mid-sized firms.

Jason Kosakow

Survey Director

Thomas Lubik discusses how inventories are tracked at the firm and aggregate levels and what fluctuations in these levels over time tell us about the health of the overall economy. Lubik is a senior advisor at the Federal Reserve Bank of Richmond.

Exploring the evolving significance of different production sectors within the U.S. economy since World War II provides methods for estimating and forecasting these shifts.

Andrew Foerster, Andreas Hornstein, Pierre-Daniel G. Sarte and Mark W. Watson

Will today's AI-related investment turn out to be a repeat of the 1990s telecom boom and bust?

John O'Trakoun

Senior Policy Economist

The third annual Marvin Goodfriend lecture, given by Richard Rogerson, covered cross-country sectoral productivity differences.

How does the rise in land-use regulation play into the decline in construction sector productivity?

How might labor productivity and total factor productivity fare over the rest of the decade?

The capital expenditure ratio — a signal of business confidence — may reveal whether uncertain business expectations are carrying over to firms' investment decisions and plans for the future.

Kristal Tejeda and John O'Trakoun

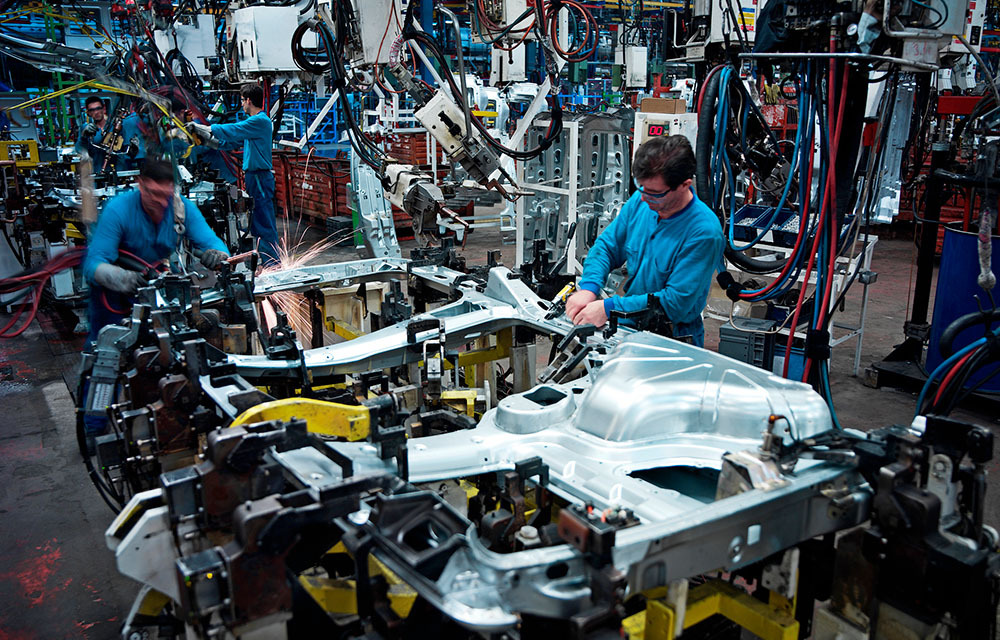

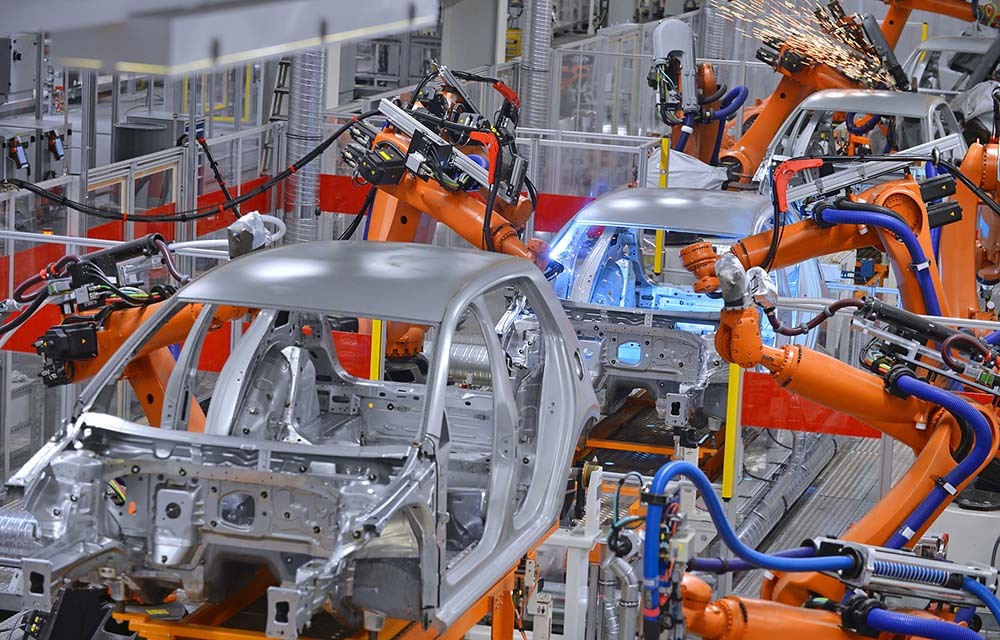

Driven by the auto industry, the Palmetto State is a global economic player. How will tariff uncertainty impact its businesses?

Exploring inventories — an enigmatic yet significant aspect of GDP data — can shed light onto business investment patterns, structures, and conditions across different industries over time.

Katherine Anderson, Thomas A. Lubik and Nathan Robino

According to our May business surveys, most firms are responding to tariffs in a variety of ways, including planning and implementing price increases, delaying capital expenditures, and changing hiring plans.

Announcements regarding AI can have significant impact on the economy, even if the actual technology isn't enacted for a while.

Christoph Görtz, Christopher Gunn and Thomas A. Lubik

Growing demand for carbon-free energy has put nuclear back in the spotlight, but hurdles to new development remain.

Pierre-Danie Sarte and Thomas Lubik discuss their research on the components of productivity growth, how that growth has varied over time and across industries, and how much it will benefit from the use of artificial intelligence. Sarte and Lubik are senior advisors in the Research Department at the Federal Reserve Bank of Richmond.

Data from the automotive industry seems to suggest car buyers could feel the effects of tariffs sooner rather than later.

John O'Trakoun

Senior Policy Economist

Our first CFO Survey of 2025 explored the extent to which firms' supplies are imported from countries facing tariffs and how this exposure impacts firms' expectations.

Zach Edwards, Lauren Taylor and Daniel Weitz

In March, we asked Fifth District businesses about the impacts of tariffs. Most expected to be impacted negatively and anticipated passing through some of the additional costs to customers.

Marina Azzimonti, Zach Edwards, Sonya Ravindranath Waddell and Acacia Wyckoff

The contributions of various sectors to aggregate productivity growth have shifted significantly since World War II.

Economic shocks can be amplified through supply chains. In response, many firms and policies are aiming to increase supply chain resilience.

The topics presented included unconventional monetary and fiscal policy, global inflation patterns and worker responses to labor shocks.

In the most recent CFO Survey, we explored how the economic outlook of financial executives changed following the 2024 U.S. presidential and congressional elections.

This paper explores the role of technological shocks and if their impact triggers a response that resembles business cycles.

Christoph Görtz, Christopher Gunn and Thomas A. Lubik

This post explores how firms whose investment plans were negatively impacted by election-related uncertainty differ from non-impacted firms in optimism levels, growth expectations, and investment motivations.

Pierre-Daniel Sarte and Sonya Waddell share survey results on businesses' use of AI tools and other forms of automation, and research on the potential effects of automation on the nation's overall productivity growth. Sarte is a senior advisor and Waddell is a vice president at the Federal Reserve Bank of Richmond.

South Carolina's recruitment of a Boeing assembly plant to North Charleston in the late 2000s boosted the state's aerospace sector and Charleston's local labor market over the subsequent decade.

Adam Scavette

Regional Economist

Policies aimed at helping specific sectors better adopt new technologies might see better returns when targeting sectors that affect a wide range of others.

Nicholas Trachter and Lindsay Li

As the capabilities of generative AI continue to improve, the CFO Survey can provide us insights on the impact these tools are having on firms and the growth of their productivity.

Sonya Ravindranath Waddell

Vice President

Technology improvements may not matter as much as the age and experience of the workforce.

Erin Henry, Pierre-Daniel G. Sarte and Jack Taylor

Firms continue to innovate and automate, although responses from Fifth District business respondents illustrate that we are in the early days of AI adoption.

The most recent CFO Survey indicates that most firms expect pricing pressures to persist during 2024, and firms implementing automation are expecting slower price growth than those who are not.

What are early studies suggesting about how AI may impact labor productivity?

Andreas Hornstein

(Emeritus)

Economic history and research can provide useful tools for thinking about the future of AI and the challenges and risks along the way.

Most native U.S. workers seem to benefit from having immigrant coworkers.

We study how random variation in the availability of highly educated, foreign-born workers impacts firm performance and recruitment behavior.

Parag Mahajan, Nicolas Morales, Kevin Shih, Mingyu Chen and Agostina Brinatti

In this report, we investigate how the firms that adopted automation differ — in performance and expectations — from those that did not adopt automation.

Top firms entering markets don't appear to drive away local businesses.

Nicholas Trachter and Lindsay Li

Even though expectations are not paramount in how most firms set their prices, there is evidence that inflation expectations matter.

Data from the monthly Construction Spending Report point to a sustained and robust pace of real private construction spending toward the end of 2023.

John O'Trakoun

Senior Policy Economist

Had U.S. immigration been more restrictive, the IT sectors in both the U.S. and India might have been worse off.

Gaurav Khanna and Nicolas Morales

Jobs held by temporary workers aren't included in the official tally of job creation and job destruction, which leads to significantly underestimating the magnitude of labor market flows.

What impacts can be seen based on the type of collateral used by businesses?

Arun Gupta, Horacio Sapriza and Vladimir Yankov

Understanding the economic effects of technological change — and of the world-changing disruptions that new technologies may bring about — is important for central bankers.

Will the recently enacted CHIPS Act bring major growth to the region's semiconductor industry?

Severe weather shocks can have long-lasting impacts on the macroeconomy.

A 2020 paper on market power has ignited considerable attention, follow-up and criticism.

Nicolas Morales discusses his research on supply chains and the factors that can help them resist and recover from economic shocks, like the COVID-19 pandemic. Morales is an economist at the Federal Reserve Bank of Richmond.

How much should imitators compensate innovators for using their ideas?

Restrictions on immigration could cause production to shift away from the U.S. to other countries.

Andy Bauer, Renee Haltom and Matt Martin share what their business contacts have told them about regional economic conditions in the Fifth District.

U.S. politics have become increasingly polarized, and this polarization has impacted the economy.

Firm productivity plays a role in how many customers a firm loses after a price increase.

Samira Gholami and Nicholas Trachter

While auto sales have been trending up over the past several months, we'll look into a couple of reasons why the future may not be so bright.

John O'Trakoun

Senior Policy Economist

Since the second half of 2022, we have observed firms increasingly pulling back on capital expenditures. This post explores the recent declines in capital investment using data from The CFO Survey and the Richmond Fed monthly business surveys.

Jason Kosakow and Sonya Waddell discuss the expectations of regional and national business leaders about the economy, based on responses to the CFO Survey and the Federal Reserve Bank of Richmond's regional business surveys during the first quarter of 2023.

In this paper, we use new data on daily firm-to-firm transactions from India, coupled with a large exogenous shock that disrupted supply chains to varying degrees.

Gaurav Khanna, Nicolas Morales and Nitya Pandalai-Nayar

The lockdowns resulting from COVID-19 provide an opportunity to examine what factors affect the strength of supply chains.

Claire Conzelmann, Nicolas Morales, Gaurav Khanna and Nitya Pandalai-Nayar

President Barkin reflects on the relationship between technological innovation, the economy and monetary policy.

Tom Barkin

President, Federal Reserve Bank of Richmond

Today's inflationary snarls reflect both supply shocks and policy stimulus.

John Mullin

Malls have been a part of the American cultural and economic fabric for generations. How will they survive recessions, the rise of online shopping, and a pandemic?

Supply chain disruptions and fluctuating input costs are improving for some Fifth District firms, but the threat of a recession looms large according to August's surveys of businesses.

How competitive is the U.S. labor market? Answering this question quantitatively is helpful for understanding how wages are affected by labor market power, and thus for understanding how workers will be affected by labor policy choices.

Abhimanyu Banerjee

Fifth District firms recently reported being able to better meet customer demand. A cooling economy may be part of the story.

Jason Kosakow

Survey Director

In the OTC market for credit default swaps, some investors are more central within the trading network than others.

President Tom Barkin discusses how firms can optimize the hybrid work environment.

Tom Barkin

President, Federal Reserve Bank of Richmond

In this essay, we describe Marvin Goodfriend's Industrial Development model and ponder its lessons for contemporary policy discussions.

Purchases of durable goods have been moderating after experiencing a surge during the pandemic. But is this due to falling demand or constrained supplies?

John O'Trakoun

Senior Policy Economist

Consumers who would benefit from lower tariffs on a good tend to matter more when setting trade policy than producers who want higher tariffs.

Fifth District firms report that two years into the pandemic, they still cannot provide enough goods and services to completely meet customer demand.

The New York Fed recently combined a variety of indicators into a single measure of global supply chain pressure. Plotting this index against the Richmond Fed's "prices paid" measurements from its business activity surveys can provide a window into the effects of supply disruptions on the Fifth Federal Reserve District.

John O'Trakoun

Senior Policy Economist

The emergence of a new COVID-19 variant poses risks to next year's economic outlook, especially if a spike in cases leads to supply disruptions in China and higher prices for Chinese imports.

John O'Trakoun

Senior Policy Economist

Doing a deep dive into inventory-to-sales ratios can yield insights into supply chain issues during the COVID-19 pandemic.

John O'Trakoun

Senior Policy Economist

Amid labor shortages and supply side disruptions, firms are struggling to fully meet demand and many reported they expect this issue to persist.

Roisin McCord

Recent data from the Institute for Supply Management and other sources offer early indications of whether and how much supply chain disruptions have eased.

John O'Trakoun

Senior Policy Economist

Manufacturers have recently seen an increase in orders, but disruptions in the supply chain have made meeting demand a challenge.

Roisin McCord and Alexander Nikolov

Some policymakers, researchers, and commentators have expressed their belief that a concerted federal investment in technology, or in research and development, can help level the playing field nationwide and spur economic growth. But is it optimal for all localities to specialize in the same sorts of industries?

Neeraja Deshpande

The construction of the Interstate Highway System helped to develop the U.S. economy.

Hailey Phelps

Sometimes money gets used when it should not, and we investigate why using surveys plus measures.

Janet Hua Jiang, Peter Norman, Daniela Puzzello, Bruno Sultanum and Randall Wright

This post looks at the current assessment of roads and bridges in the Fifth District and how states have recently allocated federal funds.

Joseph Mengedoth and Alexander Nikolov

Flu incidence declined dramatically during the pandemic. If that were to continue, we could see large social and economic gains, writes President Tom Barkin in his latest essay.

Tom Barkin

President, Federal Reserve Bank of Richmond

How much reshuffling of businesses and residents will we see among cities, suburbs, and rural areas? The answer will have important implications for local economies.

Tom Barkin

President and Chief Executive Officer

The economic recovery enabled by the vaccine rollout has increased demand for Fifth District goods and services. But can supply keep up with demand?

Jacob Crouse and Sonya Ravindranath Waddell

Sonya Waddell, Brent Meyer and John Graham discuss the latest results of the quarterly CFO Survey.

President Tom Barkin discusses the importance of training the next generation of infrastructure workers.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin talks about the pandemic’s lasting influence on office life.

Tom Barkin

President, Federal Reserve Bank of Richmond

In just 10 years, between 1999 and 2009, North Carolina's furniture manufacturing industry lost more than half of its jobs.

John Mullin

Changes in the meat supply chain have brought benefits, but are vulnerabilities a cause for concern?

Emily Green

Decisions about investment at the firm level are important to the path of economic growth

Hailey Phelps

Tom Barkin travelled to Hickory, N.C. to take part in a video roundtable with industry leaders. These included five area furniture manufacturing companies, textile suppliers and more.

Tom Barkin

President and Chief Executive Officer

Matt Martin provides his take on the tumultuous year that was 2020 and how it impacted economic conditions in North Carolina and South Carolina.

Richmond Fed president Tom Barkin discussed the latest CFO Survey results and their implications for the economy at a webinar hosted by the Economic Club of New York.

Tom Barkin

President, Federal Reserve Bank of Richmond

The authors develop a model of industry evolution that links innovation, diffusion, and intellectual property protection with 18 industries, including automobiles and personal computers to show how industry dynamics shape optimal policy design.

Episodes of booming innovation coincide with intense speculation in financial markets leading to bubbles — increases in market valuations and firm creation followed by a crash.

Valentin Haddad, Paul Ho and Erik Loualiche

While most businesses surveyed have suffered some negative effects and loss of revenue as result of COVID-19, most remained open and operating, at least partially.

Roisin McCord and Joseph Mengedoth

In this paper, we aim to provide insights into two main questions: First, which firms set up plants in which locations? Second, what determine the scale and location of production? Answering these questions requires us to think about plants and firms as distinct, albeit related, economic entities.

This paper identifies total factor productivity (TFP) news shocks using standard VAR methodology and documents a new stylized fact: in response to news about future increases in TFP, inventories rise and comove positively with other major macroeconomic aggregates.

Christoph Görtz, Christopher Gunn and Thomas A. Lubik

President Tom Barkin wrote about the potential longer-term impact of COVID-19.

Tom Barkin

President, Federal Reserve Bank of Richmond

VC: An American History is an accessible business history of the industry, one that policymakers nationwide and, indeed, worldwide can learn from in thinking about how to encourage investment in startup innovation.

David A. Price

Northwestern University economist on firms' investment decisions, intangible capital, and the college premium

Richmond Fed President Tom Barkin spoke May 16, 2019 at the Richmond Fed’s “Market Structure and the Macroeconomy” conference.

Tom Barkin

President, Federal Reserve Bank of Richmond

Richmond Fed President Tom Barkin spoke May 15, 2019, to the New York Association for Business Economics.

Tom Barkin

President, Federal Reserve Bank of Richmond

Richmond Fed President Tom Barkin spoke at the Virginia Association of Economists Annual Meeting on April 4, 2019, in Richmond.

Tom Barkin

President, Federal Reserve Bank of Richmond

Richmond Fed President Tom Barkin spoke January 10, 2019, in Raleigh to the Greater Raleigh Chamber of Commerce at its 2019 Economic Forecast event.

Tom Barkin

President, Federal Reserve Bank of Richmond

Richmond Fed President Tom Barkin spoke January 4, 2019, at the Maryland Bankers Association’s First Friday Economic Outlook Forum in Baltimore.

Tom Barkin

President, Federal Reserve Bank of Richmond

Richmond Fed President Tom Barkin spoke on the national economic outlook October 3, 2018, in Charleston, West Virginia.

Tom Barkin

President, Federal Reserve Bank of Richmond

While about half of the firms surveyed expected negative impacts to their own businesses and to the U.S. economy, there was a good portion of firms that believed the tariffs would be good for the overall U.S. economy, even if their firms would not directly benefit.

Joseph Mengedoth

Regional Economist

Industries are increasingly concentrated in the hands of fewer firms. But is that a bad thing?

In April, we surveyed firms about their adoption of technology and how it might translate into prices and employment in the next few years. Most firms reported adopting new technology, although many did not anticipate the technology to notably impact their pricing or employment decisions.

Sonya Ravindranath Waddell

Vice President

Charlotte, N.C., has the most diverse industrial mix of any Fifth District city. What causes industry diversity in cities?

Michael Stanley

Which industries in the Fifth District contributed the most to real GDP in 2016? How does that compare to employment by industry and which industries generate the most output per worker?

Joseph Mengedoth

Regional Economist

State governments that recognize the tremendous economic value that aircraft manufacturing can bring their communities are actively courting such plants to bolster their aerospace clusters.

U.S. energy production has risen sharply in recent years and is expected to continue to grow at remarkable rates in coming decades — with benefits for the U.S. economy overall as well as within the Fifth District.

R. Andrew Bauer

Vice President and Regional Executive

Robert L. Lacy