Are Companies Saving for a Rainy Day?

Some measures of business expectations have recently turned soft. For example, in the latest Richmond Fed manufacturing survey, the capital investment expectation index dropped from -2 in March to -15 in April and May and deteriorated further to -20 in June. Are these simply bad vibes, or are they translating into business action? In this week's post, we look at how firms are allocating internal funds between real investment and precautionary reserves. This balance may shed light on whether shaky business sentiment is translating into precautionary actions on the part of businesses.

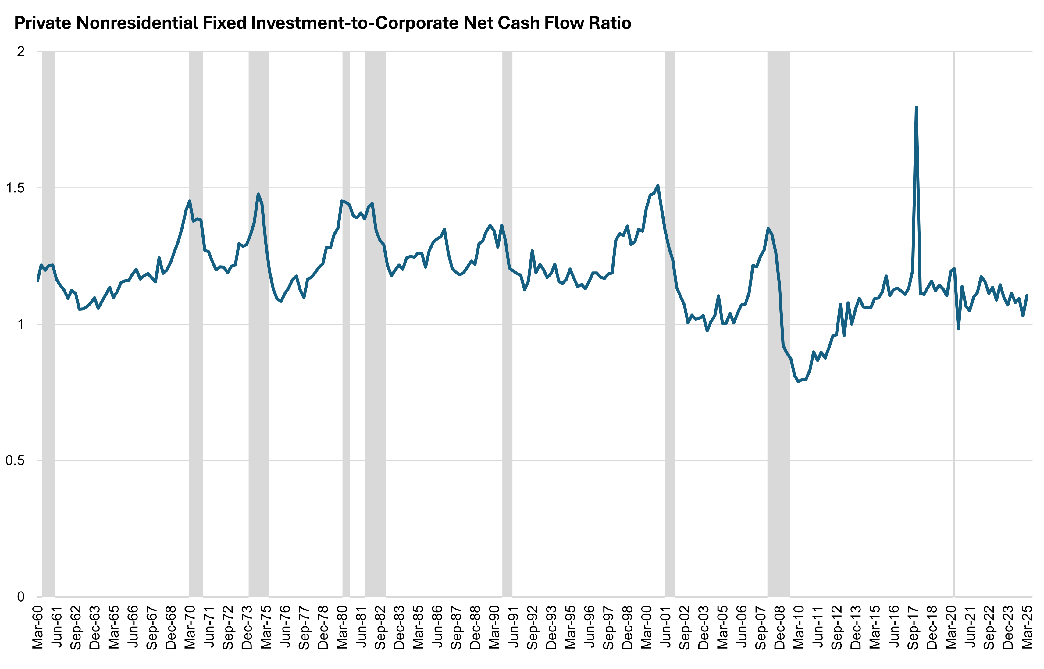

We focus on a measure of business confidence called the "CapEx ratio," which is the ratio of private nonresidential fixed investment to corporate cash flow. The ratio reflects how willing firms are to commit liquid cash flow to long-term, illiquid investments. Such long-term commitments are typically made when firms are optimistic about future economic conditions. In a 2016 speech, former Federal Reserve Chair Alan Greenspan described this ratio as "the best measure I know of what business confidence is."

The CapEx ratio is shown in Figure 1 above. As of the first quarter of 2025, the ratio was 1.1, similar to the prior quarterly reading of 1.0 and matching the median of 1.1 observed in the five years before the pandemic. Judging by this ratio, businesses do not appear to be investing at levels that signal broad-based optimism, but they also aren't behaving as though the economy is in recession.

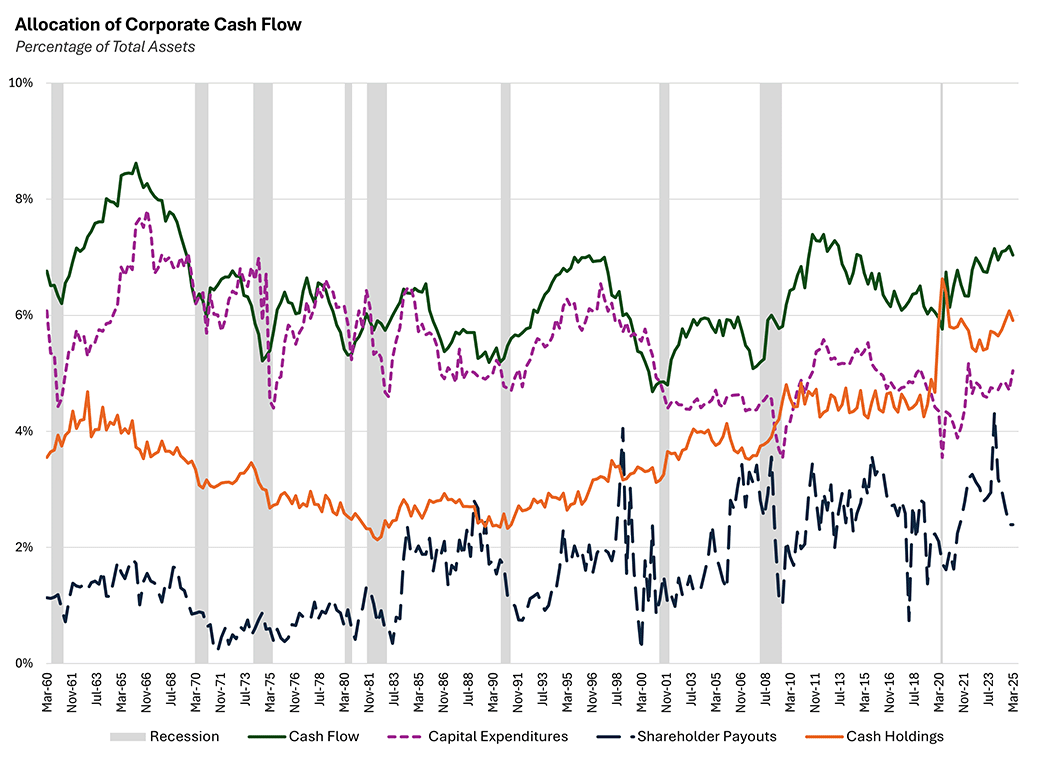

If investment remains subdued, then how are firms using their cash? Figure 2 below traces the allocation of corporate cash flow, based on data from the Federal Reserve Board of Governors.1 We report the measures relative to total assets to show how firms manage internal funds in proportion to their balance sheet capacity.

Cash flow (green line) has increased relative to the five years before the pandemic, reflecting strong profitability. However, capital expenditures (purple line) remain relatively flat and near its average for the pre-pandemic period. After mid-2021, shareholder payouts (blue line) spiked, peaked at the end of 2023 (supported by a surge in corporate profits), and returned to pre-pandemic levels.

In contrast, cash holdings (orange line) remain well above pre-pandemic levels. Elevated levels of cash holdings relative to corporate assets suggest that companies may be hoarding cash as a precaution.

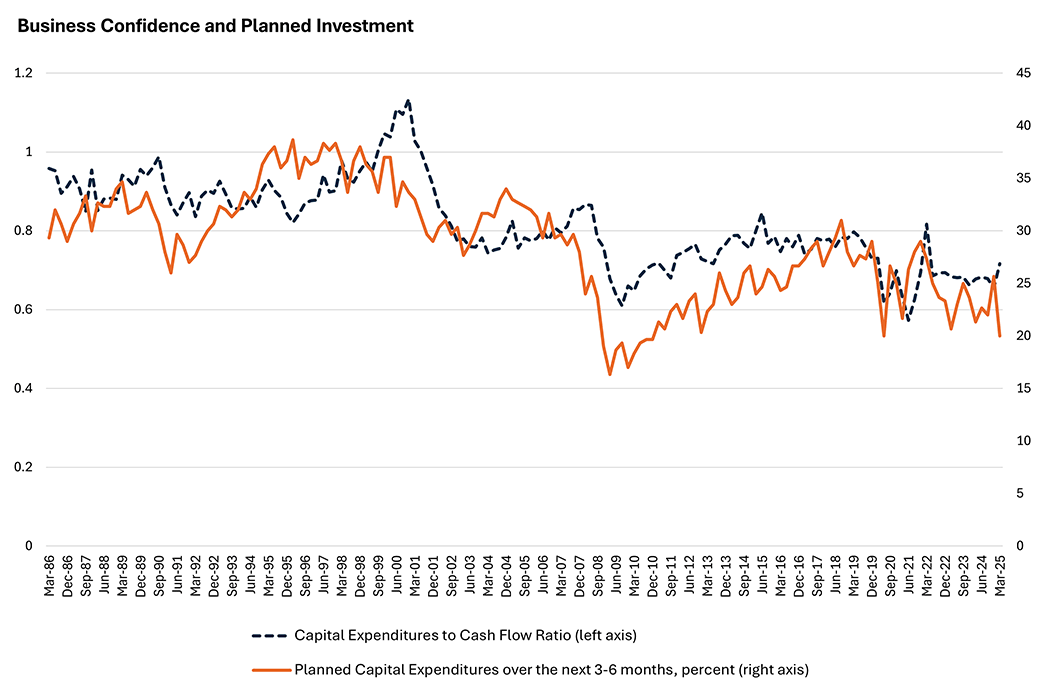

To probe whether firms' behavior corresponds to recent sentiment shifts, Figure 3 below turns to "soft" data, showing the National Federation of Independent Business's Percent Planning Capital Expenditures over the next three to six months. The survey shows that plans to invest remain below historical norms.

While businesses are not slashing investment, they appear to be proceeding with restraint despite strong cash positions. That restraint may reflect uncertainty rather than distress. If so, elevated cash buffers could eventually signal a pickup in investment once confidence picks up. But until then, the disconnect between capacity and action is worth watching: It tells us not just what firms can do, but what they're willing to do.

Kristal Tejeda is a Research Analyst in the Richmond Fed Corporate Services Department.

Data used in this analysis are for the nonfinancial corporate business sector.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.