How Much Do Multinational Companies in the U.S. Depend on Immigrant Workers?

Foreign multinational firms that operate in the U.S. hire more immigrants from their home countries than from other countries, in part because they facilitate communication between the parent company and the subsidiaries in the U.S. Restrictions to immigration in the U.S. can cause the relocation of production to countries such as India and Canada. Multinational companies drive a big part of this relocation, since they are more intensive on immigrants.

Governments and policymakers are showing increasing interest in attracting multinational companies to boost local economic activity. Multinational enterprises (MNEs) — or companies with business operations in at least two countries — tend to be bigger and more productive than domestic companies and drive many important features of economic development, such as innovation and trade. They also have positive effects on other local companies and domestic workers by improving the production processes of their consumers and suppliers and by pushing the market wage up by paying higher wages themselves. Understanding the drivers of multinational location and production decisions is crucial in an increasingly globalized economy.

My recent paper "High-Skill Migration, Multinational Companies and the Location of Economic Activity" focuses on a specific aspect of MNE decisions: the availability of high-skill immigrant workers. My hypothesis is that foreign MNEs in the U.S. find college-educated immigrants particularly valuable for production, as they help reduce communication barriers between the parent company and its subsidiaries. These companies might also find it easier to recruit and screen immigrants due to better knowledge of the immigrants' home country.

If skilled immigrants are unavailable, firms might move their operations to other countries. Hence, policies that restrict immigration have the unintended consequence of encouraging the relocation of economic activity across countries. As shown in the paper, MNEs disproportionately contribute to such relocation.

Immigration Into the U.S.

There are several ways U.S. companies can hire immigrant workers with college degrees. The biggest — and one heavily used by MNEs — is the H-1B program, which allows workers to apply for green cards and stay working in the U.S. once their H-1Bs expire. This program grants 85,000 visas for new employment every year for firms in the private sector. If the number of applications exceeds the cap, visas are assigned through a lottery. Obtaining an H-1B visa has become increasingly difficult, with the number of applications significantly exceeding the cap. For instance, the success rate for the 2023 lottery was only 14.6 percent.

There are a few other programs that college graduates can also use to come work in the U.S., but their magnitudes are much smaller than the H-1B program. Some of the most notable ones are:

L-1 Visas

L-1 visas are specifically targeted toward MNEs, as they focus on intracompany transfers across subsidiaries. While there is no cap on these visas, workers need to have worked for the MNE in a subsidiary outside of the U.S. for at least one year out of the past three years before becoming eligible for an L-1.

TN Visas

TN visas are specialty occupation visas for immigrants from Canada and Mexico. While there isn't a cap on these visas either, these are not "dual intent." That is, migrants cannot apply for a green card while on these visas.

OPT

OPT is aimed to graduates of U.S universities who can work in the U.S. for 1-3 years after graduation. Once the OPT expires, workers need to apply for some other visa status to remain eligible for U.S. work.

E-1 and E-2 Visas

These visas are aimed at those engaged in substantial trade of goods between their country of origin and the U.S. and those who direct business operations in the U.S. where they have invested significant amounts of money.

For this project, I focus on the H-1B program, since it is the predominant channel through which highly educated immigrants come into the country and the focus of most high-skill immigration policy debate. I collected a novel dataset on the universe of granted H-1B applications, obtained through a Freedom of Information Act request to the United States Citizenship and Immigration Services. This dataset was combined with the corporate datasets of Orbis and D&B Hoovers to identify which MNEs hire H-1B workers and in which countries these MNEs are headquartered. Combining these two datasets, it is possible to explore the recruitment patters of MNEs when it comes to immigrants.

Employment of Own-Country Immigrants

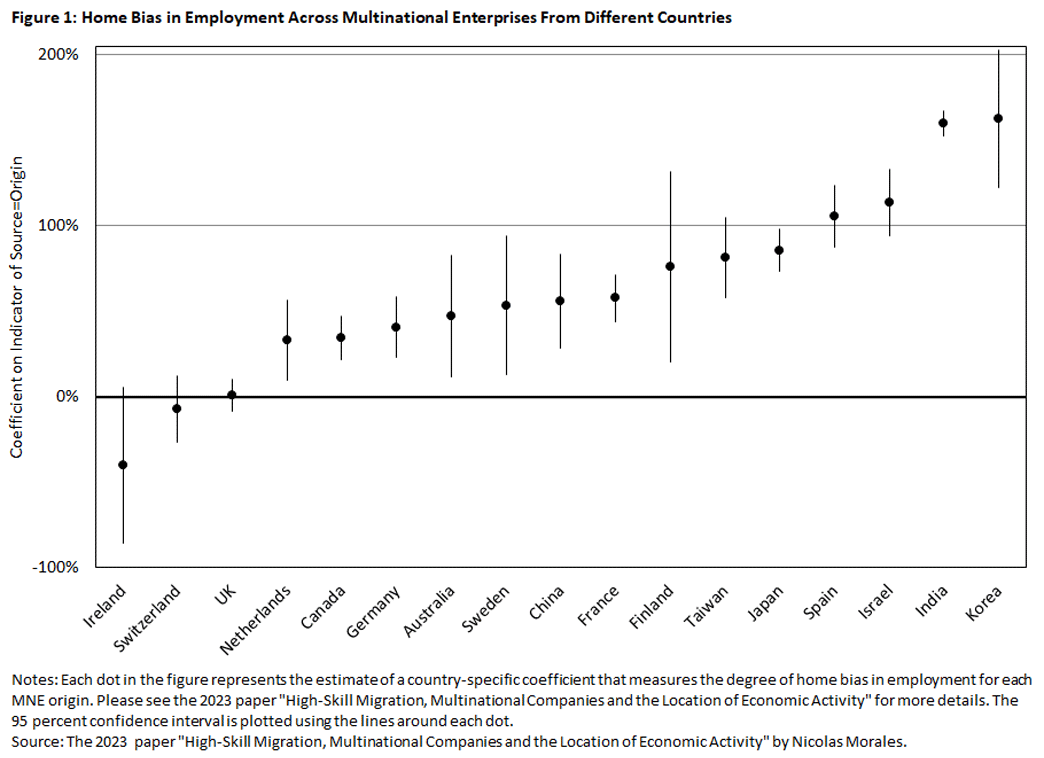

First, I use the dataset to explore whether foreign MNEs in the U.S. hire immigrants from their home countries at a higher rate than from other countries. The results for the main foreign MNE origins can be found in Figure 1.

To understand the results, let's focus on India. A reading of 159 percent means that Indian companies in the U.S. hire 159 percent more Indians than immigrants from other origins when compared to non-Indian companies in the U.S. I call this the MNE "home-bias," and it measures how intensively MNEs hire workers from their home country.

As shown in Figure 1, the home-bias is positive and large for most of the main MNE origins that operate in the U.S. MNEs from countries such as Korea, Israel and Spain also display high degrees of home-bias on immigrants.

The countries showing the smallest home-bias are Ireland and Switzerland. However, the low home-bias score may be a result of many MNEs headquartering their operations in these countries for tax purposes while producing goods or services elsewhere.

The estimates are not driven by differences in hiring across industries or differences in the migration probability by origin country. The level of home-bias is positively correlated with distance and negatively correlated with whether the foreign country has English as a native language, as exemplified by the relatively low values for the U.K. and Canada. This is consistent with MNEs needing home-country immigrants to facilitate communication between the subsidiary in the U.S. and the parent company. Longer distances between countries can mean difficulties for executives in traveling back and forth, which makes home-country immigrant language skills more relevant for communication.

Home-bias is also larger for firms that have a smaller number of H-1B applications and started recruiting immigrants more recently. This can be a signal that younger and smaller MNEs are more likely to need home-country immigrants for production in the U.S., since the subsidiaries are more dependent on the parent company.

Wages of Own-Country Immigrants

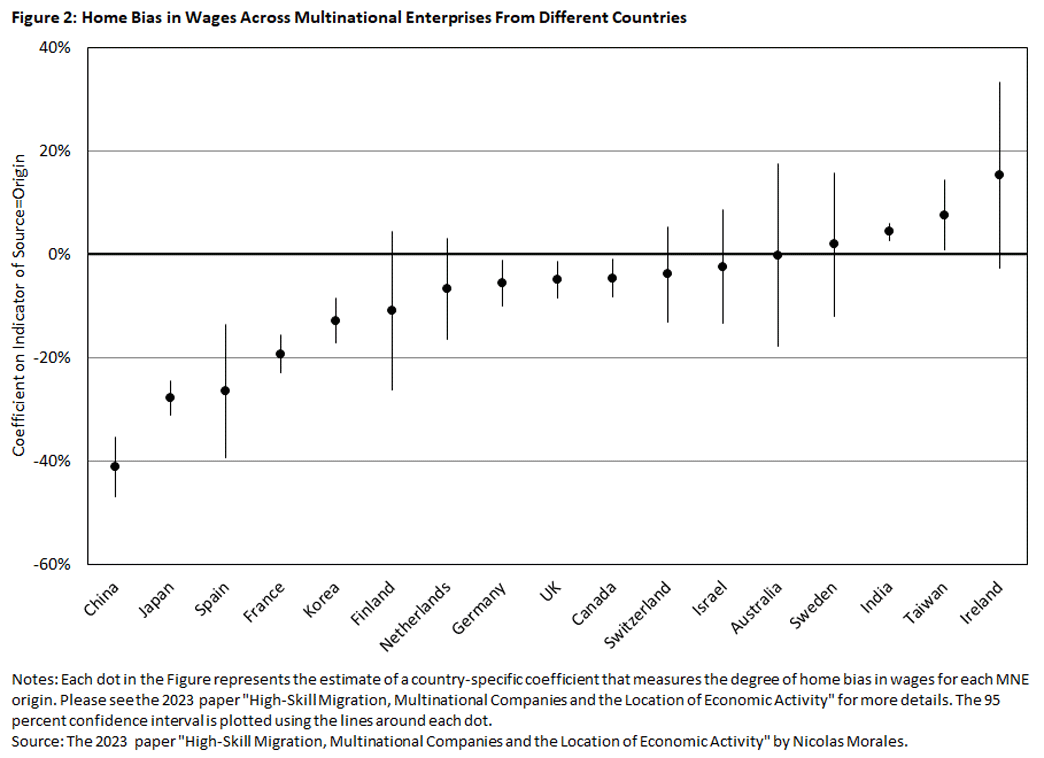

Figure 2 runs a similar analysis but for wages to measure the wage difference MNEs pay to immigrants from their home country relative to other immigrants.

The interpretation is similar to that of Figure 1. For instance, the wage home-bias for China is -41 percent. This means that Chinese companies in the U.S. pay 41 percent lower wages to their Chinese employees than to immigrants from other origins when compared to non-Chinese firms.

For most countries, there is a negative wage difference for home-country workers relative to other migrants, which is somewhat surprising. If home-country immigrants are particularly valuable for production, why don't firms pay them higher wages compared to other immigrants? One potential explanation is that MNEs have lower screening and recruitment costs in their home country. If hiring immigrants is costly, only those with high productivity (who earn high wages) would be sponsored by firms to migrate. However, if MNEs face lower recruitment costs for immigrants, they would be able to sponsor some workers who are relatively less productive and earn lower wages but are still valuable to the firm.

What if Migration Is Further Restricted?

Using these findings, my paper builds a model of the world economy. I then use the model to understand how the economy would respond to specific policies that restrict immigration. Immigration restrictions — particularly related to the H-1B program — have been proposed and occasionally implemented over the past few years. For example, the U.S. government imposed a suspension of new H-1B visas aimed at high-skill workers in June 2020, describing the restrictions as making sure Americans are first in line for scarce jobs. Other recent policies proposed in recent years have discussed rescinding work visas for the spouses of H-1B immigrants and imposing a higher minimum for H-1B wages.

In the model, I decrease the stock of college-educated immigrants by 10 percent and then quantify how key economic variables would change in response. For my first piece of the analysis, I compute how total production changes by region and industry after the 10 percent decrease. As shown in Table 1, total production in the U.S. decreases across all industries, while production in other world regions increases.

| Table 1: Percent Changes in Total Production by World Region | ||||

|---|---|---|---|---|

| IT and Professional Services | High-Tech Manufacturing | Financial Services | Other | |

| United States | -0.38% | -0.41% | -0.37% | -0.34% |

| India | 0.50% | 0.26% | 0.20% | 0.18% |

| Western Europe | 0.08% | 0.06% | 0.07% | 0.07% |

| Canada | 0.15% | 0.13% | 0.11% | 0.10% |

| China | 0.10% | 0.09% | 0.09% | 0.08% |

| Rest of the World | 0.08% | 0.07% | 0.09% | 0.07% |

| Note: Each cell shows the percent change in revenues by world region and industry when the total number of college-educated immigrants in the U.S. drops by 10 percent. High-tech manufacturing includes manufacturing industries that are intensive on college graduates (chemicals, machinery, electrical, computers, and transportation). | ||||

Skill-intensive industries respond the most to immigration restrictions, with high-tech manufacturing decreasing its production in the U.S. by 0.41 percent, IT and professional services by 0.38 percent and financial services by 0.37 percent. Production relocates the most to India and Canada for different reasons:

- Since most migrants with college degrees in the U.S. are from India, many go back in response to migration restrictions.

- Canada — which also receives a significant number of immigrants from other countries — benefits due to the proximity to the U.S., which makes production more likely to move there.

Foreign MNEs drive an important share of this production relocation. As noted in the reduced-form facts, MNEs use immigrants more intensively and have a specific use for home-country immigrants in production. In the IT and professional services sector, MNEs account for only 4.5 percent of total production but 15.5 percent of the drop in production due to the migration restriction. Similarly, for high-tech manufacturing, MNEs account for 24 percent of production but are responsible for 26 percent of the total drop. Finally, for financial services, MNEs account for 15.2 percent of production but drive up to 40.1 percent of the drop. All in all, since MNEs are more intensive on immigrants and have a higher dependence on them for production, they will be the most sensitive to relocate whenever immigration is restricted.

Wage Changes After Migration Restrictions

For the second piece of the analysis, I use the model to quantify how much the earnings of native U.S. workers change when immigration is restricted. Immigrants make production more efficient by bringing new and needed skills to the labor market. This reduces prices to consumers and increases economic activity for all education groups.

However, when looking at native outcomes, it is important to separate the results by education due to different effects in terms of labor market competition. For native college graduates, restrictions on high-skill immigration might have beneficial effects, since they compete more strongly with immigrants in the labor market. For non-college graduates, however, restricting immigration might be harmful since they perform tasks that complement those of high-skill immigrants. Fewer high-skill immigrants might cause fewer job opportunities for non-college educated workers.

The findings are shown in Table 2. College-educated natives see their wages rise by 0.25 percent when immigration is restricted. However, their real wages — which is their wage deflated by the local price index — only increases by 0.17 percent. This is because local goods and services become more expensive in the U.S. when immigration is restricted.

For non-college-educated workers, the impact is the opposite. Real wages drop by 0.26 percent since they are affected both by higher prices and lower availability of complementary labor. Overall, each fewer immigrant costs the U.S. $6,382 in terms of real income.

| Table 2: Effect of Restricting Immigration on Wages and Real Income of U.S. Native Workers | |||

|---|---|---|---|

| Wages | Real Income | Monetary Gains/Losses (per Immigrant) | |

| College-Educated Natives | 0.25% | 0.17% | $10,489 |

| Non-College-Educated Natives | -0.18% | -0.26% | ($16,872) |

| Total U.S. Natives | -0.05% | -0.13% | ($6,382) |

| Note: The table presents the percent changes in key outcomes when the number of college-educated migrants in the U.S. decreases by 10 percent. The first column shows the percent changes in "real income," which is wages deflated by the price index. The second column shows the change in wages for U.S. native workers. The third column shows the monetary gains or losses created for every immigrant that leaves the U.S. | |||

Conclusion

In summary, restrictions to college-educated immigrants into the U.S. could cause production to relocate to countries such as India or Canada. MNEs drive a big part of this shift — in part because they are more intensive on immigrants — and find home country immigrants particularly valuable for production.

From a policy standpoint, the results of this paper highlight the need to think about immigration when implementing policies that attract foreign firms into the country. Relaxing immigration constraints for firms can be a powerful tool to prevent companies locating elsewhere and increase domestic production.

Nicolas Morales is an economist in the Research Department at the Federal Reserve Bank of Richmond.

To cite this Economic Brief, please use the following format: Morales, Nicolas. (June 2023) "How Much Do Multinational Companies in the U.S. Depend on Immigrant Workers?" Federal Reserve Bank of Richmond Economic Brief, No. 23-21.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.