Are Logistical Bottlenecks Easing Yet?

Economy watchers anxious about when logistical bottlenecks will ease their grip on the supply chain must feel like they are on a rollercoaster ride that won’t end.

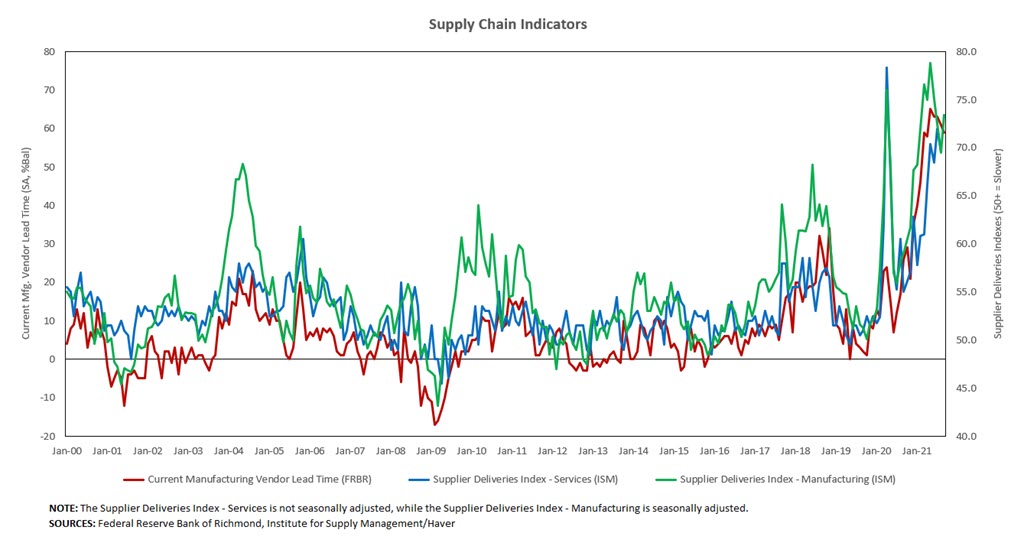

August's manufacturing and services PMI report produced by the Institute for Supply Management (ISM) showed that the Supplier Deliveries Index (SDI), which measures how long it takes for suppliers to deliver to manufacturing organizations, fell for the third straight month in the manufacturing survey, while the index for services firms eased from 72 in July to 69.6 in August. But the latest readings from September show the SDI rising again to 73.4 versus 69.5 in August. Eight out of the 10 respondents quoted in the report mentioned significant supply challenges afflicting their industry.

"... the knowledge that 'things are getting worse, but not by as much as last month' is of little comfort to businesses challenged by shortages of raw materials and intermediate goods."

Confusing the issue, other data are providing more encouraging signals. The Richmond Fed manufacturing survey’s vendor lead time index fell from 61 in August to 59 in September, indicating lead times were lengthening at a slightly slower pace compared to previous months. (See figure 1 below.)

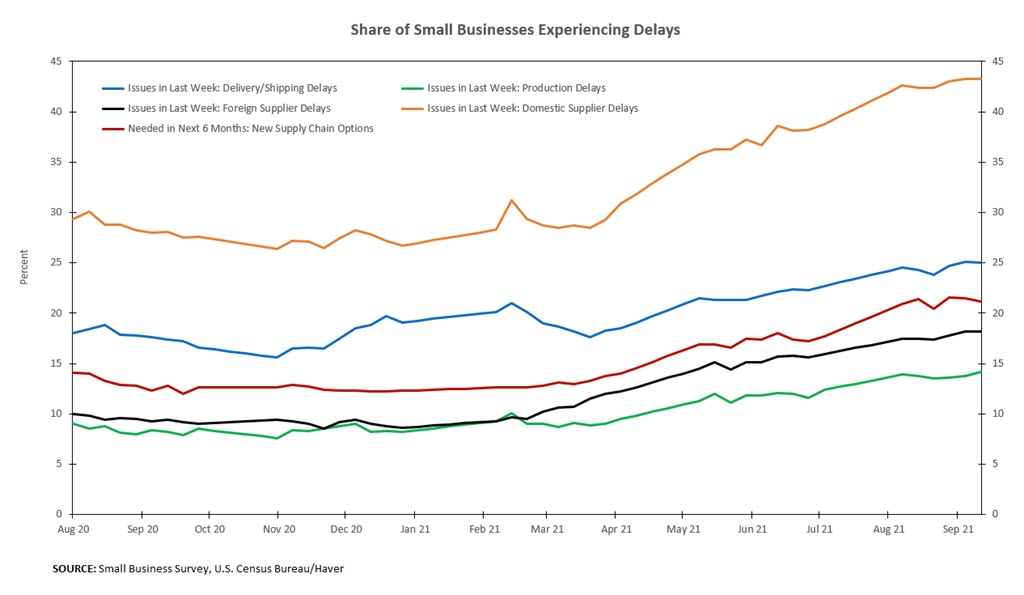

Still, the knowledge that "things are getting worse, but not by as much as last month" is of little comfort to businesses challenged by shortages of raw materials and intermediate goods. In the U.S. Census Bureau's weekly Small Business Pulse Survey, an increasing fraction of small businesses report experiencing delays with production, shipping and suppliers, both domestic and foreign. (See Figure 2 below.) And over 20 percent of small businesses say they need to find new supply chain options within the next six months, raising the possibility that today's temporary supply bottlenecks might create permanent changes in ways of doing business — changes that might also make the inflationary pressures we're experiencing today more persistent.

Looking for signs of easing supply constraints can feel overwhelming, with the bottlenecks leaving fingerprints on everything from prices to inventories, production, order backlogs and delivery times. A recent New York Times article discussed how supply chain problems have manifested as a record backlog of cargo ships are waiting to unload at California ports. When conditions do start to improve, it will take time for the improvements to percolate through the entire supply chain and show up in the economic indicators. For example, some firms may not immediately pass along lower logistics costs to their customers.

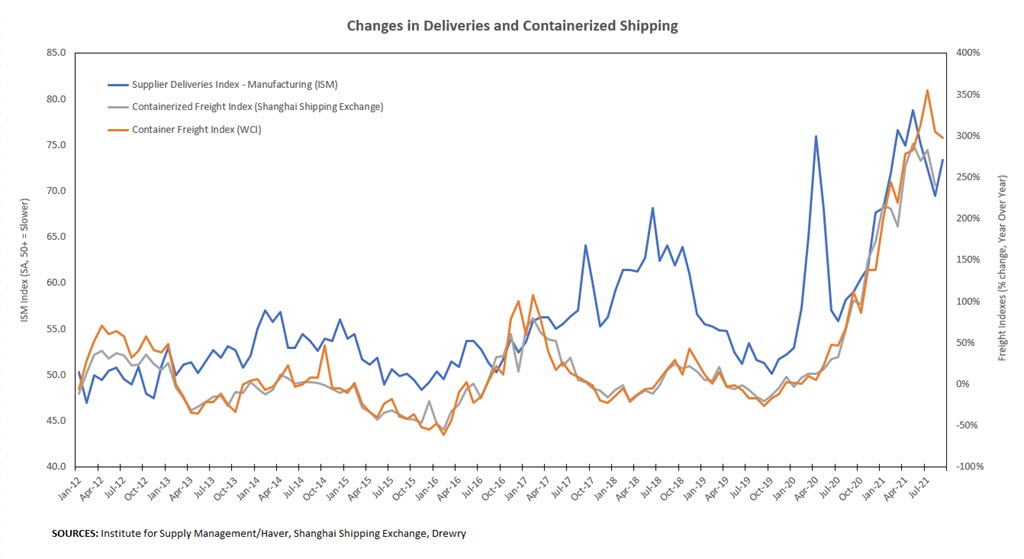

Until then, early signals can be gleaned from global container shipping rates, which are available weekly. Today's sky-high container shipping costs encapsulate many of the underlying real constraints plaguing the global supply chain, such as shortages of shipping containers and pandemic-related port shutdowns. Figure 3 shows that year-over-year changes in the Shanghai Containerized Freight Index and World Container Index have tracked well with recent movements in the SDI for manufacturers, except for the spike in early 2020 due to government-imposed lockdowns.

We'd likely have to see a significant reversal in freight costs to feel confident that real supply constraints are behind us. Based on current readings, we are a long way from that.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.