The Productivity Puzzle: AI, Technology Adoption and the Workforce

Key Takeaways

- Advancements in technology and automation continue to fail to materialize in the productivity statistics well into the 21st century.

- The age composition of the workforce seems to matter more for productivity growth than the latest technology does.

- Given the current demographics of the workforce, it appears that AI will have a small effect on productivity growth.

In 1987, economist Robert Solow said, "You can see the computer age everywhere but in the productivity statistics."1 This quote underscores the challenges in tracing the effects of information technology and automation on productivity and the economy at large. Understanding the role of technology in labor productivity growth remains an ongoing quest in economics, one made even more pertinent by recent advances in artificial intelligence (AI) as well as the further adoption of generative AI and large language models (LLMs).

Estimates of the effect of AI on economic and productivity growth range from reasonably bullish to more sedate:2

- Goldman Sachs predicted that AI would lead to a $7 trillion increase in global GDP and a 1.5 percent per year increase in U.S. productivity growth over the next decade.3

- The McKinsey Global Institute forecasts that generative AI could lead to a 1.5-3.4 percentage point increase in average annual GDP growth across the developed world in the next decade.4

- Economist Daron Acemoglu estimated more muted effects from AI over the next decade: increases of 0.07 percent in productivity annually and 0.9 percent to 1.8 percent in GDP.5

Our article suggests that the observation embodied in Solow's quote is still pertinent today, even in the current age of AI and automation. A direct and concrete relationship between technological deepening and productivity remains elusive at best. It also suggests estimates more in line with Acemoglu's work and points to an alternative mechanism as a driver of productivity growth: the age composition of the U.S. workforce.

Labor Productivity in Solow's Research (Before 1987)

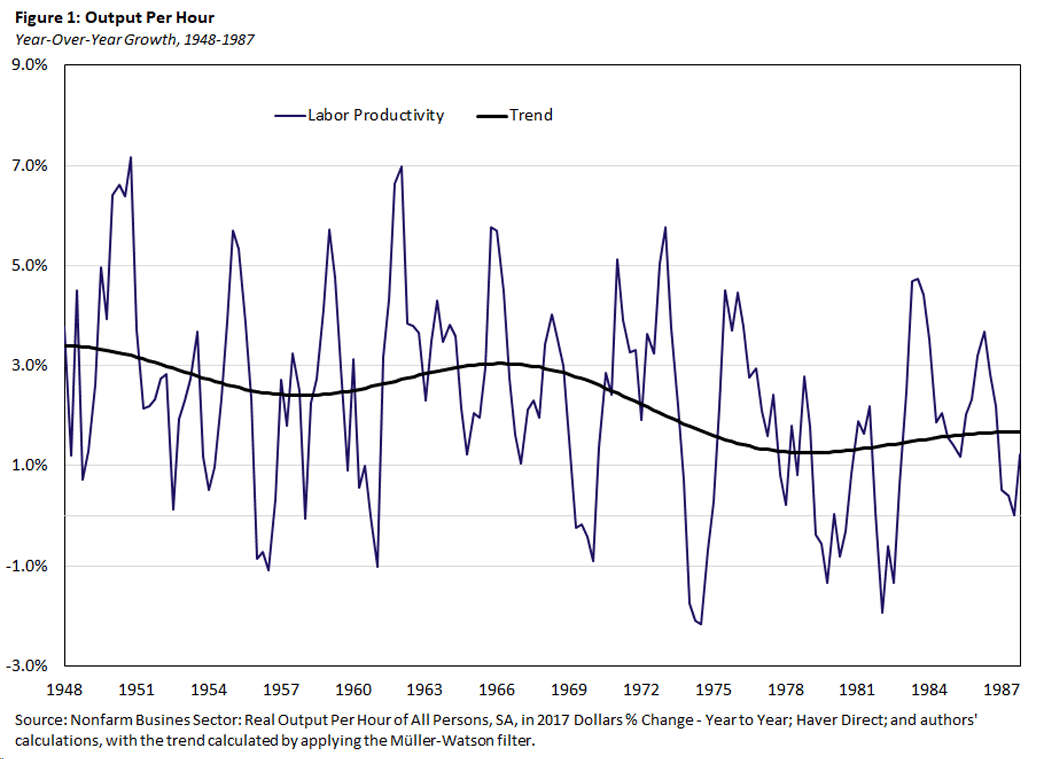

Growth in labor productivity — defined as the year-over-year growth rate of output per hour of work — tends to be volatile, with yearly rates ranging from -2 percent to 7 percent over the period 1948 to 1987 (the period covered by Solow).

In addition, the series presents no clear trend over this period. Figure 1 plots both actual labor productivity and the 20-year long-run trend in labor productivity growth. Labor productivity growth was middling and gradually declining in the U.S. economy after World War II. Specifically, actual labor productivity growth fell from 3.8 percent in 1948 to 1.2 percent in 1987. Its trend growth rate was naturally less volatile but nevertheless still fell from 3.4 percent to 1.7 percent.

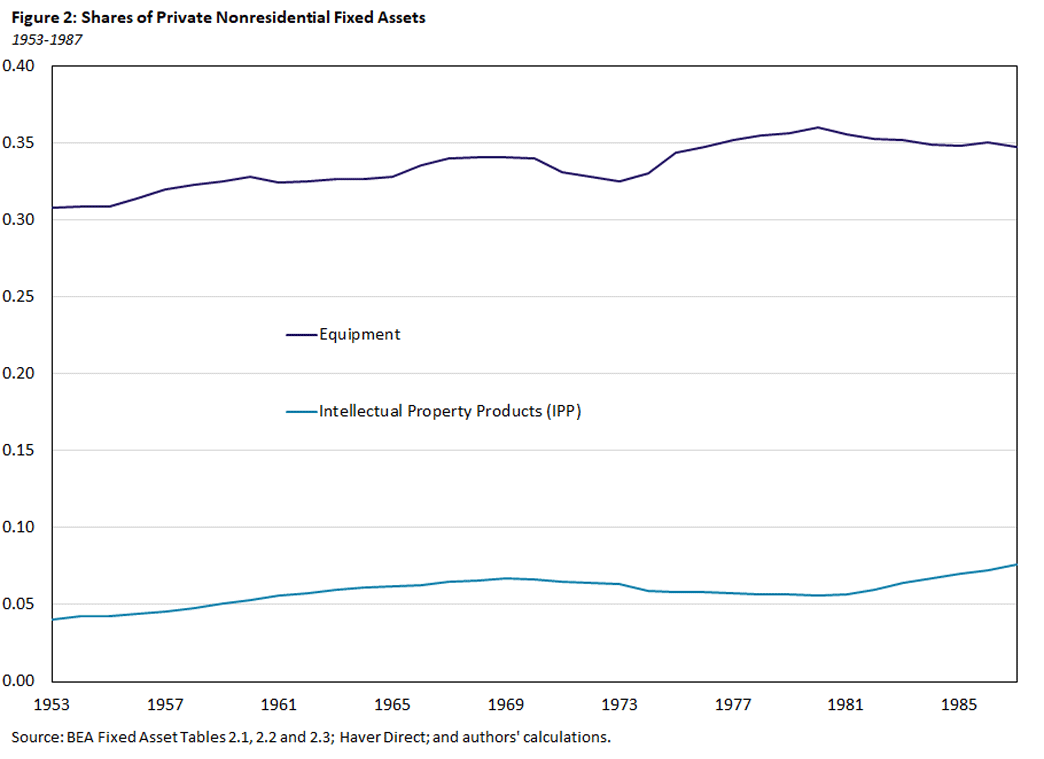

Meanwhile, the postwar economy saw the increased adoption of computers and computer-related capital. Figure 2 presents the shares of equipment and intellectual property products (IPP) to overall capital over the period 1953-1987. We can see that both shares are increasing, with the share of IPP rising from 5 percent to 7 percent and the share of equipment rising from 30 percent to 35 percent.

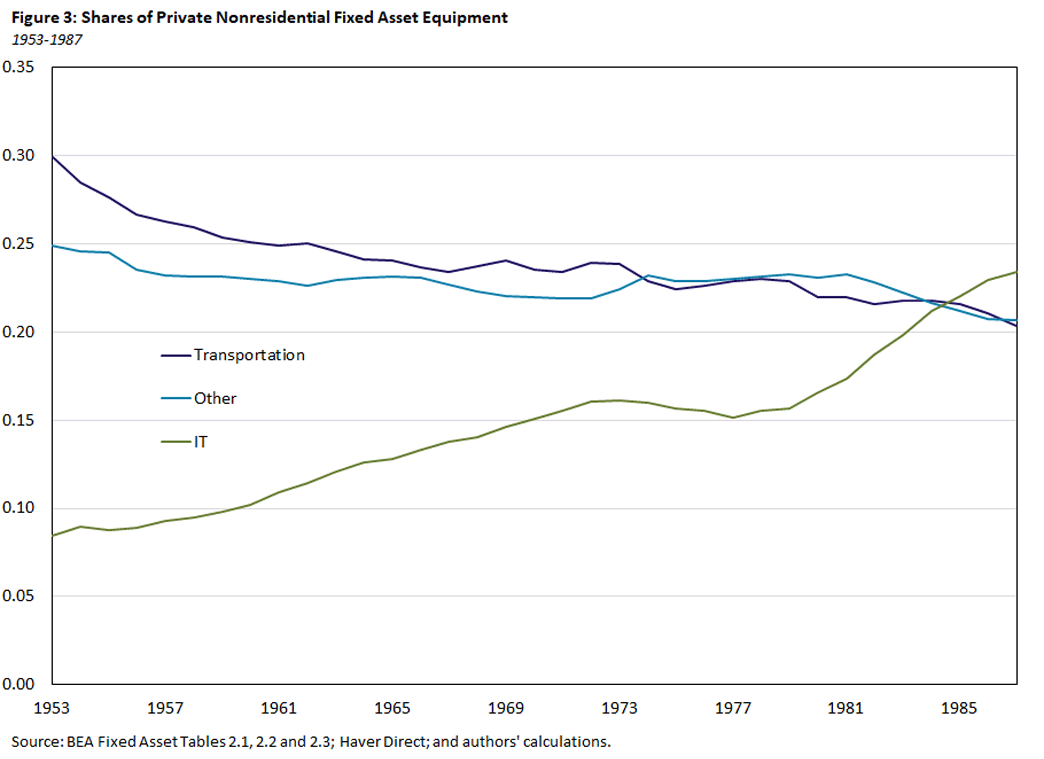

Figure 3 shows that the increase within equipment was driven by a dramatic increase in IT equipment. The share of IT equipment rose from 8 percent to 24 percent, while the shares of more traditional equipment fell from 25 percent (transportation) and 30 percent (other) to 20 percent each. These figures showcase the large-scale substitution towards computers and automation in the so-called "computer age."

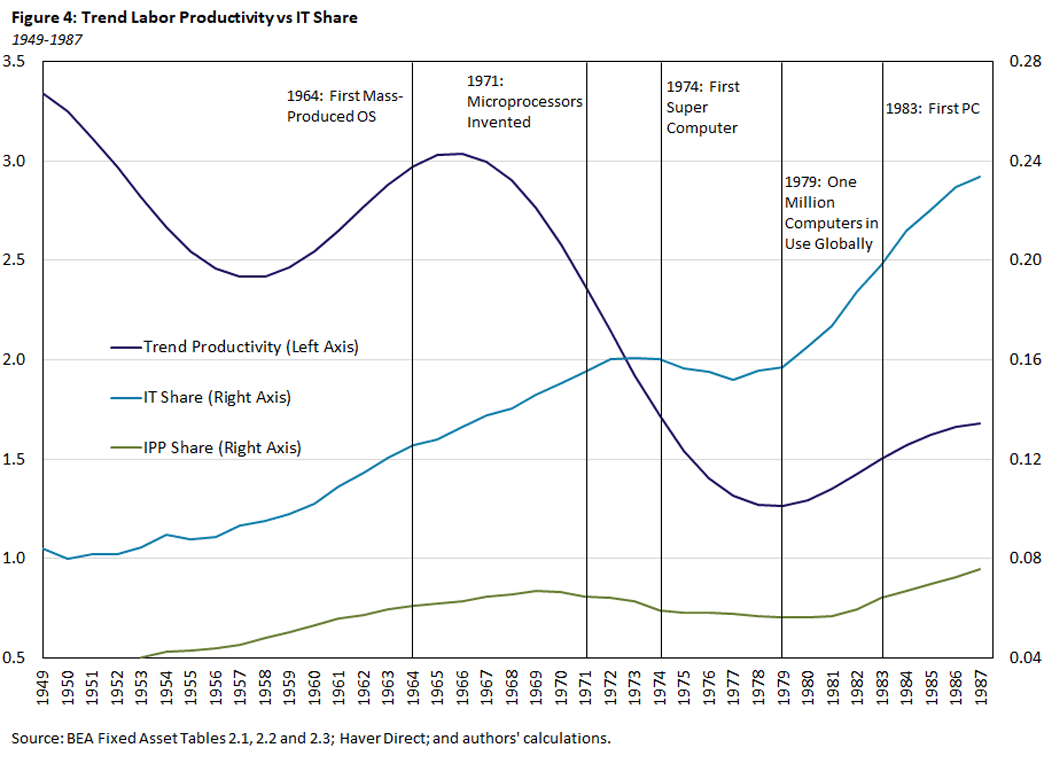

That said, Solow's quote becomes apparent when comparing trend labor productivity growth to the evolution of shares of the two series that capture the increasing adoption of computers (IPP and IT equipment) in Figure 4. Labeled with notable events in the computer age, we can see that labor productivity growth began declining around the time computers started to be adopted and continued its decline as adoption increased.

Labor Productivity Since Solow's Research

A natural question then is: Does the relationship (or lack thereof) between labor productivity growth and technological adoption in the mid-to-late 20th century persist into the more recent era. Thus, we reexamine this same sequence of data for the period 1987-2022.

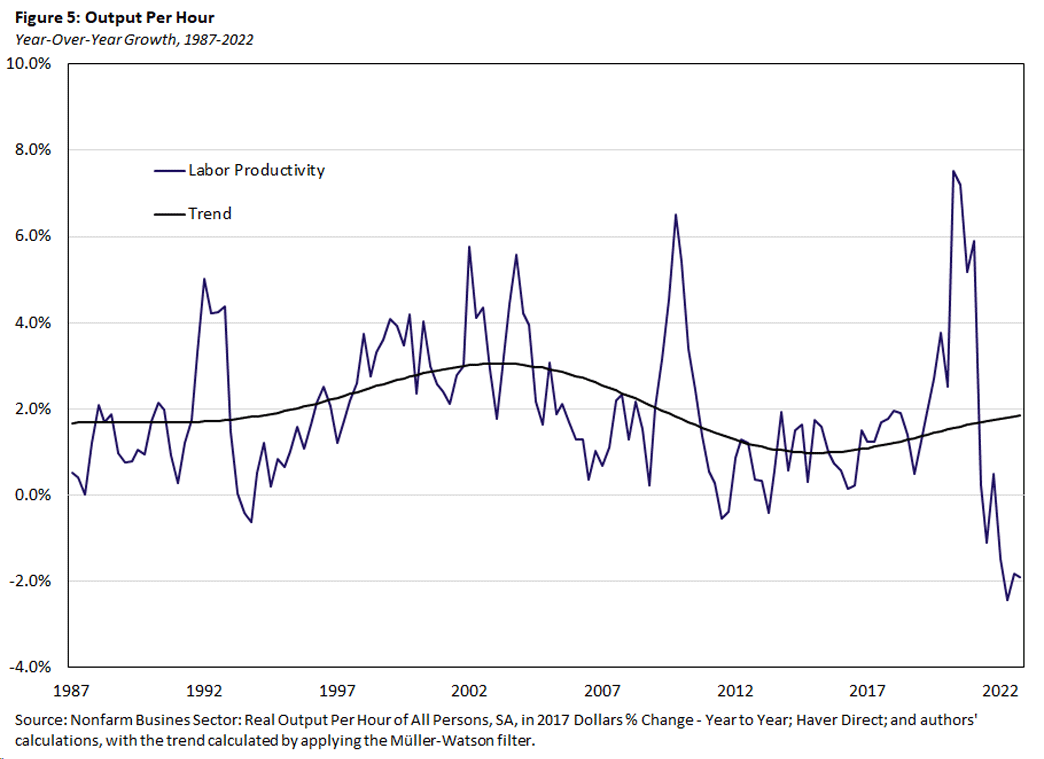

We begin by looking at growth in labor productivity. Figure 5 shows the raw series plotted against its long-run trend similar to Figure 1. We see little overall change in the trend during this period, with growth beginning the period at 1.7 percent and ending at 1.8 percent. There was a significant increase in productivity growth trend from the early 1990s to the early 2000s, reaching a peak of 3 percent, followed by a precipitous decline to 1 percent in 2015.

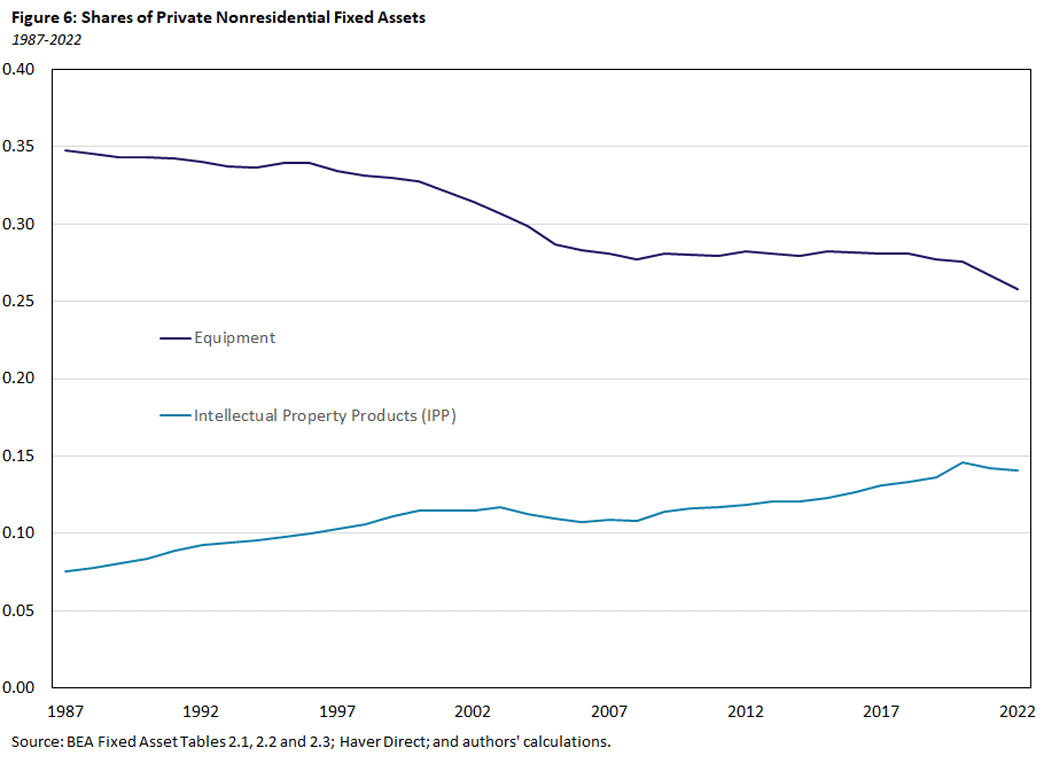

This behavior is not mirrored in other series capturing IT adoption. Figure 6 shows the shares of equipment and IPP to capital. IPP has continued to trend upward, rising to 14 percent, while the equipment share of capital has fallen from 35 percent to 26 percent.

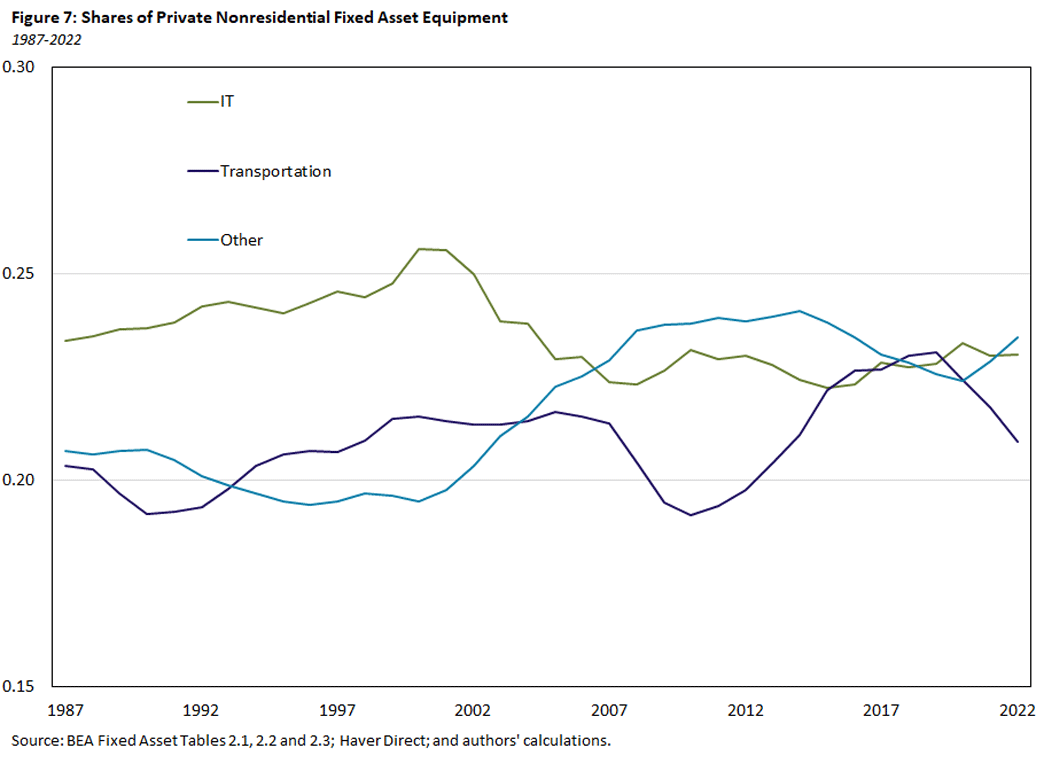

Driving the decline in equipment share is a decline in IT equipment. Figure 7 shows that IT equipment share rose to 26 percent and fell to 23 percent, with roughly no real change. However, other equipment shares experienced increases when IT began decreasing, with both series ending where they started at 23 percent for mining, oil and energy-related equipment and 21 percent for transportation equipment.

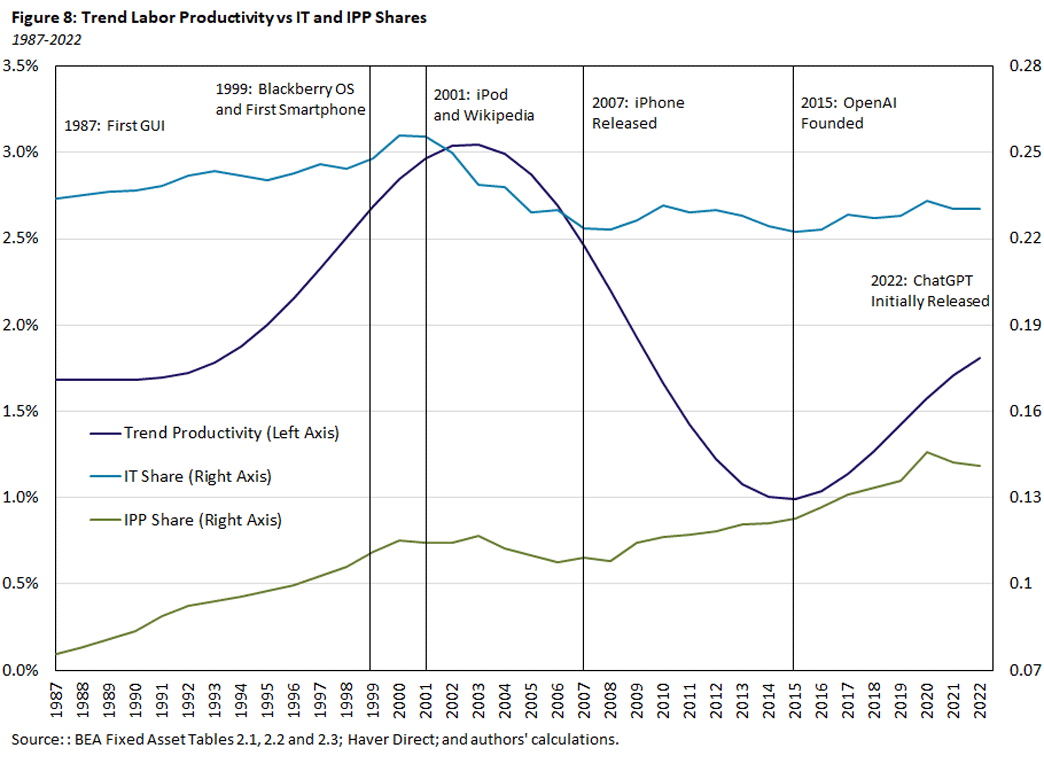

Figure 8 shows the series for labor productivity growth and IT adoption graphed together. Here, we see again that the advancement of the computer age fails to materialize clearly in the productivity statistics. There was an increase in IPP and a decline in IT equipment, but there was no overall change in labor productivity growth.

These figures suggest that the estimates of the boom in productivity from AI are perhaps more likely to follow along the lines of Acemoglu's work rather than that of Goldman Sachs or McKinsey. Moreover, if the gradual adoption of IT and automation is not immediately apparent in the productivity statistics, where does one turn to potentially explain the trend variation in postwar labor productivity growth?

Postwar Productivity Growth

The behavior of the postwar trend in productivity growth has been the subject of much debate, and a myriad of explanations — aside from computers and automation — have been offered, ranging from competition and innovation to mismeasurement.6 One potential explanation that often gets overlooked is the role of demographics, or specifically how the age composition of the workforce relates to productivity.

In a 2017 article, economist Guillaume Vandenbroucke proposes the idea that baby boomers (those born during the period 1946-1964, following WWII) in part accounted for variations in labor productivity growth.7 Vandenbroucke emphasizes the notion of human capital in drawing a link between the age composition of the work force and productivity. Specifically, young workers enter the labor force with relatively low levels of human capital, whereas older (or more experienced) workers have had a chance to accumulate human capital on the job. This is the notion that one learns on the job and becomes more productive as one gains experience.

Vandenbroucke compares the share of young workers to labor productivity for the years 1955-2014. He finds strong correlational evidence for the claim that experience (or lack thereof) affects productivity growth.8 Specifically, Vandenbroucke finds that the share of 23-33 year olds in the economy is strongly negatively correlated with labor productivity growth.

A Broader View of Labor Productivity and Workforce Age

Taking inspiration from Vandenbroucke's study, we examine the relationship between labor productivity growth and the age structure of the workforce across a longer time horizon. We take employment level data from the Bureau of Labor Statistics' Employment Situation Household Survey and construct shares by age category.

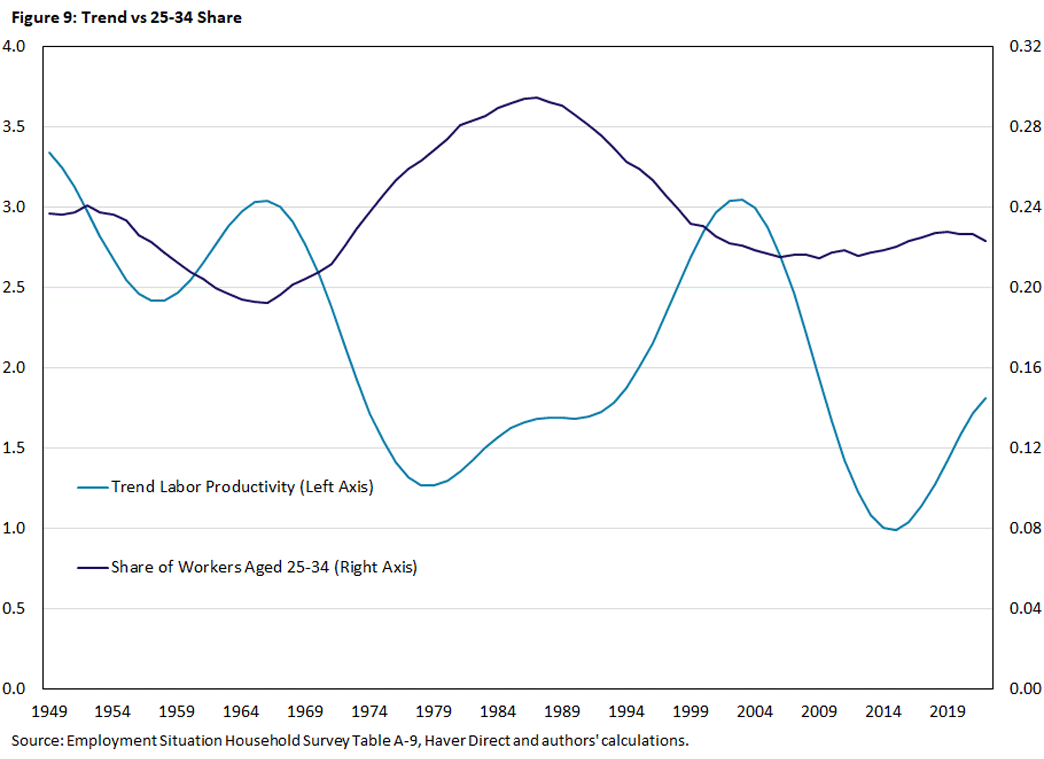

We begin by benchmarking our analysis with Vandenbroucke's. We broaden the definition of young (or inexperienced) workers to be all those employed aged 25 to 34, and we broaden the period to 1948-2023. Figure 9 shows the share of young workers against the trend growth rate of labor productivity. Our findings are more pronounced than those by Vandenbroucke.

The year 1966 serves as an inflection point: From then until 1986, there is a monotonic increase in the share of workers aged 25-34, beginning at 19 percent in 1966 and ending at 29 percent in 1986. (The baby boomer cohort would occupy space in this age range from 1971 to 1989.) This corresponds with a decline in trend labor productivity growth from 3.0 percent to 1.7 percent. Our analysis comports with what Vandenbroucke found: The correlation between these two series across our entire sample period is -0.49.

However, after 1986, trend of productivity growth began to increase as the share of young workers fell. The share of young workers declines to 22 percent by 2022, while trend labor productivity growth reaches a high of 3.0 percent in 2003 and ends at 1.8 percent.

In other words, Vandenbroucke's results are applicable across a longer time horizon and for a broader definition of young workers. Moreover, this trend is apparent for more than just the young baby boomer cohort, as this negative relationship exists between the two series well past the time when all baby boomers are older than 34.

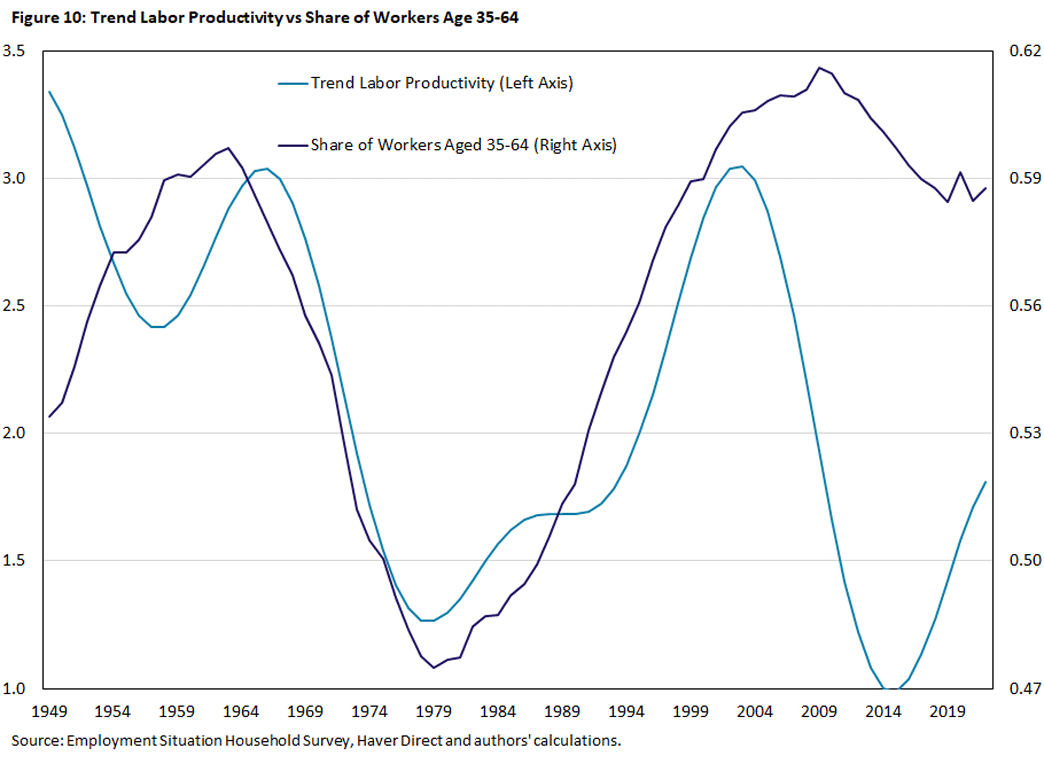

Figure 10 presents trend of labor productivity growth against the share of workers aged 35-64, the age group we classify as experienced workers. As expected, this series presents nearly the opposite of the previous figure. With a correlation of 0.37 across the same period, the two series move in tandem, particularly when looking at the baby boomer cohort.

Beginning in 1981, when the oldest of the baby boomers were 35, we see the trend growth rate in labor productivity grow. Beginning at 1.4 percent, the trend in labor productivity growth peaked at 3.0 percent in 2003. The baby boomers began occupying this age group in 1981, and the youngest baby boomers will not leave this age group until 2028. In this figure, we notice two things:

- The peak and fall in labor productivity growth precedes the peak in the share of experienced workers.

- Despite a high share of experienced workers, labor productivity falls precipitously.

Agnostic of the baby boomer cohort, the tail behavior of the two series shows something more subtle about labor productivity. If the share of experienced workers was positively correlated with labor productivity growth, then why does it peak before the share does?

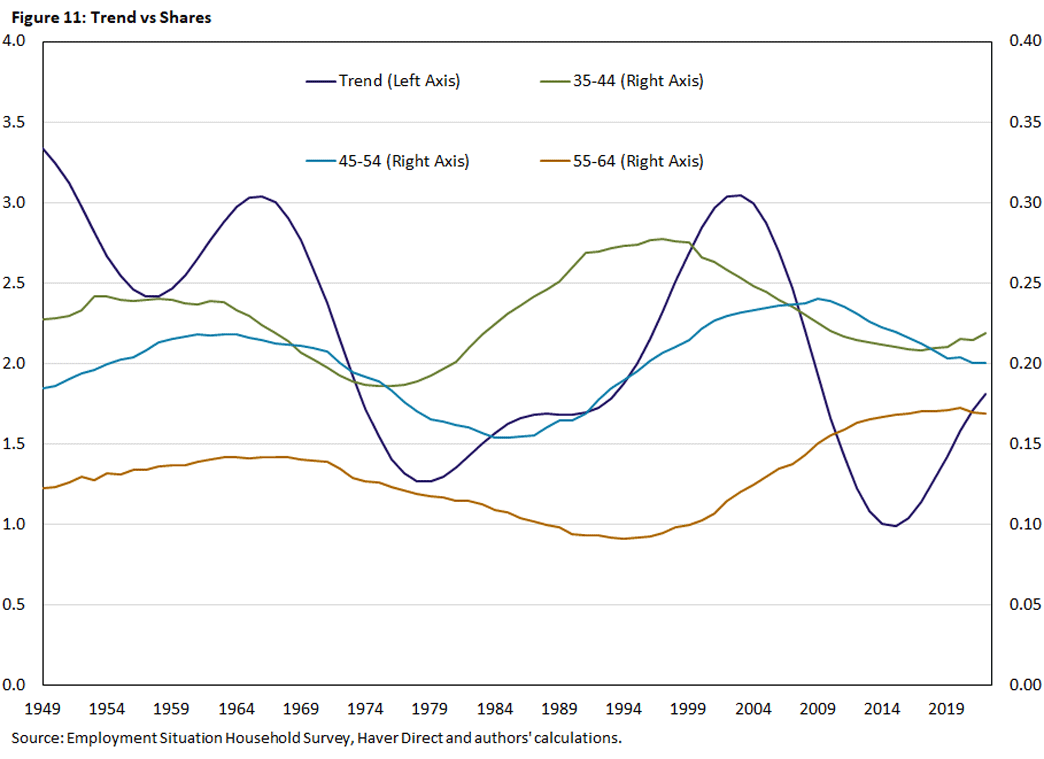

To delve into this question, we disaggregate experienced workers into three age groups — 35-44, 45-54 and 55-64 — and plot them against trend labor productivity growth in Figure 11. This figure shows that the positive correlation between experienced workers and labor productivity growth is driven by those aged 35-54.

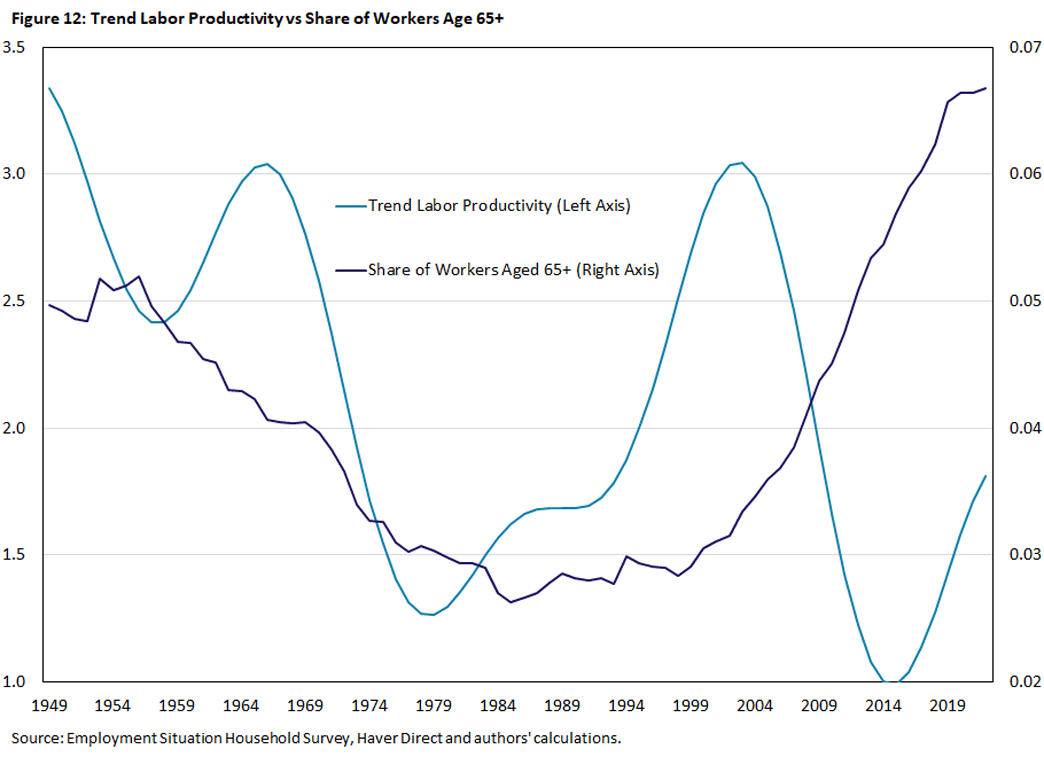

On the other hand, the share of the labor force made up by workers aged 55-64 is negatively correlated with trend of labor productivity growth. Figure 12 shows that the share of workers over 65 is somewhat uncorrelated with trend labor productivity.

This breakdown suggests an economic mechanism whereby typical workers enter the workforce relatively inexperienced but become more productive over time in learning by doing before seeing a decline in productivity at the end of their careers. Furthermore, given the declining share of experienced workers remaining in the workforce going forward, labor productivity growth may continue to decline.

Thus, labor productivity may be less directly about AI (or technology more broadly) and more about the experience of workers using these tools. While the young workers entering the workforce are arguably more knowledgeable about new technologies, they may be less adept than more experienced workers at applying them on the job. Learning how to use the appropriate technology productively and efficiently takes time. Moreover, it takes experience to foresee changes and adapt to the hiccups of a changing business environment.

Conclusion

The recent boom in interest regarding AI and its impact on labor productivity growth represents an updated version of an ongoing quest in economics: measuring the relationship between labor productivity growth and the adoption of IT. By first considering the circumstances that led to Robert Solow's famous quote and then examining the analogous setting up to the present, this article highlights a tenuous direct relationship between IT adoption and labor productivity growth.

Building on existing work, we find that the trend productivity growth is highly correlated with the age composition of the workforce. While it's clouded by the decline in the share of experienced workers, a silver lining might be that the increase in the share of workers aged 35-44 implies that labor productivity growth could pick up. Young but relatively inexperienced workers may know the most about recent IT advances but potentially need time to apply them effectively in solving the challenges they face in their business environment. It may well be that the time spent on the job gaining experience, at the interface of using the newest technology and working, is a key factor in allowing workers to become gradually more productive. Productivity growth, therefore, may be as much about who as it is about what.

Erin Henry is a former research associate, Pierre-Daniel Sarte is a senior advisor, and Jack Taylor is a research associate, all with the Research Department at the Federal Reserve Bank of Richmond.

See Solow's 1987 book review of The Myth of the Post-Industrial Economy.

See the article "Aggregate Effects of the Adoption of AI" by our Richmond Fed colleague Andreas Hornstein for more.

See the 2023 article "The Potentially Large Effects of Artificial Intelligence on Economic Growth" by Joseph Briggs and Devesh Kodnami.

See the 2023 article "Generative AI Could Raise Global GDP by 7%."

See the 2024 paper "The Simple Macroeconomics of AI."

See the 2002 article "The Real Source of the Productivity Boom" by Gardiner Morse for a discussion of competition and innovation or the 2011 paper "What Determines Productivity?" by Chad Syverson for a discussion of mismeasurement.

See the article "Boomers Have Played a Role in Changes in Productivity."

It is important to note that correlation does not equal causation.

To cite this Economic Brief, please use the following format: Henry, Erin; Sarte, Pierre-Daniel; and Taylor, Jack. (August 2024) "The Productivity Puzzle: AI, Technology Adoption and the Workforce." Federal Reserve Bank of Richmond Economic Brief, No. 24-25.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.