Diverging Trends in Market Concentration

Researchers at the University of Chicago and the Richmond Fed uncover a paradoxical trend of rising national market concentration and falling local concentration across major economic sectors. Top firms — often thought to displace local businesses — are found to instead accelerate this divergence by enhancing (rather than stifling) local competition upon entry. This challenges prevailing narratives that top firms wield the market power to negatively impact consumer welfare by geographically expanding.

Market concentration measures the distribution of market shares among competitors, with high measured market concentration implying that a small number of firms capture a large market share within an industry. In highly concentrated markets, with limited alternatives available to consumers, dominant firms may have lower incentives to engage in aggressive price competition (that is, lower prices) or to innovate. More broadly, firms with particularly large market shares may have the market power to engage in anti-competitive practices, influencing prices and other market conditions to their advantage. This proves detrimental for consumer outcomes while allowing these firms to enjoy high markups and profits.

While markups provide the ideal piece of evidence to gauge the extent of market power, measuring them is challenging. The connection between market concentration and market power is more tenuous, but market concentration is easy to measure. Thus, pundits, policymakers and researchers usually use market concentration measures as indicators of market power.

Since 1990, an increase in market concentration at the national level has been well documented for nearly all industries. As such, concerns have been raised about this increasing national market concentration and its perceived link to lower competition and rising market power in product markets. Antitrust and regulatory bodies are called upon to monitor (and, if necessary, break up) large corporations like those considered "big tech" and "big retail," among many others.

Yet a key detail that should give pause is that product markets are not countrywide in nature. For most industries, transportation costs induce firms to operate close to customers, and travel costs induce customers to patronize local stores. Even in the internet age, most product markets are local, so national market measures may be far-removed from measures at the more relevant local levels. Indeed, my (Nicholas') paper "Diverging Trends in National and Local Concentration" — co-authored with Esteban Rossi-Hansberg and Pierre-Daniel Sarte — finds that this is the case.

Local Market Concentration Trends Are Decreasing on the Whole

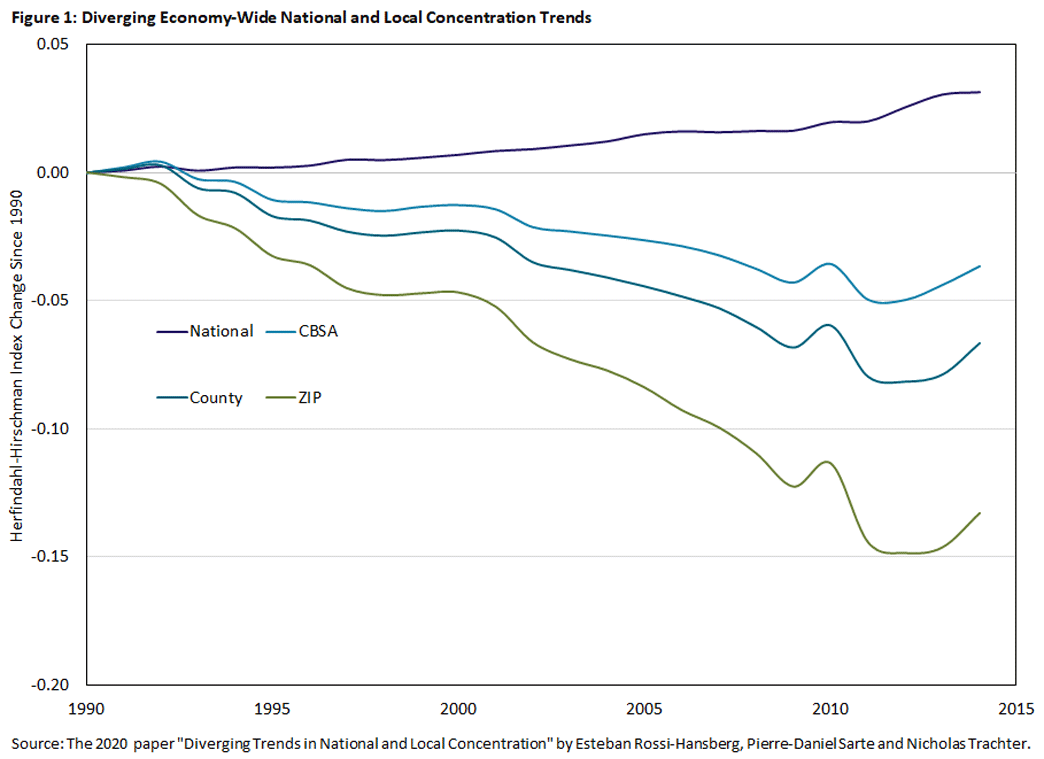

A well-known measure of market concentration is the Herfindahl-Hirschman Index (HHI), calculated by summing the squares of the market shares of competing firms. Using the National Establishment Time Series dataset — which comprises the universe of U.S. firms and their establishments between 1990 and 2014 — we construct HHI measures in two ways.

In the first way, for each industry, the whole country is considered to be the relevant market, and market shares are constructed accordingly. Then, the HHI for each industry is aggregated to produce the overall HHI measure, weighting industries by their employment level. In the second way, local markets are considered as the relevant unit, and the local HHI for each industry is aggregated into the overall HHI by averaging the different local-industry markets, where each local-industry market is weighted by its local-industry employment level.

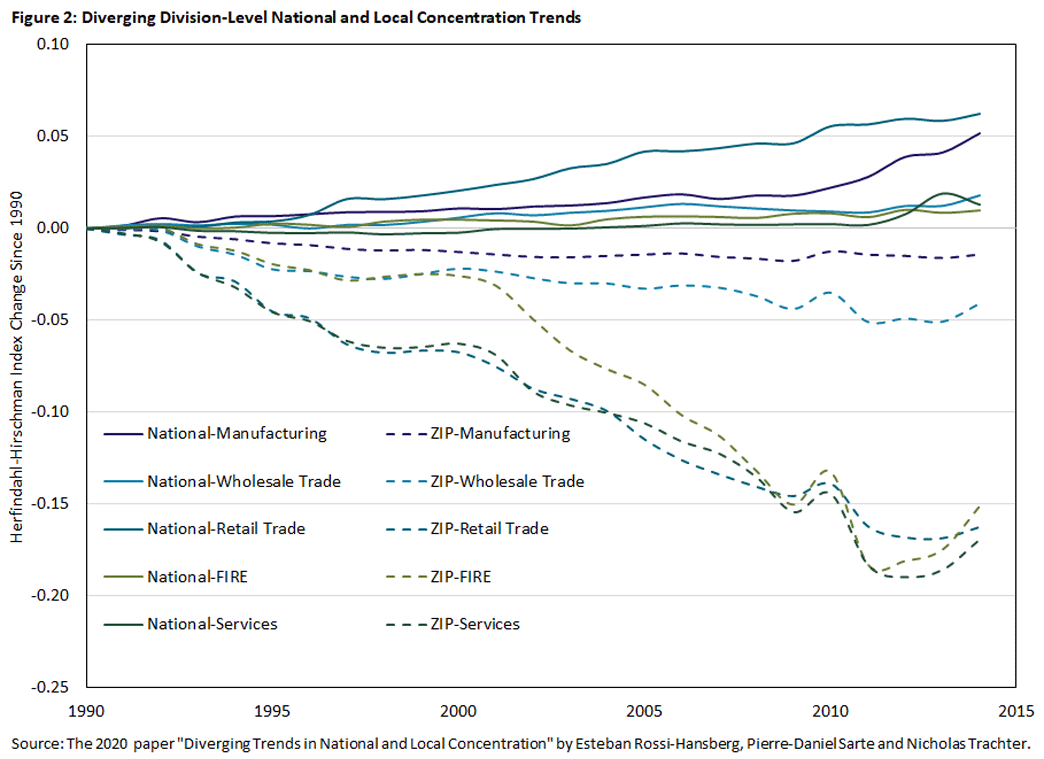

Figures 1 and 2 illustrate trends in the average change in overall HHI since 1990 for different definitions of industry classification and local markets. Industry-wise, these definitions consist of Standard Industrial Classification (SIC) 2, SIC 4, SIC 6 and SIC 8. Geographically, these definitions consist of the U.S. as a whole, individual counties, core-based statistical areas (CBSAs) and ZIP codes, as seen in Figure 1. Divergence in market concentration at the national level and at these disaggregated levels is clear. And the more disaggregated the measure of concentration, the greater the divergence from aggregated measures.

We also document that this diverging pattern holds across all major sectors within the broader economy — manufacturing; services; retail trade; wholesale trade; and finance, insurance and real estate (FIRE) — as seen in Figure 2. In fact, industries where national concentration is increasing but local concentration decreasing account for roughly 70 percent of employment and sales in the nation. The divergence is pervasive. How should we think about this seemingly paradoxical fact?

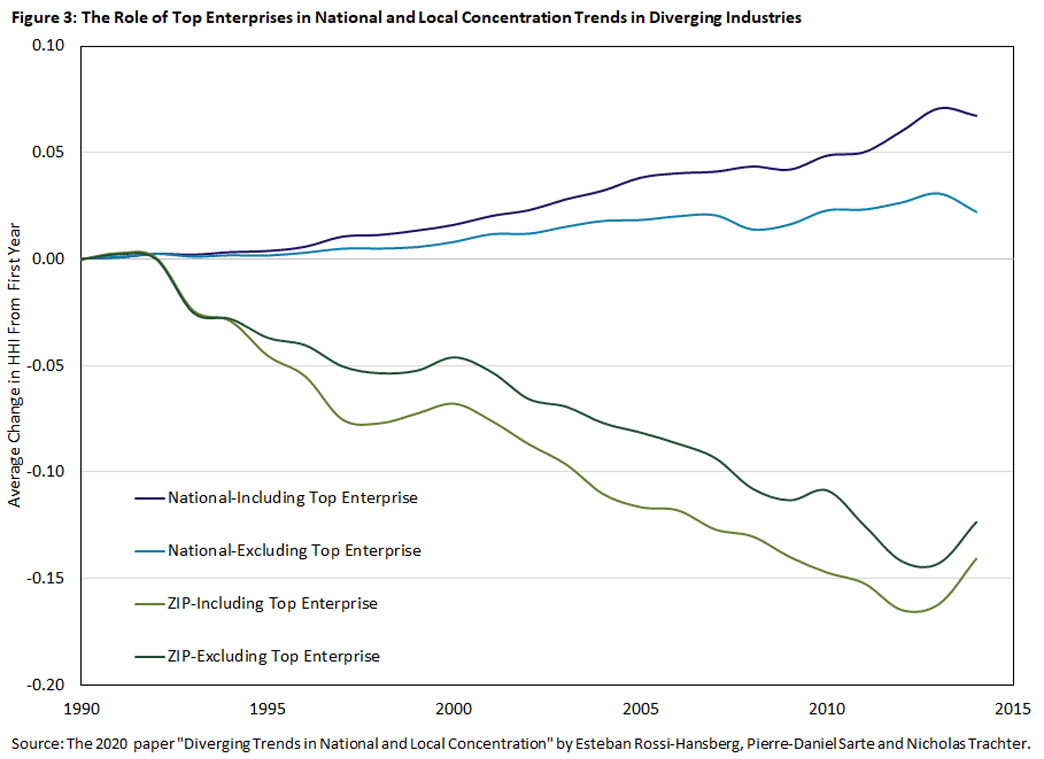

What's Behind These Diverging Trends? The Surprising Role of Top Firms

As it turns out, top firms (in terms of share of sales) influence these documented diverging trends in a marked and perhaps unexpected manner. Figure 3 considers SIC 8 industries exhibiting diverging trends and depicts the same object of average change in HHI but excludes the top firm. National concentration ends up being lower, which is expected since the most concentrated firm has been excluded. But more surprisingly, local concentration is higher. That is, top firms have contributed to both the increase in national concentration as well as the decrease in local concentration. In other words, they've accelerated the divergence of the two.

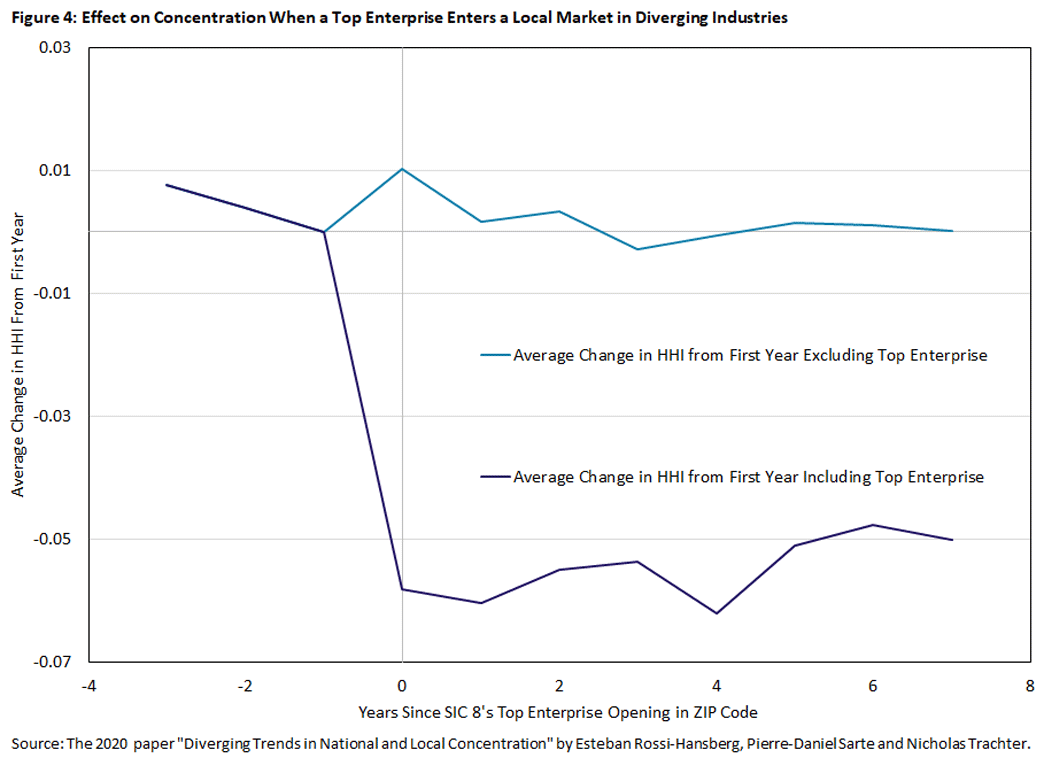

The underlying effect of top firms in influencing concentration becomes more striking when looking at what happens when an establishment associated with a top firm enters a local market. Figure 4 presents such an event study for all SIC 8 industries with diverging trends, where the HHI change is normalized to zero in the year prior to entry.

After entry, local concentration falls, and this decline is persistent for at least the following seven years. Crucially, this persistent reduction in local concentration stands in contrast to the same scenario with the top firm excluded from the analysis: Absent local entry, concentration would remain essentially unchanged over the seven-year timespan. Accordingly, entry of the top firm is the main driving factor behind the observed effect on concentration.

Such findings shed some light on the dynamic between top firms and local businesses: Prevailing narratives may hold that the former outcompetes and displaces the latter. The actual situation is more complex. Top firms, it appears, are not systematically driving out and replacing smaller local stores. This is true even for firms with nationwide reach and recognition like Walmart. A case studied in more detail in the paper, Walmart's opening of a new establishment is associated not only with a significant decline in the HHI within the ZIP code but also with an increase in the number of local establishments. So by and large, it seems that top firms simply add another competitor into the mix of local producers rather than displace them.

There are, of course, cases where these firms come to dominate and outcompete local establishments, and this pattern is more apparent among industries with increasing local market concentration (that is, those not exhibiting diverging trends). But on the whole, and in industries that account for the majority of U.S. employment and sales, the above suggests that such an occurrence is not as prevalent as might be feared.

Conclusion

The conventional association between high market concentration and reduced competition, potentially affording increased market power to top firms, warrants more nuanced consideration when considering the localized nature of product markets. This article details a paradoxical finding whereby national market concentration is on the rise while local market concentration is diminishing across major economic sectors. Top firms play an unexpected role in this interplay: In the absence of their expansion, not only national but also local concentration trends are less pronounced, suggesting that the effect of their entry into local markets is to act as just another competitor in the mix, rather than to exploit market power and displace local producers. To the extent that local concentration is associated with product market competition, then, the local entry that top firms undertake to geographically expand (thereby increasing their national market concentration) may be infusing more competition, not less, into the local market landscape.

As debates around antitrust policies continue, concerns over monopolization and rising market power harming consumer welfare — on the basis of national market concentration measures, at least — may be unfounded.

Nicholas Trachter is a senior economist and research advisor and Lindsay Li is a research associate in the Research Department at the Federal Reserve Bank of Richmond.

To cite this Economic Brief, please use the following format: Trachter, Nicholas; and Li, Lindsay. (February 2024) "Diverging Trends in Market Concentration." Federal Reserve Bank of Richmond Economic Brief, No. 24-05.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.