The Collateral Channel and Bank Credit

We identify the firm-level and aggregate effects of collateral price shocks on business lending and investment — also known as the collateral channel — using detailed bank-firm-loan level data that allow us to observe the pledging of real estate collateral and to control for credit demand and supply conditions. At the firm level, a 1-percentage-point increase in collateral values leads to an increase of 12 basis points in credit growth, whereas the average elasticity of credit to collateral values in the cross-section of metropolitan statistical areas (MSAs) is seven times larger. Our estimates imply that as much as 37 percent of employment growth over the period from 2013 to 2019 can be attributed to the relaxation of borrowing constraints on bank-dependent borrowers.

The pledging of real estate collateral often mitigates problems of asymmetric information and incompleteness in debt contracts. In such contractual situations, fluctuations in the values of real estate collateral determine borrowing capacity and credit allocations. Higher asset values relax collateral constraints, allowing firms to secure more credit and increase investment, which in turn leads to an expansion of economic activity.

This mechanism — known as the collateral channel — is frequently featured in theoretical models of financial frictions and macroeconomic fluctuations. While the predictions of theory about the role of collateral values for credit allocations and business cycles are unambiguous, empirical analysis on the role of real estate values for firm borrowing capacity has been limited by data availability. Empirical studies have focused on large, publicly listed firms; have relied on aggregate data; or have lacked information on the pledging of collateral, instead relying only on measures of firm ownership of real estate.

However, we show that the decision to pledge real estate as collateral is important, because it is concentrated in private and high bank-dependent firms. Increases in collateral values relax the borrowing constraints of these pledging firms, leading to significant expansion in bank credit and economic activity.

Our 2022 working paper "The Collateral Channel and Bank Credit" attempts to fill in these gaps in the literature by examining the role of pledging of commercial real estate collateral for bank credit and by quantifying the real effects of bank credit allocations that result from the relaxation of borrowing constraints.

Literature

A large theoretical strand of the literature explores the role of the collateral channel for macroeconomic fluctuations.1 This theoretical body of work places the collateral channel as a main amplification mechanism for aggregate fluctuations. Increases in asset values boost firms' net worth and expand borrowing capacities, leading to significant increases in aggregate activity.

However, the empirical analysis on the role of the collateral channel has been less clear cut. More direct evidence for the collateral channel was provided by the 2012 paper "The Collateral Channel: How Real Estate Shocks Affect Corporate Investment," which examines the effects of changes in value of commercial real estate holdings of large publicly traded companies on investment. The authors estimate an increase in investment of 6 cents for every dollar increase in the value of a firm's commercial real estate. This empirical finding has been replicated by several more recent studies that use the same sample of publicly traded firms.

However, the existing empirical evidence for the role of the collateral channel has been challenged recently. The 2021 study "Anatomy of Corporate Borrowing Constraints" documents that most publicly traded firms do not pledge real estate as collateral even if they own real estate properties. Instead, most large firms use debt contracts that are unsecured or based on earnings-based collateral, whose recovery value depends on the continuation value of the firm rather than specific assets. One potential reason for the low use of assets as collateral is that U.S. bankruptcy code makes it harder to liquidate the assets of large corporations. Instead, restructurings are preferred for bankruptcy resolution.

The 2020 paper "Do Credit Market Shocks Affect the Real Economy? Quasi-Experimental Evidence From the Great Recession and 'Normal' Economic Times" uses data from the Small Business Administration to argue that the restricted access to credit to small businesses during the Great Recession did not have a significant effect on economic activity. In contrast, the 2015 paper "House Prices, Collateral and Self-Employment" — which uses County Business Patterns (CBP) data — argues that the collateral channel that explains 15 to 25 percent of employment variation across geographic markets.

However, none of these studies provide direct evidence for the presence (or lack thereof) of the collateral channel because none of these studies use granular enough data to document the actual pledging of collateral. Our analysis fills this gap in the literature, providing direct evidence for the workings of the collateral channel and its manifestation in both quantities and prices of credit. It also examines the collateral channel's real effects on investment, employment and establishment growth. Our estimates imply that as much as 37 percent of employment variation over our sample period from 2013 to 2019 can be attributed to the relaxation of borrowing constraints and increases in bank credit to high bank-dependent borrowers.

Data

We use confidential supervisory bank-firm-loan data derived from supervisory reports for both publicly traded and private firms in the U.S. from the first quarter of 2013 through the fourth quarter of 2019. Our data allow us to quantify the collateral channel conditional on both borrower and lender characteristics.

On the borrower side, we capture a diverse set of firms. We identify firms that are credit constrained and highly dependent on bank funding, which we refer to as high bank-dependent borrowers. Our data allow us to observe the pledging of different types of collateral and compare the relative relaxation of borrowing constraints based on the collateral use. Importantly, in our analysis, we distinguish between the pledging and the ownership of real estate.

On the lender side, our data include the largest banking organizations in the U.S., which provide a significant fraction of bank credit to corporate borrowers of different sizes and across different geographic regions.

Identification

The identification of the collateral channel at the firm level is equivalent to describing the extent to which the firm's borrowing constraint binds and restricts the firm from achieving its optimal level of capital. A binding collateral constraint creates a tight link between asset values and credit growth.

The identification challenge is that such associations can be confounded with changes in credit demand and credit supply that co-move with real estate values. To address endogeneity of real estate prices, we use a two-pronged approach:

- First, we use real estate supply elasticities constructed in the 2010 paper "The Geographic Determinants of Housing Supply" as instruments for real estate values.

- Second, we exploit the richness of the data to decompose changes in bank lending into borrower-specific loan demand factors and lender-specific credit supply factors, following the 2018 paper "How Much Do Idiosyncratic Bank Shocks Affect Investment? Evidence From Matched Bank-Firm Loan Data."

Another identification challenge involves the endogeneity of the choice to pledge real estate collateral. We address this by including several determinants — firm size, fixed asset share and firm leverage — of the pledging choice as controls in our estimation.

Results

We identify the firm-level effects of the collateral channel conditioning on firm-level demand factors and bank-level supply conditions using detailed bank-firm-loan level data. Among our findings:

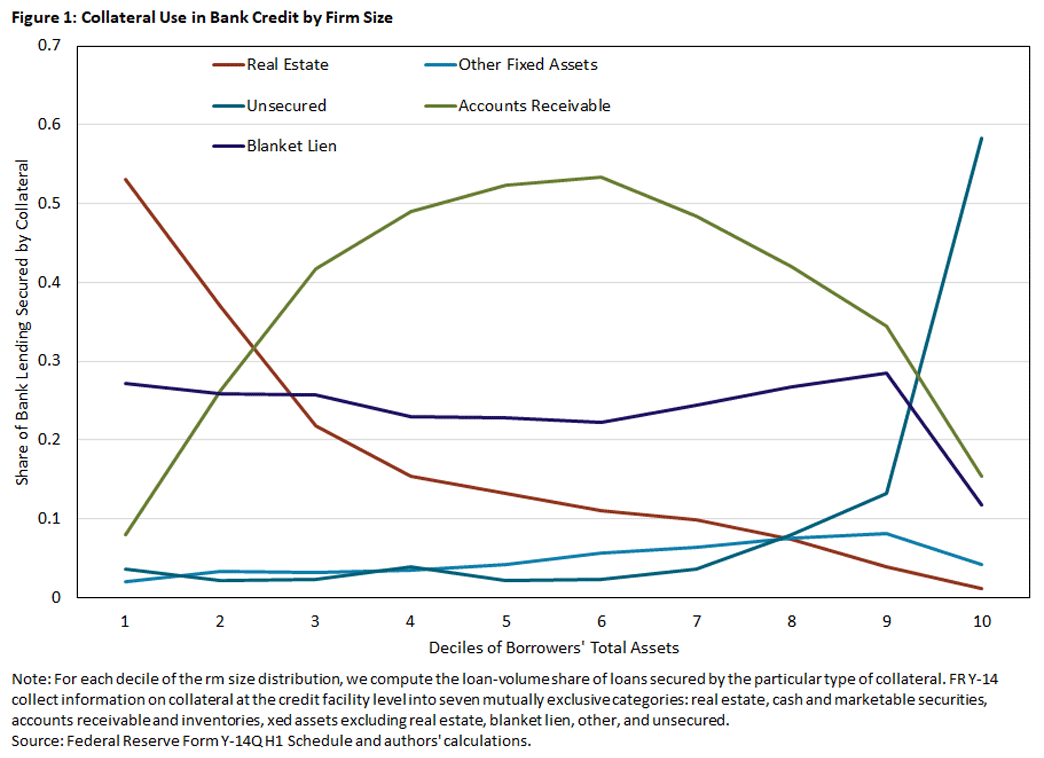

- Small firms tend to pledge real estate collateral, medium-sized firms tend to pledge accounts receivables and blanket liens, and large firms tend raise unsecured financing.

- A 1-percentage-point increase in real estate values contributes to:

- An annual increase of 7 to 12 basis points in bank credit growth

- An increase of 3 to 7 basis points in capital expenditures

- An increase of 6 to 9 basis points in asset growth

- Collateral channel effects are stronger for high bank-dependent firms.

- Higher collateral values reduce cost of credit and increase maturity.

- There is a well-defined rank order of collateral types and credit growth.

The market-level effects of the collateral channel indicate amplification of firm-level effects and significant real economic outcomes. More specifically:

- The aggregate credit multiplier effect is about seven times that of micro-level elasticities.

- A 1-percentage-point increase in real estate collateral values:

- Reduces the MSA unemployment rate by 0.8 basis points

- Increases the growth rate in employment by 14 basis points

- Increases the growth rate in establishments by 4 basis points

- Nearly 37 percent of employment growth could be attributed to relaxation of borrowing constraints from the first quarter of 2013 through the fourth quarter of 2019.

Discussion of Key Results

Firm Size and Collateral

Below we deep dive into the main results from the previous section. Figure 1 shows that the use of real estate collateral declines monotonically with firm asset size.

Close to 60 percent of credit to firms in the first decile of the firm-size distribution is collateralized with real estate. As size increases, firms substitute away from real estate, increase the use of accounts receivable and inventories, and increase their income-generating sources reflected in their customer relationships and accounts receivable.

Firms also use blanket liens as collateral. Blanket liens give the lender the power to seize and liquidate all assets not already encumbered by other liens. The use of blanket liens is relatively constant across the size distribution, except for the largest firms. Borrowers in the top decile have more than 60 percent of bank credit in the form of unsecured loans. This is in stark contrast to the significant reliance on real estate collateral for very small firms, but it is in line with findings for large publicly traded firms in the aforementioned 2021 paper "Anatomy of Corporate Borrowing Constraints."

Asset-Based and Earnings-Based Collateral

We next put the choice of pledging real estate as collateral in the broader context of the choice between asset-based or earnings-based collateral types following the taxonomy of the "Anatomy of Corporate Borrowing Constraints" paper. It documents that (for the sample of publicly traded firms) around 80 percent of debt contracts use earnings-based forms of collateral and only 20 percent of debt contracts are secured by specific assets. In contrast, our data show that 68 percent of borrowers use some form of asset-based collateral and about 37 percent of borrowers use real estate collateral. The use of asset-based collateral by bank dependent borrowers is consistent with previous studies.2

Table 1 shows empirical estimates of the collateral channel effect on firm-level bank credit using ordinary least squares (OLS) and instrumental variable (IV) regression specifications. We have expressed the price indexes in decimals, whereas the growth in lending is expressed in annualized percentage points. Therefore, the estimate of the (interaction) coefficient of interest in column (1) implies that a 1-percentage-point appreciation in the commercial real estate prices results in higher annual growth in credit of about 14 basis points.

| Table 1: The Collateral Channel Effects on Firm-Level Bank Credit | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable: Growth in Bank Credit | |||||||||

| OLS | IV | ||||||||

| |

(1) | (2) | (3) | (4) | (5) | (6) | |||

|

RE price x Decision to pledge RE (0/1) |

13.80*** (1.45) |

13.37*** (1.53) |

7.40** (3.56) |

7.75** (3.65) |

|||||

| RE price x Fixed assets as share of total assets |

6.37** (2.57) |

3.39 (2.56) |

-3.03 (6.31) |

-4.29 (6.40) |

|||||

| Controls | Y | Y | Y | Y | Y | Y | |||

| Observations | 726,328 | 726,328 | 726,328 | 726,328 | 726,328 | 726,328 | |||

| R2 | 0.27 | 0.27 | 0.27 | 0.27 | 0.27 | 0.27 | |||

| Note: RE stands for real estate. The regression analysis is based on an unbalanced panel of 32 banks, 68 MSA markets and 73,760 borrowers, for which we observe all control variables and, out of which, 27,124 borrowers pledge real estate as collateral. The left-side variable is the year-over-year growth rate in lending of bank b to firm f in market m. The growth in lending is expressed in percentage points, whereas commercial real estate prices are expressed in decimals. Therefore, the magnitudes of the main coefficient estimates are in basis points. That is, in column (1), a 1-percentage-point increase in commercial real estate prices leads to a 13.8-basis-point increase in borrowing. All regressions include firm and bank-market-time fixed effects. Market-level commercial real estate prices are instrumented based the 2010 paper "The Geographic Determinants of Housing Supply." The standard errors in columns (4) though (6) are constructed based on a bootstrap with clustering at the borrower and market level. Significant at ∗p<0.1; ∗∗p<0.05; ∗∗∗p<0.01. | |||||||||

Although the OLS regression controls for loan demand, this control may not completely purge associations between loan demand and commercial real estate values. There could still be a positive bias in the estimate of the coefficient of interest due to the correlation between real estate values and loan demand. Comparing the OLS estimates in column (1) with the IV estimates in column (4), we observe that the sensitivity of bank lending to collateral values declines by half. The IV estimate implies that, on average, lending increases by about 7 basis points for every percentage point increase in real estate values for firms that pledge real estate collateral.

The specifications in columns (2) and (5) include the borrowers' share of fixed assets and the interaction of this share with the price index. The OLS estimate uncovers that, on average, a 1-percentage-point increase in the price index leads to about a 3-basis-point increase in borrowing for a firm with 50 percent share of fixed assets.

However, the effect disappears once we introduce the IV estimation in column (5) or reintroduce the real estate collateral terms in columns (3) and (6). This confirms that changes in collateral values impact firms' borrowing capacities through the pledging of real estate collateral and not necessarily through a broader net worth channel based on the ownership of real estate alone.

Similar to the reasoning in the 2022 working paper "Collateral and Secured Debt (PDF)," when a specific asset such as real estate is pledged, any increase in collateral value would accrue exclusively to the bank in the case of borrower default. However, any increase in the value of an unencumbered real estate asset or any other fixed asset not explicitly pledged to the bank would accrue to all debt holders in a bankruptcy. The pledging of a specific asset improves the expected recovery rate on the loan and saves the costs associated with uncertainties and delays in assessing and liquidating unencumbered assets inherent in the bankruptcy process that general creditors must go through. Similar to the arguments in the "Anatomy of Corporate Borrowing Constraints" study, we interpret the evidence in columns (2) and (5) as capturing the collateral channel mechanism and highlighting the importance of observing the actual collateral used rather than simply the ownership of real estate and its market value.

As shown in Table 2, firms that pledge real estate collateral in markets with higher real estate values experience higher investment rates, and the effect of the collateral channel is statistically significant for high bank-dependent borrowers. A 1-percentage-point increase in real estate collateral values increases investment rates about 3 basis points for all firms and by about 7 basis points for high bank-dependent borrowers. The last column of the table shows that the asset growth of high bank-dependent borrowers that pledge real estate collateral experience increases by 9 basis points for every percentage point increase in collateral values.

| Table 2: The Effect of the Collateral Channel on Capital Expenditures and Asset Growth | ||||||

|---|---|---|---|---|---|---|

| Bank Dependence | Dependent Variable: | |||||

| Firm Capital Expenditures | Growth in Firm Assets | |||||

| All | Low | High | All | Low | High | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|

RE Price x Decision to pledge RE (0/1) |

3.48** (1.70) |

2.37 (1.95) |

6.85* (3.67) |

5.62*** (1.49) |

4.15** (1.93) |

8.75*** (2.27) |

| Controls | Y | Y | Y | Y | Y | Y |

| Observations | 642,288 | 551,746 | 90,542 | 948,256 | 747,043 | 201,213 |

| R2 | 0.76 | 0.76 | 0.79 | 0.15 | 0.14 | 0.17 |

| Note: Firm capital expenditures are expressed as the annualized percent of lagged total assets. Firm asset growth is the year-over-year growth of firms' total assets. Commercial real estate prices are instrumented with the measure from the 2010 paper "The Geographic Determinants of Housing Supply." All regressions include firm, bank and market-time fixed effects. Heteroscedasticity consistent standard errors are clustered at the firm level. Significant at ∗p<0.1; ∗∗p<0.05; ∗∗∗p<0.01. |

||||||

Collateral and Market-Level Economic Activity

We next evaluate the effect of the collateral channel on market-level economic activity. The results of this analysis are summarized in Table 3. Although the relaxation of borrowing constraints had statistically significant effects on bank credit to the relatively small high bank-dependent borrowers, small firms have disproportionately larger shares in employment, as documented in the 2011 paper "Do Small Businesses Create More Jobs? New Evidence for the United States From the National Establishment Time Series." The coefficient estimates of the collateral channel term for the unemployment rate and the growth in employment capture both the disproportionately higher shares of employment in small businesses as well as any agglomeration effects of the collateral channel. The estimates imply that a 1-percentage-point increase in collateral values in the median market — which has 20 percent of borrowers pledging real estate collateral — leads to about a 0.8-basis-point decrease in unemployment rate and about a 14-basis-point increase in the growth of total employment. Consistent with the fact that the nontradable sectors concentrate a higher share of high bank-dependent borrowers, the collateral channel has large and statistically significant impact on employment in the non-tradable sector of about 20 basis points for the median market and has an overall impact on employment of about 14 basis points. In contrast, we do not find evidence that the collateral channel affects employment growth in the tradable sector.

| Table 3: The Effect of the Collateral Channel on Market-Level Employment | ||||

|---|---|---|---|---|

| |

Dependent Variable: Growth in Employment | |||

| Unemployment Rate | Total | Non-Tradable | Tradable | |

| (1) | (2) | (3) | (4) | |

| RE price x Share of loans secured by RE |

-3.81* (2.16) |

68.51** (31.85) |

98.27*** (24.23) |

-16.68 (125.90) |

| Controls | Y | Y | Y | Y |

| Observations | 1,674 | 1,768 | 1,768 | 1,768 |

| R2 | 0.97 | 0.63 | 0.74 | 0.20 |

| Note: RE stands for real estate. The regression is based on a panel of 68 MSAs from the first quarter of 2013 to the fourth quarter of 2019. Commercial real estate prices are instrumented using the measure from the 2010 paper "The Geographic Determinants of Housing Supply." All regressions include market and time-fixed effects and are weighted by the lagged bank credit. Heteroskedasticity and autocorrelation robust standard errors are clustered at the market level. Significant at ∗p<0.1; ∗∗p<0.05; ∗∗∗p<0.01. | ||||

Collateral and Employment Creation

Based on the significant employment effects documented for the nontradable sector, we next examine the effect of the collateral channel on net business creation in this sector using annual data from the Census Bureau's CBP. We measure net growth in establishments in four groups based on number of employees: up to nine employees (which comprise more than 70 percent of all establishments), 10-99, 100-499 and more than 500.

We use the annual growth in establishments for each market and group as an outcome variable. The results from this estimation are summarized in Table 4. The coefficient estimates imply that, for the median market, a 1 percent increase in commercial real estate values boosts overall establishment growth about 4 basis points. The effect is concentrated in the group of establishments with the fewest employees. This evidence is consistent with smaller firms being more credit constrained and more dependent on bank credit. The results on establishment growth are in line with the overall effects of the collateral channel on the unemployment rate and the growth in employment.

| Table 4: The Effect of the Collateral Channel on the Growth in Establishments | |||||

|---|---|---|---|---|---|

| |

Dependent Variable: Growth in Establishments | ||||

| Aggregate | Nontradable | ||||

| (1) | (2) | (3) | (4) | (5) | |

|

All |

1-9 |

10-99 |

100-499 |

500+ |

|

| RE price x Share of loans secured by RE |

21.26** (10.42) |

24.71* (13.86) |

19.25 (20.51) |

-34.50 (54.86) |

396.98 (276.88) |

| Controls | Y | Y | Y | Y | Y |

| Observations | 372 | 372 | 372 | 372 | 372 |

| R2 | 0.69 | 0.44 | 0.64 | 0.57 | 0.48 |

| Note: RE stands for real estate. The regressions are based on a panel of 68 MSA areas from 2013 to 2019. Commercial real estate prices are instrumented. All regressions include market and year fixed effects. Heteroscedasticity and autocorrelation robust standard errors are clustered at the market level. Significant at ∗p<0.1; ∗∗p<0.05; ∗∗∗p<0.01. |

|||||

Our Results in the Context of the Literature

We use this section to put our estimates of the collateral channel effects in perspective vis-a-vis the existing literature. The average annual growth in commercial real estate prices is 6.4 percent in our sample period. Combining this with a firm-level elasticity of 12.4 basis points for high bank-dependent firms implies that the relaxation of borrowing constraints due to higher real estate collateral values accounts for about 79 basis points of additional annual growth in credit for these borrowers.3

Based on our summary statistics, the credit channel accounts for about 16 percent of credit growth of the median high bank-dependent firm in our sample. A similar calculation of real firm-level effects implies that the collateral channel accounted for an additional growth of 44 basis points in capital expenditures over our sample period.

Although our data and empirical framework are fundamentally different, it is worth comparing our estimates with the seminal 2012 paper "The Collateral Channel: How Real Estate Shocks Affect Corporate Investment." This paper estimates an elasticity of investment to changes in commercial real estate values of about 6 percent for large publicly traded companies. The authors document a higher elasticity for constrained firms of 8.4 percent and a lower elasticity for unconstrained firms of about 4.3 percent.

Our estimates are smaller for our high bank-dependent borrowers, and estimates for the group of low bank-dependent borrowers are statistically insignificant. Furthermore, we find that when we condition on the pledging of real estate collateral, the role of the presence of a high share of fixed assets is not statistically significant. Other than differences in data, methodology and sample periods, we believe that our estimates based on the pledging of real estate collateral capture the collateral channel effects directly and for a subset of firms not present in the Compustat sample of the 2012 study.

We have shown that the micro-level estimates have statistically significant and economically important aggregate effects. For the median market with 20 percent of firms pledging real estate collateral, the estimate of the market-level elasticity implies that a 1-percentage-point increase in commercial real estate prices leads to higher annual growth of 82 basis points in credit to high bank-dependent borrowers. As a result, the general equilibrium credit multiplier of bank credit is defined as the ratio of the firm-level and market-level coefficient estimates: (market elasticity × avg. share real estate pledged) / firm elasticity = (414 × 0.2) / 12.4 = 6.7. As a comparison, using a similar methodology, the 2021 working paper "Estimating Credit Multipliers (PDF)" identifies a credit multiplier effect equal to 4.5 for credit to households.

A similar calculation shows that the relaxation of borrowing constraints of high bank-dependent borrowers increases the annual growth in overall employment by about 88 basis points. The collateral channel contributes about 37 percent of the average annual growth in employment over the period from 2013 to 2019. This effect is larger than similar estimates provided by the 2015 paper "House Prices, Collateral and Self-Employment," which finds that the collateral channel accounts for 10 to 25 percent of the increase in employment from 2002 to 2007. Apart from differences in the sample period, data and methodology, our much broader firm coverage allows us to provide a more comprehensive assessment of the importance of the collateral channel for the non-financial business sector.

Conclusion

We provide direct evidence that the collateral channel is most relevant for non-publicly traded and high bank-dependent firms. Furthermore, we show that the firm-level relaxation of borrowing constraints due to the appreciation of the value of pledged real estate collateral leads to aggregate market-level effects with significant amplification of the micro-level elasticities in markets with higher shares of firms pledging real estate as collateral. Unlike the existing literature — which has relied on associations between housing prices and firm-level investment providing indirect evidence for the workings of the collateral channel — the keys to our identification are that we observe the pledging of real estate collateral and that we can appropriately control for lender-specific credit supply and firm-specific credit demand factors when quantifying the effects of borrowing constraints.

Our data and methodology allow us to aggregate the micro-level effects of collateral constraints and examine their aggregate effects controlling for other credit allocation mechanisms and the endogenous substitutions among a menu of available asset-based and earnings-based types of collateral. Although our estimates are reduced-form, they could be useful in calibrating a more structural approach to assess the general equilibrium and welfare effects of the collateral channel in the presence of heterogeneous firms with different access to market-based finance.

Arun Gupta and Vladimir Yankov are senior economists in the Financial Institution Risk Evaluation Section of the Federal Reserve Board of Governors. Horacio Sapriza is a senior economist and policy advisor in the Research Department at the Federal Reserve Bank of Richmond.

This literature includes the 1976 study "The Loan Market, Collateral and Rates of Interest," the 1981 study "Credit Rationing in Markets With Imperfect Information," the 1989 study "Agency Costs, Net Worth and Business Fluctuations," the 1994 study "A Theory of Debt Based on the Inalienability of Human Capital," the 1997 study "Credit Cycles," the 1997 study "Financial Intermediation, Loanable Funds and the Real Sector," the 1999 handbook chapter "The Financial Accelerator in a Quantitative Business Cycle Framework" and the 2018 study "Asset Bubbles and Credit Constraints."

See, for example, the 1990 paper "Collateral, Loan Quality and Bank Risk."

For the coefficient estimate of 12.4 basis points, see column 3 in Table 9 of our original 2022 working paper "The Collateral Channel and Bank Credit."

To cite this Economic Brief, please use the following format: Gupta, Arun; Sapriza, Horacio; and Yankov, Vladimir. (October 2023) "The Collateral Channel and Bank Credit." Federal Reserve Bank of Richmond Economic Brief, No. 23-33.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.