Does AI Cause Higher Operational Losses at Banks?

The rapid advancement and widespread adoption of artificial intelligence (AI) has fundamentally transformed how firms operate across industries. In the U.S. banking sector, AI applications range from customer service and fraud detection to trading and risk management. Prior research has shown that AI can boost sales, innovation, and product quality. However, there is surprisingly little evidence that it improves operational efficiency. To address this puzzle, our research paper: “AI and Operational Losses: Evidence from U.S. Bank Holding Companies,” investigates the relationship between AI investments and operational losses at large U.S. banking organizations.

Operational losses can be traced to inadequate or failed internal processes, people and systems or external events.1 How could AI potentially affect operational losses? First, AI deployment at banks can raise the risk of cyber threats and external fraud. For example, AI implementation often depends on a technology “supply chain,” involving external data providers, third-party cloud services, or outsourced development teams. These connections expand the network through which breaches, manipulated data, or other security lapses can propagate, potentially triggering widespread operational disruptions and losses. Second, AI-driven processes can increase compliance and regulatory risks. For example, AI algorithms using historical data may learn and embed existing biases, potentially leading to discrimination. This risk is higher in credit and lending decisions, where biased models can expose banks to regulatory fines and legal liabilities. Third, technical and systemic failures represent another significant risk with poorly designed or inadequately monitored AI. For example, technical complexity can arise when integrating AI with legacy platforms not built for advanced analytics. Integration failures can lead to system outages that disrupt critical services.

Findings

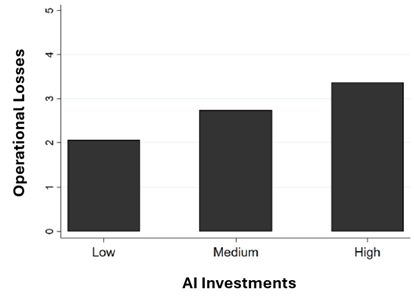

We measure operational losses using loss-to-assets ratio, and measure AI investments using the proportion of a bank’s employees who are skill in AI.2 Figure 1 displays the average loss-to-assets ratio for banks, sorted into terciles of “Low,” “Medium,” or “High” based on AI investments. We observe a clear positive relationship: Banks with higher AI investments incur greater operational losses than their less AI-intensive counterparts.