Buy Now, Pay Later: Recent Developments and Implications

Key Takeaways

- The total transaction value of "buy now, pay later" (BNPL) loans, measured in real terms, has grown roughly 20 percent per year since 2021, reaching an estimated $70 billion in 2025, or about 1.1 percent of total credit card spending.

- Given its current scale, debt outstanding and observed default rates, the impact of BNPL on financial stability appears limited at present, and while spillovers to other consumer credit markets are possible, there is no clear evidence of elevated stress to date.

- BNPL users generally retain access to traditional forms of credit and tend to carry higher balances on other unsecured credit products, but there is no clear evidence of a causal relationship between BNPL usage and unsecured debt balances, and the welfare effects of BNPL appear mixed.

"Buy now, pay later" (BNPL) is a form of point-of-sale consumer financing that lets shoppers split a purchase into multiple installments paid over time. After rapid expansion during the pandemic, BNPL usage has continued to grow, raising ongoing concerns about consumer lending practices and potential implications for financial stability. In this article, I assess the growth and scale of the BNPL market and evaluate its implications for financial stability, consumer credit and welfare.

BNPL here refers specifically to the "pay-in-four" product: a short-term, no-interest consumer loan repaid in four equal installments, with the first payment due at the time of purchase and the remaining three installments due at two-week intervals.1 In contrast to most other forms of consumer credit, these BNPL loans do not involve hard inquiries into borrowers' credit histories, and lenders generally do not report loan performance to credit bureaus. As a result, BNPL usage and its associated risks are difficult to measure at both individual and aggregate levels. This article seeks to address these issues and shed light on the implications of BNPL growth for consumers and the broader financial system.

BNPL Market Growth and Scale

To study BNPL, we draw on the latest information from the Consumer Financial Protection Bureau (CFPB), which used its supervisory and data-collection authority to obtain detailed pay-in-four loan data from six leading BNPL providers: Affirm, Afterpay, Klarna, PayPal, Sezzle and Zip. A December 2025 report from the CFPB notes nominal BNPL loan origination volumes and average loan sizes for these six lenders over the period 2019-23, summarized in Table 1.2

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Loan Origination (in Millions) | 19.8 | 77.9 | 196.6 | 273.8 | 335.8 |

| Dollar Origination (in Billions) | $2.2 | $8.9 | $25.5 | $33.4 | $43.9 |

| Average Loan Size | $111 | $114 | $129 | $122 | $131 |

| Source: Consumer Financial Protection Bureau. | |||||

The data indicate that BNPL lending experienced explosive early growth, with nominal origination values increasing by 304.5 percent between 2019 and 2020 and by 186.5 percent between 2020 and 2021. Growth then decelerated sharply after 2021, settling into a more stable pace of 31.0 percent between 2021 and 2022 and 31.4 percent between 2022 and 2023.

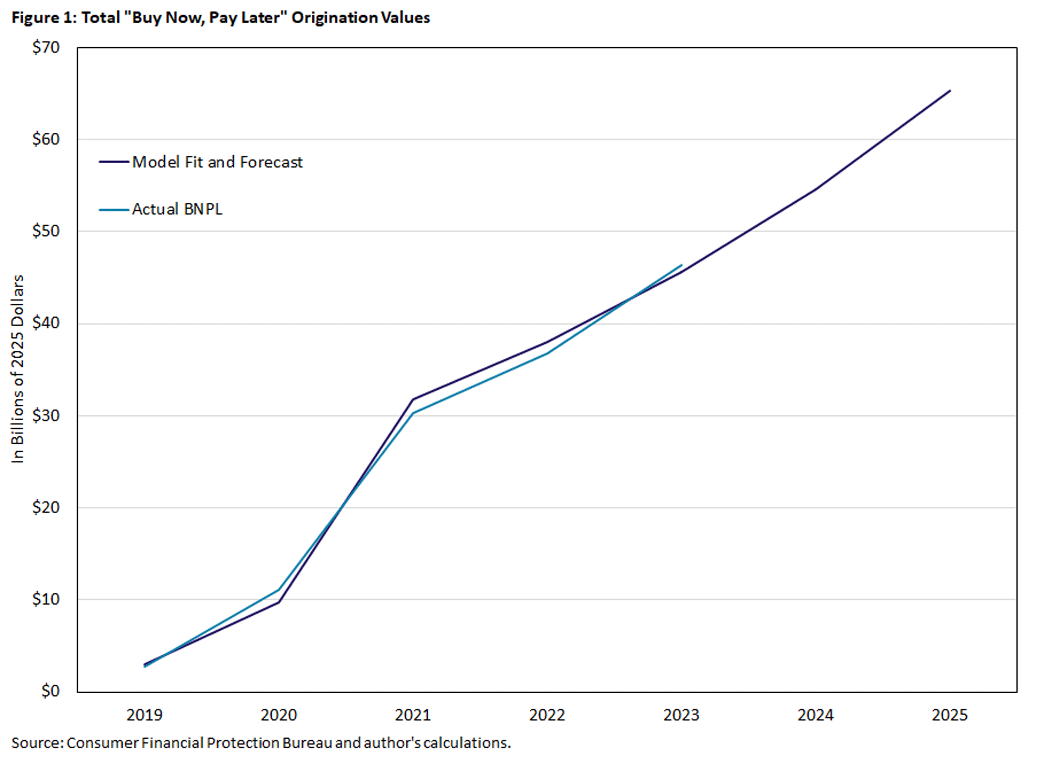

In light of this pattern, I first deflate BNPL origination values to 2025 prices and then estimate the industry growth trajectory by fitting a log-linear model with a structural break in 2021, which yields a post-2021 annual growth rate of roughly 20 percent.3 Figure 1 displays the model's fitted values and forecasts alongside the actual BNPL dollar originations in 2025 prices.

Based on the post-2021 growth rate, the model projects real BNPL origination values (in 2025 dollars) of $54.55 billion in 2024 and $65.31 billion in 2025.

Finally, I scale the origination volumes of the six leading BNPL lenders to estimate total BNPL market activity. According to a 2025 survey by LendingTree, PayPal is the most commonly used BNPL provider, cited by 56 percent of BNPL users. At 38 percent each, Klarna, Affirm and Afterpay are the next most popular, followed by Zip (15 percent), Sezzle (11 percent), Splitit (6 percent) and other providers (6 percent).4 Taken together, these usage shares imply that the six leading BNPL lenders account for about 94.23 percent of BNPL lending.5

Using this coverage ratio, I estimate that total BNPL purchase volume in 2025 is roughly $70 billion.6 For comparison, total U.S. credit card purchase volume likely exceeded $6.3 trillion in 2025.7 On this basis, BNPL would equal about 1.1 percent of total credit card spending in the same year.

BNPL Impact on Financial Stability

Despite the continued expansion of BNPL, its impact on financial stability appears limited at present. Relative to other consumer credit products, BNPL is associated with much smaller amounts of outstanding debt and lower default rates. While spillovers from BNPL to other consumer credit markets remain possible, there is no clear evidence of elevated stress to date.

BNPL Debt Outstanding

While I estimate total BNPL transaction value to be roughly $70 billion in 2025, the amount of BNPL debt outstanding at any point in time is substantially smaller, reflecting both the required down payment and the short repayment horizon.

First, BNPL transactions typically require the first payment — equaling 25 percent of the purchase price — immediately, implying that the BNPL loan principal equals only 75 percent of total transaction value. Second, because BNPL loans are short term, the annual BNPL loan principal must be scaled by the number of repayment cycles in a year — that is, 52 weeks divided by a six-week repayment period — to obtain the loan principal per repayment cycle. Finally, I compute the average debt outstanding within a repayment cycle, considering linear amortization over the repayment period.

Applying this framework to an estimated BNPL transaction value of $70 billion in 2025, the implied average stock of outstanding BNPL debt at any point in time is approximately $3.02 billion.8 By comparison, credit card debt outstanding stood at about $1.23 trillion at the end of the third quarter of 2025, roughly 400 times larger.

BNPL Defaults

BNPL has maintained a low default rate over the years. According to the CFPB report, the BNPL loan charge-off rate was 2.63 percent in 2022 and 1.83 percent in 2023. Similarly, the dollar amount of charged-off debt as a share of total transaction value fell from 1.71 percent to 0.92 percent in 2023, the lowest level since 2019. By comparison, the charge-off rate on credit card loans at U.S. commercial banks was 4.19 percent in the fourth quarter of 2023. The CFPB report attributes the decline in BNPL charge-off rates in 2023 in part to improvements in industry practices, including more refined credit risk models and a strategic shift toward deepening usage among existing customers rather than expanding to new borrowers.

There is indicative evidence from consumer surveys that late payment and delinquency behavior among BNPL users has increased since 2023. For example, LendingTree's 2025 survey reports that 41 percent of BNPL users made at least one late payment in the past year, up from 34 percent a year earlier. However, there is no direct evidence of rising aggregate BNPL charge-off rates to date, though continued monitoring is warranted.

BNPL Spillovers

While the BNPL sector itself currently appears to pose limited direct risks, this does not rule out the possibility of spillovers to other consumer credit markets. One potential concern is that BNPL usage may encourage some consumers to overborrow, thereby weakening their ability to service non-BNPL debt obligations. Given its relatively lighter underwriting standards and lack of credit bureau reporting, BNPL may serve as an entry point for risk accumulation that could spill over into other forms of consumer credit.

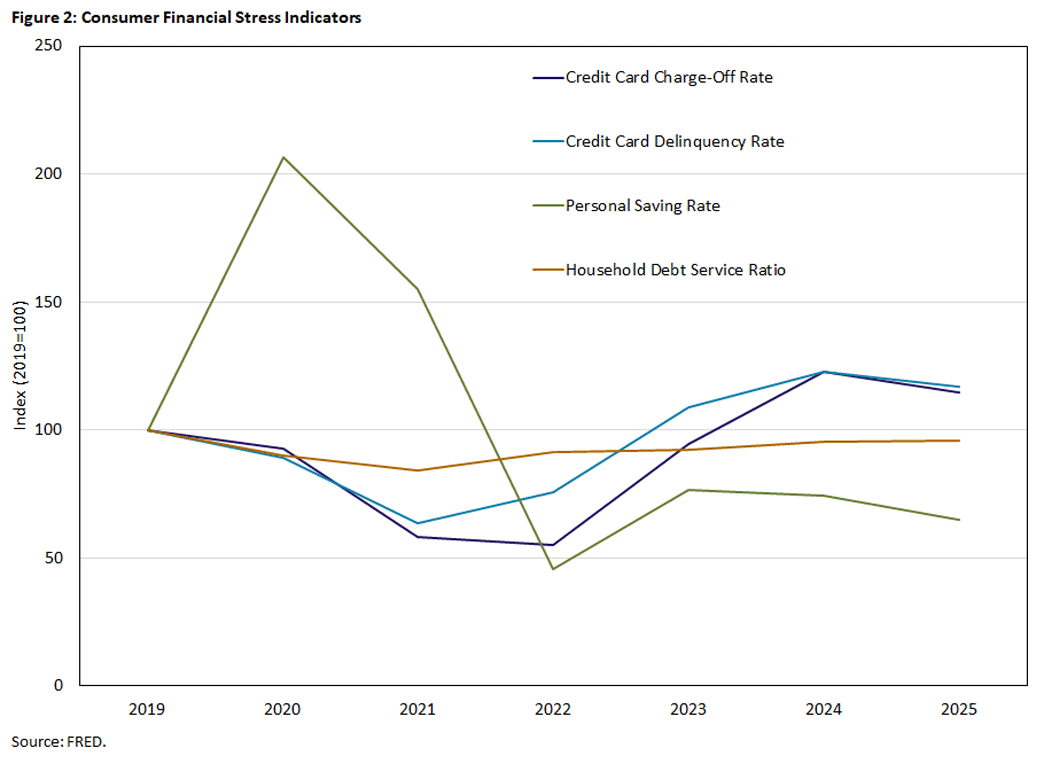

At the same time, the relatively small size of the BNPL sector may constrain the magnitude of any such spillovers. To date, there is no clear evidence of elevated stress in other consumer credit markets. Figure 2 plots four commonly used indicators of consumer financial stress over the period 2019-25. The credit card delinquency rate (90+ days past due) and the credit card charge-off rate capture payment distress and realized credit losses in unsecured consumer credit. The household debt service ratio measures required debt payments relative to disposable income, reflecting cash-flow pressure. The personal saving rate provides a proxy for household liquidity buffers, with lower saving implying thinner buffers.

Taken together, these indicators show a sharp improvement in household financial conditions during the pandemic, followed by normalization after 2021. Credit card delinquency and charge-off rates — while modestly above pre-pandemic levels — have stabilized in recent periods. The household debt service ratio has returned close to its prepandemic level without rising sharply, and while personal saving is lower than during the pandemic, it has declined gradually rather than abruptly. Overall, there is no clear evidence of elevated or accelerating consumer financial stress through 2025.

BNPL Impact on Consumer Credit and Welfare

The impact of BNPL on consumer credit and welfare is another potential issue. Key questions for gauging this issue include:

- Who uses BNPL loans?

- How do heterogenous BNPL borrowers perform on these loans?

- How does BNPL usage interact with other consumer credit products?

- What are the overall implications for consumer welfare?

A separate CFPB study provides a comprehensive, consumer-level analysis of BNPL usage.9 The findings reveal that 21 percent of consumers with a credit record financed at least one BNPL loan with one of the six largest BNPL firms in 2022. From 2021 to 2022, borrowers with deep subprime credit scores (or FICO scores between 300 and 579) accounted for 45 percent of BNPL originations, while those with subprime credit scores (or FICO scores between 580 and 619) were responsible for another 16 percent of originations. While consumers with no FICO scores and those rated as deep subprime exhibited higher default rates on loans originated in 2021-22 compared to consumers with higher FICO scores, they still repaid their BNPL loans 96 percent of the time.

The study further finds that most BNPL users retain access to traditional credit products, and BNPL users are consistently more likely than non-BNPL users to hold higher balances across a range of unsecured credit products, including credit cards, personal loans, retail loans, alternative financial services and student loans.

However, the relationship observed between BNPL usage and overall unsecured debt balances may not be causal. There is no clear evidence that BNPL induces increases in non-BNPL credit usage since it is also plausible that increases in other forms of credit (or reductions in available credit) make consumers more likely to finance purchases using BNPL.

In theory, BNPL can have mixed effects on consumer debt and welfare. On the one hand, BNPL provides borrowers with access to lower-cost credit. For credit card revolvers, interest starts accruing immediately for a purchase, with rates commonly spanning from 18 percent to 30 percent depending on credit quality and account terms. Therefore, substituting BNPL for credit card revolving may help some consumers reduce borrowing costs and near-term debt burdens.

On the other hand, BNPL may adversely affect consumers with limited financial planning or liquidity management. For example, LendingTree's 2025 survey finds that only 59 percent of BNPL users report being very confident in their ability to repay BNPL loans on time, with the remainder reporting lower levels of confidence. For these consumers, BNPL may encourage higher near-term spending that strains cash flow, potentially reducing liquidity buffers and increasing vulnerability to future financial shocks.

Given these mixed effects, there is no clear evidence to date that BNPL has materially increased overall consumer indebtedness or financial fragility. Indeed, despite the continued expansion of BNPL, a recent Federal Reserve study finds that credit card delinquency rates, while above prepandemic levels, began to flatten leading up to the third quarter of 2025, and this stabilization is broad-based, occurring across credit score tiers, income groups and homeownership status.10

Ongoing Developments

One ongoing development that may meaningfully improve BNPL industry practices and consumer welfare is Affirm's move to begin reporting BNPL loans to credit bureaus in 2025.11 Affirm has stated that this practice is intended to ensure that responsible repayment behavior is reflected in consumers' credit scores. It has also framed the move as part of a broader effort to promote greater transparency and responsible lending within the BNPL industry.

Other major BNPL providers (including Klarna and Afterpay) have cautioned against reporting BNPL activity to credit bureaus.12 These firms have raised concerns that traditional credit scoring models — which are designed for longer-term revolving or installment credit — may misinterpret frequent, short-term BNPL usage or small missed payments as elevated credit risk, potentially penalizing responsible borrowers rather than improving credit assessment. Some providers (such as Sezzle) offer consumers the option to have BNPL payments reported but do not automatically report all accounts.

The broader shift toward incorporating BNPL data into mainstream credit reporting and scoring frameworks reflects growing momentum to integrate BNPL into the traditional credit ecosystem. This development could benefit consumers (particularly those with limited credit histories) by allowing positive BNPL repayment behavior to contribute to credit scores, while also enabling lenders to assess creditworthiness using more complete information on borrowers' obligations. At the same time, widespread adoption is likely to be gradual, depending on how credit scoring models evolve and how lenders incorporate BNPL data into underwriting and risk management practices.

Conclusion

This article examines the growth and implications of the pay-in-four BNPL market. BNPL has continued to grow since 2021, reaching an estimated $70 billion in transactions in 2025, though still a small share (about 1.1 percent) of total U.S. credit-card spending. At its current scale, there is no clear evidence that BNPL poses material risks to financial stability or has generated significant spillovers to other consumer credit markets.

At the consumer level, BNPL users generally retain access to traditional credit and tend to carry higher debt than nonusers, though there is no clear evidence of a causal link between BNPL use and higher indebtedness. The welfare effects of BNPL appear mixed, potentially lowering borrowing costs for some consumers while increasing risks for others with limited liquidity or financial planning. Taken together, my findings suggest that BNPL is an increasingly important but still relatively small component of the consumer credit landscape, warranting continued monitoring and improvements in data and reporting as the market evolves.

Zhu Wang is vice president for research in financial and payments systems in the Research Department at the Federal Reserve Bank of Richmond.

This definition excludes other point-of-sale installment loans, including those offered by BNPL firms and marketed as BNPL. These loans are typically used for larger purchases and repaid over much longer duration. They usually involve hard credit checks, interest or finance charges, and they are reported to credit bureaus. As a result, they are largely captured by credit scores and aggregate consumer credit statistics and, thus, do not create the same policy concerns as "pay-in-four" loans.

See the 2025 report "The Buy Now, Pay Later Market" by the CFPB.

I fit a log-linear model with a structural break in 2021: , where Vt is real BNPL origination values (in 2025 dollars), t=0 in 2019, and the structure break occurs at 2021 (that is, I=1 if t≥2, otherwise I=0). The regression yields estimates of α=1.085, β₁=1.187 and β₂=-1.007, implying a post-2021 annual growth rate of roughly 20 percent (that is, ).

See the 2025 article "BNPL Tracker: 41% of Users Late in Past Year, More Using Loans for Groceries" by Matt Schulz.

Usage shares reported in the LendingTree consumer survey are not mutually exclusive, as individual consumers may use multiple BNPL providers. As a result, the implied market coverage of the six lenders should be interpreted as an approximate estimate.

To get this estimate, I divide my estimated BNPL amount for these six lenders for 2025 ($65.31 billion) by my estimated share of the market (94.23 percent), which yields $69.31 billion.

This estimate combines Nilson Report data indicating approximately $6.1 trillion in U.S. credit card purchase volume in 2024 and about $4.8 trillion through the first three quarters of 2025, implying year-over-year growth of roughly 5 percent to 6 percent. Given historical seasonality where the first three quarters account for approximately 70 percent to 75 percent of annual spending, annualizing the 2025 year-to-date volume implies total U.S. credit card transaction value in 2025 in the range of $6.4 trillion to $6.6 trillion, conservatively exceeding $6.3 trillion.

My calculation for the average outstanding BNPL debt can be expressed as , where s=75% (which denotes the financed share after the initial 25 percent down payment), τ=52/6=8.7 (which is the number of repayment cycles per year) and b=0.5 (which represents the average outstanding balance as a fraction of the financed amount under linear amortization over a repayment cycle).

See the 2025 report "Consumer Use of Buy Now, Pay Later and Other Unsecured Debt" by the CFPB.

See the 2025 article "A Note on Recent Dynamics of Consumer Delinquency Rates" by Robert Adams, Cord Barnes, Connor Bopst and Kamila Sommer.

See the 2025 article "Buy Now, Pay Later Loans Will Soon Affect Some Credit Scores" by the Associated Press.

See the 2025 article "Buy-Now-Pay-Later Companies Get Cold Feet About Handing Data to Credit Bureaus" by Nathan Borney.

To cite this Economic Brief, please use the following format: Wang, Zhu. (February 2026) "Buy Now, Pay Later: Recent Developments and Implications." Federal Reserve Bank of Richmond Economic Brief, No. 26-05.

This article may be photocopied or reprinted in its entirety. Please credit the author, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.