A Dramatic Shift in the U.S. Energy Sector: Hitting Close to Home

There has been a dramatic shift in the U.S. energy sector. For decades, it was assumed that U.S. energy production would gradually decline as proved energy reserves were exhausted and, as a consequence, U.S. imports of energy products would continue to climb. Technological advances in extracting oil and natural gas along with higher energy prices changed those assumptions. After peaking at 9.6 million barrels per day in 1970, U.S. oil production declined 48 percent to 5.0 million barrels per day in 2008. Remarkably, as a result of new extraction methods, production rebounded by 88 percent to 9.4 million barrels a day in 2015.

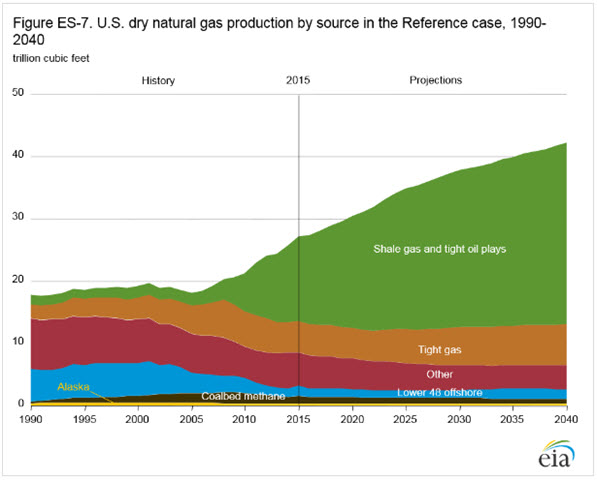

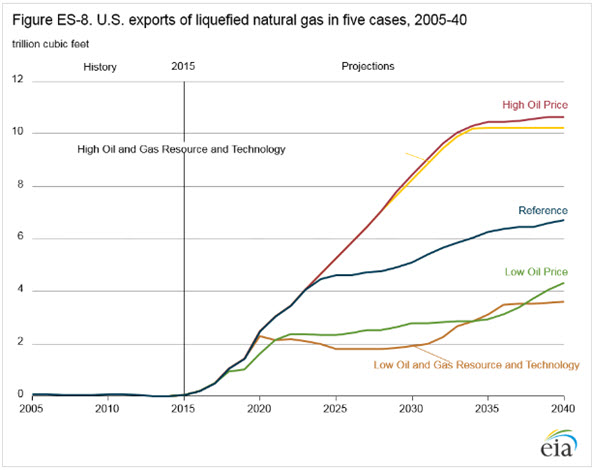

Natural gas production experienced a similar sharp rise in recent years. After peaking in 1973, natural gas production declined by 26 percent to 16.1 trillion cubic feet (Tcf) in 1986 and then gradually rose 12 percent through 2005. Since then the growth in production has been tremendous, increasing by 50 percent. Natural gas production in 2015 was 25 percent higher than the previous peak in 1973. By 2015, facilities that were originally built to import natural gas were being retrofitted to facilitate U.S. exports.

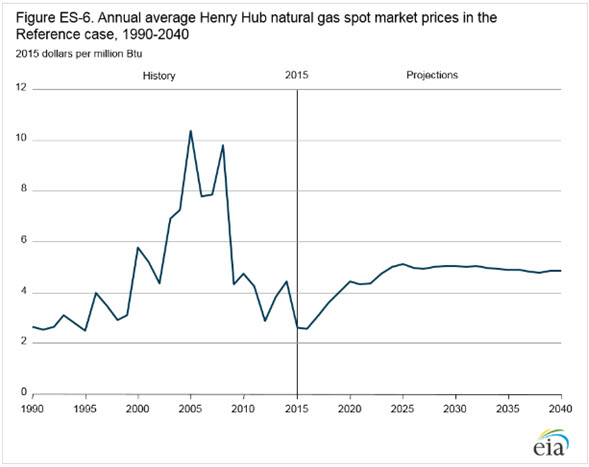

Despite this remarkable shift, the outlook for the oil and gas sector has been less positive of late. Oil prices fell from over $100 per barrel in the summer of 2014 to below $50 in early 2015 and have remained at or below $50 since. Natural gas prices averaged above $4 per MMBtu in 2014 but declined to under $2 by the beginning of 2016, averaging $2.61 for 2015. Lower prices have had a considerable impact on production and employment. The number of active oil rigs fell from a peak of 1,609 in October 2014 to 316 in May 2016 while the number of natural gas rigs dropped from 356 in November 2014 to 82 in June 2016.

In terms of production, the most recent data indicate a decline in U.S. oil production of 6.7 percent over the past 12 months while U.S. natural gas production is down 1.6 percent after reaching a high in early 2016. With the decline in drilling activity and production, employment in the oil and natural gas sector is down sharply. Total employment in oil and gas extraction in the United States dropped from just over 200,000 workers in August 2014 to 181,270 in March 2016. However, those losses only reflect the direct impact of the decline in production. Related industries experienced job losses as well. There was a decline of 18,000 jobs in oil and gas pipeline construction while employment in support activities for oil and gas drilling fell by over 220,000 jobs.

Despite lower prices and weaker output, the long-term outlook for the oil and natural gas sector remains positive. In its 2016 Annual Energy Outlook, the Energy Information Agency (EIA) projects natural gas prices to rebound to near $5 per MMBtu in its reference case with a steady increase in natural gas production through 2040 (see figures below).

Similarly, in its reference case the EIA projects a strong rebound in oil production in the near term and a steady increase through 2040 with oil prices gradually increasing over the forecast period, reaching $100 per barrel in 2027 and $150 by 2040. However, it could be the case that with such large quantities of proved reserves that natural gas and oil prices do not rebound as outlined in the EIA’s reference scenario. If that was the case, domestic production would be softer in coming decades.

For example, under a more subdued path for oil prices, with prices staying near $50 through 2031 and then moderately increasing to $73 by 2040, the projected path of oil production will continue to soften over the next decade before beginning to pick up (see "Low Oil Price" case in chart below). However, while activity in the oil and gas extraction sector would be softer, the benefit of lower natural gas and oil prices would benefit the broader U.S. economy.

This dramatic shift in the energy sector has been felt within the Fifth District. One of the most active regions of energy production is the Marcellus Shale that underlies most of West Virginia, western Maryland, parts of Ohio, Pennsylvania, and New York. The Marcellus Shale is a rock formation located deep beneath the earth’s surface that contains vast amounts of natural gas. West Virginia and Pennsylvania have been actively developing this resource in recent years, and the growth in production and the impact on the local economies has been tremendous.

In West Virginia, natural gas production rose sharply in recent years, up nearly 400 percent from 2010 to 2015. However, as prices began to soften, beginning in late 2014, production peaked and was down 9.7 percent from September 2015 to September 2016. Exploration and drilling slowed considerably as a result, and the impact on the state economy has been considerable. Employment in the oil and gas extraction sector dropped by 15 percent while employment in oil and gas pipeline construction and support activities for oil and gas extraction fell by 65 and 37 percent, respectively. A total of 5,310 jobs were lost in these sectors in less than two years.

Another facet of the dramatic shift in the U.S. energy sector is the shift away from coal as a fuel source. U.S. coal production peaked at 1.2 trillion short tons in 2008 after a fairly steady increase over the course of the 20th century. Coal production increased 144 percent from 1949 to 2008, with an average annual increase of 1.7 percent. However, after peaking in 2008, U.S. coal production dropped sharply, by 23 percent from 2008 to 2015. And despite a sharp reversal over the past five months (up 42 percent), the outlook remains very uncertain.

What is the source of the coal decline in recent years and the uncertain outlook? A number of factors have combined to change the trajectory of the coal sector. First, the boom in natural gas production and cheap natural gas prices provided another fuel source to compete with coal. Electricity generation from natural gas represented 21 percent of total generation in 2008 while coal represented 48 percent. In 2015, coal represented just 33.2 percent while the share attributed to natural gas rose to 32.7 percent. In 2016, natural gas overtook coal as the primary fuel source for electricity generation. Second, increased worldwide coal production created greater competition for U.S. coal exports. Lastly, domestic policies such as the Clean Power Plan accelerated the shift to less carbon-intensive energy sources.

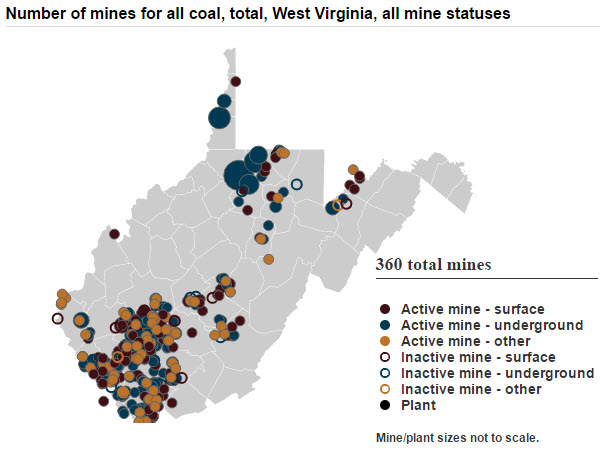

The impact of the shift in the coal sector on the West Virginia economy cannot be overstated. The drop in coal production in West Virginia was more acute than for the United States overall. Coal production fell 40 percent from 2008 to 2015 with mines in the southern half of the state bearing the brunt of the decline. Production in southern West Virginia mines fell by 59 percent over this period while production in northern West Virginia mines increased 16 percent. Both northern and southern West Virginia has seen a strong uptick in production since April, of 28 and 17 percent through September respectively, but the overall outlook for the sector remains very uncertain.

The loss in employment in the West Virginia coal mining sector has been tremendous. Employment in coal mining peaked in 2011 at 23,095 and subsequently fell to 15,437 in 2015, a 33 percent decline. The most recent data available, for the first quarter of 2016, indicate that job loss in the sector continued with the number employed in the sector dropping to 12,068 from 13,551 in the fourth quarter of 2015. Importantly, the mining sector is fairly concentrated geographically (see map below), and as a result those heavily mining-concentrated areas are hit especially hard by the downturn.

Not surprisingly the unemployment rates in those counties most dependent on coal have risen sharply in recent years. The effect of the downturn extends past employment, however. Business creation, the housing market, the state budget—severance taxes from coal production are a significant revenue source, and the broader state economy have all been impacted by the decline in the coal sector.

Have a question or comment about this article? We'd love to hear from you!

Views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Richmond or the Federal Reserve System.