Pricing Vice

Can "sin taxes" be good for your health and the economy?

It's rare for a tax to become trendy. But that's what's been going on in cities across the United States when it comes to soda taxes — levies on sugary beverages ranging from colas to sports drinks. For years, soda taxes failed at the ballot box, and in 2013, New York City's then-mayor Michael Bloomberg suffered a major defeat in court when he proposed a ban on large soda servings. A turning point came in 2014, when Berkeley, Calif., passed a soda tax after fierce debate. Philadelphia and four other cities followed suit in 2016, and just this past June, Seattle's City Council approved a soda tax of 1.75 cents per ounce to be levied on distributors. In all of these cases, the measure's backers argued the tax would cut consumption and help address obesity. On the opposing side were retailers and beverage industry groups, who charged it would hurt small businesses and disproportionately burden low-income consumers.

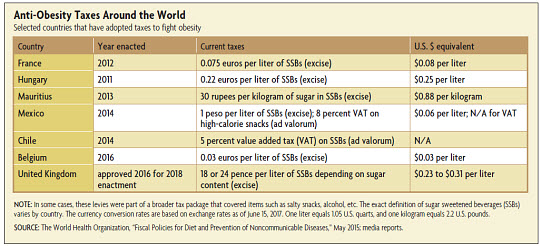

The movement is gaining ground beyond the United States as well. Citing rising obesity rates worldwide, the World Health Organization has called upon governments to consider soda taxes — along with a broad mix of health policies — as part of an international campaign against childhood obesity. Mexico enacted a nationwide soda tax in January 2014, and almost 30 other countries are considering or experimenting with similar measures. (See table below.) Although there's variety in how these taxes are structured, they usually take the form of excise taxes levied on the retailer or distributor, who to date have passed most or all of the cost along to consumers. Another common feature is that they cover not just soda but most drinks with added sugar, from flavored waters to energy drinks, collectively known as "sugar sweetened beverages" (SSBs).

Soda tax proponents often cite the campaign against tobacco as a playbook. U.S. smoking rates have plummeted in recent decades, and in tandem with other reforms — package warnings, ad restrictions, and smoking bans, to name a few — tobacco taxes have risen sharply. These advocates have drawn the lesson that higher soda taxes will cut consumption and lead to better health outcomes. They focus in particular on illnesses correlated with obesity, such as diabetes and heart disease, which have been on the rise globally. Since these diseases often consume a large share of public health spending, some economists and policymakers argue that obesity could be considered an "externality" akin to the effects of smoking — that is, the "external" cost of an individual's decision that society must pay for, like illnesses from secondhand smoke.

Others, including some who support anti-obesity measures for health reasons, see the externality comparison as inexact. For one, while obesity is strongly correlated with an array of diseases and health risks, there's still vigorous debate over the extent of obesity's causal role. Moreover, it's difficult for researchers to separate the effects of soda consumption on obesity from the effects of the rest of the foods in our diets, not to mention genetics and exercise. (Soda contributes about 7 percent of all calories in an average American diet.) And taxes may not have the desired effect if consumers have ways to get around price hikes — say, by finding other caloric fixes that are untaxed or crossing state borders if soda is less pricey there. Finally, some scholars, including those who favor less government intervention, argue that taxation may overlook the potential of other approaches — from education to "nudge" mechanisms — that promote healthier habits.

Soda taxes are only the latest example of "sin taxes" — levies on goods or activities seen as undesirable or harmful. Over time, justifications have ranged from raising revenue to addressing the external costs of private decisions to improving personal decisionmaking for its own sake. But when does it make economic sense to put a price on "bad" habits?

A Brief History of Sin Taxes

For centuries, governments have imposed taxes on tobacco and alcohol. Cleopatra taxed beer to help fund her wars and reduce public drunkenness. Tobacco was taxed early on in the American colonies, and in the 1790s, Pennsylvania farmers revolted against the first new levy imposed by the new republic, on their whiskey. Most of these measures were justified primarily on fiscal grounds, as a revenue source for limited public purposes like military funding. Even the Scottish economist Adam Smith embraced sin taxes with the justification that if the government was to raise revenue, it may as well tax nonessential goods.

Sin taxes have also been viewed as a way to curb behavior seen as costly to society. In the early 20th century, the economist Arthur Pigou formalized the idea of taxing externalities: If an individual acts in a way that imposes costs on others without having to pay for it, then the costs of the consumption will exceed benefits — and some parties will be harmed involuntarily. A tax on the good, however, can push the private cost closer to the social cost, reducing consumption and benefiting society as a whole. Unlike many other taxes, then, "Pigouvian" taxes are more about changing behavior than raising revenue. If there's no externality, however, using taxes to alter private choices may invite the charge of paternalism and can make both consumers and producers worse off: Taxing a good prevents people from consuming something that gives them enjoyment, however unsavory it may seem to others. It also reduces production and associated jobs.

Outright bans — such as Prohibition in the 1920s — are an alternative to taxes if a government wants to curb an unwanted or illicit activity. When weighing the two approaches, though, most economists have advocated the use of taxes. For example, Gary Becker and Kevin Murphy of the University of Chicago famously argued banning activities such as drug use is likely to be less effective and more costly to society than taxes: Rather than eliminating demand, they drive the activity underground, leading to violence, costly prison sentences, and wasted police resources. More recently, some economists have promoted "nudges" — simple, targeted mechanisms that rely on predictable psychological responses — to help people make "better" personal choices without restricting the set of options available. For example, rather than banning junk food outright, retailers could place fruit and vegetables at eye level.

Taken together, these insights have helped shape tax and health policy in recent decades. Policymakers have justified sin taxes in several ways, but they are seen as most likely to benefit society if they counter an externality. So for economists, the key issue in studying sin taxes often turns on the question: To what extent does an externality exist?

Private Choices, Public Cost

Take smoking: In terms of human cost, it's the top preventable cause of death in the United States, causing about 480,000 premature deaths a year, including 41,000 due to secondhand smoke. Economists usually consider the health costs and deaths of nonsmokers to be an externality, as well as the amount of public health care funding on tobacco-related illnesses. A 2015 study estimated that total tobacco-related health care costs come to $170 billion annually, 60 percent of which is covered by public dollars. Moreover, long-term smokers typically die 10 years earlier than nonsmokers — although some economists consider this, however tragic, as partially offsetting the externality due to fewer Social Security and Medicare outlays.

These statistics have made it relatively easy for U.S. policymakers to justify over the years a series of federal, state, and local tax hikes on tobacco, though state and local taxes still vary. In 1962, the federal tax per 1,000 cigarettes was just $4.00 (adjusted for inflation), compared to $50.50 in 2014. On average, all combined taxes now make up about 44 percent of the total price of a pack of cigarettes.

Alcohol — especially its role in drunk driving — is another case. The U.S. National Highway Traffic Safety Administration estimates that there are more than 10,000 alcohol-related fatalities on the road annually, or about 30 percent of all driving fatalities. Of drunk-driving fatalities in 2014, roughly 36 percent were non-drivers. It has also calculated the total economic cost of these accidents at about $44 billion. (Overall, the nominal number of U.S. drunk-driving deaths has been more than halved since 1980, but it's still relatively high compared to other industrialized countries.) Excluding drunk driving, the government estimates that alcohol causes around 30,000 deaths directly each year; that number rises to almost 90,000 when alcohol is indirectly involved.

In contrast to smoking, though, most health experts agree that there are safe levels of alcohol consumption. Moreover, to the extent that the goal is to reduce drunk driving, the activity that's targeted is a step removed from the activity being taxed. The result is that some people are being taxed who are not causing externalities, making society worse off. This raises the question of whether there are more targeted and efficient ways to counter the externality — with the qualification that other alternatives (say, increased highway checkpoints) may be even costlier on net.

When it comes to soda consumption, the potential externality cited by soda tax advocates — obesity — has become a pressing public-health concern. One in three Americans is obese, up from one in seven in the early 1960s. Obesity is also skyrocketing around the world, a trend that has caused alarm among public-health experts because it's correlated with illnesses such as heart disease and diabetes. In the United States, these diseases account for around 10 percent of all health care spending. However, the medical community remains divided over how and when obesity causes these diseases compared to other health risk factors.

"The key externality with obesity is the significant health care costs that publicly funded insurance programs pay for," says economist and public-health expert Frank Chaloupka of the University of Illinois at Chicago. "There's very strong evidence that obesity causes diabetes, as well as a number of other diseases, with many of these chronic conditions requiring treatment for many years. But other externalities of obesity are likely to be minimal, certainly not like secondhand smoke exposure for nonsmokers."

Consumption of sugary drinks is considered an important contributor to obesity because unlike solid food, they contain less-filling "empty" calories that aren't offset by caloric reductions elsewhere; a diet heavy on soda amounts to a substantial increase in calories over time. In addition, children consume much more soda than adults do, and kids who become obese are more likely to be obese adults. The challenge for researchers, however, is that soda's worldwide popularity means there is no counterfactual to work with: Had sugary drinks been unavailable over the last several decades, would the obesity epidemic have occurred anyway?

As with alcohol, medical experts also generally agree there are safe levels of soda consumption, and many people drink soda without becoming obese. So it's not clear that soda taxes are the most effective way to address externalities. And there are some who contend that obesity has a much greater "internal" cost than an external one. For example, Jay Bhattacharya of Stanford University and Neeraj Sood of the University of Southern California have argued that since obese individuals are often less healthy and work and earn less than the non-obese, they actually bear most of the economic cost.

A Success Story?

Whether sin taxes benefit society or improve health outcomes depends in part on whether they actually have an effect on consumption. The rich economics literature on tobacco suggests that, on balance, higher prices via taxes do tend to have that effect, everything else equal. The United States has witnessed a slew of policies since the 1960s, including smoking bans, restrictions on tobacco advertising, health education, and graphic package labeling. A 1990s settlement with tobacco companies channeled billions of dollars toward anti-smoking efforts. And all the while, smoking rates have sharply dropped for adults and teens. In 1964, 42 percent of adults smoked compared to 15 percent today. Among seniors in high school, the rate dropped from about 36 percent in 1997 to 19 percent in 2011. For economists studying consumption effects, then, it's important to isolate the tax effects from other policy changes.

The degree to which higher taxes reduce demand depends on the "price elasticity of demand," which measures how sensitive consumers are to price changes. For example, economists have found that a 10 percent price increase for cigarettes will reduce adult smoking by between 2 percent and 6 percent, but for teens, it will reduce smoking by as much as 13 percent. In short, teens react more strongly to higher prices by buying less. This is important as the teen years are when most smokers start.

One major increase was the 2009 hike in federal tobacco taxes, boosting the per-pack tax from about $0.40 to $1.00 and lifting taxes on other tobacco products significantly as well. In a 2012 study, Chaloupka and Jidong Huang of the Georgia State University School of Public Health analyzed the immediate effect on prices and consumption by comparing poll results asking high school students before and after the hike whether they smoked in the last 30 days; they then controlled those results for individual and state-specific factors. They found that cigarette prices went up around 22 percent, while the share of smokers dropped by a range between 9.7 percent to 13.3 percent. The authors concluded this tax hike led to a drop of up to 287,000 fewer smokers just that year.

To be sure, researchers have long noted that smokers may work around taxes by trying to find cheaper substitutes, such as buying fewer — but higher-tar — cigarettes. To analyze this effect, a 2016 study published in the American Economic Journal: Economic Policy looked at nationwide purchasing data from 2004 to 2012 to see how households changed consumption patterns over time. On balance, with other factors held equal, every $1 in extra taxes reduced the quantity of cigarettes purchased by 17 percent. This drop greatly outweighed a slight increase in tar and nicotine quantities that resulted from some smokers switching to higher-tar products.

Economists have also looked at whether the differences in state and local taxes weaken the impact of taxation, letting consumers avoid high taxes by crossing state or city lines to buy. Many studies have found that this "leakage" exists, but it usually doesn't offset the overall drop in demand. For example, an analysis of Maryland's 2003 tobacco tax hike of 36 percent (from $1.00 to $1.36) found that leakage shaved about 5 percentage points off the tax revenue. But in Washington, D.C., which is small and borders two states, the same hike would bring in only 17 percent. On average, the authors found, a typical smoker will travel three miles to save $1, so this effect would dissipate once a smoker travels more than a few miles away from a low-tax state.

"Even with addictive substances, the law of demand still applies," says Erik Nesson, an economist at Ball State University who co-authored the 2016 study on consumption changes. "People consume less when the price goes up. But it's also clear that we can't really see what the actual substitution effects are until policies are in place. And people will try to find ways to get around these price increases."

Pick Your Poison

When it comes to alcohol, economists have unearthed similar demand effects, even though some studies suggest that drinkers may substitute more among their drinks of choice. A 2009 meta-analysis of 112 alcohol-tax studies found that almost all showed an inverse relationship between price and consumption, but this varied across different groups of drinkers. Beer drinkers were least sensitive to price changes, followed by wine drinkers, then by liquor drinkers. Heavy drinkers, not surprisingly, were far less sensitive than any one of those groups. And some consumers are apt to switch beverages if their preferred libation becomes pricier. A 2011 paper on alcohol and injuries suggested that if spirits become more expensive relative to alternatives, liquor drinkers might be more inclined to switch to wine. But if wine — which ranges more widely in price — becomes pricier, wine drinkers tend to turn to cheaper wine.

In the context of externalities — namely, drunk driving — beer has gotten special attention. Beer drinkers are least sensitive to prices, but beer has been most closely correlated to drunk-driving accidents, in part because its packaging and shelf life can lead to quicker consumption. That same 2011 paper noted that most studies have found beer taxes might produce a consumption effect that, in turn, may help reduce drunk driving, while taxes on wine and spirits do not. The authors calculated that a 10 percent beer tax hike is correlated with a 2.2 percent drop in drunk-driving deaths. A 2015 study, focusing on large container beer purchases — which are tied to binge drinking because they may be quickly consumed — had a similar result. In short, the relationship between prices and alcohol intake appears to be more complicated than that for tobacco — due in part to the substitution effects across beverages and in part to variables such as demographics (alcohol preferences vary widely with age, gender, income, and education).

The latest question for researchers is whether taxes can cut soda consumption to the extent they did with tobacco. In Mexico, the soda tax has attracted interest partly because it's constructed to minimize substitution: A wide array of SSBs was taxed, while diet soda, milk, pure fruit juice, and bottled water were untaxed. The tax amounts to about 9 percent of the purchase price, and it raised SSB prices by an average of 7 percent to 11 percent. A recent study by researchers at the University of North Carolina and Mexico's National Institute of Public Health concluded that SSB consumption dropped 5.5 percent in 2014 and 9.7 percent in 2015 (both compared to the 2013 baseline), with even bigger drops among lower-income consumers. Sales of untaxed drinks such as bottled water, meanwhile, rose modestly. In short, the researchers discovered a consumption response similar to other sin tax findings. (The sample excluded small towns and rural areas, as well as sales in Mexico's large informal retail sector.)

Will this policy make a dent in Mexico's high obesity rates? It's too early to tell, as the government only began collecting health data in 2016 as part of its assessment. This effort will likely take time, according to one of the study's co-authors, economist Shu Wen Ng at the University of North Carolina at Chapel Hill. "Behavioral changes don't shift overnight," she says. "It took decades for this public-health crisis to evolve, and it will take a long time to address. One policy on its own -- like the soda tax — is an important start but is not enough. It will require a whole set of changes."

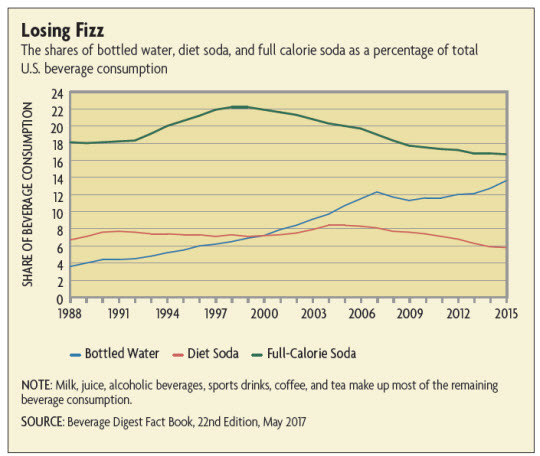

Meanwhile, soda consumption can fall even in the absence of higher taxes — a good case being the United States. After rising for decades, full-calorie soda consumption began dropping in the 1990s and is now about 25 percent lower than in 1998, while bottled water sales have jumped. (See chart below.) This trend started well before soda taxes were part of the public debate.

What's a Fair Tax?

Critics of sin taxes often note that low-income consumers bear the brunt of these policies because they spend a larger share of their income on these goods. (The poorest quartile of consumers spends almost 10 times as much on cigarettes as a share of their income as do consumers in the top quartile.) In the case of soda taxes, policymakers are now looking for ways to offset that effect. One response is to channel soda tax revenue to programs that improve the welfare of disadvantaged groups. In Philadelphia, this is done through prekindergarten funding, while Seattle will use some of the money to reduce class disparities in education. In Mexico, the government is planning to expand water fountains in schools so lower-income children don't have to spend money on drinks.

This tactic takes a page from the anti-tobacco campaigns: Some states, such as California, channel part of the money from tobacco taxes to efforts like smoking cessation programs, including those for lower-income consumers. And the 2009 federal tobacco hike was a revenue raiser for Medicaid's program for low-income children.

Meanwhile, if people are consuming fewer "sinful" products anyway, these products may become more popular as tax targets regardless of whether they cause externalities. Political science literature suggests that individuals (not surprisingly) tend to support taxes that don't affect them much — perhaps partly explaining the rising popularity of tobacco taxes as the population of smokers shrinks. As soda consumption drops, this, too, may make soda taxes more acceptable. And with sin taxes more broadly, some scholars argue that they can have an impact beyond what an industry-led price increase could achieve, because the tax can serve as a more visible public signal to consumers to seek healthier behavior.

As soda-tax experiments in the United States and around the world unfold, researchers will keep analyzing fresh data to see how these efforts might curb obesity. But for now, policymakers are still grappling with how to target these policies so they tackle the complicated mix of inputs that go into our diets. A good case in point is the Seattle City Council. After voting overwhelmingly for the SSB tax, it still has to decide whether coffee beverages that are heavy on milk, like lattes, are exempt, even if they include sugary syrups.

"Seattle is Sugartown," opined Seattle Magazine editor-at-large Knute Berger, citing the city's love of Starbucks' array of sweetened drinks. "They may take our 'soda tax' money, but they will never take our Cinnamon Dolce Lattes!"

Readings

Chiou, Lesley, and Erich Muehlegger. "Crossing the Line: Direct Estimation of Cross-Border Cigarette Sales and the Effect on Tax Revenue." The B.E. Journal of Economic Analysis & Policy, December 2008, vol. 8, no. 1, article 48. (Article available with subscription.)

Cotti, Chad, Erik Nesson, and Nathan Tefft. "The Effects of Tobacco Control Policies on Tobacco Products, Tar and Nicotine Purchases among Adults: Evidence from Household Panel Data." American Economic Journal: Economic Policy, November 2016, vol. 8, no. 4, pp. 103-123.

Herrnstadt, Evan, Ian W.H. Parry, and Juha Siikamaki. "Do Alcohol Taxes in Europe and the U.S. Rightly Correct for Externalities?" International Tax Public Finance, February 2015, vol. 22, no. 1, pp. 73-101. (Article available with subscription.)

Hoke, Omer, and Chad Cotti. "The Impact of Large Container Beer Purchases on Alcohol-Related Fatal Vehicle Accidents." Contemporary Economic Policy, July 2015, vol. 33. no. 3, pp. 477-487. (Article available with subscription.)

Huang, Jidong, and Frank J. Chaloupka IV. "The Impact of the 2009 Federal Tobacco Excise Tax Increase on Youth Tobacco Use." National Bureau of Economic Research Working Paper No. 18026, April 2012. (Article available with subscription.)

Wagenaar, Alexander C., Matthew J. Salois, and Kelli A. Komro. "Effects of Beverage Alcohol Price and Tax Levels on Drinking: A Meta-Analysis of 1,003 Estimates from 112 Studies." Addiction, February 2009, vol. 104, no. 2, pp. 179-190. (Article available with subscription.)

Topics

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.

As a new subscriber, you will need to confirm your request to receive email notifications from the Richmond Fed. Please click the confirm subscription link in the email to activate your request.

If you do not receive a confirmation email, check your junk or spam folder as the email may have been diverted.

You can unsubscribe at any time using the Unsubscribe link at the bottom of every email.