Time for a Career Change? Inter-Industry Job Mobility in the Fifth District

According to the Bureau of Labor Statistics (BLS), the average worker will have 12 jobs over the course of their lifetime. Whether workers transition to another job for career advancement, better skills alignment, or geographic location, job mobility is typically viewed as a key driver of labor productivity. There are two ways that workers can switch jobs: by moving to a new job within their current industry or by switching industries. Making a job transition to a different industry can be disruptive to an individual's career trajectory due to large gaps in skills and knowledge across sectors. However, this is not always the case. Some occupations are very mobile across industries. For example, workers in administrative occupations, such as executive assistants, are more likely to be able to transfer their skills across industries without much disruption to their careers because their job duties are often not industry specific.

The frequency of inter-industry job moves can provide important insight into shifting labor market dynamics. A 2014 article by Carlos Carrillo-Tudela of the University of Essex, Bart Hobijn of the Chicago Fed, and Ludo Visschers of the University of Edinburgh showed that during economic downturns, the rate at which workers switch industries declines. The reduced reallocation of workers across industries during recessions can be partially attributed to increased selectivity on the part of employers and partially to reduced willingness to change careers on the part of workers. Reduced hiring and an increased supply of unemployed individuals means that employers can be more selective, making it less likely that they will hire workers from a different industry whose skills and experiences may not perfectly align with the open position. Conversely, during economic expansions, job opportunities are more plentiful, and increased competition among employers can advantage job seekers looking for a new opportunity.

Recent changes in labor market dynamics have brought the topic of inter-industry job mobility to the forefront. Between 2021 and 2022, amid pandemic-related burnout and the emergence of more remote work opportunities, many workers reevaluated their career paths and made moves to other industries that in many cases paid off — the wage premium for individuals who switched to a different industry grew notably during this period. This period of reshuffling across industries raises several questions. Which industries experienced the most switching, and where did their workers go? Which demographic groups were more likely to switch industries? Has this change in inter-industry switching had a lasting impact on the labor market? Data from the U.S. Census Bureau's Job-to-Job Explorer provide insights around these questions.

A Brief Overview of the Data

The job-to-job flows data from the Census Bureau provide information on the job mobility patterns of U.S. workers. Using administrative data on the job histories of workers from the Longitudinal Employer-Household Dynamics program, the data track workers if they leave an employer and are hired by a new employer within a single quarter. Since it only tracks a worker's job move within that timeframe, one limitation of the data is that it does not include workers who go through an extended period of unemployment before being hired for a new job. The data also provide characteristics of these workers, including age, gender, and education, as well as characteristics of the firms, including age, size, and industry.

Using these data, it is possible to identify the number of workers who move between an origin and destination industry during a given quarter. The data can be thought of as a matrix where the rows of the matrix capture the number of workers who moved out of an industry and the columns represent the number of people who moved into an industry. Summing across rows gives the total number of workers who moved from a specific industry, while summing the columns gives the total workers who moved into an industry. (See table.) The data are lagged — the most recent quarter of data available is the third quarter of 2024.

| Destination | ||||

|---|---|---|---|---|

| Industry 1 | Industry 2 | Industry 3 | ||

| Origin | Industry 1 | 100 | 75 | 45 |

| Industry 2 | 50 | 80 | 65 | |

| Industry 3 | 25 | 20 | 32 | |

Which Industries Exhibit More Inter-Industry Switching?

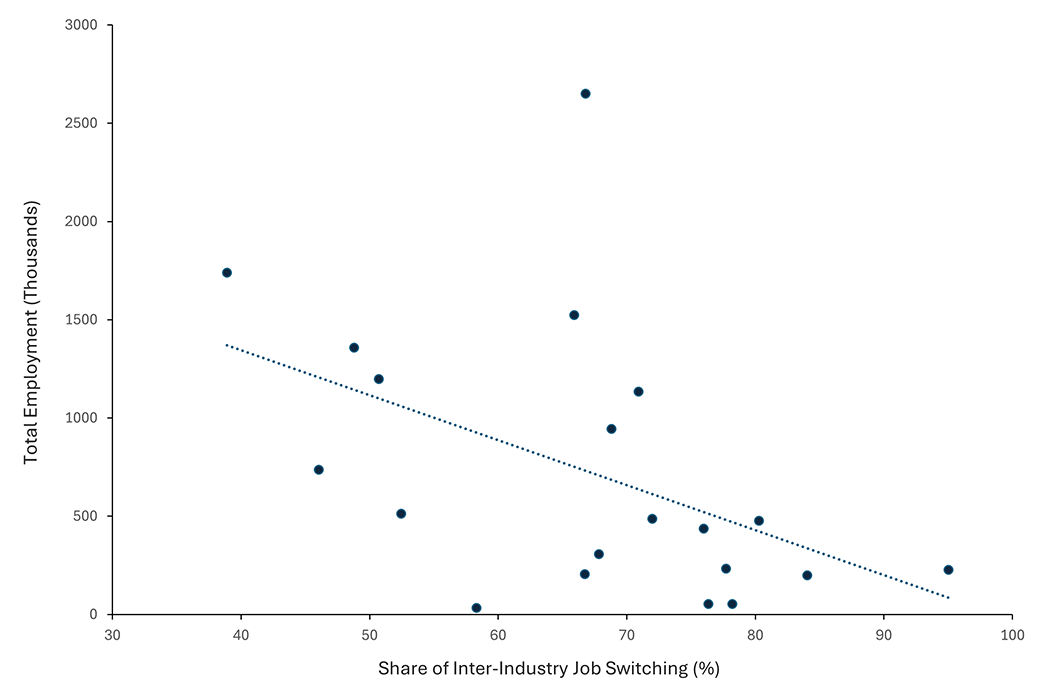

Certain industries are more likely to have workers who switch to a different industry. It is possible to compare switching across industries by dividing the total number of workers who moved to a job outside of their origin industry by the total number of job moves. In the first quarter of 2019, inter-industry moves were most common in management of companies and enterprises (95 percent); art, entertainment, and recreation (84 percent); and wholesale trade (80 percent). Individuals were least likely to move when they were in health care (39 percent); construction (46 percent); accommodation and food services (49 percent); and professional, scientific, and technical services (51 percent). (See chart.) There are several possible reasons for this variation. Some industries require more specialized knowledge, credentialling, and training, which can make a career change out of that industry particularly costly. Health care is a prime example. Doctors, nurses, surgical techs, and other health care professions require credentials and training that is typically not transferable to other industries. These highly specialized workers may be less willing to switch to an industry where their knowledge and training may be underutilized or irrelevant.

Conversely, some industries are closely linked and have occupations that overlap or skills that are easily transferrable. For example, in the first quarter of 2019, most inter-industry moves from wholesale trade were made to administrative and support and waste management services. Both industries employ a significant share of freight, stock, and material movers. Another example is arts and entertainment and food and accommodation. Both fall under the hospitality umbrella and have overlapping job competencies. In fact, most arts and entertainment workers who left their job in the first quarter of 2019 transitioned to a job in the food and accommodation industry. Industries like arts and entertainment and retail can also be described as "transient," meaning a higher share of their workforce views them as a temporary stop instead of a long-term career choice. These industries tend to attract younger workers and have lower wages, leading to higher turnover as workers seek career advancement in other, higher-paying fields. In industries like finance and insurance and professional business services, where average wages tend to be higher, the opposite may be true — workers are more likely to view jobs within these industries as permanent career choices. Also, jobs in industries like public administration are often viewed as providing a higher level of job security that may encourage workers to stay put in order to remain insulated from business cycle fluctuations.

Lastly, some of the variation in inter-industry job switching could be due to differences in the size and level of job growth across industries. Some industries simply have fewer jobs that a worker can choose from when they are looking for a new job, and, as a result, the worker is more likely to find a job in a different industry. Indeed, smaller industries tend to have higher shares of inter-industry switching. (See chart.) Management of companies and enterprises; art, entertainment, and recreation; and information are relatively small industries, each making up less than 2 percent of total Fifth District employment. Larger industries, such as health care and social assistance and professional, scientific, and technical services, make up 12 percent and 8 percent of total Fifth District employment, respectively. A higher share of inter-industry switching is likely to occur in industries that have fewer opportunities, as the probability of finding a job outside of the origin industry is higher.

Does Job Switching Differ by Demographic Group?

Making a major career change can be costly, and this cost varies by age. The repercussions of job switching, such as the potential loss of professional relationships and institutional knowledge, can be penalizing, particularly for workers with longer tenures. According to the BLS, job transitions are more common for younger workers, particularly those under the age of 22, who use these frequent job moves to gain skills and experience early in their careers. Frequent job transitions also provide a way for less established workers to discover which careers align best with their interests, lifestyle, and qualifications. Transitions tend to decline with age as workers become more established in their careers and seek stability.

The job-to-job flows data reflect this pattern of higher rates of job mobility for younger workers. Not only do young workers move to different jobs more often, but a larger share of their job moves are also to a different industry, which may indicate a higher likelihood of major career changes. Workers under the age of 24 have the highest share of inter-industry job moves (65 percent), and this share declines with age, steeply at first and then more gradually. (See chart.)

While age clearly plays a role in a worker's willingness and ability to transition to a different industry, there is only a slight difference in the share of inter-industry job moves by gender. For female workers, the share is approximately 59 percent, and it is 2 percentage points higher for male workers. However, there are larger differences when looking at this share within industries. These differences typically emerge in industries that traditionally skew toward one gender. For example, a much higher share of female workers transition to a different industry if they were previously employed in industries with a low share of female workers, such as agriculture (29 percent female), mining (14 percent female), construction (11 percent female), transportation (24 percent female), and information (40 percent female). In construction, 64 percent of female workers' job transitions were to a different industry compared to 43 percent for men. For male workers, there is a much higher share of moves to a different industry from health care and social assistance — 55 percent for men versus 36 percent for women. (Women make up 78 percent of the health care and social assistance workforce.) In industries dominated by one gender, the smaller pool of job opportunities for the opposite gender may lead to more inter-industry switching.

How Have Inter-Industry Job Transitions Changed Recently?

In April 2020, the U.S. economy lost a net 20 million jobs. When the labor market rebounded post-COVID, a net 2.6 million workers were added back into employment within a month. As the economy reopened, job growth accelerated. In 2022, the ratio of job openings to unemployed reached peak levels, and labor shortages placed upward pressure on wages, particularly for lower-wage jobs where vacancies were most acute. Within a matter of months, the job market went from a COVID low to an employee's market.

The job flows data tell the same story. Even though the labor market in 2019 was very tight, between 2019 and 2022, the total number of job-to-job transitions increased by 9.5 percent in the Fifth District. Job transitions reached their peak in the third quarter of 2022, increasing by 14 percent relative to the third quarter of 2019. The industries that experienced the highest percentage of growth in transitions in 2022 were transportation and warehousing, finance and insurance, utilities, manufacturing, and wholesale trade. Accommodation and food services saw a decline in total job-to-job transitions over that timeframe. Since leisure employment declined dramatically and its recovery lagged behind other industries, it generally had fewer job transitioners during that time.

Which industries did workers move to the most? Transportation and warehousing, finance and insurance, wholesale trade, and information also experienced the highest growth from job transitioners. This provides some context for recent employment trends. Over the last few years, significant employment gains occurred in the transportation and warehousing industry. These job gains were mostly from couriers and warehouse workers, which was driven by the growth in online sales during this period. According to the job flows data, the increase in transitions to transportation and warehousing was driven by workers who left manufacturing, retail, and food and accommodation. Two of these sectors — retail and food and accommodation — were most impacted by layoffs during the pandemic. Payroll employment data show that food and accommodation employment was particularly delayed in returning to pre-COVID levels of employment. Though retail employment has now returned to pre-COVID levels, it has experienced sluggish employment growth since, a contrast from the strong employment growth seen in other industries in the Fifth District, such as health care and construction. Given the job flows data, this slow recovery and growth may be partially attributed to a significant flow of these workers into transportation and warehousing, an industry that was rapidly expanding at the time.

The data also show that workers were more willing to make a significant career change by switching to a different industry during this period. Between 2019 and 2022, the number of people who transitioned to a different industry grew by 12.5 percent, while the number of people who transitioned to a different job within their industry grew by only 4.8 percent. Therefore, most of the growth in job-to-job transitions during that period was driven by people who made an industry change. As a result, the share of inter-industry job transitions grew from 61 to 63 percent during that period. This was the case for most industries, with industries such as health care, public administration, and transportation showing a particularly large increase in industry switchers relative to those who remained in their original industry. This aligns with numerous stories of health care workers who, after experiencing difficult work environments during the pandemic, decided to make a major career change. Additionally, public administration is an industry in which workers expressed dissatisfaction with their work environments and pay. According to a 2022 survey conducted by the MissionSquare Research Institute, an organization that produces research on labor market issues pertaining to state and local governments, 62 percent of respondents in the public sector reported an increase in the number of workers who left their jobs voluntarily. Many may have left in search of higher wages. According to a 2024 report from the Economic Policy Institute, a think tank that focuses on labor issues, state and local government employees earned 17.6 percent less than their private sector counterparts between 2020 and 2024.

For other industries (manufacturing, educational services, finance and insurance, real estate, and information) there was a decline in the share of inter-industry transitions between 2019 and 2022. (See chart). This means there was more growth in the number of job-to-job transitions within the same industry. These trends may highlight workers' greater satisfaction with these specific industries more generally. By the first quarter of 2024, most industries saw a decline in job transitions to other industries compared to the first quarter of 2022. This slowdown in inter-industry job mobility in 2024 reflects the labor market coming into better balance after historically tight conditions.

Conclusion

Recently, labor markets have cooled, with slower job gains, fewer employers hiring, and fewer employees quitting. When 2025 job flows data become available, it will likely show slowing job mobility across industries, as fewer opportunities are available and fewer workers are comfortable leaving their job. Perhaps a softer labor market will further "job hugging," or workers holding tightly to their current job in the midst of uncertainty. As of July 2025, the gap in wage growth between job stayers and job switchers has narrowed, lessening the incentive to change jobs even further. Even in a slower aggregate labor market, conditions can vary by industry: health care, for example, continues to add jobs at a solid pace. Some of this is the catch up from the outflow of workers in 2020 and 2021, a phenomenon also occurring in industries like government and leisure and hospitality. Data on job-to-job transitions can shed light on the underlying labor market dynamics even beyond what other, more aggregated, data can provide.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.