GameStop, AMC and the Self-Fulfilling Beliefs of Stock Buyers

The recent stock market gyrations of GameStop and AMC Entertainment illustrate that companies' fates can sometimes hinge on self-fulfilling beliefs. Pessimistic expectations can raise the specter of bankruptcy, while optimistic expectations can allow for survival and eventual success. We show how it is sometimes possible for small coalitions of buyers — such as those that formed on the online forum Reddit — to tip the balance in favor of an optimistic scenario. By doing so, a coalition can reap large profits and fundamentally improve a company's prospects.

A cash-strapped company's survival can depend on the self-fulfilling beliefs of investors. It is possible for the company to fall prey to a vicious cycle in which pessimistic expectations bar it from raising additional funds and thereby force it into bankruptcy. Alternatively, the company may benefit from a virtuous cycle in which optimistic expectations permit it to raise additional funds and thereby allow it to survive and even prosper.

These divergent possibilities were demonstrated by the recent market swings of GameStop (GME) and AMC Entertainment (AMC). The pessimistic cases for GME and AMC were obvious: Reduced traffic at malls and movie theaters, respectively, decimated their revenues, and the persistence of these tough operating conditions could have saddled the companies, which were heavily indebted, with even larger debt burdens, possibly resulting in bankruptcy. Many hedge funds acted on this pessimistic view by "short selling" the companies' stocks.1

But there were also optimistic cases to be made for GME and AMC. Michael Burry (the investor portrayed in The Big Short movie) argued that GME, a retailer of video games and consoles, was given an extension for its current business model when manufacturers revealed that next-gen video consoles would continue to include physical media.2 As for the movie-theater chain AMC, it had been profitable before the pandemic and could conceivably be so afterward, provided it could continue servicing its debts.

In dramatic fashion, the now famous (or infamous) Reddit WallStreetBets (WSB coalition) appears to have tipped the balance in favor of the optimistic scenarios for GME and AMC. By buying large quantities of the companies' stock, the WSB coalition drastically bid up the share prices. For example, a $10,000 investment in GME shares on Jan. 4 was worth $250,000 on Jan. 28. This giant leap in GME's price increased the mark-to-market value of outstanding shares by $20 billion and cost hedge funds (who were shorting the stock) $12.5 billion, according to one report.3 The story was similar for AMC.

For both AMC and GME, the emergence of optimistic scenarios turned out to have very real effects on the companies' fundamentals. On Jan. 28, AMC issued 44.4 million shares and paid off $600 million in debt. Notably, its share price went up when it announced this plan, indicating that buyers, sellers and holders of the stock believed on average that it was worth diluting the existing shares to recapitalize the company. As for GME, it announced a 3.5 million share stock offering on April 5 worth approximately $670 million at April 5 prices.4 The company may use those proceeds to pay off some of its $485 million in debt,5 and GME had said previously it was considering issuing stock to fund its new focus on e-commerce.6

By buying GME and AMC stock aggressively, the WSB coalition reaped massive rewards and fundamentally improved the companies' prospects. Of course, it is difficult to say how well GME and AMC will fare in the future, but they are much stronger financially and better positioned to take advantage of demand increases if they occur.

A Model of Self-Fulfilling Expectations

Our research sheds light on the stock price dynamics of GME and AMC.7 We built a model of a company that is fundamentally solvent but illiquid in the sense that it needs access to financial markets to continue operating. In the model, both pessimistic and optimistic outcomes are mathematically possible, and only investor expectations determine which outcome will occur.8 In the model's optimistic scenario, the company is able to finance productive investments that increase the company's fundamental and market values. In the pessimistic scenario, the company is forced to cease operations.

We show that when the pessimistic case is initially expected, there is an arbitrage opportunity — that is, an ability to make riskless profit — for a coalition of investors. Provided that the coalition has sufficient buying power, it can bid up the value of the company's securities, thereby allowing the company to raise money by issuing additional shares. By doing so, the coalition can effectively push the company into the optimistic outcome. A key result of the model is that a pessimistic outcome cannot be sustained if investors anticipate a "short squeeze" — that is, an aggressive bidding up of the stock price by the coalition of buyers.9 Importantly, the model does not require the coalition to invest in a bubble or be irrational. However, the model does require that the coalition can buy additional shares, which became impossible at a number of brokerages at the peak of the short-squeeze turmoil in the case of GME and AMC.

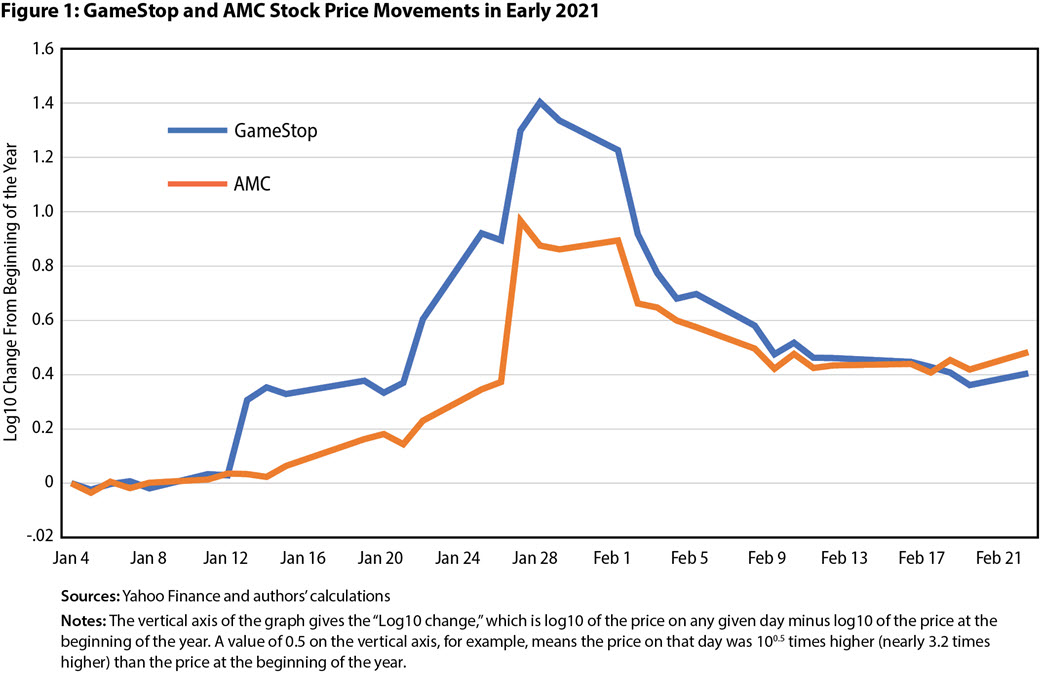

The model provides a natural explanation of the recent stock price swings of GME and AMC (shown in Figure 1). Specifically, early this year, the market appeared to anticipate that a pessimistic outcome would prevail and did not expect a short squeeze. However, as buying by the WSB coalition intensified, the companies' stock prices increased substantially, and investors became increasingly aware that a coalition of optimistic investors existed and that a short squeeze was happening. This condition temporarily ceased when trading restrictions were put in place during late January amid rallies in the companies' stock prices. After the restrictions hit, GME and AMC stock prices declined. However, those restrictions have been lifted. And, with the possibility of a short squeeze now firmly in investors' minds, GME and AMC stock prices have remained at elevated levels.

Methodology

We use a theoretical model with many potential investors and a single firm. There are three periods in the model — zero, one and two. In period one, the firm generates revenue but must repay its debt (or default) and make an investment decision. We assume that if the firm invests during period one, the revenue it would produce in period two would be sufficient to make the investment lucrative for both the firm and its investors. Crucially, the firm does not have enough revenue in period one to make the investment and repay its debt, so to invest, it must raise funds by issuing stock.10 If the share issuance raises enough resources for the firm to invest, it pays out its substantial net worth as a dividend at the end of period two and dissolves. If it is not able to invest, it liquidates — and if its debt is larger than period-one revenue, it files for bankruptcy.

In period zero, each investor owns initial shares of stock and debt (although this assumption can be relaxed). They then engage in trading that establishes period-zero prices for the shares and the bonds. However, their ability to do so might be limited by trading frictions. In period one, they again trade stock, and their total demand for shares must equal the supply, which is the initial shares plus the newly issued shares. This trading determines the price in period one.

We first consider the case of competitive equilibrium, which describes what outcomes are possible when all investors take prices as given. Second, we consider the notion of a coalition game. In this game, a coalition of investors can coordinate their actions, but they only do so to the extent that it is in the self-interest of each individual coalition member — which theoretically we characterize as a Nash equilibrium.11

Results

Our first result is a standard one in the spirit of research published in 2000 by Harold L. Cole of the University of Pennsylvania and Timothy J. Kehoe of the University of Minnesota.12 We show that, for certain levels of debt and revenue, there are two competitive equilibrium outcomes: an optimistic one, where the firm stays solvent in period one and invests; and a pessimistic one, where the firm does not invest and liquidates (possibly through bankruptcy). Either of these outcomes can occur, with the outcome hinging exclusively on investor beliefs. In both outcomes, the price of the new shares issued by the firm is competitive and does not entail a risk-adjusted profit or loss for investors. The pessimistic outcome features low prices for shares in periods zero and one and a low price for bonds in period zero, while the optimistic outcome features high prices for shares and bonds. In other words, the optimistic outcome is better for all investors than the pessimistic one.

Our main result concerns the coalition game. We show that in the pessimistic outcome, an arbitrage opportunity for a small coalition exists. Taking advantage of this opportunity requires two steps. First, the investors in the coalition must buy stock or debt at extremely cheap prices. For convenience, we assume investors already own debt in period zero, so this step is not necessary; however, that assumption can be relaxed. Second, the coalition of investors executes a short squeeze, offering to buy the newly issued shares at their optimistic values in an amount sufficient to fund the firm's investment. At this price, the coalition does not make profit on purchasing the additional shares, but it does make a massive return on the stock and/or debt it acquired in the first step. When the coalition can execute this strategy, the pessimistic-equilibrium prices cannot prevail.

Taking advantage of this arbitrage opportunity requires the coalition to collectively buy shares at elevated prices. Therefore, the coalition members must jointly have enough wealth or credit to do this. Additionally, the coalition's success requires the ability to buy shares. In the actual case of GME and AMC, this last requirement was not met: At the peak of the run-up, the popular trading firm Robinhood and other brokers drastically restricted the ability of investors to buy shares.13 This coincided with the break in the explosive growth in prices. (See Figure 1.) However, the ability to trade has improved, meaning the threat of a short squeeze continues. And, according to the model, the threat alone is enough to rule out the pessimistic outcome.

Conclusion

A company's survival sometimes depends on the beliefs of investors. If investors have faith in a company's long-term prospects, they may invest in its stock believing that, even though their stakes will be diluted through new equity issuance, performance down the road will compensate them for that loss. Conversely, if investors don't believe in a company's long-term prospects, they may sell the stock, driving down the price and limiting the firm's ability to recapitalize by issuing additional shares. Our research shows that such a pessimistic outcome cannot be rationalized if a small group of investors can coordinate their behavior, buying newly issued shares in amounts sufficient to keep the company solvent.

In our model, short squeezes do entail price manipulation but only in a limited sense. The coalition of investors actively tries to bid up prices. However, the coalition does so because it believes the firm has substantial fundamental value. And, in both the pessimistic and optimistic outcomes, the stock trades at fair market value. Consequently, price manipulation does not occur in the more general sense of distorting the price away from its fair value. Regardless of the legality or ethics of such collusion, our theoretical results indicate the threat of short squeezes (rather than the squeezes themselves) can actually help achieve positive outcomes for investors and firms.

Gaston Chaumont is an assistant professor of economics at the University of Rochester. Grey Gordon is a senior economist and Bruno Sultanum is an economist in the Research Department at the Federal Reserve Bank of Richmond.

"Short selling" is a way to bet that a particular company's stock price will decline. To achieve a short position, a short-seller borrows stock and then returns it later. If the stock price has declined during the intervening period, the short-seller profits. However, if the stock price has increased, the short-seller loses money. Since, in principle, there is no upside limit to a stock's price, a short-seller's potential losses are also unlimited. This is why shorting a company's stock is considered to be highly risky.

Ben Gilbert, "Why 'Big Short' Investor Michael Burry Is Going Long on GameStop, the Video-Game Retail Titan That's Been Crashing All Year," Business Insider, Aug. 28, 2019.

John McCrank, "Explainer: How Were More Than 100 Percent of GameStop's Shares Shorted," Reuters, Feb. 18, 2021.

"GameStop Announces At-The-Market Equity Offering Program," GameStop press release, April 5, 2021.

The company had $485.5 million in long-term debt, according to ycharts.com as of Feb. 18, 2021.

Maggie Fitzgerald, "GameStop Shares Fall 33 Percent on Lack of Transformation Detail, Possible Share Sale," CNBC.com, March 23, 2021.

Gaston Chaumont, Grey Gordon and Bruno Sultanum, "Eliminating Pessimistic Outcomes Through Collusion and Arbitrage: The Case of GameStop and AMC," Manuscript, 2021.

Our related work explores similar ideas in the context of sovereign default. See Chaumont, Gordon and Sultanum, "Self-Fulfilling Debt Crises and Limits to Arbitrage," Manuscript, 2021.

We use the term "short squeeze" loosely to mean bidding up share prices. More generally, a short squeeze refers to the interaction between purchasers of a stock and short-sellers. Specifically, short-sellers borrow shares, expecting the share price to go down. If the share price is bid up by purchasers, the short-sellers may either have to put up more collateral (make margin calls) or buy the stock (cover their positions). Hence, when share prices increase, short-sellers sometimes switch from sellers to buyers, further driving up the price. GameStop was particularly vulnerable to such a short squeeze because there was more short interest than outstanding shares — consequently, there were not enough shares in existence for all the short-sellers to cover their positions simultaneously. Our model allows for short-selling, but at both the pessimistic and optimistic price, there is no short-selling, so the model does not feature a short squeeze in this traditional sense.

We can obtain the same results if we consider the issuance of new debt instead of equity. However, the case for equity is the relevant one for the current application.

The Nash equilibrium of a game is a set of player strategies such that each player's strategy is optimal when taking into account the strategies of all the other players.

Harold L. Cole and Timothy J. Kehoe, "Self-Fulfilling Debt Crises," Review of Economic Studies, January 2000, vol. 67, no. 1, pp. 91–116.

Mengqi Sun, "Robinhood Faces Civil Lawsuits Over Trading Restrictions," Wall Street Journal, Feb. 3, 2021.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.