Why Is the U.S. Lagging in Adopting Mobile Payments?

The U.S. is considered a global leader in payment services. Yet, the U.S. appears to lag some developing countries in adopting the latest mobile payment innovations. We show that previous card payment leaders such as the U.S. naturally tend to fall behind in mobile payment adoption. This can be explained by optimal choices of card payment users in such countries because the incremental improvement introduced by the current mobile payment technology does not justify the costs for them to switch.

With the successful launch of credit cards in the late 1950s and debit cards in the mid-1980s, the U.S. has been the world leader of the card payment revolution. However, the U.S. appears to have fallen behind when it comes to mobile-phone-based payment innovation (henceforth, "mobile payments").

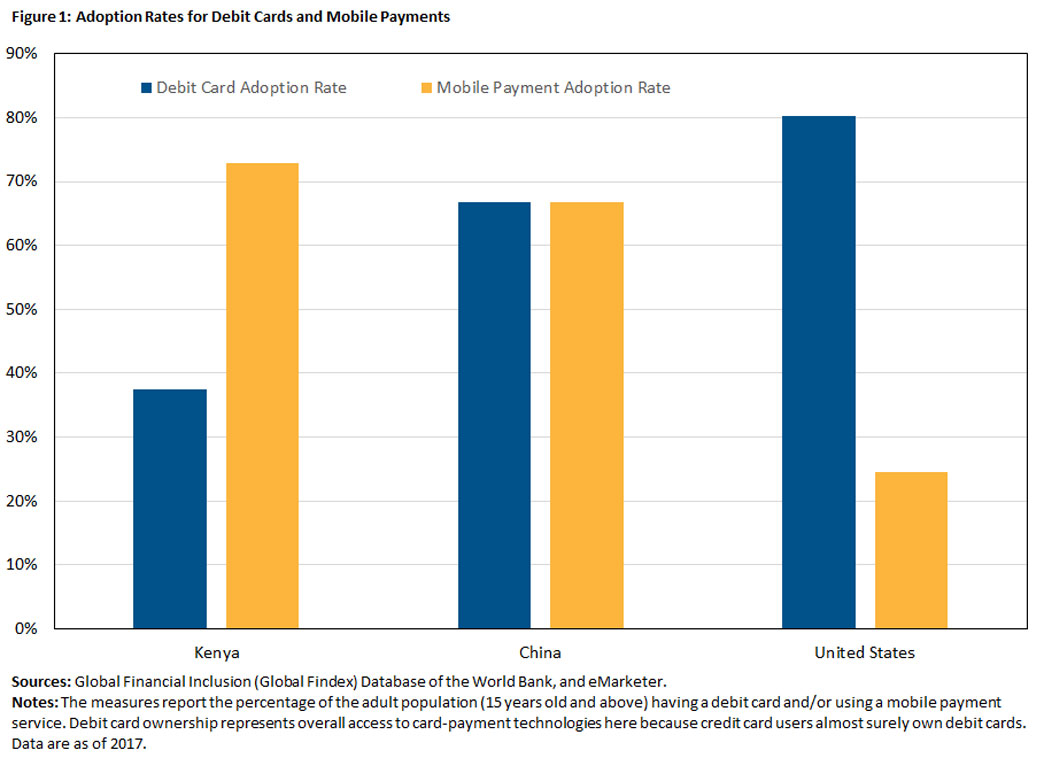

The U.S. is often compared to two developing countries for mobile payment adoption: Kenya and China. As shown in Figure 1, the U.S. boasts a much higher card payment adoption rate, but it has been significantly surpassed by Kenya and China in mobile payment adoption.

This raises concerns about the efficiency and competitiveness of the U.S. payments system. Specifically:

- Why did developing countries like Kenya and China lag in adopting card payments but seemingly lead in adopting mobile payments?

- Has the U.S. lost its global leadership in the payment area?

- Should the U.S. government implement policies to boost mobile payment adoption?

What Is Mobile Payment?

A mobile payment refers to a money payment made for a product or service through a mobile phone, regardless of whether the phone actually accesses the mobile network to make the payment. Mobile payment technology can also be used to send money from person to person.

While there are many mobile payment solutions, they fall into two basic categories:

- Bypassing existing bank-related card payment systems, which we name card-substituting mobile payments

- Complementing existing bank-related card payment systems, which we call card-complementing mobile payments

The card-substituting mobile payment (epitomized by Kenya's M-PESA) is often referred to as Mobile Money in practice. It allows customers to use mobile payments without having bank accounts. Most users of Mobile Money are concentrated in developing countries, particularly in sub-Saharan Africa, South Asia and Southeast Asia.

In contrast, card-complementing mobile payments are popular in developed countries. They piggyback on existing banking and card networks, with Apple Pay being a leading example.

The Relationship between Payment Methods and Country Income

In our study, we compile a novel dataset to uncover the general adoption patterns of card and mobile payments across countries. The data show that the overtaking in mobile payment adoption is a systematic pattern between developing countries and advanced economies, beyond just Kenya, China and the U.S. Our data cover debit card and mobile payment adoption in 94 countries.1

We first plot the adoption rates of debit card and mobile payments against log per capita GDP in 2017. Once we run a regression line to the data, we find that debit card adoption rate strictly increases with per capita GDP across countries, meaning that wealthier countries tend to have higher card payment adoption rates. However, no clear relationship is apparent between mobile payment adoption and per capita GDP.

As we delve further into the mobile payment adoption data, however, some patterns start to emerge. First, we divide the sample into three groups:

- Low-income countries, or those with per capita GDP less than $2,500

- Middle-income countries, or those with per capita GDP between $2,500 and $30,000

- High-income countries, or those with per capita GDP above $30,000

We then distinguish different payment technologies used in each country in the sample. We find that most low- and middle-income countries choose card-substituting mobile payments, while most high-income countries choose card-complementing mobile payments.

Considering that mobile payments are a fairly recent technological innovation, it is possible that some countries may not have fully introduced it due to information or coordination frictions (e.g., unfamiliar with the technology or disagreeing on technical standards). Once we remove countries that have very low adoption rates (less than 10 percent), we find that mobile payment adoption displays a non-monotonic relationship with per capita GDP: It increases in low-income countries, decreases in middle-income countries and increases again in high-income countries.

Modeling Payment Method Adoption

We then construct a quantitative model to match the empirical pattern. Our model explains the early success of advanced economies in adopting card payments and how their advantage in card payments hinders their adoption of mobile payments.

In our model, three payment technologies — cash, card and mobile — arrive sequentially. Newer payment technologies lower the ongoing costs of payment transactions, but there is a significant upfront cost to adopt a new technology.

When card arrives after cash, high-income consumers who spend more on purchases find it more attractive to adopt because they save more on the variable costs. That is, the savings on ongoing transactions outweighs the upfront costs of adopting the new technology. This explains the high adoption rate in rich countries.

However, when mobile arrives after card, the adoption incentives are different between existing card users and cash users. Since the fixed cost for adopting card is already paid, card users face a higher income threshold to adopt mobile payments than cash users. As a result, the pre-existing composition of cash users and card users in each country leads to the non-monotonic relationship between mobile payment adoption and per capita income across countries.

Since both card and mobile payment adoption requires fixed costs, cash users would favor mobile payments as a card-substituting solution, rather than paying the costs to establish both card and mobile payments. This explains why most developing countries choose Mobile Money, the mobile payment method bypassing card services. Card users, on the other hand, would more likely consider mobile payments complementary, which is why most advanced economies use card-complementing mobile solutions such as Apple Pay.

Using our model, we conduct quantitative analyses on several welfare and policy issues. We find that lagging in mobile payment adoption does not necessarily mean that advanced economies fall behind in overall payment efficiency,2 even though they benefit less from mobile payment innovation than developing countries.

Moreover, in our model economy, lagging in adopting mobile payments is an optimal choice for advanced economies, and greater technological advances in mobile payments are needed for advanced economies to regain leading positions in the payment race.

Model Implications on Kenya, China and the U.S.

Kenya and China currently are front-runners in mobile payment adoption. In fact, their adoption rates are much higher than their peer countries and our model prediction, which suggests that their extraordinary performance may have idiosyncratic components beyond the theory that we offer to explain the average cross-country pattern.

Some factors outside our model might help explain Kenya and China's adoption success. For example, recent studies suggest that the unique urban-rural remittance pattern in Kenya may have contributed to its exceptionally wide adoption of M-PESA.3 In China, two giant tech firms have developed their mobile payment services — Tencent with WeChat Pay and Alibaba with Alipay — strategically to extend their business models to cross-sell consumer and business loan services based on payments data.4 It would be valuable for future research to explore these additional factors.

Our model, however, does match the adoption pattern of most other countries well. Particularly, the U.S. is in line with the cross-country average pattern explained by our theory. Therefore, our model provides a useful framework for policy discussions in the U.S. context.

Our analysis shows that the previous card payment leaders (such as the U.S.) naturally tend to fall behind in the mobile payment adoption race. Falling behind is an optimal choice for such countries because the incremental improvement introduced by the current mobile payment technology does not provide a sufficient incentive for most card users in those countries to switch.

Given this finding, directly subsidizing mobile payment adoption would be socially inefficient in those countries. Instead, policymakers may consider promoting mobile payments in more productive ways. For example, they may encourage greater mobile payment technology progress or reduce coordination frictions.

Pengfei Han is an assistant professor of finance at the Guanghua School of Management, Peking University. Zhu Wang is vice president for research in financial and payments systems in the Research Department at the Federal Reserve Bank of Richmond.

Our data sources include eMarketer and the Global Financial Inclusion (Global Findex) Database of the World Bank.

"Payment efficiency" is measured as the fraction of the first-best welfare (i.e., in a frictionless model without payment costs) that can be achieved by using particular payment methods.

For example, see William Jack and Tavneet Suri, "Risk Sharing and Transaction Costs: Evidence from Kenya's Mobile Money Revolution," American Economic Review, January 2014, vol. 104, no. 1, pp. 183-223.

See Harald Hau, Yi Huang, Hongzhe Shan and Zixia Wang, "How Fintech Enters China's Credit Market," AEA Papers and Proceedings, May 2019, vol. 109, pp. 60-64.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.