Building Momentum: Garrett County, Md., Economy on the Upswing

The westernmost county in Maryland, Garrett County sits at the crossroads of Maryland, Virginia, West Virginia, and Pennsylvania in the Allegheny Mountains. In January, the Garrett County Chamber of Commerce held an annual event at Wisp Resort, where the economic outlook for the year was presented and local businesses shared their views regarding the outlook for business.

There was a general sense of cautious optimism for 2017 at the meeting, although attendees noted that excessive regulations were a factor in restraining the local economy and there was concern regarding potential federal policy changes. The data show that the Garrett County economy has improved in recent years but has yet to fully recover from the severity of the downturn experienced during the Great Recession.

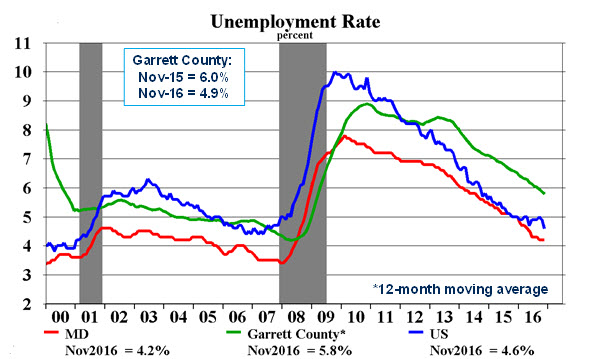

The unemployment rate, an important gauge of labor market conditions, declined considerably from 8.9 percent (annual average) in 2010 (which included peaking at 11 percent in the first quarter) to 5.7 percent in 2016. Notably, the jobless rate was still well above the pre-recession low of 4.4 percent in 2007. (See chart below.)

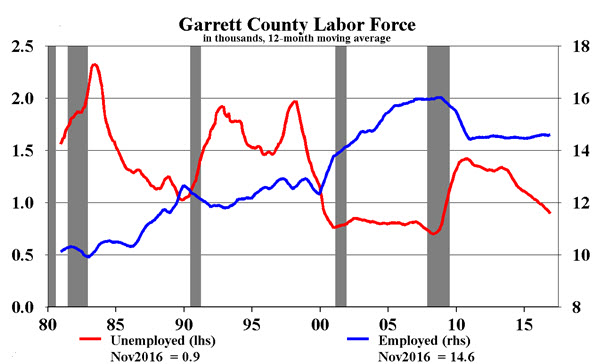

The decline in the unemployment rate largely reflected people dropping out of the labor force, however, rather than staying in the labor force and finding work (moving from unemployed to employed). The number of employed persons, according to the Bureau of Labor Statistics’ (BLS) Household Survey, was 14,606 in 2016, which was slightly higher than the low of 14,404 reached in 2010 and well below the 15,975 it was prior to the recession in 2008.

So the decline in unemployment gives a somewhat incomplete picture of the degree to which the labor market improved in recent years. It is also interesting to note that despite the severity of the Great Recession on the county’s economy, Garrett County faced more difficult economic times in the not-so-distant past. Both the number of unemployed and the unemployment rate were higher in the early 1980s and during the 1990s than during the most recent cycle.

Another BLS data source that gives insight into the labor market is the Quarterly Census of Employment and Wages (QCEW). The data in the QCEW are derived from establishments that report to the national Unemployment Insurance programs and represent roughly 97 percent of all wage and salary civilian employment. The most recent data are through the second quarter of 2016.

According to the QCEW data, the Garrett County labor market has fared better than indicated by the household survey, with job growth of roughly 2.5 percent between 2010 (annual average) and 2016 (average of the first six months). From the lowest quarterly level of employment (in the first quarter of 2010) to the most recent quarter (the second quarter of 2016), employment grew by a more robust 5.6 percent.

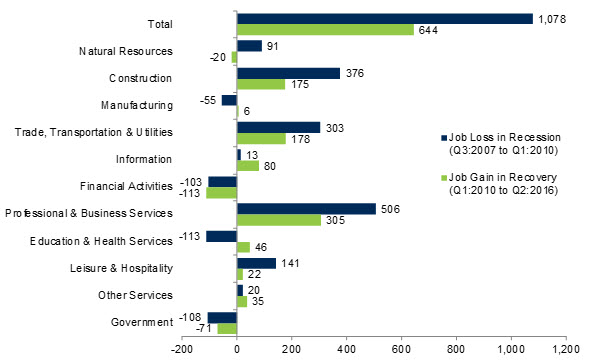

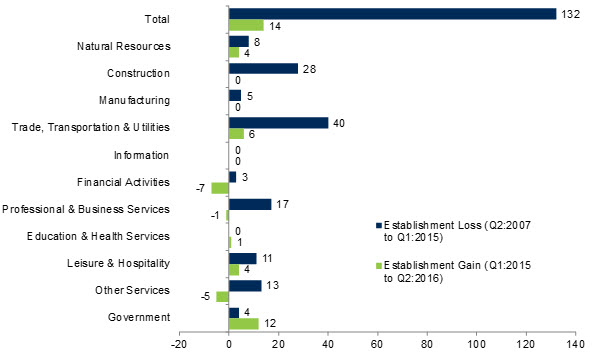

Still, that growth was not enough to fully compensate for the 8.7 percent decline from the third quarter of 2007 through the first quarter of 2010. More than 1,000 jobs were lost during that time period (blue bar in the chart below), and just 644 jobs were created since the first quarter of 2010—or a little more than 100 jobs per year.

The gains over the past six years were largely concentrated in a few sectors: construction (175), trade, transportation, and utilities (178), and professional and business services (305). These three sectors also experienced the greatest job loss (1,185 combined) during the downturn. In addition to the gains in these sectors, there were also increases in information, education and health services, and “other” services. Notably, over the past six years, several sectors continued to lose jobs on net: natural resources, financial activities, and government.

To summarize, the labor market has gradually improved in Garrett County since 2010 with the more comprehensive data (QCEW) indicating a more sustained recovery. But in both cases, current levels of employment remain well below pre-recession levels, indicating the county has yet to fully recover all of the jobs that were lost during the recession. There have been notable gains in key sectors, however.

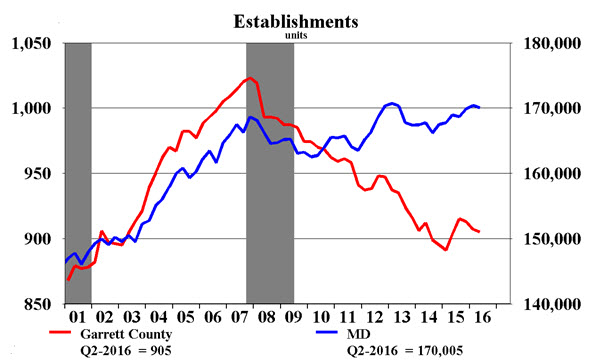

Another facet of the Garret County economy where there has yet to be a full recovery has been in business formation. Business formation is a key element of a dynamic economy, contributing to a more vibrant labor market and driving new investment. Overall, in the state of Maryland and in the United States, startup activity and business expansion has been subdued.

In Maryland, the number of business establishments fell by 3.6 percent (or 6,120 establishments) from the fourth quarter of 2007 through the first quarter of 2010. Then, after a brief increase in 2012, it wasn’t until 2015 that the number of establishments regained the pre-recession level. In Garrett County, the number of business establishments declined into the first quarter of 2015 before leveling off. All told, there was a decline of 132 establishments, a drop of almost 13 percent.

The decline in establishments was fairly widespread during this period; however, several sectors experienced the greatest decline. Trade, transportation, and utilities experienced a sizeable decline (40), followed by construction (28). There were also notable losses in professional and business services, leisure and hospitality, and “other” services. (See chart below.)

Since the first quarter of 2015, there has been a net increase in establishments. Although the turnaround in the number of business establishment is nascent and relatively modest in the absolute number, it does suggest greater optimism and underlying momentum in the local economy.

Have a question or comment about this article? We'd love to hear from you!

Views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Richmond or the Federal Reserve System.