What Two Billion Retail Transactions Reveal about Consumers’ Choice of Payments

Although cash continues to be a major form of payment in retail transactions, data on the use of cash are challenging to obtain. Research at the Richmond Fed has exploited a large dataset of cash, check, credit card, and debit card transactions at a nationwide retail chain to examine consumer payment choice based on transaction size and location, day-of-week and day-of-month cycles, and longer-term trends.

The types of payments available to consumers have evolved significantly in recent decades, as have consumers' payment preferences. Of particular significance, the U.S. payments system has seen the rise of electronic forms of payment at the point of sale, such as debit and credit cards, along with a concurrent decline in the use of paper forms of payment — cash and checks.

Researchers have sought to measure trends and patterns in the use of these forms of payment to better understand a variety of microeconomic and macroeconomic questions. In research that looks at the use of cash in relation to other forms of payment, the data generally have come from consumer surveys — a choice driven in large measure by the difficulty of obtaining transactional data on the use of cash.1 Unlike transactions with card payments and checks, a cash transaction does not generate a discrete record within the banking system. It's important to overcome this difficulty because cash continues to be a highly important component of the payments mix.

Recent research at the Richmond Fed has analyzed transaction-level trends at the point of sale for cash payments as well as card and check payments. This work has been based on access to a private dataset from a large national retail chain; the data cover approximately two billion transactions involving millions of consumers. The breadth of the data enabled two of the authors of this brief (Wang and Wolman) to look in detail at several major areas regarding consumer payment choice: patterns in payment choice related to transaction size and location, patterns related to the day of the week or the day of the month, and underlying longer-term trends.2

Transaction Data from a National Retailer

The dataset was provided by a discount retail chain with thousands of stores throughout the United States, typically in lower-income zip codes. These zip codes also have higher percentages of blacks, Hispanics, and Native Americans and lower percentages of Asians and non-Hispanic whites than the country as a whole. On the other hand, the demographic characteristics of the zip codes generally resemble the national average in terms of age, gender, and share of households that are families. The chain sells a wide range of goods; most transactions are for household consumables such as health and beauty aids and food.

The data cover the chain's sales of goods during the three-year period from April 1, 2010, through March 31, 2013. For each transaction during this period made with cash, check, credit card, or debit card, the dataset provides the method of payment, date and time, location, and amount. (Transactions with multiple payment types are not included.)

Wang and Wolman analyzed the data using a regression model to assess the relationships between various potential influences on consumer behavior and the extent to which each of the four payment methods was used (in terms of the share of the total number of transactions). In particular, their model looked at the statistical relationships between these factors and the payment shares for each of the four methods on a given day at the chain's stores within a given zip code.

Effects of Transaction Sizes and Locations

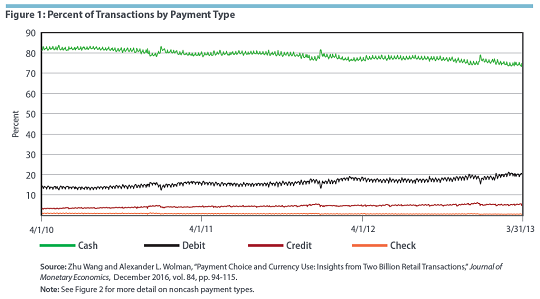

The data show that while cash use has been declining, cash continues to play a major role at this large retailer. (See Figure 1.) A common framework for looking at cash use is to posit that each consumer has a cash threshold — that is, a transaction size below which he or she generally will use cash and above which he or she will use some noncash payment method.

To assess whether such a pattern was present, Wang and Wolman divided the transactions into twenty-two bins by transaction size and ran regressions for each. Consistent with the notion of a cash threshold, the fraction of cash transactions decreased as the transaction sizes increased. For transactions between $1 and $1.99, consumers used cash in about 90 percent of transactions at most locations. For transactions of $50 and above, in contrast, consumers used cash in only 42 percent of transactions at the median location. At the same time, the share of debit card transactions increased over this range, as did the shares of credit cards and checks (but to a much more modest degree).

As consumers' payment behavior changed with transaction size, the dispersion of their behavior by location also increased, a novel empirical finding. For example, in the preceding scenarios, while payment behavior was tightly clustered across locations for transactions between $1 and $1.99 — with, as noted, nearly universal use of cash — the use of cash in transactions of $50 and above ranged from as little as 30 percent at the 5th percentile location to as much as 55 percent at the 95th percentile location.

Wang and Wolman tested a number of location-specific factors (by zip code) for their association with changes in payment behavior. These included variables related to demographics of the area, crime (robberies), bank competition, and the density of bank branches.3 For the demographic variables — share of households that are families, share of housing that is owner-occupied, age, race and ethnicity, gender, and education — customers of this retailer might not have the same characteristics, on average, as those of residents of the store's zip code. With that caveat in mind, a notable finding with regard to demographics is the association between age and form of payment: a higher representation of the age group 55–69 is associated with significantly greater use of cash, while a higher representation of ages 70 and older is associated with greater use of checks.

A higher robbery rate would be expected to reduce the use of cash, and the results supported the existence of such an effect. A higher level of local bank competition — as measured by the Herfindahl-Hirschman Index (HHI) within the local banking market (either a Metropolitan Statistical Area or a rural county) — would be expected to improve the terms available to consumers on deposits, thereby increasing consumers' opportunity costs of holding cash and reducing cash use. The results were consistent with this reasoning in rural areas but not in metropolitan areas. The authors believe the latter result could reflect that in a metropolitan area, a concentrated banking market may simply represent the presence of a small number of highly efficient institutions. A higher density of bank branches per capita would be expected to reduce the consumers' costs of obtaining cash and thereby increase cash use, and this conjecture was borne out by the regression results.

Day of Week and Day of Month Effects

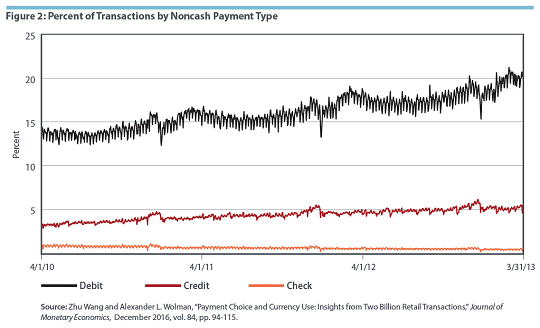

The usage patterns of the four payment types show marked monthly cycles, as well as higher-frequency cycles that, in fact, are weekly. (See Figures 1 and 2.) These patterns may reflect constraints related to events such as paydays, receipt of Social Security benefits, and making rent payments and other bill payments. For example, consumers who are credit-constrained and have a limited savings cushion (or who are reluctant to use consumer credit or dip into their savings) might shop less as more time passes since their previous payday or receipt of government benefit payment.

To analyze the consumer shopping behavior that may potentially affect payment patterns, Wang and Wolman ran regressions with the volume of transactions (again divided into twenty-two bins by transaction size and separated by zip codes) as the dependent variable and with the same explanatory variables as in the payment-share regressions. They found that for both the day-of-week cycles and the day-of-month cycles, the variation in the number of transactions was high, and the variation increased with transaction size. Over the course of a week, the volume of transactions between $1 and $1.99 varied by approximately 20 percent between the low day of Sunday and the peak days of Friday and Saturday; at transaction sizes over $50, however, the variation was nearly 40 percent (and Monday and Tuesday joined Sunday as low days). Over the course of a month, transaction volume hit a low point five or six days before the month's end. Here again, the extent of the variation was sensitive to the transaction size: for transactions in the $1 to $1.99 range, there was less than a 10 percent difference between the highest-volume and lowest-volume days; for transactions of $50 and above, the difference was over 50 percent. These day-of-week and day-of month shopping patterns are largely consistent with the weekly and monthly frequencies at which people receive wages or transfer payments.

Longer-Term Trends

The researchers' analysis showed a longer-term decline in the share of cash transactions at the retailer as well as a longer-term increase in the share of debit card transactions and, to a lesser extent, in the share of credit card transactions. These trends were most pronounced with higher transaction sizes. For example, the share of debit card transactions increased less than 1 percentage point per year for transactions in the $1 to $1.99 range but 2.6 percentage points per year for transactions over $50.

Wang and Wolman considered a number of possible explanations for these trends. One possibility is changes in the chain's payment acceptance policies, perhaps arising from implementation of the Durbin Amendment limits on debit card interchange fees. But the chain reported that more than half of its debit transactions are exempt from the Durbin regulation. Moreover, the regulation has resulted in higher interchange fees on small-ticket transactions. Thus, if anything, the chain should have been motivated to try to reduce rather than increase debit card use. The researchers also rejected macroeconomic and demographic explanations for the trends.

The most plausible explanations, Wang and Wolman suggested, are technological progress in electronic payments and changing consumer perceptions of debit payments. "These attributes include but are not limited to adoption costs, marginal cost of transactions, speed of transaction, security, record keeping, general merchant acceptance, and ease of use," they wrote. They noted that the Boston Fed's annual Survey of Consumer Payment Choice has indicated that consumers' perceptions of debit card security relative to cash have become more positive over time.

While Wang and Wolman's study is informative for understanding cash use at this retailer, they noted that caution is warranted when applying it to the overall retail sector given the characteristics of the retailer in the study.4 Nevertheless, the findings of the study highlight important factors for cash use, in particular the rise of debit, which are likely to be shared in the broader retail sector. In fact, debit has seen tremendous overall growth in the past decade. According to the 2016 Federal Reserve Payments Study, debit has become the top noncash payment instrument in the U.S. economy in terms of the number of transactions, with more than double the number of transactions of the next most commonly used instrument (credit cards). The Richmond Fed study provides firsthand micro evidence that the increase in debit came at the expense of cash at a large cash-intensive retailer.

Avenues for Future Work

A large transaction-level dataset that incorporates cash transactions has provided insight into changes in consumer payment choice. Ongoing work at the Richmond Fed analyzes a larger version of the retailer dataset, spanning an additional three years through March 2016. The analysis finds, among other things, continuing decline in the share of cash transactions at this retailer, mostly replaced by debit.

In addition, research analyzing data from other retailers, especially those serving areas with different demographic profiles from the stores in this study, and selling a different range of goods, could lead to a richer picture of payment choice. Related questions that could be addressed using such data together with an explicit model include the welfare cost of inflation, the optimal rate of inflation, and the costs and benefits of proposals to eliminate most physical currency (as suggested by Kenneth Rogoff).5 Further insight could be gained from incorporating product and consumer information, such as that in the Kilts-Nielsen consumer panel data, into the research.

David A. Price is senior editor, Zhu Wang is a senior economist, and Alexander L. Wolman is vice president for monetary and macroeconomic research in the Research Department at the Federal Reserve Bank of Richmond.

An exception is Elizabeth Klee, "How People Pay: Evidence from Grocery Store Data," Journal of Monetary Economics, April 2008, vol. 55, no. 3, pp. 526–541.

The research is set out in more detail in Zhu Wang and Alexander L. Wolman, "Payment Choice and Currency Use: Insights from Two Billion Retail Transactions," Journal of Monetary Economics, December 2016, vol. 84, pp. 94–115. A working paper version is available online. An analysis of a somewhat longer period, covering only zip codes in the Fifth Federal Reserve District, is presented in Zhu Wang and Alexander L. Wolman, "Consumer Payment Choice in the Fifth District: Learning from a Retail Chain," Economic Quarterly, First Quarter 2016, vol. 102, no. 1, pp. 51–78.

Because the American Community Survey does not provide annual estimates for areas with fewer than 20,000 residents, the authors used the 2011 values of these zip-code-level variables. Research in progress reexamines the data using annual estimates of these variables.

Data from the 2012 Diary of Consumer Payment Choice — which, as the name implies, is based on diaries recorded by consumers — show 15 percent cash use for $50 retail transactions at grocery stores, pharmacies, liquor stores, and convenience stores, compared with approximately 40 percent shown by the transaction data in the Richmond Fed research. See Tamás Briglevics and Scott Schuh, "This Is What's in Your Wallet ... and Here's How You Use It," Federal Reserve Bank of Boston Working Paper No. 14-5, June 2014.

Kenneth S. Rogoff, The Curse of Cash, Princeton, N.J.: Princeton University Press, 2016. Rogoff's proposal is to phase out all currency denominations greater than $10.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.