Understanding the Surge in Commercial Real Estate Lending

U.S. banks have increased their commercial real estate (CRE) lending significantly in the past five years. Economists and regulators note that some positive factors are driving this trend, but they also see potential risks. Analysts at the Richmond Fed have found that some banks could be especially vulnerable if economic conditions deteriorate. These include institutions that are in certain major urban areas and have high concentrations of CRE loans, rapid CRE loan growth, and heavy reliance on "noncore" (or illiquid) funding. But the analysts also conclude that, overall, banks' CRE exposures do not appear to be as elevated as they were before the Great Recession.

While many aspects of the U.S. economic recovery since 2009 have been modest, growth in commercial real estate (CRE) lending has surged in recent years. CRE lending is a broad term that refers to financing for almost any type of income-producing real property, whether it's office buildings, warehouses, retail boutiques, or apartment complexes. After declining in the wake of the Great Recession, the total volume of CRE loans outstanding has rebounded to greater than prerecession levels in recent years, boosted in part by low interest rates and strong foreign demand for U.S. real estate.1 Another driver is continued growth in multifamily housing, that is, apartment buildings with five or more units. Many economists see this surge in lending as boosting economic activity, but they also point out that this sector has historically been volatile and vulnerable to downturns. For these reasons, regulators have been watching CRE loan growth carefully.

One recent example of this caution was an interagency statement that the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency sent to financial institutions in December 2015. The statement noted substantial growth in many CRE markets, increased competitive pressures, and "an easing of CRE underwriting standards." It also flagged "certain risk management practices at some institutions that cause concern, including a greater number of underwriting policy exceptions and insufficient monitoring of market conditions." The statement encouraged lenders to review existing interagency guidance, issued prior to the Great Recession, regarding regulators' expectations for CRE risk management.2

The Board of Governors also has shared this view with Congress. In its February 2017 Monetary Policy Report, it said rising CRE valuations have been "of growing concern," adding that small banks are at special risk if the market declines. (The Board's Senior Loan Officer Opinion Survey noted, however, that 2016 saw a tightening of CRE lending standards.)3 Meanwhile, among members of the Federal Open Market Committee, Boston Fed President Eric Rosengren has been especially vocal about potential vulnerabilities. In a May speech, he noted that while he didn't expect a downturn at present, current CRE valuations are a risk that he "will continue to watch carefully."4

Analysts at the Richmond Fed also have been looking closely at CRE lending. In a recent internal study, they compared current trends to the sector's performance in the years leading up to the Great Recession. They found that banks with high concentrations of CRE loans that had aggressive growth and funding strategies, such as heavy reliance on brokered deposits, were most susceptible to failure when the recession hit. Looking at today's landscape, some areas in the United States have multiple banks with relatively high CRE concentrations that have been growing rapidly — while relying on potentially risky funding sources to do so. However, the Richmond Fed analysis concluded that, overall, banks' CRE exposures today are still more stable than those in late 2007. This Economic Brief will summarize those findings.

Unique Risk Factors

The defining feature of a CRE loan is that it finances real property that generates income. In most cases, these properties are either rented out to tenants (say, an office building) or sold to other buyers. These loans fall into three categories. The first is construction and land development (CLD) loans, which finance the purchase of land, the preparation of sites, and the construction of the buildings; these loans typically have maturities of three years. A second category is commercial mortgages, which allow a borrower to purchase some or all of an existing property; these loans usually have maturities of ten years. Finally, there are multifamily loans, which are similar to commercial mortgages but often have longer maturities — from ten to forty years — and are designated specifically for apartment buildings that generate rental income.5

There are several factors that can make CRE lending relatively risky. For one thing, CRE projects are often relatively long-term, and many variables may change between groundbreaking and ribbon cutting. For example, a large office complex may begin when economic conditions are favorable but not be completed until years later, at which point conditions may have deteriorated and demand may have fallen. In addition, over the course of a multiyear contract, environmental or zoning regulations affecting a proposed building can change dramatically. Unpredictable local economic developments — say, a large employer that goes out of business and sheds workers — also can reduce the value of a project. But since commercial real estate isn't mobile, developers don't have the option of simply moving an ongoing project to a more prosperous location. These problems can be particularly acute with construction loans because construction projects often involve long development periods and may start before developers have full commitments from potential tenants or buyers. This is why CLD loans have historically posted higher loss rates than other types of loans during market downturns (and why they tend to have relatively short maturities).

Due to the need for specialized knowledge, local lenders, such as community and regional banks, are seen as better informed and better positioned to make small CRE loans than their larger and more geographically dispersed counterparts: They are considered to be more attuned to regional conditions and often have a longer and more personal history with their borrowers.6 This feature helps explain why community and regional banks (banks with less than $50 billion in assets) held over half of all CRE loans by year-end 2016, even though they accounted for only about a quarter of total assets in the banking industry.

Taken together, the previously mentioned risk factors traditionally have meant that CRE lending is more cyclical and volatile than other types of lending, an instructional case being the boom-and-bust cycle of the 1980s and early 1990s. The tax and regulatory changes enacted in the early 1980s, including more relaxed underwriting rules, first boosted CRE lending In 1981, for example, tax legislation improved the rate of return on CRE loans, notably through more favorable depreciation rules. Lending surged as a result but then began to slow down after another tax reform in 1986 undid some of those provisions. In subsequent years, other developments further dampened the market. The rapid construction of commercial real estate projects, especially office buildings, led to a spike in vacancy rates by the late 1980s, depressing rents and property values. The recession of 1990-91 also played an important role, especially in regions that were hardest hit, such as New England and the Southwest. In response to the savings and loan crisis, lawmakers passed financial reforms in 1989 and 1991 that enhanced regulators' powers and toughened lending standards, among other measures. One effect of these reforms was a further tightening of credit in the CRE market. Taken together, these tax, economic, and regulatory changes produced a sharp boom-and-bust cycle. According to the FDIC, the peak year of 1985 saw about $125 billion (in 1992 dollars) of new construction completed (2.3 percent of GDP); in 1992, that number fell to about $87 billion (1.4 percent of GDP).7

Despite the regulatory overhauls in the previous decades, the 2008-09 financial crisis showed that CRE lending remained vulnerable.8 From 2008 to 2012, banks with high concentrations of CRE loans were about three times more likely to fail than all banks nationwide, according to Richmond Fed research. But since 2012, the picture has brightened again for CRE lending. For one thing, the United States has become an increasingly popular destination for foreign investors because it can offer relatively high returns, including on real estate, in a low-yield world. (In fact, 2015 marked a record year for such investment with $91.1 billion in direct U.S. property purchases by foreign investors; 2016 saw only a slight dip.)9 Another driver is that as more cities gentrify and more millennials opt to put off house-buying, demand for multifamily housing has been especially robust.10 But there is a flip side to these trends: they could be reversed if interest rates were to rise and make borrowing more costly, if other countries were to become more attractive for foreign direct investment, or if millennials were to start buying houses as they age out of apartments. More generally, the historic sources of risk for CRE lending and investment have not disappeared.

In addition, potential congressional action on housing finance could alter the multifamily CRE market. Some lawmakers and Treasury officials have discussed the need for legislation overhauling Fannie Mae and Freddie Mac, the government-sponsored enterprises (GSEs) that were placed in conservatorship under the Federal Housing Finance Agency in 2008. The GSEs hold or back more than 40 percent of all multifamily mortgages, many of which have been repackaged as mortgage-backed securities. In recent years, the GSEs have become profitable again, prompting talk of possibly privatizing their operations or at least unwinding their government guarantees. But for now, there is little agreement among lawmakers on what an overhaul would look like.11

Recent Trends

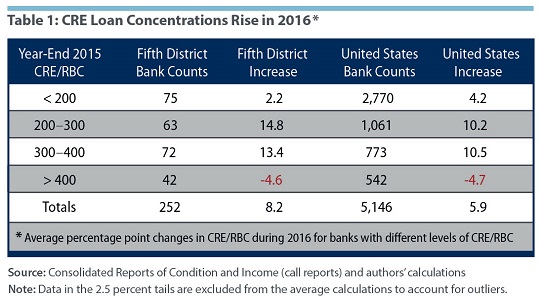

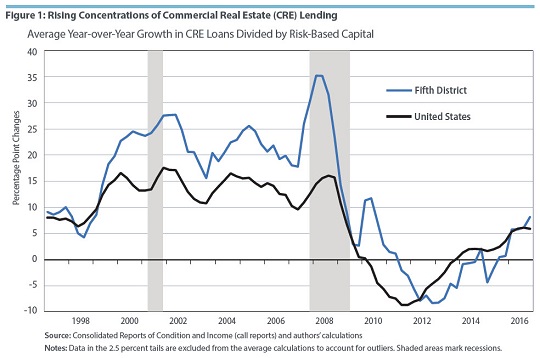

What is the risk, then, that CRE lending poses today? The Richmond Fed study analyzed several measures to assess the recent growth in CRE lending. One measure is how a bank's concentration of CRE loans compares to its total capital base, known as its risk-based capital (RBC). RBC is one metric that regulators use to assess how much capital a bank has on hand to protect itself against operating losses adjusted to account for the level of risk that the institution has taken on. In 2016, the study found, banks increased their CRE/RBC ratios by an average of 6 percentage points, with over half of banks reporting increases in their ratios. This rise was the largest increase since 2008, lifting the national average ratio to 205 percent, which means that CRE loans totaled 205 percent of banks' risk-based capital. Banks holding between $1 billion and $10 billion in assets maintained the highest concentrations and also reported the largest increases and CRE loan growth rates. In short, despite the regulatory concerns expressed in late 2015, the concentrations of CRE loans rose at many banks across the nation in 2016.12 (See Table 1 for growth in 2015–16 and Figure 1 for changes in concentrations since 1997.)

The Richmond Fed analysis also looked at banks with especially high concentrations of CRE loans, defined as having a CRE/RBC ratio of more than 400 percent. In contrast to the broader sample, this group of banks did decrease their concentrations of CRE loans during 2016, by almost 5 percentage points on average — perhaps as a result of increased regulatory attention. The reason this subgroup of banks is so important to regulators is that CRE-concentrated institutions were much more likely to fail or be taken over by healthier banks in the last recession. The Richmond Fed study notes that about 17 percent of those banks failed from 2008 through 2012, whereas the nationwide failure rate was about 5 percent. Another 18 percent of CRE-concentrated banks were acquired, compared with the nationwide acquisition rate of 13 percent.13

Another question this study considered was whether certain characteristics within this group of CRE-concentrated banks can determine survival or failure. It found that the banks that failed had significantly higher CRE loan growth rates in the years leading up to the recession than CRE-concentrated banks that survived. The institutions that failed also relied more on funding from less liquid sources, known as "noncore funding." (Examples include time deposits that exceed the FDIC insurance limit, fully insured brokered deposits, federal funds purchased or resold by banks, foreign office deposits, and other borrowed money.) If a bank relies too heavily on noncore funding, liquidity problems can emerge when there is a downturn because these sources are less stable than core deposits. Indeed, even before other indicators of financial health — such as earnings or asset quality — showed any significant differences, banks that failed in the recession already were showing higher CRE loan growth rates and higher reliance on noncore funding than banks that survived.14

These risk factors vary considerably by region, according the Richmond Fed study. For example, at year-end 2016, the metro areas of Los Angeles, Miami, Washington, D.C., and New York City had especially large shares of banks with high CRE concentrations that also experienced relatively rapid growth of their CRE portfolios and relied heavily on noncore funding. Regional variation in CRE concentrations, as well as growth and funding strategies, can reflect differences in local market competition and economic conditions. Banks in Richmond's Fifth Federal Reserve District — which includes Washington, D.C., as well as the Carolinas, Virginia, Maryland, and most of West Virginia — had average concentrations of CRE loans above the national average, with an average ratio of 285 percent, although high concentrations have long been a feature at many Fifth District banks.

Assessing the Risk

Given the rise in CRE lending and in loan concentrations, how does the climate today compare to the years before the financial crisis? The Richmond Fed study found that banks' CRE exposures are still not as elevated as they were in 2007–08. For example, the average CRE loan ratio noted above for year-end 2016 — 205 percent — remains well below the peak ratio reached in 2008, which was 250 percent. And the riskiest type of CRE loans, for construction and land development, are also a smaller share today than they used to be. At the end of 2016, the average ratio of CLD loans to risk-based capital was 33 percent, less than half the peak ratio of 74 percent reached in 2008.

Another metric the Richmond Fed study looked at was the share of all banks with CRE loan ratios that topped 400 percent. In late 2007, it was 21 percent; by 2016, it had fallen to 12 percent. Among these high-concentration banks, CRE loan growth rates and reliance on noncore funding also has fallen since the recession: in 2016, CRE lending growth was 15 percent, down from 20 percent in 2007, while reliance on noncore funding fell from 30 percent to 15 percent during that period. And the share of banks that featured all three risk factors — relatively high CRE loan concentrations, rapid CRE loan growth, and heavy reliance on noncore funding — dropped from 7 percent to 5 percent.

Why does this matter for the bigger macroeconomic picture? Some economists and policymakers have argued that CRE lending can play an oversized role during a downturn because banks that rely heavily on these loans will suffer an especially sharp shock once property values fall.15 According to this view, such shocks can amplify an economic downturn because institutions suffering a major reduction in their CRE portfolio might be less willing and able to lend to consumers and businesses more broadly. This type of credit constriction could hit small businesses particularly hard because they historically have relied heavily on community and regional banks for their borrowing needs. In this way, problems in the CRE sector can cause a mild slump to become much more severe.16 As Rosengren cautioned in his May speech, "It is important for holders of debt or equity related to CRE to carefully consider how their positions would be impacted if tailwinds were to give way to headwinds. … The regulatory community must also remain attuned to developments, understand how a reversal may propagate through the financial system, and consider whether the system is resilient enough to withstand such shocks, should they occur."

In conclusion, while banks' exposures related to CRE lending do not appear to be as elevated as they were before the Great Recession, the CRE sector remains a potential source of problems due to its unique risk factors. Banks with high CRE concentrations, particularly those that also have rapid CRE loan growth and heavy noncore funding reliance, bear careful watching.

Helen Fessenden is an economics writer in the Research Department and Catherine Muething is a quantitative research analyst in the Supervision, Regulation, and Credit Department at the Federal Reserve Bank of Richmond.

Call report data show that the total volume of CRE loans outstanding was $1.6 trillion at year-end 2007, compared with $1.9 trillion at year-end 2016.

See Board of Governors of the Federal Reserve System, "SR 15-17: Interagency Statement on Prudent Risk Management for Commercial Real Estate Lending," December 18, 2015. Also see "SR 07-1: Interagency Guidance on Concentrations in Commercial Real Estate," Footnote 1, January 4, 2007. For a recent analysis of the 2006 guidance, see William F. Bassett and W. Blake Marsh, "Assessing Targeted Macroprudential Financial Regulation: The Case of the 2006 Commercial Real Estate Guidance for Banks," Board of Governors of the Federal Reserve System Finance and Economics Discussion Series No. 2014-49, June 12, 2014.

Board of Governors of the Federal Reserve System, "Monetary Policy Report," February 14, 2017.

Eric S. Rosengren, "Trends in Commercial Real Estate," Speech to the Risk Management for Commercial Real Estate Financial Markets Conference at New York University's Stern School of Business, May 9, 2017.

James DiSalvo and Ryan Johnston, "The Growing Role of CRE Lending," Federal Reserve Bank of Philadelphia Banking Trends, Third Quarter 2016, pp. 15–21.

Lael Brainard, "Community Banks, Small Business Credit, and Online Lending," Speech to the Third Annual Community Banking Research and Policy Conference at the Federal Reserve Bank of St. Louis, September 30, 2015. Brainard, a Federal Reserve Board governor, notes that while community banks’ share of commercial and industrial loans has dwindled due to increased competition, their share of small CRE lending has been relatively stable.

"Commercial Real Estate and the Banking Crises of the 1980s and Early 1990s," in History of the Eighties: Lessons for the Future, Vol. I: An Examination of the Banking Crises of the 1980s and Early 1990s, Washington, D.C.: Federal Deposit Insurance Corporation, 1997, pp. 137–165, and Bureau of Economic Analysis estimates of GDP. Also see John V. Duca, Patric H. Hendershott, and David C. Ling, "How Taxes and Required Returns Drove Commercial Real Estate Valuations over the Past Four Decades," Federal Reserve Bank of Dallas Working Paper No. 1703, Revised January 27, 2017.

Some research suggests that those regulatory overhauls and general tightening of capital requirements were not enough to offset the risks posed by heavy CRE lending during the 2008–09 financial crisis. See Rebel A. Cole and Lawrence J. White, "Déjà Vu All Over Again: The Causes of U.S. Commercial Bank Failures This Time Around," Journal of Financial Services Research, October 2012, vol. 42, no. 1-2, pp. 5–29 (article available with subscription).

See Jim Costello, "Cross-border Investment in US Commercial Real Estate," NAIOP, the Commercial Real Estate Development Association Development magazine, Spring 2016.

Recent Kansas City Fed research suggests that a bank’s concentration in CRE is significantly correlated with higher failure or acquisition risk, but it also is associated with higher returns than residential real estate. See Kristin Regehr and Rajdeep Sengupta, "Sectoral Loan Concentration and Bank Performance, 2001–2014," Federal Reserve Bank of Kansas City Research Working Paper No. 16-13, November 2016.

For a summary of the issue, see Jerome H. Powell, "The Case for Housing Finance Reform," Speech at the American Enterprise Institute, Washington, D.C., July 6, 2017.

To regulators, there is usually no one particular "safe" ratio. What's more important is the trend (whether the ratio is rising or falling) and how it relates to institution-specific factors such as the bank's underwriting, risk management, and geography. As this brief notes, while the average ratio of 205 percent for year-end 2016 represents an increase over the previous year, it remains well below the average preceding the Great Recession.

For this study, failures were defined as bank closings where government assistance was provided in the dissolution of the bank. Acquisitions are defined as those where no government assistance was provided.

One important change in how noncore ratios are measured occurred in 2010, when the FDIC insurance limit rose permanently from $100,000 to $250,000. This resulted in a drop in noncore ratios.

See Cole and White, 2012.

One analysis that has influenced the study, more broadly, of how banking failures affect economic downturns is Ben S. Bernanke, "Nonmonetary Effects of the Financial Crisis in the Propagation of the Great Depression," American Economic Review, June 1983, vol. 73, no. 3, pp. 257–276 (article available with subscription). Along with Rosengren, Joe Peek, also of the Boston Fed, has looked at the particular role of CRE lending during the recession of the early 1990s; see Joe Peek and Eric S. Rosengren, "The Capital Crunch: Neither a Borrower nor a Lender Be," Journal of Money, Credit and Banking, August 1995, vol. 27, no. 3, pp. 625–638 (article available with subscription). For other resources, see Diana Hancock and James A. Wilcox, "Has There Been a 'Capital Crunch' in Banking? The Effects on Bank Lending of Real Estate Market Conditions and Bank Capital Shortfalls," Journal of Housing Economics, December 1993, vol. 3, no. 1, pp. 31–50 (article available with subscription) and Donald D. Hester, "Financial Institutions and the Collapse of Real Estate Markets," Federal Reserve Bank of Boston, Conference Series No. 36, September 1992.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.