The Differing Effects of the Business Cycle on Small and Large Banks

Small banks and large banks respond differently to business cycle fluctuations. The average net interest margin (NIM) at large banks is negatively correlated with the business cycle, while the average NIM at small banks is positively correlated with the business cycle. In a popular view, small banks are different from large banks because of their close relationships with their borrowers. But a decomposition of the cyclical properties of NIM into the asset and liability sides of the balance sheet suggests that small banks' procyclical NIM is due to their ability to keep funding costs less sensitive to the business cycle.

The U.S. banking sector is composed of very few large banks and many small ones. Indeed, about 95 percent of all institutions insured by the Federal Deposit Insurance Corporation (FDIC) are small, community banks. But those banks hold only about 15 percent of all banking assets.1 Despite their relatively low level of asset holdings, many bank supervisors and monetary policymakers believe that small, local banks play an important role in the intermediation of credit in the U.S. economy. For instance, in 2013, Federal Reserve Governor (and current chairman) Jerome H. Powell stated:

My colleagues on the Board of Governors and I understand the value of having a diverse financial system that includes a large and vibrant contingent of community banks. By fostering the economic health and vitality of local communities throughout the country, community banks play a central role in our national economy. One important aspect of that role is to serve as a primary source of credit for the small businesses that are responsible for creating a substantial proportion of all new jobs.2

Further, small banks are thought of as having close relationships with their borrowers that provide early signals of changing business cycle conditions. In a 2017 address at the Community Bankers Association of Ohio, Cleveland Fed President Loretta J. Mester commented:

Because of their important work, community bankers are among the most knowledgeable about changes in conditions on the ground in local areas. Such information often takes much longer to show up in official statistical reports. So I find the insights gained from speaking with bankers to be especially valuable as part of the mosaic of information I use in formulating my views on appropriate monetary policy.3

In a recent paper, three authors of this Economic Brief (Grochulski, Schwam, and Zhang), looked at U.S. commercial banking data for signs consistent with these widely held views about the special role of small banks.4 In particular, from those views they extract two hypotheses. First, if small banks indeed have access to business cycle information not available to other financial intermediaries, then one could expect to see differences in how small and large banks' profit margins react to changes in business cycle conditions. Second, if the advance information available to small banks comes from the long-term relationships with local businesses — that is, their borrowers — then one could expect these differences to appear on the asset side of the banks' balance sheets rather than on the liability side.

What Is NIM? And Why Is It Important?

In the empirical literature on bank profitability, the net interest margin (NIM) is perhaps the most commonly used profit margin indicator. NIM is defined as the ratio of a bank's net interest income and average earning assets. Net interest income is the difference between interest earned on assets and interest incurred on liabilities. Earning assets include items from which banks earn interest, such as loans and securities.

Economists have used aggregate U.S. banking sector data to examine the cyclical properties of NIM. Using administrative data collected by the FDIC, Kevin E. Beaubrun-Diant and Fabien Tripier have found that NIM is countercyclical for the banking sector overall.5 However, little is known about the extent to which the cyclicality of NIM differs between small and large banks.

Grochulski, Schwam, and Zhang investigate the cyclical properties of NIM in the banking sector as a whole and among small and large banks as classes. Using the FDIC's Statistics on Depository Institutions dataset from the fourth quarter of 1992 through the second quarter of 2016, they find that the cyclical component of NIM exhibits negative correlation with the cyclical component of gross domestic product (GDP) with a point estimate of this correlation coefficient of -0.30. Similarly, they find a point estimate of -0.33 for large banks. Among small banks, however, the estimated correlation between the cyclical components of average NIM and GDP is 0.34, meaning that NIM is positively correlated with the business cycle.

These empirical findings document a significant difference between small and large banks. In particular, they are consistent with the first hypothesis mentioned above: the timing of the business cycle signals received by smaller banks is earlier than those received by large banks.

What Flips the Sign?

Having found that the average NIM at large banks (and for the banking sector overall) is negatively correlated with the business cycle and that the average NIM at small banks is positively correlated with the business cycle, Grochulski, Schwam, and Zhang examine the second hypothesis mentioned above — that the discrepancy is due to the asset side of the balance sheet.

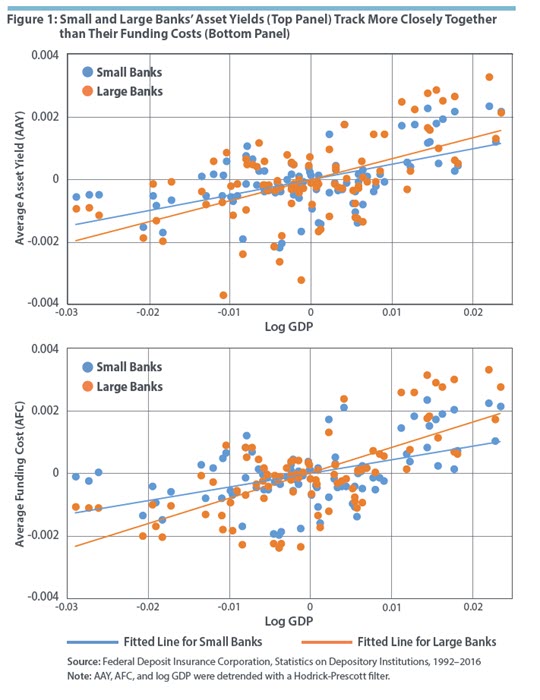

To test that hypothesis, they decompose the cyclicality of NIM into the asset side of the balance sheet and the liability side of the balance sheet. In that decomposition, correlation between NIM and GDP is represented as a weighted average of the GDP correlations of average asset yield (AAY) and average funding cost (AFC), where the weight on AAY is positive and the weight on AFC is negative.6 They find that the correlation of AAY is positive and of almost the same magnitude at small and large banks. Differences exist, however, in the cyclical properties of the funding costs and in the weights with which the asset-yield and funding-cost correlations contribute to the cyclicality of NIM. While funding costs are procyclical among both small and large banks, the small banks' correlation is much lower. In particular, it is lower than the correlation of AAY, consistent with small banks' NIM being procyclical. Large banks' NIM, on the other hand, is countercyclical because their AFC is more strongly procyclical than their AAY.

The top panel of Figure 1 below plots the relationship of AAY at small and large banks to the business cycle. The bottom panel does the same for AFC. The small-large bank difference between the fitted lines showing the response of AAY to GDP is narrower than the small-large bank difference showing the response of AFC.

These findings point to the liability side of the small banks' balance sheets as the source of their procyclical profit margins. This result seems to be at odds with the view that it is the small banks' close relationships with their borrowers that gives small banks a special role in the intermediation of credit. Instead, these findings point to the small banks' relationships with their depositors.7 Consistent with that hypothesis, Grochulski, Schwam, and Zhang show that small banks rely on deposits for their funding significantly more than large banks do. Domestic office deposits account for 91 percent of total liabilities for small banks and only 62 percent for large banks. Large banks also hold significant amounts of foreign office deposits, while small banks hold virtually none. But, still, total deposits constitute a much smaller fraction of liabilities at large banks than at small banks. The compositions of the small and large banks' asset portfolios are less dissimilar. The average bank allocates 53 percent of assets to domestic office loans, with the average small bank allocating 64 percent and the average large bank allocating 51 percent.

In addition, Grochulski, Schwam, and Zhang find that the difference in GDP correlations of asset yields and funding costs is amplified among small banks by the relatively high magnitude of the weights with which these correlations contribute to the overall correlation of NIM with GDP. They attribute the magnitude of these weights to the lower volatility of NIM among small banks, which in turn can be accounted for by the stronger correlation between small banks' average asset yields and funding costs.

Conclusion

Small banks do, in fact, play a special role in the intermediation of credit in the U.S. economy. But when the cyclical properties of NIM are decomposed into the asset and liability sides of the balance sheet, it appears that the liability side drives the difference in the performance of small and large banks. That finding suggests that small banks' special role is their ability to keep their funding costs relatively insensitive to the business cycle rather than their ability to extract business-cycle-relevant information from their long-term relationships with borrowers.8

Borys Grochulski is a senior economist at the Federal Reserve Bank of Richmond, Daniel Schwam is a research associate at Harvard Business School, Aaron Steelman is director of publications at the Federal Reserve Bank of Richmond, and Yuzhe Zhang is an associate professor of economics at Texas A&M University.

Community banks traditionally have been defined as banks operating in a limited geographical area and having less than $1 billion in assets, though recent studies have suggested that this threshold should be increased to $10 billion. See Federal Deposit Insurance Corporation, "FDIC Community Banking Study," December 2012. For the purposes of this article, small banks are defined as being within the bottom 95 percent of the size distribution of banks by assets.

Jerome H. Powell, "Community Banking: Connecting Research and Policy," address at the Federal Reserve/Conference of State Bank Supervisors Community Banking Research Conference, St. Louis, Mo., October 3, 2013.

Loretta J. Mester, "Perspectives on the Economic Outlook and Banking Supervision and Regulation," address at the Community Bankers Association of Ohio Annual Convention, Cincinnati, Ohio, August 2, 2017.

Borys Grochulski, Daniel Schwam, and Yuzhe Zhang, "Cyclical Properties of Bank Margins: Small versus Large Banks," Federal Reserve Bank of Richmond Economic Quarterly, First Quarter 2018, vol. 104, no. 1, pp. 1–33.

Kevin E. Beaubrun-Diant and Fabien Tripier, "Search Frictions, Credit Market Liquidity, and Net Interest Margin Cyclicality," Economica, January 2015, vol. 82, issue 325, pp. 79–102. Roger Aliaga-Díaz and María Pía Olivero also have examined this issue. See their paper, "The Cyclicality of Price-Cost Margins in Banking: An Empirical Analysis of Its Determinants," Economic Inquiry, January 2011, vol. 49, no. 1, pp. 26–46.

In particular, a more strongly procyclical AFC will reduce the cyclicality of NIM.

John C. Driscoll and Ruth A. Judson find that depositors do not move funds from one bank to another as much as one might expect. See their paper, "Sticky Deposit Rates," Federal Reserve Board Finance and Economics Discussion Series No. 2013-80, October 2013. Grochulski, Schwam, and Zhang's findings may suggest that deposit "stickiness" is particularly strong at small banks.

This is not to suggest, however, that such relationships and the information gleaned from them are unimportant. As noted previously, monetary policymakers maintain that contacts across a variety of sectors, including banking, do, in fact, provide vital information about what is happening in the economy in real time.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.