President Tom Barkin shares his views on today’s economy and the path ahead.

Business Cycles

Economies experience times of growth and times of recession. Learn more about these fluctuations known as business cycles.

Updating Results

Updating Results

From the end of 2025 through mid-January, businesses said they are increasingly confident but are still hesitant to make moves; the low-hire, low-fire equilibrium seems likely to continue.

President Tom Barkin reflects on 2025 and shares his economic outlook for the year ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

Since the last FOMC cycle, businesses said growth has been solid, but narrow; the low-hire, low-fire equilibrium continues.

President Tom Barkin shares his perspective on the economy and how the Richmond Fed's outreach efforts inform it.

Tom Barkin

President, Federal Reserve Bank of Richmond

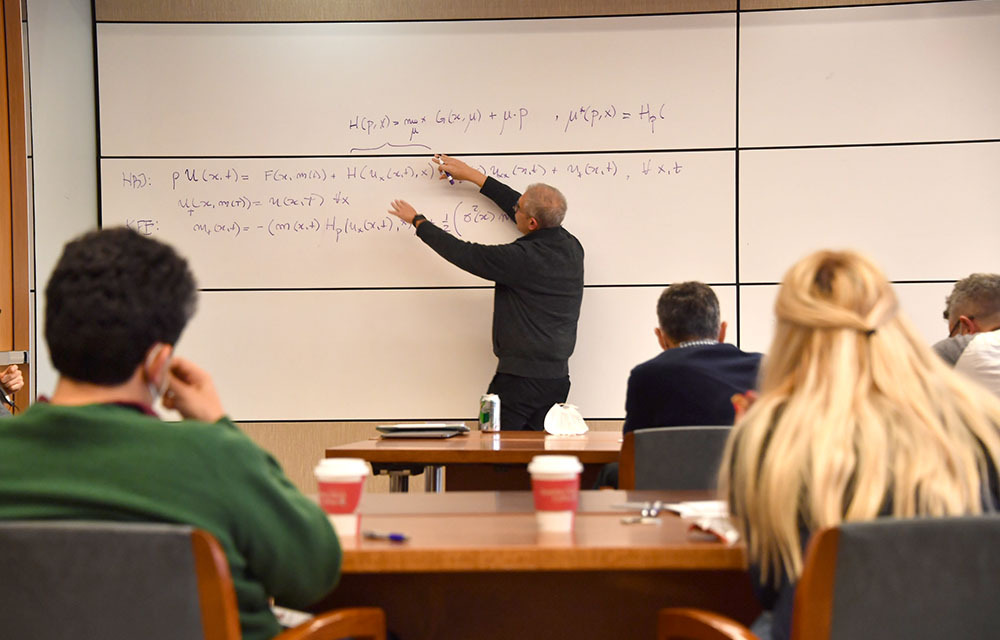

An econometric framework that can jointly leverage identification strategies from the applied microeconometric toolkit and identification assumptions from the macro/time series literature exploits both time series and crosssectional variation to identify aggregate macroeconomic effects as well as idiosyncratic effects of identified shocks.

Christian Matthes, Naoya Nagasaka and Felipe F. Schwartzman

During the last nonfinancial recession, negative credit supply shocks reduced firms' employment and increased their exit probability.

Alex Rivadeneira, Carlo Alcaraz, Nicolas Amoroso, Rodolfo Oviedo, Brenda Samaniego de la Parra and Horacio Sapriza

Banks' behavior can still amplify economic downturns even when they are not the source of a crisis and have robust liquidity and capital positions.

Carlo Alcaraz, Nicolas Amoroso, Rodolfo Oviedo, Alex Rivadeneira, Brenda Samaniego de la Parra and Horacio Sapriza

Conversations with businesses since the last FOMC cycle did not suggest any big shifts in the economy; economic conditions remained stable.

The authors develop a single-proposer noise bargaining game and embed it in a two-sector sovereign default model to find that hard defaults coincide with deeper and more protracted recessions.

Grey Gordon and Pablo Guerron-Quintana

Tom Barkin

President, Federal Reserve Bank of Richmond

This post shares sensing insights from business contacts in recent weeks. Overall, businesses said activity increased somewhat while expectations remained mixed, labor availability improved, and more cost passthrough was expected.

The Fed's "maximum employment" mandate isn't directly measurable, so how can we tell if the economy is close?

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin discusses what he’s seeing in the data, hearing from businesses and expecting in the months to come.

Tom Barkin

President, Federal Reserve Bank of Richmond

Global interconnectedness has been present for decades, as seen by how countries' GDP growth and inflation tend to move together.

Katherine Anderson, Paul Ho and Nathan Robino

The authors show how max-share identification could be problematic and that stringent conditions are required to accurately identify the shock of interest.

Liyu Dou, Paul Ho and Thomas A. Lubik

John O'Trakoun and Adam Scavette discuss their new approach to gauging the health of the economy and the likelihood that a recession is taking place before other indicators would detect it. O'Trakoun is a senior policy economist at the Federal Reserve Bank of Richmond and Scavette is a community development economic advisor at the Federal Reserve Bank of Philadelphia.

President Tom Barkin considers the economic outlook amid elevated uncertainty.

Tom Barkin

President, Federal Reserve Bank of Richmond

While valuation fluctuations successfully explain stock market dynamics, they appear insufficient as the sole driver of variation in firms' hiring decisions.

Several economic indicators appear to respond notably to shocks in credit sentiment.

Danilo Leiva-León, Thomas A. Lubik, Gabriel Pérez-Quirós, Nathan Robino, Horacio Sapriza, Francisco Vazquez-Grande and Egon Zakrajšek

A new indicator might be able to signal recessions faster and more accurately than the Sahm rule.

Looking back at the historical correlations between business optimism and measures of business investment could help us see if the recent rise in business optimism will have predictable results.

John O'Trakoun

Senior Policy Economist

Economic shocks can be amplified through supply chains. In response, many firms and policies are aiming to increase supply chain resilience.

President Tom Barkin reflects on the past year and shares his outlook for the year ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

This paper explores the role of technological shocks and if their impact triggers a response that resembles business cycles.

Christoph Görtz, Christopher Gunn and Thomas A. Lubik

Some inferred early retirement or unexpected wealth gains played a role, but the data suggest that these drops were either not very persistent or reflected as part of long-run trends.

Andreas Hornstein

(Emeritus)

President Tom Barkin explores where the U.S. economy is today, how it got here and where it may be headed.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin shares his views on the economy and the recent rate cut, and then looks to what could come next.

Tom Barkin

President, Federal Reserve Bank of Richmond

According to a multisector DSGE model, heterogeneity in shock variances across sectors is critical for matching the empirical relationship between inflation and the distribution of relative price changes.

Alexander L. Wolman and Francisco Ruge-Murcia

The authors show that disruptions in access to corporate bond markets have an economically material, statistically significant impact on the real economy.

The authors find evidence that bank capital matters for the tails of future GDP growth, with a relationship that is particularly strong in reducing the probability of the worst GDP outcomes. The relationship between bank capital and growth, however, is not strong for its central tendency.

Nina Boyarchenko, Domenico Giannone and Anna Kovner

Although the communities surrounding universities experienced some shielding effects from previous recessions, the unemployment rate actually increased in these areas following the COVID-19 recession.

The authors study how changes in banks' lending standards affect economic activity, inflation, and interest rates to gain a better understanding of the macroeconomic effect that banks can have.

Elijah Broadbent, Huberto M. Ennis, Tyler J. Pike and Horacio Sapriza

Andy Bauer and Renee Haltom talk about why consumers and businesses are telling a different story about the economy than the data suggests. They also discuss how economists reconcile such differences between sentiment and data. Bauer and Haltom are regional executives at the Richmond Fed.

President Tom Barkin explores why it has been particularly challenging to predict the path of the economy over the last few years.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin reflects on recent data and shares his view on where the U.S. economy is headed.

Tom Barkin

President, Federal Reserve Bank of Richmond

Temporary losses look to be severe after the collapse of the Francis Scott Key Bridge and closure of the Port of Baltimore, but there are several reasons to be optimistic about recovery.

Adam Scavette

Regional Economist

President Tom Barkin explores different ways to look at recent data, and then gives his own perspective.

Tom Barkin

President, Federal Reserve Bank of Richmond

Several factors include labor market participation, business cycle volatility and responsiveness to the underlying economic environment.

How has the economy navigated previous rate cycles, and how do they compare to the current one?

Erin Henry, Pierre-Daniel G. Sarte and Jack Taylor

President Tom Barkin reflects on 2023 and shares his outlook for the year ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

Upcoming Event: What do Uber and the Federal Reserve have in common? They both hire economists! Did you know that some of your favorite brands also hire economists? But what do economists actually do? Registration required.

President Tom Barkin shares how communities in the Fifth District are working to move the needle on housing.

Tom Barkin

President, Federal Reserve Bank of Richmond

President Tom Barkin explores potential paths for the U.S. economy and their implications for monetary policy.

Tom Barkin

President, Federal Reserve Bank of Richmond

Is it possible durable goods spending will settle above the pre-pandemic trend line? If so, what might this consumption shift mean for the aggregate economy?

John O'Trakoun

Senior Policy Economist

President Tom Barkin explores what’s happening in the labor market and how it could impact the path ahead.

Tom Barkin

President, Federal Reserve Bank of Richmond

Out of the many components that make up the PPI, one particularly relevant item from the perspective of shoppers may be the PPI's trade indexes.

John O'Trakoun

Senior Policy Economist

The current cycle appears to be unique in how inflation has moved during this most recent series of rate hikes.

Conner Mulloy, Pierre-Daniel G. Sarte and Erin Henry

President Tom Barkin discusses what’s driving the resilient U.S. economy and where it may be headed next.

Tom Barkin

President, Federal Reserve Bank of Richmond

How do state economies behave differently through the ups and downs of national business cycles? Do some states tend to enter recessions sooner (or later) than others? Are some states more recession-proof (or prone) than others?

Adam Scavette

Regional Economist

Nicolas Morales discusses his research on supply chains and the factors that can help them resist and recover from economic shocks, like the COVID-19 pandemic. Morales is an economist at the Federal Reserve Bank of Richmond.

While auto sales have been trending up over the past several months, we'll look into a couple of reasons why the future may not be so bright.

John O'Trakoun

Senior Policy Economist

Wage-price pass throughs may help explain why core goods inflation has risen so much faster in the current expansion than in previous ones.

Changes in unemployment appear to be strong recession predictors, especially when combined with lagged term spreads.

Andreas Hornstein

(Emeritus)

Moves toward stable inflation and maximum employment can be in conflict in the short term.

Among the topics discussed were income growth volatility, AI's impact on productivity and how housing price changes affect young businesses.

Jason Kosakow and Santiago Pinto describe how survey data is gathered and used to assess regional and national economic conditions. Kosakow is survey director and Pinto is a senior economist and policy advisor at the Federal Reserve Bank of Richmond.

The lockdowns resulting from COVID-19 provide an opportunity to examine what factors affect the strength of supply chains.

Claire Conzelmann, Nicolas Morales, Gaurav Khanna and Nitya Pandalai-Nayar

Hard (or large) sovereign defaults have been associated with larger negative economic responses than soft defaults.

Brandon Fuller, Grey Gordon and Pablo Guerron-Quintana

A new real-time measure of credit market sentiment appears to outperform credit conditions indicators currently used in the literature.

Danilo Leiva-León, Gabriel Pérez-Quirós, Horacio Sapriza, Francisco Vazquez-Grande and Egon Zakrajšek

The yield curve is often used to gauge potential recessions. Can its predictive value be improved?

Andreas Hornstein

(Emeritus)

While several indicators have pointed to a recent slowdown in economic activity, one that uses unemployment rates to gauge recession probabilities may offer new insights.

John O'Trakoun

Senior Policy Economist

Sonya Ravindranath Waddell shares insights from the latest survey of chief financial officers and other financial decision-makers at companies across the United States. Waddell is a vice president and economist at the Richmond Fed.

As the Fed works to contain inflation, many ask whether we are headed into a recession. President Barkin shares his perspective.

Tom Barkin

President, Federal Reserve Bank of Richmond

We search for hysteresis in aggregate post-WWII U.S. data. Our findings suggest that hysteresis effects have been virtually absent for the sample excluding the financial crisis and the Great Recession, and they only appear when including the period following the collapse of Lehman Brothers.

Luca Benati and Thomas A. Lubik

Unlike in other recessions, women's labor force participation was impacted more than men's. What impact did child care have?

How did unemployment insurance expansion affect recovery from the pandemic-induced recession? What are the effects of federal minimum wage hikes? A recent research conference addressed these questions and more.

John Mullin

The unemployment rate is close to pre-pandemic lows, and job openings are at record highs. Yet, participation and employment rates are still below pre-pandemic levels.

The recent high inflation had been due to price changes in a small group of expenditures, but that changed a few months ago.

Studies suggest that short-term effects of such spending are small and long-term effects depend on an economy's sensitivity to such investment.

News about productivity shocks — even when these shocks have not even happened yet — seems to be a powerful additional source of economic fluctuations.

Thomas A. Lubik, Christoph Görtz and Christopher Gunn

Is money essential? How do self-interested parties bargain to achieve mutually beneficial outcomes? These were among questions addressed at a recent research conference.

A surge of interest in starting new businesses could reverse a long-running drought.

The Beveridge curve — which measures the inverse relationship between the unemployment and vacancy rates — has shifted significantly outward and is much steeper than in pre-COVID times.

Felipe Schwartzman and Chen Yeh discuss their research on business cycles and what forces impact them on the individual and aggregate level. Schwartzman is a senior economist and Yeh is an economist at the Federal Reserve Bank of Richmond.

The Fed's relatively new repo facilities may create greater price certainty, but the Fed's intervention may mute valuable market signals regarding economic efficiency and stability.

Huberto M. Ennis and Jeff Huther

Some argue that damages from climate change aren't large enough to affect the financial system, but what about amplification effects?

Unemployment insurance seems to help smooth consumer spending after a job loss, but there's disagreement on how much it discourages people from finding new jobs.

How do local government borrowing, default, and migration interact? We find in-migration results in excessive debt accumulation due to a key externality: Immigrants help repay previously issued debt.

Grey Gordon and Pablo Guerron-Quintana

Household consumption shocks have accounted for close to 40 percent of pre-pandemic business cycle fluctuations.

University of Texas at Austin economist on wage growth, labor's share of income, and the gender unemployment gap

David A. Price

Contrary to the traditional view, adverse events for a single firm can affect the economy as a whole, if the firm is large enough.

Without a recent directly comparable episode, economic forecasters modified their models or sought additional information in data to create forecasts during the pandemic.

Recent legislation has again highlighted the U.S. welfare system. This EB summarizes the welfare system and a "work bias" embedded in many U.S. welfare programs.

Conducting a statistical analysis of U.S. economic data, economists from the Richmond Fed and the University of Bern find no evidence of hysteresis, the idea that seemingly temporary economic shocks can have permanent effects.

Luca Benati and Thomas A. Lubik

Households' expectations often differ from formal economic forecasts. The researchers quantify these differences and explain them by developing a "theory of time-varying pessimism." Embedding their new theory into a quantitative economic model, they find that fluctuations in pessimism have significant effects on macroeconomic measures, most notably the unemployment rate.

Anmol Bhandari, Jaroslav Borovicka and Paul Ho

The COVID-19 pandemic has caused severe economic distress in the Fifth District, but the regional housing market has proven remarkably resilient.

Benjamin Lukas

Intern (2020)

Much of the previous economic research on the aftermath of recessions has focused on their short-term effects on earnings and jobs. New research suggests that with longer-term consequences, workers' earnings, health and family outcomes may be affected.

Emily Green

This paper identifies total factor productivity (TFP) news shocks using standard VAR methodology and documents a new stylized fact: in response to news about future increases in TFP, inventories rise and comove positively with other major macroeconomic aggregates.

Christoph Görtz, Christopher Gunn and Thomas A. Lubik

There is enough research to suggest that sentiment does play a role in shaping the business cycle. The question facing policymakers is what to do about it.

Richmond Fed president Tom Barkin discusses economic conditions and the potential for a recession.

Tom Barkin

President, Federal Reserve Bank of Richmond

What caused the housing boom and bust of the early 2000s?

Daisuke Ikeda, Toan Phan and Tim Sablik

Richmond Fed president Tom Barkin discusses economic conditions and the potential for a recession.

Tom Barkin

President, Federal Reserve Bank of Richmond

This Economic Brief evaluates the predictive capabilities of the yield curve and several other leading indicators, including the Conference Board Leading Economic Index (LEI), claims for unemployment insurance, manufacturing activity, consumer lending, and CEO optimism.

Matthew Murphy, Jessie Romero and Roy H. Webb

This brief makes the case that research and policy should focus on four aspects of economic fluctuations: a short-term component (cycles of less than two years), a business cycle component (cycles between two and eight years), a medium-term component (cycles up to thirty-two years), and a long-term component (the trend).

The recent flattening of the yield curve has raised concerns that a recession is around the corner. Such concerns stem partly from the fact that yield curve inversions have preceded each of the past seven recessions.

Renee Haltom, Elaine Wissuchek and Alexander L. Wolman

Small banks do, in fact, play a special role in the intermediation of credit in the U.S. economy. But when the cyclical properties of NIM are decomposed into the asset and liability sides of the balance sheet, it appears that the liability side drives the difference in the performance of small and large banks.

Borys Grochulski, Daniel Schwam, Aaron Steelman and Yuzhe Zhang

A downturn following the collapse of an asset bubble — an episode of speculative booms in asset prices — can be severe and sustained, with output and employment often lower than in the prebubble economy. This Economic Brief considers some possible theoretical explanations.

Helen Fessenden and Toan Phan

Economic growth in the United States following the Great Recession has been well below the post-World War II average. Some observers have called this the "new normal."

Aaron Steelman and John A. Weinberg

Real business cycle (RBC) models have been highly successful at explaining business cycles that occurred before 1984. But since then, shifts in comovements and relative volatilities of key economic aggregates have challenged their preeminence.

Thomas A. Lubik, Karl Rhodes, Pierre-Daniel G. Sarte and Felipe F. Schwartzman

Are the majority of inner cities experiencing a renaissance thanks to rapid gentrification, or is growth limited to a small number of high-technology regions, resulting in inequality among metropolitan areas?

Aggregate demand is the total demand for all goods and services in an economy. Should the government try to boost it with fiscal stimulus during recessions?

Renee Haltom

Vice President and Regional Executive

Richmond Fed President Jeffrey M. Lacker addressed the Global Interdependence Center in Sarasota, Florida.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey Lacker addressed the Greater Richmond Chamber of Commerce.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Stanford University economist on the effects of economic uncertainty, the role of management practices in economic performance, and fostering good management

Renee Haltom

Vice President and Regional Executive

Richmond Fed President Jeffrey M. Lacker addressed business leaders during a luncheon hosted by the Rotary Club of Charlotte in Charlotte, N.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

This paper studies equilibrium pricing in a product market for an indivisible good where buyers search for sellers.

Guido Menzio and Nicholas Trachter

In this paper, we show that variations in the discount factor estimated using inventories correlate well with established independent measures of credit market frictions.

The Richmond Fed conducts monthly surveys of business conditions in the manufacturing and service sectors of the Fifth Federal Reserve District. This article provides background information on these surveys and on other manufacturing and service sector surveys.

David A. Price and Aileen Watson

Richmond Fed President Jeffrey M. Lacker spoke about the economic outlook Jan. 17, 2014, in remarks to the Richmond chapter of the Risk Management Association.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

In this paper we ask how uncertainty about fiscal policy affects the impact of fiscal policy changes on the economy when the government tries to counteract a deep recession.

Christian Matthes and Josef Hollmayr

We study the impact of intersectoral and interregional trade linkages in propagating disaggregated productivity changes to the rest of the economy.

Pierre-Daniel G. Sarte, Esteban Rossi-Hansberg, Fernando Parro and Lorenzo Caliendo

In a stylized quantitative analysis, we show that the consumption effect dominates, so that unemployment benefits increase per-worker productivity. We also analyze the welfare-maximizing benefit level and find that it decreases as moving costs increase.

David L. Fuller, Marianna Kudlyak and Damba Lkhagvasuren

We study the sovereign debt duration chosen by the government in the context of a standard model of sovereign default.

A new database of online job posting data sheds light on how workers search for jobs.

This paper provides a theoretical framework to quantitatively investigate the optimal accumulation of international reserves to hedge against rollover risk.

Javier Bianchi, Juan Carlos Hatchondo and Leonardo Martinez

In view of the increasing share of long-term unemployment since the 2007-09 recession, we provide an extension of the Shimer (2012) unemployment accounting scheme that allows for both short-term and long-term unemployment and that uses data on the duration distribution of unemployment.

Andreas Hornstein

(Emeritus)

We show that, whereas during earlier recessions it was sufficient to examine the flows between employment and unemployment to account for the dynamics of the unemployment rate, this was not true in the Great Recession.

This paper examines the optimality of fiscal rules and measures their aggregate effects using a baseline sovereign default framework.

Juan Carlos Hatchondo, Leonardo Martinez and Francisco Roch

As households strengthen their balance sheets, their ability to take on new debt to finance consumption is improving, but household debt remains elevated by historical standards, and other determinants of consumer spending remain weak.

R. Andrew Bauer and Betty Joyce Nash

Lacker Addresses Dulles Regional Chamber of Commerce, Chantilly, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker speaks at Southern Growth's 2011 Chairman's Conference in Roanoke, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Since the recession started in 2007, there has been a growing concern that small businesses may lack adequate access to credit. This Economic Brief examines the complexity of small business credit issues.

Betty Joyce Nash and Kimberly Zeuli

President Lacker Addresses Piedmont, N.C.'s Business Leaders

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker Addresses Greensboro, NC Business Leaders

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

President Lacker addresses the Maryland Bankers Association

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Cover Story: The Price is Right? Has the financial crisis provided a fatal blow to the efficient market hypothesis?

President Lacker addresses Charlotte business leaders

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Cover Story: Measuring Quality of Life: How should we assess improvements to our standard of living?

Economists and policymakers often use average income as a way to gauge a country's "standard of living." But income alone doesn't capture overall quality of life. Should policymakers use other measures — including health, education, and even aggregate happiness — when making economic policy?

Related Links

Lacker addresses VA House Appropriations Committee

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Existing policies to reduce emissions of carbon dioxide (CO2) largely have been structured to subsidize alternative energy technologies. Yet these policies are likely not to be as useful as ones that target CO2 emissions directly, such as an emissions tax or a "cap and trade" program.

Lacker Speech to Charlotte RMA (Video Available)

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Cover Story: Reforming the Raters: Can regulatory reforms adequately realign the incentives of credit rating agencies?

Lacker Speaks to Danville Chamber of Commerce

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

It is widely believed that public sector spending and investment can restore aggregate economic activity to efficient levels. But some policy responses are likely to be more successful than others.

Lacker Speaks at North Carolina Senate Appropriations Committee

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Lacker Speaks at Beijing Banking Summit

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

President Lacker speaks to Charlottesville, Va., business leaders

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

President Jeffrey Lacker speaks to the Charleston Metro Chamber of Commerce.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

President Lacker addresses the National Association for Business Economics at the 2009 Washington Economic Policy Conference

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

In this paper we develop a quantitative dynamic stochastic small open economy model with incomplete markets, endogenous fiscal policy and sovereign default where public expenditures and tax rates are optimally procyclical.

Gabriel Cuadra, Juan M. Sanchez and Horacio Sapriza

President Lacker addresses the Risk Management Association, Richmond Chapter

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

President Lacker speaks to the Maryland Bankers Association.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke December 3, 2008, at the Charlotte Chamber of Commerce Economic Outlook Conference in Charlotte, N.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke at the November 21, 2008 meeting of The Tech Council of Maryland in Bethesda, Md.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke November 18, 2008 at the CATO Institute's 26th Annual Monetary Conference in Washington, D.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke at the Global Interdependence Center Conference held November 3, 2008 at the Hebrew University of Jerusalem.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke June 5, 2008 at the Distinguished Speakers Seminar European Economics and Financial Centre, London, England.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke February 5, 2008 to the West Virginia Bankers Association and the Community Bankers of West Virginia in Charleston, W.Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker spoke January 18, 2008 to the Risk Management Association in Richmond, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

It's a pleasure to be here today and to have this opportunity to comment on conducting monetary policy in a low inflation environment.

J. Alfred Broaddus

President

Reviews the Bank's operations and includes the article entitled "Accounting for Corporate Behavior"