The Roots of ‘Bubbly’ Recessions

A downturn following the collapse of an asset bubble — an episode of speculative booms in asset prices — can be severe and sustained, with output and employment often lower than in the prebubble economy. This Economic Brief considers some possible theoretical explanations. It argues, based on insights from a simple economic model, that the interaction among financial frictions, wage rigidity, and the constraints of monetary policy near the zero lower bound is a key source of inefficiency in large bubbles. One potential remedy is to regulate speculative investment on bubbly assets so that individual investors internalize their investments' effects on systemic risk.

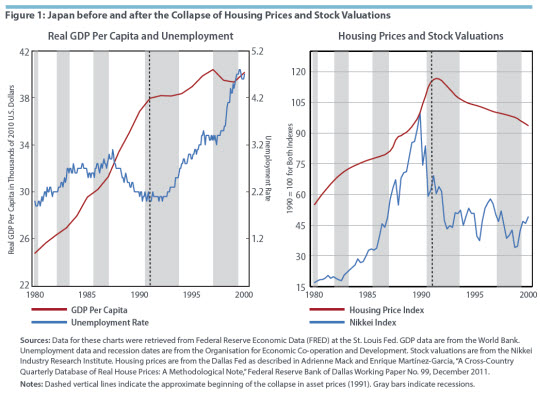

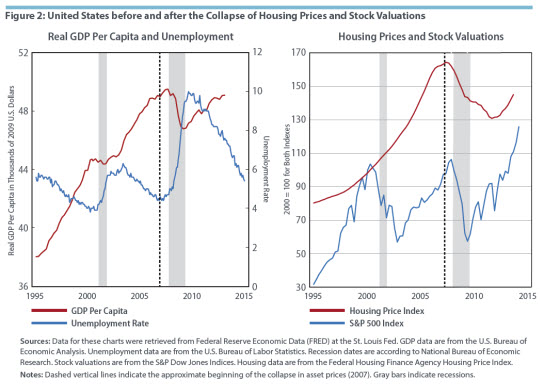

In recent decades, asset speculation has driven sizeable boom-and-bust cycles in some of the world's largest economies — cycles that have sometimes resulted in deep and persistent recessions. Two prominent examples of what are often termed "bubbles" occurred in Japan in the 1990s and in the United States in the mid-to-late 2000s. In both cases, the bubbles began in real estate and coincided with a surging stock market. And in both cases, the ensuing recessions were severe, and in the case of Japan, especially long-standing. The size of these shocks has led to increased interest among economists and policymakers to find preventive tools to mitigate the adverse impact of bubbles and the financial crises that can follow. The 2010 Dodd-Frank Act, for example, included provisions to strengthen "macroprudential" oversight, that is, supervision and regulation that consider how individual financial institutions may affect the financial system as a whole. Those changes have included more stringent capital requirements and regular stress testing.

To understand potential policy implications, however, it's critical to understand how bubbles emerge in the first place and how their collapse can lead to such deep downturns. A coauthor of this Economic Brief, Toan Phan, has analyzed this question through a simple and standard model of the macroeconomy, focusing on how a bubble's collapse can contribute to particular economic inefficiencies. He argues that this outcome is due to a combination of market failure and specific features of the modern economy.1 The market failure takes the form of financial "frictions," namely imperfections in the financial market that lead to constraints on borrowing. When such financial frictions coincide with a monetary policy that's limited by very low interest rates, as well as the real-world tendency of employers to eschew sharp cuts in nominal wages, the result can be an especially harsh and enduring recession.

The concept of financial frictions has a particular meaning in this context. In an ideal world, consumers and firms are able to borrow as much as they need. But in the real world, many factors can limit the amount of borrowing, including the amount of the borrower's net worth. The greater the net worth, generally speaking, the more someone can borrow. The growth of a bubble can reduce these frictions by increasing the net worth of borrowers — for example, through the value of commercial or residential real estate during a housing price boom.

This Economic Brief explains how the combination of these factors can contribute to severe downturns, even if speculative investors are forward-looking and rational in the sense that they understand the bubble's risk of collapse. The analysis also implies that macroprudential regulations on speculative investment during a bubble episode could reduce the severity of the postbubble recession. Indeed, some governments (for example, Vancouver, Canada, and China) are discussing or already experimenting with such measures in the context of certain types of regulations on housing investment, including taxes. Such measures could help reduce some of the inefficiencies associated with the bust, but they would come with a trade-off: to reduce the adverse consequences of a downturn, these levies also would have to scale back the economic growth of the preceding boom.

The Upside of Bubbles

The question of how bubbles form goes to a core issue of financial frictions. In an economy with relatively low interest rates, lenders earn only a modest return on their loans or investments. By contrast, speculation in a "bubbly asset" — where an investor buys an asset with the expectation that it can be sold later for a return that is possibly higher but riskier than the safe interest rate — often may look like the more attractive option. Instead of putting one's cash in a savings account to earn a low interest rate, for example, it may be tempting to put that money into a booming real estate market. However, such speculation is inherently risky because it requires a coordination of expectations or beliefs across investors. That is, a speculator would invest in a bubbly asset only if he or she expected that someone else would buy that asset from them in the future, and in turn, the subsequent buyer would expect to be able to resell the asset, and so on.

In a model economy with financial frictions, the boom of asset prices may then lead to a credit boom. As a bubbly asset appreciates, it enhances investors' net worth, and higher net worth typically allows easier access to credit and higher credit limits. An uptick in borrowing then could lead to higher investment and could ultimately boost credit, output, wages, and consumption. In this way, a bubble can encourage (or "crowd in") investment because rising investment is a result of rising net worth.2 Indeed, this dynamic is roughly consistent with the boom in investment, employment, and other economic activity during the Japanese and U.S. housing bubbles. (See Figures 1 and 2 below.)

What happens when such bubbles collapse? In theory, if only financial frictions were involved, the economy should shrink as borrowing would go back to normal, while wages would fall by a corresponding amount. This downturn would return the economy and borrowing levels to their prebubble state and no further. But as some well-known real-world examples have suggested, the resulting recessions can leave everyone much worse off than before the bubble began. How can this happen?

The Downside of Bubbles

In this model environment, severe postbubble recessions result from the combination of financial frictions and the particular effects of downwardly rigid (or "sticky") wages and the constraints of monetary policy near the zero lower bound. Without rigidities, a firm should be able to adjust wages up or down to reflect its workers' marginal product of labor — that is, the amount of output provided by each additional worker. In a downturn, firms would like to cut down investment and production, leading to a reduction in the demand for labor. The drop in the demand for labor can result in either reduced wages or reduced employment. In practice, as has been well-documented in history, nominal wages tend to not fall (thus the term "downward wage rigidity"); instead, employment falls. In other words, rather than cutting wages, firms tend to lay off workers or reduce their work hours, and unemployment rises.3 At that point, a firm has fewer workers and less capital, so its output declines, and the firm's owner sees a drop in net worth. Firms might borrow less and less, and capital stock might fall. Only when wages start, belatedly, to fall amid high unemployment will a firm be willing to start hiring again. As a real-world example, it took about a decade in Japan for real and nominal wages to fall back to prerecession levels.

Along with wage rigidity, low interest rates can exacerbate this type of downturn. When a central bank faces a recessionary environment, with falling employment and output, it typically would like to cut the nominal interest rate to stimulate demand. In a postbubble economy, however, there might be an excess of capital left over from the boom, in the sense there is not enough demand to utilize all of it. The excess capital leads to a low marginal product of capital — which, exacerbated by high unemployment, puts more downward pressure on the return on capital and thus the real interest rate. A low real interest rate also implies a low nominal interest rate. Usually, the nominal interest rate is unlikely to fall below zero because a negative nominal interest rate can compel households and firms to switch from deposits to holding cash. With sufficient downward pressure, the nominal interest rate can be pushed against the zero lower bound.4

Economists refer to this scenario as a liquidity trap, in which a central bank is unable to reduce its monetary policy interest rate enough to stimulate output. Employment and investment might stay depressed, and inflation might be stuck below its target. As noted above, this was the case in 1990s Japan, which saw unemployment more than double while nominal and real wages stayed high. Similarly, in the United States, unemployment jumped from 5 percent to 10 percent from 2007 to 2009 while real and nominal wages kept rising. In both cases, monetary policymakers cut nominal interest rates down to zero, but inflation stayed mired below prerecession levels. In recent years, some economists have argued that these and many other major economies might even be facing "secular stagnation" — that is, a long-standing slowdown in growth and productivity independent of business cycles.5

Private Risk, Public Costs

If the severity of postbubble recessions is caused by this mix of factors, what can policymakers do to prevent these scenarios in the future? One approach is to understand these downturns as producing negative "externalities," or the costs of an individual's decision that others bear. There's a rich literature in economics on externalities, especially in areas such as traffic congestion, pollution, and tobacco consumption. In these cases, economists have tried to quantify the social costs of particular individual actions and remedy them through pricing schemes that, in turn, put the onus of the cost back on the responsible individual or firm.6 An example is tobacco, which causes such externalities as second-hand smoke and an extra burden on the health care system; taxing cigarettes can help individuals internalize the externalities of their own actions.

In the case of bubbles, individual investors do not internalize the effects of their investments on raising asset prices, which can produce an excessive boom that is followed by an inefficient bust. For example, a hedge fund is unlikely to internalize the fact that its speculative investment contributes to escalating real estate prices and that bigger booms are associated with deeper busts. Some of the risks associated with decisions made by investors to buy bubbly assets are, in this sense, borne by the population as a whole. By extension, one way to price these externalities would be to impose a tax on investors as they speculate on bubbly assets. Such a tax would make them internalize the potential cost in the long run.

A caveat is warranted. For the government to impose this levy, it would need to be able to identify and observe the bubble ahead of its peak, which is a strong assumption. As former Federal Reserve Chairman Ben Bernanke noted in a 2010 speech that addressed asset bubbles and the Fed's role, "Although the house price bubble appears obvious in retrospect — all bubbles appear obvious in retrospect — in its earlier stages, economists differed considerably about whether the increase in house prices was sustainable; or, if it was a bubble, whether the bubble was national or confined to a few local markets."7

But if the government does recognize the bubble and implements a levy, such a measure would mean that investors would adjust their demand for the asset downward since the tax would make it more expensive. The price of the bubbly asset would still rise but not as much as it would if left untaxed, and the risk would be better internalized among those investors who could also reap the upside of the bubble. The trade-off is that their net worth also would rise by less than it would without the tax, so the positive spillover effect of greater borrowing on investment would also be somewhat muted.

There are several recent cases where governments have considered a tax on bubbly assets. In China, for example, leaders have been increasingly concerned about the broader effects of property speculation. (Many speculators buy apartments that remain unoccupied, and home prices in cities such as Shanghai and Beijing have soared.) In December 2016, for example, President Xi Jinping announced that the government would implement a mix of regulatory policies to better meet housing demand and control financial risk; at the Communist Party Congress this past March, he repeated that theme by noting that "houses are built to be inhabited, not for speculation." Officials are now crafting a national property tax that could come into effect next year.8 Meanwhile, in Vancouver, Canada, a 15 percent surcharge on real estate purchases, imposed in summer 2016, caused an immediate and sharp drop in home sales, including among the foreign buyers who have favored the city as an investment destination.9

These examples point to the frequent role of the real estate sector in financial crises and show that policymakers might be becoming more responsive to this link.10 But as this Economic Brief explains, these boom-and-bust cycles can occur across sectors and have multiple drivers. Understanding the interaction of these factors can help policymakers develop tools to contain the costs of such episodes.

Helen Fessenden is an economics writer and Toan Phan is an economist in the Research Department at the Federal Reserve Bank of Richmond.

This Economic Brief is based on the findings presented in a recent working paper published by the Federal Reserve Bank of Richmond. See Siddhartha Biswas, Andrew Hanson, and Toan Phan, "Bubbly Recessions," Federal Reserve Bank of Richmond Working Paper No. 18-05, February 22, 2018. Also, see Andrew Hanson and Toan Phan, "Bubbles, Wage Rigidity, and Persistent Slumps," Economics Letters, February 2017, vol. 151, pp. 66–70.

For a discussion of how asset bubbles affect growth amid financial frictions, see Tomohiro Hirano, and Noriyuki Yanagawa, "Asset Bubbles, Endogenous Growth, and Financial Frictions," Review of Economic Studies, January 2017, vol. 84, no. 1, pp. 406–443. Also, see Alberto Martin and Jaume Ventura, "Economic Growth with Bubbles," American Economic Review, October 2012, vol. 102, no. 6, pp. 3033–3058, and Jianjun Miao and Pengfei Wang, "Asset Bubbles and Credit Constraints," American Economic Review, forthcoming.

The evidence for downward nominal wage rigidity has been well-documented. See Takeshi Kimura and Kazuo Ueda, "Downward Nominal Wage Rigidity in Japan," Journal of the Japanese and International Economies, March 2001, vol. 15, no. 1, pp. 50–67. Also, see Steinar Holden and Fredrik Wulfsberg, "How Strong Is the Macroeconomic Case for Downward Real Wage Rigidity?" Journal of Monetary Economics, May 2009, vol. 56, no. 4, pp. 605–615. A study of European wages can be found in Jan Babecký, Philip Du Caju, Theodora Kosma, Martina Lawless, Julián Messina, and Tairi Rõõm, "Downward Nominal and Real Wage Rigidity: Survey Evidence from European Firms," Scandinavian Journal of Economics, December 2010, vol. 112, no. 4, pp. 884–910. U.S. wages are analyzed in Mary Daly, Bart Hobijn, and Brian Lucking, "Why Has Wage Growth Stayed Strong?" Federal Reserve Bank of San Francisco Economic Letter, April 2, 2012.

See also Stephanie Schmitt-Grohé and Martín Uribe, "Liquidity Traps and Jobless Recoveries," American Economic Journal: Macroeconomics, January 2017, vol. 9, no. 1, pp. 165–204. For a related discussion of the limits of monetary policy on bubbles and the role of the zero lower bound, see Vladimir Asriyan, Luca Fornaro, Alberto Martin, and Jaume Ventura, "Monetary Policy for a Bubbly World," National Bureau of Economic Research Working Paper No. 22639, September 2016.

See Gauti B. Eggertsson, Neil R. Mehrotra, and Lawrence H. Summers, "Secular Stagnation in the Open Economy," American Economic Review, May 2016, vol. 106, no. 5, pp. 503–507.

See Helen Fessenden, "Pricing Vice," Federal Reserve Bank of Richmond Econ Focus, Second Quarter 2017, pp. 11–15.

Ben S. Bernanke, "Monetary Policy and the Housing Bubble," Speech at the Annual Meeting of the American Economic Association, Atlanta, January 3, 2010.

See "Xi Again Pledges to Curb Speculation in China Property Market," Bloomberg News, December 21, 2016; "Housing Should Be for Living in, Not for Speculation, Xi Says," Bloomberg News, October 18, 2017; and "China Gets Closer to Game-Changing Property Tax," Bloomberg News, March 7, 2018.

See Natalie Obiko Pearson, "Foreign Buying Plummets in Vancouver after New Property Tax," Bloomberg Markets, September 22, 2016.

As former Fed Vice Chairman Stanley Fischer noted in a speech in June 2017, "[F]inancial crises can, and do, occur without a real estate crisis. But it is true that there is a strong link between financial crises and difficulties in the real estate sector." He added: "The drop in house prices in a bust is often bigger following credit-fueled housing booms, and recessions associated with housing busts are two to three times more severe than other recessions. And, perhaps most significantly, real estate was at the center of the most recent crisis." He noted research finding that there is a 59 percent to 67 percent chance of a recession following a credit and housing boom within three years, depending on how "boom" is defined. Also, see Stijn Claessens, M. Ayhan Kose, and Marco E. Terrones, "What Happens during Recessions, Crunches, and Busts?" Economic Policy, October 2009, vol. 24, no. 60, pp. 653–700.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.