Climate Change and Financial Stability? Recalling Lessons from the Great Recession

Some argue that direct economic damages from climate-related shocks are not big enough to have a notable impact on the economy. However, this argument misses an important lesson from the Great Recession: amplifications in the financial markets. In the 2007-09 recession, reactions in the financial markets substantially amplified the initial losses directly related to household default of subprime mortgages. Recent research found evidence of similar amplification of direct climate damages. For instance, climate-related disasters like hurricanes or flooding can cause housing prices to drop even in the absence of direct hurricane or flood damages.

Does climate change have implications for financial stability? This is a relevant and important question. In fact, many central banks around the world are directly or indirectly monitoring and studying climate risks based on the premise that climate-related risks could affect the stability of the financial system. (An example would be the 2021 report "Climate Change and Financial Stability" by the Federal Reserve Board of Governors.)

An opposing view is that damages from climate change are not going to be big enough relative to the size of the economy to affect the financial system. From a pure cost standpoint, this view is understandable. For example, Hurricane Katrina caused about $161 billion in total damage in 2005, which was only about 1 percent of U.S. GDP that year, a percentage too small to pose a threat to the financial system.

However, this view may be too narrow. In this Economic Brief, I'll explore the importance of accounting for amplified costs of climate-related issues and disasters.

Climate Change and Amplification

The aforementioned view of climate-related disasters misses an important lesson from the 2007-09 recession: The amplifications of small shocks through the financial system matter. The subprime shock triggered a far-reaching financial collapse and a global recession, even though direct losses due to household default on subprime mortgages leading up to the recession were estimated to be at most $500 billion, which were relatively small compared to the subsequent loss of $8 trillion in U.S. stock market values between October 2007 and October 2008.

The macrofinance literature has noted several important amplification mechanisms. One of them is via balance sheet adjustments. An abrupt drop in asset prices — especially in real estate, which is commonly used as collateral for borrowing — caused households and firms to rapidly liquidate their assets. This then further lowered prices, leading to a negative feedback loop that amplified the initial losses.

Another mechanism is uncertainty. For example, the 2008 paper "Collective Risk Management in a Flight to Quality Episode" by Ricardo Caballero and Arvind Krishnamurthy argues that the unusual losses in 2007 caused investors to question the quality of their investments, which led to them selling off risky assets and, in turn, caused abrupt changes in asset prices.

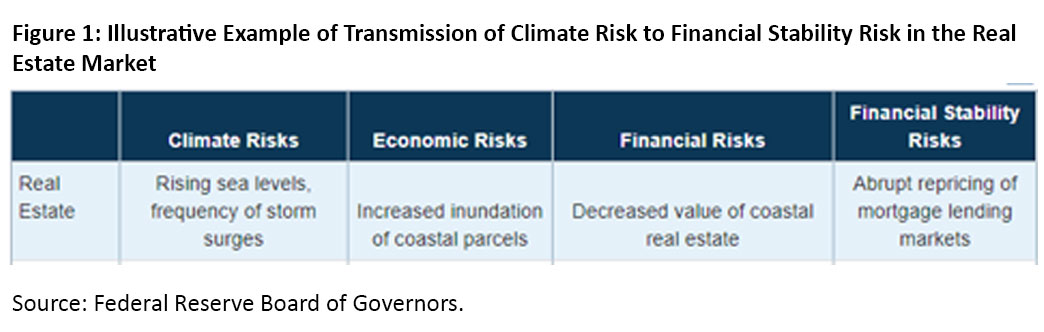

Could these powerful amplification mechanisms again be at play in magnifying climate damages? This question underlies the key policy concern for central banks in thinking about climate change. For example, as illustrated in the figure below from a recent report on climate change and financial stability, the risk of abrupt repricing in housing and mortgage assets is at the heart of the Fed's research into climate risks. The rapidly growing research literature on climate economics and climate finance have yet to provide conclusive answers.

Evidence of Amplifications of Climate-Related Disasters

However, there have been some hints from looking at recent data. Recent empirical research has found evidence that, for example, Hurricane Sandy may have amplified declines in housing prices. The 2021 working paper "Climate Change and Commercial Real Estate: Evidence from Hurricane Sandy" by Jawad Addoum and co-authors finds that Sandy — which made landfall in New York and New Jersey — caused a persistent drop in the prices of coastal commercial properties in Boston, despite being far away from the storm and hence suffering no direct hurricane damage.

This finding echoes those in earlier studies, which found that flood events typically cause sharp declines in the prices of vulnerable homes. Examples include the 2005 publication "Market Responses to Hurricanes" by Daniel G. Hallstrom and V. Kerry Smith and, more recently, the 2021 paper "Flood Risk Belief Heterogeneity and Coastal Home Price Dynamics: Going Under Water? (PDF)" by Laura Bakkensen and Lint Barrage.

What could explain this phenomenon? The aforementioned uncertainty mechanism is one prominent candidate:1 The direct catastrophic damage from Hurricane Sandy in New York and New Jersey may have caused coastal property investors outside those areas to question how exposed they were to similar climate-related risks.

In fact, the 2021 publication "Climate Change and Long-Run Discount Rates" by Stefano Giglio and co-authors finds that real estate investors inside and outside of New York and New Jersey increased their attention to climate risks in the years after Sandy. More generally, as summarized in the 2019 publication "Flood Risk and Salience: New Evidence From the Sunshine State," a growing literature has found evidence that flood risk salience tends to spike directly following a flood event.

All together, these papers suggest that investor reaction in the real estate market may have amplified the direct damages from a large climate-related disaster.

Conclusion

In summary, I believe it is premature to conclude with confidence that climate-related risks pose no threat to the financial system.

Before the Great Recession, the dominant macroeconomic models largely ignored the role of financial frictions and thus the possibility that small shocks can be amplified, as noted in the 2017 article "The Great Recession: A Macroeconomic Earthquake" by Lawrence Christiano. But as we learned, shocks that are small relative to the whole economy can be amplified through reactions in the financial system.

And recent empirical research in climate finance has documented some early evidence that market reactions have already amplified climate damages — for example, the amplification of the direct damages to coastal properties due to Hurricane Sandy and other flood events.

Finally, I also believe that further investigation — both empirical and theoretical — into amplification mechanisms of climate damages is a very promising area for future research. So far, research in climate economics has largely ignored the role of the financial sector in either estimating the social cost of carbon or calculating optimal policy responses.

Toan Phan is a senior economist in the Research Department at the Federal Reserve Bank of Richmond.

Whether the balance sheet mechanism was also active in amplifying the direct damages from Sandy is a question open for future research.

This article may be photocopied or reprinted in its entirety. Please credit the author, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.