Housing Prices in the Fifth District During COVID-19

Introduction

Home listings in Burlington, N.C., approached a median listing price of nearly $300,000 in September 2020—20 percent higher than September 2019. You may be asking: What’s going on in Burlington? But this story does not end with one city in North Carolina; Burlington is hardly an anomaly. Across the Fifth District and nationwide, home price growth has remained strong this year despite the precipitous decline in economic activity brought on by the COVID-19 pandemic. This Regional Matters post presents home listings and price data from Realtor.com along with industry insights to shed light on why regional home prices proved resilient against COVID-19 even as GDP plummeted and unemployment soared.

Home Price Growth Across Business Cycles

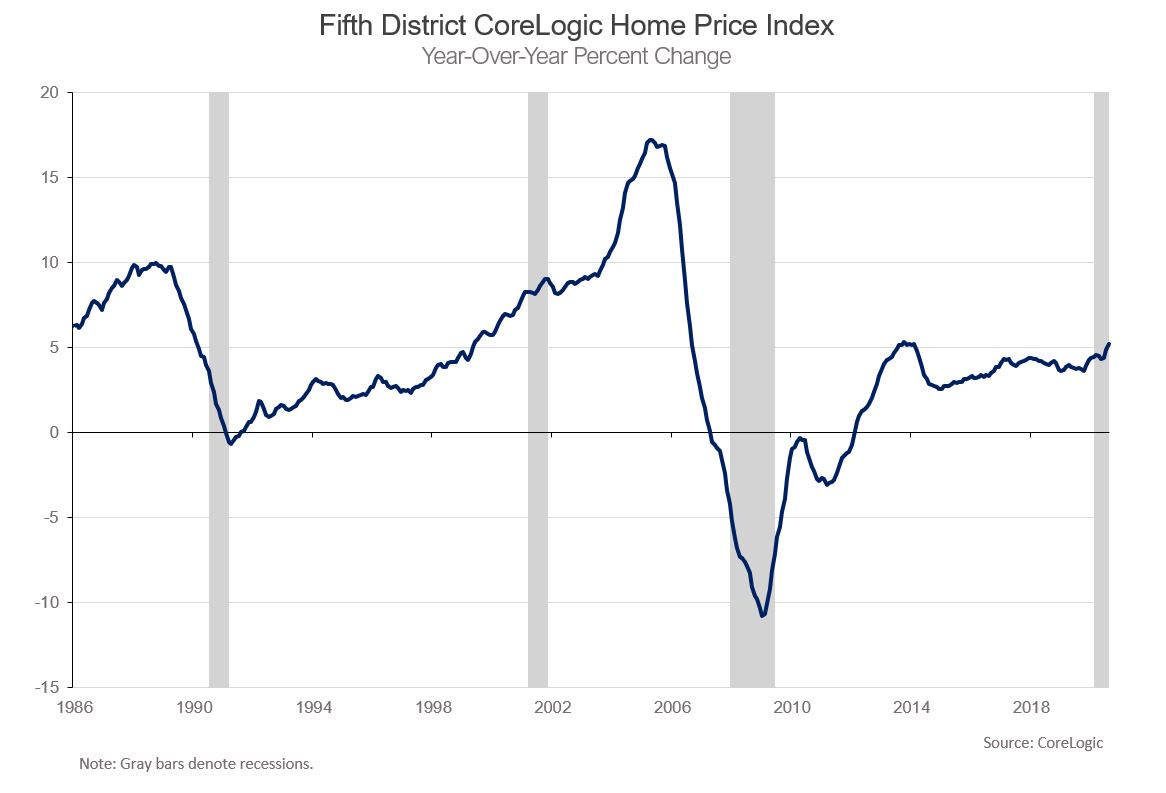

Every economic downturn has its own story, and the movement of home prices across the business cycle is not always straightforward. But one thing is for certain: In the current downturn, home price growth in the Fifth District (and the country overall) has remained solid. According to the most recent data available from CoreLogic Information Solutions, Fifth District home values were up 5.2 percent on a year-over-year basis in August. Looking back at previous downturns, home price growth also remained strong in the early 2000s, which saw a fairly mild recession. By contrast, in the early 1990s and during the financial crisis and Great Recession of the late 2000s, home price growth decelerated sharply, leading into and through those recessions.

Oppositional Demand Shocks

Lost income and economic turmoil can cause a negative demand shock. All else equal, people are less likely to make a home purchase when they are unsure about their future earnings and the state of the economy. In addition, high degrees of uncertainty, like those stirred by a global pandemic, may create pause for someone taking a long-term housing loan. Whether this would yield a long-term decrease in demand or merely a deferment pending the return of more normal conditions, these effects seem highly applicable to the spring of 2020.

On the other hand, these forces may have been countered by historically low interest rates. Fueled in part by monetary policy decisions at the Fed, mortgage rates are the lowest they have been in modern American history. The average 30-year mortgage rate has fallen steadily since early in the year, dropping below 3 percent in August for the first time since Freddie Mac began reporting the information in 1971. For context, the lifetime payment on a 30-year mortgage of $300,000 at 2.8 percent, the current average rate, would amount to $444,000. Last fall, when rates were averaging around 3.7 percent, the lifetime payment would have been $497,000. In other words, even less than a 1 percentage point decrease can have a substantial impact on homebuyers. A rush to buy under these favorable conditions could work to drive prices up.

Bruce Harvey, president and co-owner of the Maryland-based new housing development firm Williamsburg Homes, says that while his business experienced difficulties in March and April, sales momentum has been strong since May. He has found interest rates to be the "major driving force" keeping homebuyers in the market. He said, "People are trying to do one of two things to take advantage of [low rates] right now—buying or refinancing.”

A Supply Slash

Supply data can further explain the phenomenon of strong home price growth. Active listings in the Fifth District were down 45 percent year-over-year in September 2020. As is evident in the fluctuations seen below, seasonality is a regular factor in the real estate market. In contrast with regular seasonality though, there were actually more homes on the market in December 2019 than this summer in the Fifth District. There were also more instances of price increases—sellers raising their asking price in a given month—this summer than any other month in the past several years. According to research from the National Association of Home Builders, in the second quarter of 2020, 30 percent of active homebuyers nationwide reported being outbid by another offer, up from 18 percent in the second quarter of 2019.

The low number of home listings may have a few sources. Harvey noted that many sellers have been skeptical to show their homes through online platforms but also do not want people touring their homes in person. Negative economic sentiment may also have made some sellers presuppose that this spring and summer would be a bad time to sell and make a transition to a new home. Additionally, federal and state forbearance policies have provided relief to homeowners in financial distress who may otherwise have been forced to sell or lose their home through foreclosure.

Conclusion

The entirety of a housing market cannot be represented through aggregate measures, of course. Harvey notes that his firm, which skews toward the luxury market, has been more impacted than many large builders. This has caused him to lower prices and offer incentives, while more modest homes continue to be listed higher and sell with ease. The future of the market, like much about these tumultuous times, remains uncertain. For as long as interest rates remain low, they will provide some incentive for customers to buy homes. In a press conference on June 10, Fed Chair Jerome Powell said of the Fed's policies: "We're not thinking about raising rates, we're not even thinking about thinking about raising rates." It is also possible that homeowners who intended to sell this year may induce a surge in listings following the return to more normal conditions. And it remains in question how homeowners will fare once forbearance programs end. Thus far, though, it appears that the regional housing market has proven more resilient than may have been anticipated given the historic drop in GDP and widespread labor market dislocations.

Have a question or comment about this article? We'd love to hear from you!

Views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Richmond or the Federal Reserve System.