Mortgage and Student Loan Forbearance During the COVID-19 Pandemic

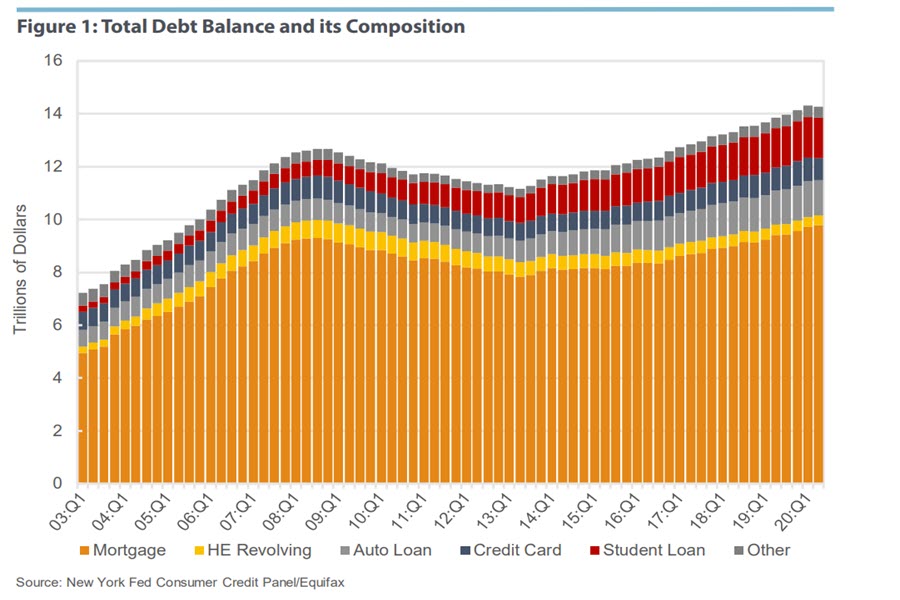

In addition to direct financial supports for consumers — including unemployment insurance and economic impact payments — federal and state governments and individual financial institutions have enacted forbearance policies in response to the COVID-19 pandemic.1 Forbearance is a special arrangement that allows borrowers to suspend loan payments for a set period of time. The forbearance policies enacted by the federal government through the coronavirus relief bill (commonly referred to as the CARES Act) addressed two consumer credit products: mortgages and student loans.2 Mortgage debt and student loan debt rank as the number one and two largest categories of outstanding household debt, respectively. According to data from the New York Fed Consumer Credit Panel (CCP), in the second quarter of this year, there was $14.27 trillion in total household debt — 69 percent of that balance was mortgage debt, while 11 percent was student loans. (See Figure 1 below.)3

Current forbearance programs are intended to help individual households, loan servicers, and the overall economy. Forbearance helps households maintain financial security by supporting their ability to allocate spending toward things they need now and to avoid delinquency or default. It also helps prevent hits to their credit score. Forbearance helps loan servicers mitigate losses that would occur through more costly default. On a large scale, helping tens of millions of households reallocate their spending from debt service to current consumption of goods and services directly supports current economic activity. Forbearance also prevents a potential sudden and widespread wave of defaults that could have severe negative effects on the economy overall.

Still, forbearance only provides short-term relief, and the debt must be reckoned with at some point in the future. While forbearance can be highly effective at preventing serious delinquency in the short term, the COVID-19 pandemic may present a much longerterm challenge for both borrowers and servicers. Mortgage and student loan borrowers may face economic hardship and uncertainty that last well beyond the forbearance term, while mortgage servicers may face liquidity strains as they simultaneously provide relief to their customers and fulfill their payment obligations to investors. This special report aims to contextualize the existing forbearance programs by discussing (1) how the CARES Act forbearance programs are currently designed; (2) how mortgage and student loan borrowers were faring pre-COVID-19; and (3) what the financial future of households and servicers might look like as the programs continue and end.

How Are CARES Act Forbearance Policies Designed?

The CARES Act, which became a law on March 27, establishes mortgage and student loan forbearance programs that are designed to provide substantial support and minimal administrative burden to borrowers. While a mortgage or student loan borrower is in forbearance under the CARES Act, their loan servicer cannot charge any additional fees, penalties or interest, and they cannot report missed payments to the credit bureaus. Although the CARES Act does not specify repayment terms, federal guidance prohibits servicers from requiring customers to pay the full balance of missed payments as soon as their forbearance period ends (also known as "lump sum" or "balloon" payments). Instead, servicers should ensure borrowers know all of their repayment options.

CARES Act mortgage forbearance eligibility extends to all borrowers with a federally-backed mortgage — that is, a mortgage insured, purchased, and/or securitized by a federal entity, such as the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), Fannie Mae, or Freddie Mac. This covers approximately 70 percent ($7 trillion) of single-family home mortgages.4 The CARES Act makes these borrowers eligible for forbearance if they submit a request to their loan servicer and affirm that they are experiencing economic hardship that is directly or indirectly linked to the COVID-19 pandemic. No additional documentation is required. The CARES Act guarantees an initial forbearance period of 180 days and allows borrowers to request an additional 180-day extension.

Notably, the CARES Act did not provide specific support for mortgage servicers, but support has emerged since its passage. Support was of particular concern to nonbank servicers, which did not have access to the same liquidity facilities as banks. As a general rule, mortgage servicers are required to advance principal and interest payments even when those payments are missed due to forbearance. When forbearance is short and targeted, this is not a problem because mortgage servicers — even those that are nonbank servicers — typically have enough capital on hand to cover the shortfall and still make good on their required obligations. But current mortgage forbearance was expected to be potentially widespread. Consequently, Fannie Mae and Freddie Mac have put a four-month cap on servicers'obligations to deliver missed payments. And Ginnie Mae, which guarantees payments to investors in mortgage-backed securities (MBS) backed by FHA, VA, and other federally guaranteed or insured loans, created a lending facility that servicers can access to cover payment obligations.

Of course, an economic downturn affects more than just homeowners and mortgage servicers. Renters are similarly vulnerable. Although a full examination of COVID-19 rental housing support falls outside of the scope of this publication, a range of federal, state, and local policies were enacted to help renters stay in their homes, including eviction moratoriums and rent relief.5 Additionally, like single-family homeowners, landlords with federally-backed mortgages are eligible for CARES Act forbearance (originally a 90day period that was extended by another 90 days). Participating landlords may not evict tenants for financial hardship through their forbearance term. Still, some research suggests that more support is needed, and there are concerns about renter housing stability once eviction moratoriums are lifted.6

Turning to forbearance policy for student loans, relief for borrowers has been even more automatic than for mortgages. The federal government is the primary provider of student loans in the country, and the CARES Act automatically places all federal student loans owned by the Department of Education (ED) in administrative forbearance at 0 percent interest from March 13 to September 30. Borrowers do not have to request relief based on financial hardship. Prior to the passage of the CARES Act, about 88 percent ($1.340 trillion) of total outstanding federal student loans were ED-owned, covering 42 million borrowers.7 Student loans that were excluded from automatic forbearance include Federal Family Education Loan (FFEL) Program loans owned by commercial lenders and Federal Perkins Loans held by schools (which combined make up the remaining 12 percent of outstanding federal student loans), plus about $120 billion in outstanding private loans made by financial institutions, state agencies, or schools.8

Do borrowers without a federally-backed mortgage or ED-owned student loan have relief options? The short answer is: maybe. Federal and state financial regulators issued a joint statement in April that broadly encourages mortgage servicers to be flexible when responding to customer requests and assures financial institutions that they will not face enforcement actions as they respond to mortgage-borrower requests.9 Although forbearance is not guaranteed, a number of mortgage servicers have announced that forbearance or other relief programs are available to those impacted by the COVID-19 pandemic.10 Similarly, many student loan servicers are offering short-term relief to borrowers, but the terms vary, and borrowers must contact the loan servicer to request relief. Some states, including Virginia, have supported this process by entering into a formal agreement with student loan servicers to give state residents relief for loans that were excluded from the CARES Act.11

How Were Borrowers Faring Prior to the Pandemic?

Attention is starting to turn to the question of borrowers' ability to service their debt after forbearance ends. One way to gain insight into the future is to look at how borrowers were faring before the pandemic hit. For broad context, it's worth noting that mortgage holders are in general economically advantaged relative to student loan holders. For example, data from the Federal Reserve's Survey of Consumer Finances show that families with mortgages tend to have much higher net worth than families with student loans.12 In this section we look specifically at the issue of borrowers' ability to make their payments by examining the prevalence of mortgage and student loan delinquency and forbearance prior to COVID-19.

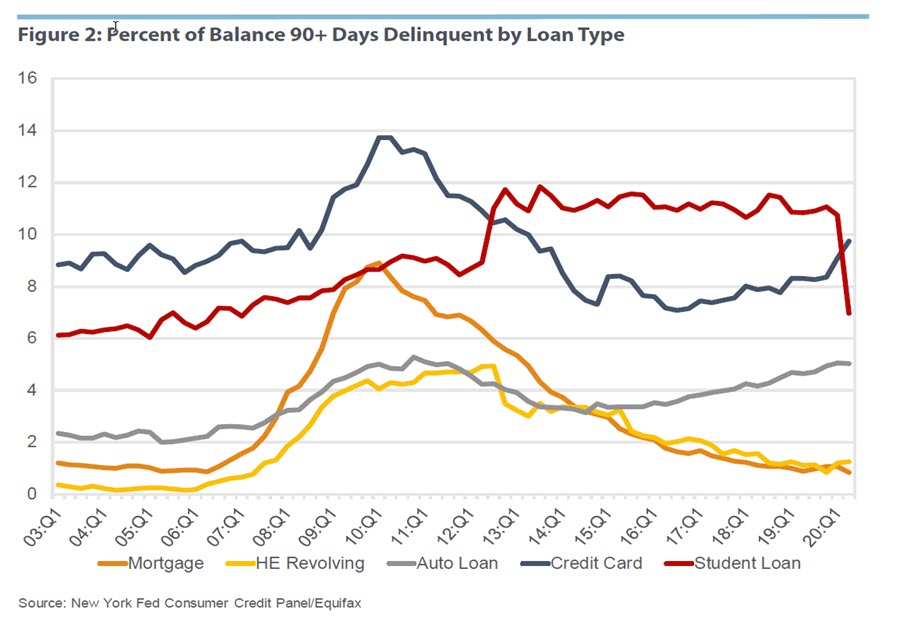

Prior to the pandemic, indicators of borrowers' ability to stay current on their payments varied significantly between mortgages and student loans. In the last quarter of 2019, serious mortgage delinquency — defined in the New York Fed's Quarterly Report on Household Debt and Credit as the percent of outstanding debt that was 90 days or more past due (including default) — was quite low at 1.1 percent. By contrast, serious student loan delinquency was 11.1 percent.

As shown in Figure 2 below, delinquency rates have long diverged between mortgages and student loans. Mortgage delinquency surged during the Great Recession but has otherwise been relatively low and has decreased over time. Alternatively, student loan delinquency is relatively high and has increased over time.

Several factors help explain these pre-pandemic level and trend differences. In the mortgage market, credit terms are tailored to individual borrowers and reflect, among other considerations, the value of the house being acquired. But federal student loan borrowing limits and interest rates are generally uniform and disconnected from an assessment of a student's ability to repay. In addition, mortgage loans are secured by real property, while student loans are unsecured and fund intangible human capital (i.e., knowledge and skills). If a mortgage borrower gets into significant financial trouble, debt relief may be available through modifying the loan, parting with the home, or seeking relief through the bankruptcy process. Student loan borrowers may be eligible to pause or reduce payments, but they cannot sell their human capital like other assets, and in most cases, they cannot discharge their loans in bankruptcy.

Mortgage delinquencies spiked during the Great Recession and trended downward as the economy recovered. Since the recovery, lending standards have tightened, house price growth has been positive and relatively stable, and mortgage debt service payments as a percentage of disposable income have fallen to their lowest level in 40 years.13

By contrast, student loan delinquency has remained elevated in the post-Great Recession period. Part of this is explained by a portion of large student loan balances that are delinquent; a small number of borrowers have large balances, but those balances make up the majority of outstanding student loan debt. Research also indicates that much of the rise in serious delinquency can be explained by a Great Recession surge in enrollment and borrowing by nontraditional student loan borrowers who attended private for-profit and public two-year colleges.14 These students had relatively high noncompletion rates and weak labor market outcomes. They also tended to be first-generation borrowers from lower-income families.

Beyond pre-pandemic delinquency rates, what do we know about forbearance rates prior to COVID-19? Before the pandemic, the mortgage and student loan markets handled forbearance in very different ways.

Prior to the pandemic, the mortgage industry did not systematically track the number of mortgages in forbearance, because forbearance was either highly personalized to the borrower, or enacted in response to a shorter-term disaster. Instead the industry tracked delinquency, default, foreclosure, and short sale rates to identify when forbearance may be necessary and to understand the efficacy of forbearance in preventing home loss. Data from forbearance programs enacted after the 2017 hurricane season help illustrate this tracking method. The 2017 hurricane season led to a spike in serious delinquencies (90+ days past due) in disaster affected counties, and forbearance programs helped prevent home losses over the following year. According to Black Knight's McDash mortgage performance data, these forbearance programs helped bring the home loss rate down to 1 percent among seriously delinquent borrowers in hurricane affected areas, despite the initial spike in serious delinquency.15

On the student loan side, the office of Federal Student Aid provides deferment and forbearance options to federal student loan borrowers who experience financial hardship. The office reports participation in these programs on a quarterly basis. At the end of last year, 5.6 percent of the total federal student loan balance was in discretionary forbearance or deferment due to unemployment or economic hardship (1.79 million borrowers). This was in addition to the much higher percentage of loans in serious delinquency.

Where Do Forbearance Rates Currently Stand, and What Might the Future Hold After Programs End?

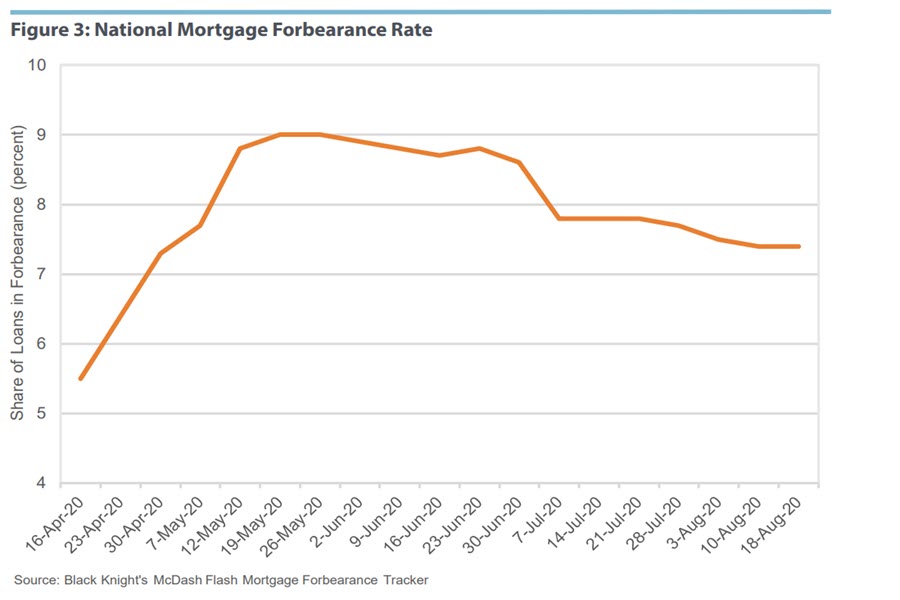

Indications are that mortgage borrowers and servicers as a whole are weathering the storm better than expected. In mid-April, Black Knight announced that they would be tracking mortgages in forbearance through their McDash Flash Forbearance Tracker. As of August 18, 3.9 million homeowners were in forbearance. This represents 7.4 percent of all mortgages and $833 billion in unpaid principal balance. (See Figure 3 below.)16 These figures are down from the late-May peak of 4.76 million loans in forbearance — or 9.0 percent of all mortgages — representing over $1 trillion in unpaid principal. Although this may seem high, the forbearance uptake rate is lower than some expected, especially worst-case scenarios that put the expected rate near 30 percent.17

Second quarter data on student loan forbearance is not yet available from the office of Federal Student Aid. But, given that the vast majority of outstanding federal student loans were automatically placed in administrative forbearance, we expect to see a major shift in loans from repayment status (including delinquency status) to forbearance. We can already see this shift from the CCP data in Figure 2 above. In the second quarter, there was a sharp decline in the percent of debt counted as seriously delinquent.

What might these borrowers face going forward? On August 8, President Donald Trump issued an Executive Memorandum extending forbearance for ED-owned federal student loans through the end of the year, beyond the CARES Act expiration date of September 30.18 Even so, borrowers face some significant headwinds. As of writing this publication, the $600 per week in additional federal unemployment insurance (UI) benefits has expired, and Congress has not passed other additional stimulus measures. A separate Executive Memorandum established additional UI up to $400 per week, but the degree to which that money will reach out-of-work individuals remains unclear.19 For borrowers who previously received UI and economic impact payments, a drop in disposable income will make it more difficult for them to make ends meet overall, including servicing other debt. The July employment report also indicated that the jobs recovery may be slowing, potentially further hampering future income prospects for borrowers.20

Should hard times continue beyond when automatic forbearance eventually ends, federal student loan borrowers will be able to access standard deferment, forbearance, and income-driven repayment programs, just like they could before the pandemic. But enrollment in these programs is not automatic; borrowers will have to overcome administrative hurdles to determine their eligibility and to secure support. And these programs are also not available to borrowers whose loans are in default status (unless these borrowers go through loan rehabilitation or consolidation first). These borrowers face the prospect of a January restart in interest accrual, wage garnishment, and offsets of tax refunds and Social Security benefits, which has been on pause since March.

Mortgage borrowers have a longer time horizon for low hurdle, CARES Act forbearance support than student loan borrowers (up to 360 days). But some of the same headwinds facing student loan borrowers, namely exhaustion of other government benefits and a slowing employment recovery, could result in financial hardship for mortgage borrowers as well. For borrowers with both a mortgage and student loans, the cessation of student loan forbearance could also make it more difficult for homeowners to stay current on payments. On the positive side, record low mortgage interest rates may bolster ability to repay for borrowers eligible to refinance.21 The strong housing market overall — including stable house prices, low interest rates, and homeowners' relatively high equity — generally provides a buffer against pandemic-driven economic shocks and incentivizes borrowers to continue payment.

Where Does That Leave Us?

CARES Act mortgage and student loan forbearance policies support individual borrowers and help stabilize markets. Although these policies and other government support have not eliminated financial stress completely, there are some positive signs about their efficacy. The CARES Act UI benefits and economic impact payments helped households absorb initial financial shocks, and in some cases, even put the household in a better financial position; a portion of the population either saved their economic impact payment or used the money to pay down debt.22 In addition, with forbearance programs in place, mortgage delinquency has remained low, and the administrative pause in student loan repayment has kept borrowers from falling into (or further into) delinquency.

Notably, mortgage forbearance uptake has been moderate, compared to projected uptake, and is declining. Mortgage servicers initially experienced liquidity strain with forbearance provision, but liquidity and regulatory supports appear to have provided stability. The picture is opaquer on the student loan side. With all borrowers automatically placed in forbearance, we lack a good understanding of the true degree of uptake — but pre-COVID-19 measures of ability to pay indicate that a relatively high percentage of student loan borrowers were already struggling with repayment.

All that said, the next several months will be important for household financial security, and there are several related issues that the Richmond Fed is continuing to monitor: What will employment recovery look like, and how will potential large-scale industry shifts affect workers and households across all income brackets? What is the relationship between local COVID-19 outbreaks and household financial distress?23 How will the expiration of government benefits, or the introduction of new stimulus measures, affect household balance sheets? Once mortgage and student loan forbearance programs eventually end, it will be especially important to monitor which borrowers are struggling with repayment, so that policymakers can consider targeted options to support these individuals.

Emily Wavering Corcoran is a research analyst, and Nicholas Haltom is a senior manager for research/regional and community analysis in the Research Department of the Federal Reserve Bank of Richmond.

For a deeper discussion of unemployment insurance and economic impact payments, see Surekha Carpenter and Laura Dawson Ullrich, "Unemployment Benefits and Changes under the CARES Act," Richmond Fed Regional Matters, May 22, 2020, and Surekha Carpenter and Emily Wavering Corcoran, "COVID-19 Financial Support: Who’s Covered and Who’s Not?" Richmond Fed Regional Matters, May 6, 2020.

The full name of the CARES Act is the Coronavirus Aid, Relief, and Economic Security Act.

See the New York Fed's Quarterly Report on Household Debt and Credit, 2020: Q2.

For the composition of the mortgage market, see page 6 in "Housing Finance at a Glance: A Monthly Chartbook, July 2020," Urban Institute.

See "Protection for renters." Consumer Financial Protection Bureau.

Strochak, Sarah, Aaron Shroyer, Jung Hyun Choi, Kathryn Reynolds, and Laurie Goodman. "How Much Assistance is Needed to Support Renters through the COVID-19 Crisis?" Urban Institute, June 2020.

For the composition of federal student loans, see the "Federal Student Loan Portfolio" from the office of Federal Student Aid.

For the dollar value of private student loans outstanding, see MeasureOne.

See "Federal Agencies Encourage Mortgage Servicers to Work With Struggling Homeowners Affected by COVID-19," Office of the Comptroller of the Currency, April 3, 2020.

The American Bankers Association provides examples of efforts taken by banks.

See "Governor Northam Announces Expansion of Payment Relief for Student Loan Borrowers," April 29, 2020.

See pages 936 and 1,116 in the "2016 SCF Chartbook."

See the Federal Reserve Board's report on "Household Debt Service and Financial Obligations Ratios."

Looney, Adam, and Constantine Yannelis. "A Crisis in Student Loans? How Changes in the Characteristics of Borrowers and in the Institutions They Attended Contributed to Rising Loan Defaults." Brookings Papers on Economic Activity, Fall 2015.

See Black Knight's Special Briefing, "COVID-19: Impact on the Real Estate and Mortgage Markets."

See "Number of Loans in Forbearances Remains Flat," Black Knight Blog Post, August 21, 2020.

For a discussion of actual versus projected uptake, see Kristopher S. Gerardi, Carl Hudson, Lara Loewenstein, and Paul S. Willen, "An Update on Forbearance Trends," Atlanta Fed Real Estate Research blog, July 2, 2020.

See "Memorandum on Continued Student Loan Payment Relief During the COVID-19 Pandemic," August 8, 2020.

See "The Employment Situation – July 2020." U.S. Bureau of Labor Statistics.

For a related discussion of the Fed's purchase of mortgage-backed securities to support the functioning of the mortgage market and to put downward pressure on mortgage rates, see Borys Grochulski, "Federal Reserve MBS Purchases in Response to the COVID-19 Pandemic," Richmond Fed Economic Brief No. 20-08, July 2020.

See "How Are Americans Using Their Stimulus Payments?" based on results from the U.S. Census Bureau's Household Pulse Survey, June 2020.

See Kartik B. Athreya, José Mustre-del-Río, and Juan M. Sanchez, "COVID-19 and Households' Financial Distress, Part 4: Financial Distress and the Second Wave of COVID-19 Infections," Richmond Fed Special Report on the Economic Impact of COVID-19, July 2, 2020.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.