Zhu Wang and Russell Wong discuss the shutdown in the production of pennies in the U.S. and their research on how the penny's demise is expected to impose costs on consumers. Wang is vice president for research in financial and payments systems and Wong is a senior economist, both at the Federal Reserve Bank of Richmond.

Economic and Financial Education

Enhance your understanding of economics, personal finance and the Federal Reserve.

Updating Results

Updating Results

Daniel Davis talks about the importance of understanding the economies of small towns and rural areas. He also discusses the work that the Federal Reserve Bank of Richmond has done to examine these economies and connect with community leaders, including the recent launch of the Richmond Fed's Center for Rural Economies and Investing in Rural America webinar series. Davis is group vice president for regional economics at the Richmond Fed and director of the center.

Grey Gordon and Felipe Schwartzman discuss the creation and evolution of the Federal Reserve's monetary policy framework and the Fed's current review of the framework. Gordon and Schwartzman are senior economists at the Federal Reserve Bank of Richmond.

Findings suggest there are meaningful differences in the content of recommendation letters correlated with the gender, race, and ethnicity of the candidate, which matter in predicting early career outcomes.

David Cox, Adin Hammond and Tyrese Wheaton describe their summer at the Federal Reserve Bank of Richmond interning in three different departments.

The Office of the Comptroller of the Currency (OCC), the Federal Reserve Bank of Richmond (FRBR) and the Federal Deposit Insurance Corporation (FDIC) are sponsoring a virtual workshop on the Community Reinvestment Act.

Designed for community-based organizations, this workshop will review the regulation and discuss ways through which community organizations can collaborate more effectively with banks. Topics discussed include an overview of the CRA, understanding the impact of bank performance context, the types of bank activities that qualify for CRA consideration and strategies to develop successful partnerships with banks.

After almost three years, pandemic-era SNAP enhancements ended this spring. Another support — the pause on federal student loan payments — is ending this fall. Are households ready?

Stephanie Norris

Associate Director, Community College Initiative

Join fellow economic educators as Federal Reserve Bank education specialists share their content knowledge and lots of complimentary teaching tools for the economics classroom.

Annamaria Lusardi on financial literacy, seniors versus scammers, and learning from the mistakes of NFL players.

David A. Price

The three leading explanations for the "retirement savings puzzle" are the desire to insure against uncertain lifespans and medical expenses, the desire to leave bequests to one's heirs, and the desire to remain in one's own home. We discuss the empirical strategies used to differentiate these motivations.

Eric French, John Bailey Jones and Rory McGee

Adam Scavette provides an approach to interpreting news coverage of the economy and applies that framework to the major economic stories of 2022. Scavette is a regional economist based at the Baltimore, Md., branch of the Federal Reserve Bank of Richmond.

A key concern about the Biden administration's debt forgiveness program is its inflationary impact. This post provides a back-of-the-envelope calculation of this impact, based on a specific view of the federal budget and how it interacts with monetary and fiscal policies.

Aubrey George and Thomas A. Lubik

Grey Gordon discusses his research and other economists' work on the macroeconomic and policy factors that shape the price of higher education. Gordon is a senior economist at the Federal Reserve Bank of Richmond.

Does everyone have the same set of choices when it comes to retirement and other financial decisions pertaining to aging, and is there anything we can do about disparities in access to those choices? Charles Gerena poses these questions to the three panelists from the District Dialogues event in August 2022 titled "The Economics of an Aging America."

There can be high returns to earning an economics degree, helping to draw students to the profession.

John Mullin

Some believe rises in financial aid such as student loans cause corresponding rises in tuition. But reality seems much more nuanced.

Grey Gordon and Aaron Hedlund

How many more borrowers working in public services recently became eligible for student loan forgiveness in the Fifth District?

Elizabeth Link, Jessie Romero and Sarah Turner

We study the implications of mixing economics and personal finance standards in a high school course.

Stephen Day, Evelyn Nunes and Bruno Sultanum

Eight times a year, Richmond Fed economists, along with visitors from universities and policy institutions throughout the world, gather in Richmond for CORE (Collaboration of Research Economists) Week.

Nearly two-thirds of academic economists have taken on work as paid consultants at some point in their careers — and two in five have done so within the past five years.

David A. Price

This post explains how the newest round of stimulus dollars can be used to help governments and communities recover from the pandemic.

In Fifth District states, as in most of the nation, spending appears to be falling short of what is required to support students most in need.

Nicholas Haltom

Senior Manager

For Financial Literacy Month, two teachers in South Carolina discuss how they help high school students learn about economics and personal finance.

Educational attainment has increased across the Fifth District, but there are large geographic and racial disparities, according to the 2019 American Community Survey estimates.

Jacob Crouse

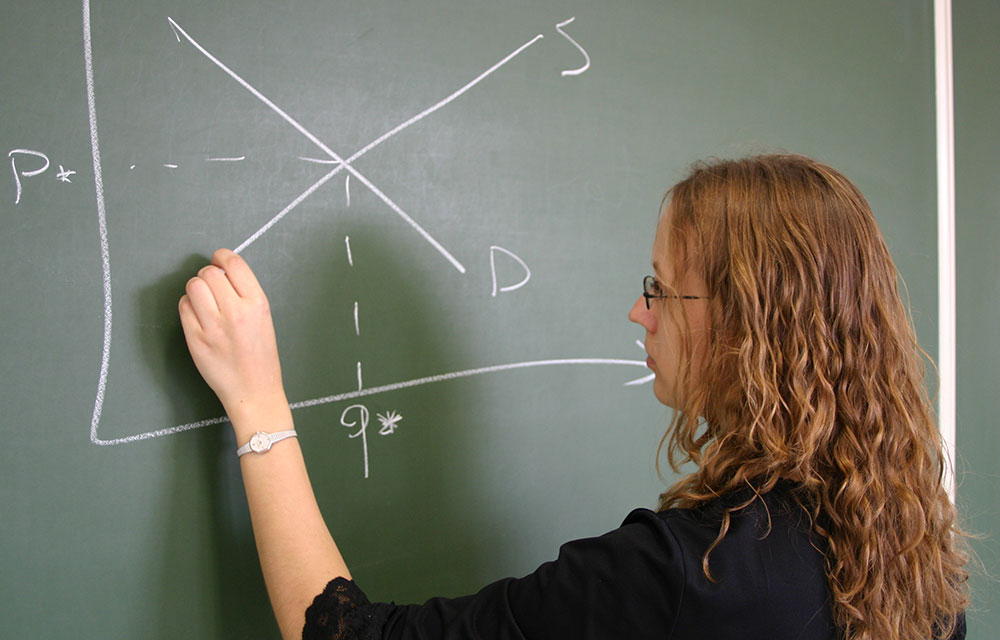

Sarah Gunn and David Bass discuss economic and financial literacy and the role of the Federal Reserve in educating teachers, students and the general public.

Richmond Fed Research Director Kartik Athreya spoke about the benefits of a market system — and the places where that system falls short.

Kartik Athreya

Executive Vice President and Director of Research

The Richmond Fed's museum teaches students about the roles that individuals and the Federal Reserve play in the economy.

Hailey Phelps

As the COVID-19 pandemic forced schools to shift their approach to instruction, the Fed and other economic and financial literacy organizations pivoted, too.

Sarah Gunn, Nicholas Haltom and Donovan Pearce

Forbearance programs are allowing mortgage and student loans borrowers to pause their payments. How are borrowers faring and what happens when these programs end?

Emily Wavering Corcoran and Nicholas Haltom

COVID-19 has disrupted traditional higher education institutions and is forcing institutions to make substantial changes to their plans for the coming academic year.

Lucas Moyon and Laura Dawson Ullrich

Disruptions to schooling can have long-term educational and economic effects.

The authors forecast the effects of COVID-19 on loan-delinquency rates under three scenarios for unemployment and house-price movements.

Individuals experience frequent occupational switches during their lifetime, and initial worker characteristics are predictive of future patterns of occupational switching.

Aspen Gorry, Devon Gorry and Nicholas Trachter

The fracking boom might have led workers to forego educational opportunities.

Through an empirically-disciplined human capital model, we demonstrate that the value of college varies dramatically across US high school completers.

When children enter a parent's profession, they probably aren't doing it blindly — they may have smart economic reasons. What's behind this footstep-following phenomenon?

David A. Price

Since 2011, BMW's South Carolina plant has been expanding its apprenticeship program to help grow a tech-savvy workforce.

Helen Fessenden

There are large differences across school districts in enrollment and attendance at high-resource colleges and universities.

Emily E. Cook, Jessie Romero and Sarah Turner

Why isn't the U.S. producing more college graduates? Two key — and related — factors appear to play a role in college enrollment and completion: socioeconomic status and preparedness, broadly defined to include both academic preparation and the knowledge needed to make informed choices about college.

We document the growth in higher education costs and tuition over the past 50 years.

John Bailey Jones and Fang Yang

A theory of education is built and contrasted empirically to find that (i) option value explains a large part of returns to enrollment, (ii) enrollment in academic two-year colleges is driven by the option to transfer up, and (iii) the value of the stepping stone is small.

Why do kids drop out of high school, and what can be done to help them finish?

Are investors ignoring financial advice to their detriment? Research by a number of economists suggests otherwise. Using more detailed lifecycle models, they find that young investors may be considering a number of risk factors not captured by simple investment rules of thumb.

This paper shows that dispersion in the likelihood of college noncompletion, and to a lesser extent risks to earnings over the life cycle, may strongly limit the response of aggregate human capital investment to further increases in the U.S. college earnings premium.

Kartik B. Athreya and Janice Eberly