Navigating Energy Booms and Busts

The fracking revolution has created new job opportunities, but are workers prepared for the fluctuations of the energy economy?

In 1956, Shell Oil Co. researcher M. King Hubbert predicted that U.S. oil and gas production would begin to decline after 1970. This theory of "peak oil" caught on quickly when it seemed that Hubbert was spot on. According to the U.S. Energy Information Administration, crude oil production grew to just shy of 10 million barrels per day in 1970 and then declined to roughly half that over the next three decades. Natural gas production kept growing a bit longer, until 1973, before declining as well.

Recently, however, oil and gas drilling have been making a comeback. Oil production is nearly back to its previous peak, and natural gas production has surpassed its 1973 high point. In 2017 and 2018, the United States extracted so much oil and gas that it became a net exporter for the first time in over half a century. The twin developments of hydraulic fracturing ("fracking") and horizontal drilling are responsible for this boom. They have allowed firms to tap into previously difficult to reach deposits of oil and natural gas in shale rock formations throughout the country. (See "The Once and Future Fuel," Region Focus, Second/Third Quarter 2012.)

For states sitting on top of rich shale oil and gas reserves, such as North Dakota, Texas, Pennsylvania, Ohio, and West Virginia, the fracking boom has brought huge job opportunities. From 2007 through 2014, the oil and gas industry added roughly 60,000 jobs on net during a period when many industries were still reeling from the Great Recession.

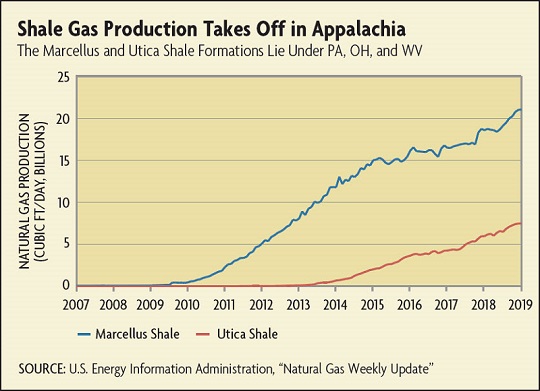

Much of the boom in natural gas extraction has been driven by activity along the Marcellus shale formation underlying where Pennsylvania, Ohio, and West Virginia meet. From the beginning of 2007 to the end of 2018, the Marcellus shale region went from producing a million cubic feet of gas per day to over 21 billion cubic feet per day, a 21,000-fold increase. (See chart below.) The shale revolution has resulted in huge economic opportunities in energy extraction, construction, and related fields. But are some workers giving up their education, and future opportunities, to get in on the boom?

"Caution: Pipeline Construction Ahead," Regional Matters, June 29, 2018.

"Expanding the Scope of Workforce Development," Economic Brief No. 14-05, May 2014.

"The Prevalence of Apprenticeships in Germany and the United States," Economic Brief No. 14-08, August 2014.

A Different Kind of Boom

Early on, fracking companies needed a lot of labor to transport materials and build the wells and pipelines. But Denova says that in Pennsylvania those jobs were short lived. Dropping out of school to work may be less attractive if the job is expected to only last about a year rather than a decade, as in the case of the coal and oil booms of the 1970s.

Additionally, many of the shale well construction jobs don't always go to locals, says Jen Giovannitti, president of the Benedum Foundation and a former community development manager at the Richmond Fed. "The companies doing the initial drilling and exploration are often out-of-town companies that have the ability to move their workforce from site to site."

A study by Riley Wilson of Brigham Young University confirmed that the surge in demand for fracking workers generated a "sizable migration response" across shale regions. These effects may have muted some of the incentives for local students to drop out and work. Once the wells were constructed, shale firms needed workers to operate them, but those positions are not low skill.

"The technicians who run the wells all need at least two years of training to operate the complex systems," says Paul Schreffler. From 2011 to 2016, he served as dean of the School of Workforce Education at Pierpont Community and Technical College in Fairmont, W. Va. "Companies couldn't find enough of those workers, no matter how much they were willing to pay."

Firms began turning to local community colleges and technical schools, like Pierpont, to train workers for those jobs. Pierpont was an early participant in ShaleNET, an effort to develop those training and certification programs across shale oil and gas regions. The program received initial federal funding from the U.S. Department of Labor in 2010. Energy companies helped to develop curricula and also provided funding, instructors, and apprenticeship opportunities for students. Although Schreffler says firms were committed to student development, some students were still lured away from their studies by the opportunities in the industry.

"The companies right now are so eager for workers that they are hiring students right out of programs," says Elizabeth McIntyre, director of the Tristate Energy and Advanced Manufacturing (TEAM) Consortium that connects schools and employers across western Pennsylvania, eastern Ohio, and northern West Virginia.

In the case of both technicians and lower-skilled positions, though, students who left school to work in the shale industry may not be out for good. The study by Emery, Ferrer, and Green that looked at the oil boom in Alberta during the 1970s found that while postsecondary education attainment fell initially, it later recovered after the boom ended. The authors hypothesized that individuals who went to work in the oil fields instead of going to school were able to save enough money to make it easier to go back to school once the boom ended. In contrast, they found that the cohorts of students who came of age after the oil boom had gone bust were less likely to go to college, perhaps because they did not have the same opportunity to earn the premium wages in the energy sector that would have helped them cover the costs of higher education.

"Are people worse off for having not pursued college because of an energy boom?" asks University of Pittsburgh's Weber. "Suppose I graduate from high school and instead of going to college, I go to work in a shale-related industry. When the boom goes bust, maybe I get a two-year degree in a field I'm interested in and see a demand for, or maybe I go to college with a clearer focus and more money so I don't need to borrow as much. It's not clear to me that that scenario is so problematic."

Of course, that partly depends on the drive and circumstances of each individual and may also depend on his or her age when the boom ends. Kerwin Charles and Erik Hurst of the University of Chicago and Matthew Notowidigdo of Northwestern University studied the educational effects of the U.S. housing boom and bust that lasted from the late 1990s to the late 2000s. They found that the boom in housing demand drew many young people into related sectors, including construction and real estate. But unlike the case of the Alberta oil workers, after the housing market collapsed, educational attainment for individuals who had deferred school remained low, suggesting that many did not return to their studies.

"Once you start working and start a family, it can become very difficult to go back to college," says Weber. "So I could see different scenarios playing out."

Preparing for the Future

Fulfilling the boom demand for workers is important but so is having a plan for the bust.

"I think everyone knows that the energy sector is very volatile when it comes to employment," says Gabriella Gonzalez, a researcher at the RAND Corporation who studies the energy sector in Pennsylvania, Ohio, and West Virginia. She has also been involved in promoting education and industry partnerships in that region.

At the national level, signs of a slowdown are already here. Employment in shale oil and gas extraction peaked in 2014 and has now declined to pre-boom levels. In places like West Virginia, where the shale boom started a bit later, employment has held steady so far, but growth has largely plateaued. (See charts below.) Both signs point to one truth that experienced workers in the energy sector know well: Booms don't last forever.

Readings

Black, Dan A., Terra G. McKinnish, and Seth G. Sanders. "Tight Labor Markets and the Demand for Education: Evidence from the Coal Boom and Bust." Industrial and Labor Relations Review, October 2005, vol. 59, no. 1, pp. 3-15. (Article available with subscription.)

Cascio, Elizabeth U., and Ayushi Narayan. "Who Needs a Fracking Education? The Educational Response to Low-Skilled Biased Technological Change." Manuscript, Feb. 21, 2019.

Emery, J.C. Herbert, Ana Ferrer, and David Green. "Long-term Consequences of Natural Resource Booms for Human Capital Accumulation." Industrial and Labor Relations Review, June 2012, vol. 65, no. 3, pp. 708-734. (Article available with subscription.)

Marchand, Joseph, and Jeremy G. Weber. "The Local Effects of the Texas Shale Boom on Schools, Students, and Teachers." University of Alberta Working Paper No. 2017-12, January 2019.

Rickman, Dan S., Hongbo Wang, and John V. Winters. "Is Shale Development Drilling Holes in the Human Capital Pipeline?" Energy Economics, February 2017, vol. 62, pp. 283-290. (Article available with subscription.)

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.