Student Debt Cancellation Raises the Price Level and Inflation

Relief for student loan borrowers may be on the way, but how might forgiving billions of dollars in student loans impact inflation?

On Aug. 24, the Biden administration took steps to fulfill a major campaign promise by announcing a three-step plan for student debt relief. Of the plan's three components, the one-time student debt forgiveness received the most attention. According to the administration's proposal, borrowers with an annual income of up to $125,000 or households with income of up to $250,000 can apply for $10,000 in student loan debt forgiveness. Those who received Pell Grants are eligible for $20,000 in forgiveness. A borrower cannot be forgiven for more than their current outstanding debt. According to the Congressional Budget Office, up to 43 million borrowers will qualify for at least partial forgiveness.

"A key concern about the debt forgiveness program is its inflationary impact in an environment where inflation has been persistently elevated for over a year."

Cancellation would not erase the amount of student debt owed but would rather shift the liability from an individual's balance sheet to the federal government's (that is, taxpayers') balance sheets. There are several estimates of the expected burden on the federal government, ranging from $330 billion (lower estimate from the Committee for a Responsible Federal Budget) to $519 billion (from the Penn Wharton Budget Model).

Table 1: Estimates of the Cost to the Federal Government of Debt Cancellation Proposal

| Institution | Estimate (Billions of USD) | Authors' Estimated Inflation Impact (Month-Over-Month Growth) |

|---|---|---|

| Cato Institute | $427 | 1.4% |

| Committee for a Responsible Federal Budget | $330 - $390 (mean of $360) | 1.2% |

| Congressional Budget Office | $400 | 1.3% |

| National Taxpayers Union Foundation | $395 | 1.3% |

| Penn Wharton Budget Model | $467 - $519 | 1.7% |

A key concern about the debt forgiveness program is its inflationary impact in an environment where inflation has been persistently elevated for over a year. In this post, we provide a back-of-the-envelope calculation of the program's inflationary impact. It is based on a specific view (known as the fiscal theory of the price level) of the federal budget and how it interacts with monetary and fiscal policies.

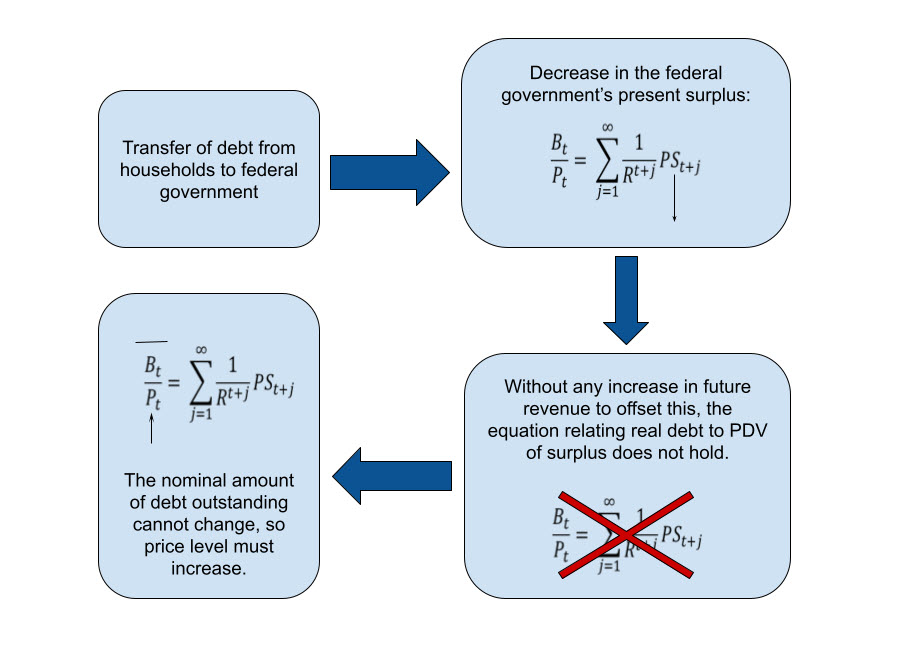

The basic idea is that investors in U.S. Treasury securities — such as bills, notes and bonds — willingly buy and hold them only if they expect repayment in the future. This thinking implies what economists call an intertemporal government budget constraint. It stipulates that the real value of outstanding government debt must be matched by future surpluses of revenues over spending, properly discounted. In this case, the government eventually generates enough net resources to pay off its debt holders in terms of principal and interest.

The central insight is that it is the real value of debt that is backed by real future resources. Since almost all federal debt is nominal, this theory posits that the current price level is the variable that equalizes discrepancies between these metrics, given their current expected future levels.

This insight allows us to put some numbers on the debt cancellation impact. The immediate effect is that it reduces future interest and principal payments, which is revenue for the federal budget. Debt cancellation therefore leads to a sudden decline in expected net revenues, all else equal, which becomes insufficient to back the outstanding level of debt. Consequently, the price level needs to rise to reduce the real value of debt as future real revenues decline. The fiscal theory thus predicts a jump in the price level as an equilibrating mechanism.

The main caveat of this line of reasoning is that, at some point in the future, there may be some combination of new tax revenue and reduced spending that counteracts the effect of debt forgiveness. Since none of this is in the discussion now, the debt forgiveness proposal presents a clean thought experiment.

At the end of June, total outstanding federal debt stood at $30.6 trillion. The various estimates suggest that debt forgiveness adds roughly 1 percent to the outstanding nominal debt, which is about the size of a full year's primary deficit. As the fiscal theory suggests, this must be covered by future revenues. Since the student loan cancellation program is unfunded, all else equal there won't be any additional future revenues to offset this increase. Thus, the real burden has to decline. This is achieved by an increase in the price level. Using the relationship in Figure 1, we calculate this as an increase of the PCE price level from 295.7 to a midpoint of estimates of 300.2, plus or minus 0.9. As shown in Table 1, the increase in price level represents a monthly inflation rate of up to 1.7 percent.

This number is certainly an upper bound as there are various mitigating factors:

- The price level may not rise instantaneously, as some contractual prices in the economy are fixed.

- Some aspects of loan forgiveness may be modified or phased in later so that the expected present discounted value is smaller.

- There may be compensating factors, as Congress may pivot to tax hikes to combat the unfunded debt forgiveness.

In addition, at the time of this writing, there are legal challenges proceeding that may prevent debt forgiveness from being implemented at all. There could also be some stimulating impact, as the debt cancellation could free up borrowers' cash flow, and the additional spending may create more tax revenue.

However, at the same time, this is also likely to be inflationary. Expectation of additional debt forgiveness programs evokes a moral hazard incentive for college students to take out more loans and for universities to increase tuition rates.1 To the extent that inflation is inherently persistent, any initial price level increase would also lead to sustained inflation over the near future. The Committee for a Responsible Federal Budget estimates that the Fed will need to raise rates by an additional 50 to 75 basis points to counteract the Biden debt cancellation proposal.

Indeed, when estimating the cost of Biden's entire three-part debt relief plan and accounting for behavioral responses, the Penn Wharton Budget Model estimates a burden of $1 trillion over the next 10 years. A $1 trillion decrease in the present surplus would result in a price level increase to 305.70, a monthly inflation rate equal to 3.4 percent. Moreover, the total stock of student debt is estimated to return to current levels in about five years if this policy is implemented.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.