Over time, older households have become more likely to age in place and more likely to receive long-term care at home.

Housing and Housing Finance

Explore our research and analysis into the housing market, including pricing, supply and financing.

Updating Results

Updating Results

John Bailey Jones and Urvi Neelakantan discuss the decline in the movement of workers from one place to another, and possible explanations and policy solutions for the decline. Jones is vice president of microeconomic analysis and Neelakantan is a senior policy economist, both at the Federal Reserve Bank of Richmond.

Single-room occupancies met basic housing needs well into the 20th century until they were pushed into the margins. Can alternatives fill the gap?

Recent research can show how sea level rise is beginning to shape property values across U.S. coastlines.

Banks continued to compete with NMCs in the downstream mortgage origination market, despite financing competing NMCs.

Alessandro Rebucci, Horacio Sapriza, Alex Sclip and Daniel te Kaat

Eliminating exclusive buyer representation contracts could have several positive effects in the real estate industry.

How do shocks to the banking system affect nonbank mortgage companies through warehouse lines of credit?

Daniel te Kaat, Alessandro Rebucci, Horacio Sapriza and Alex Sclip

John O'Trakoun discusses recent trends in the pricing of rental housing and what rents tell us about overall inflation as well as housing markets on the national and local levels. O'Trakoun is a senior policy economist at the Federal Reserve Bank of Richmond.

Since brokers operate a two-sided platform for trading homes, this model explains the 6 real estate broker commission and implies that commission rates should be higher where price-rent ratios are higher.

Rent growth appears to be slowing, with rent CPI remaining unchanged in April. Do current market rent measures predict a continued decline in growth?

John O'Trakoun

Senior Policy Economist

Literature suggests much of the decline may be a response to the changing needs of both households and firms.

A look at where USDA Rural Development funding goes across the Fifth District. Which programs drive total investments, and which states and counties get the largest shares of funding?

This post highlights the short-term and potential long-term impacts of Hurricane Helene on Western North Carolina's housing market while also exploring how pre-existing market conditions may interact with the storm's impact.

Months supply does better at predicting house price growth than many other relevant variables, such as the unemployment rate and the 10-year Treasury yield.

Understanding how housing components are measured in the NIPA offers insights into recent inflation dynamics.

In a follow-up to a past Regional Matters post that focused on Maryland and Virginia, this post explores heirs' property in other Fifth District states, including the challenges, risks, and potential resolutions.

John Bailey Jones and Urvi Neelakantan discuss their research on the living arrangements of older individuals and the implications of these homeowners aging in place for wealth accumulation and housing markets. Jones is vice president of microeconomic analysis and Neelakantan is a senior policy economist at the Federal Reserve Bank of Richmond.

Hurricanes Helene and Milton have put a spotlight on both the immediate and long-term aftermath of such storms.

Not only has the share of the U.S. population that is 65 and older risen, but the share of these households living in their own homes has risen as well.

A low inventory of houses on the market, caused by factors such as a need for more construction and homeowners discouraged from selling, continues to push home prices higher.

What roles do large and small investors play in local housing markets across the Fifth District and how do they shape the availability and prices of homes?

In the past couple of years, Charlotte's high multifamily rent growth appears to be driven by differences in demand via renter household growth, but this growth has been moderated by growth in multifamily supply.

The Richmond Fed has been closely studying the housing sector, with a focus on small towns and rural communities. What obstacles does the region face and what role can the Richmond Fed serve?

Could July's slump in housing starts be attributed to severe weather, such as Hurricane Beryl that made landfall on July 8? Data suggests the national impact may be small.

John O'Trakoun

Senior Policy Economist

Sierra Stoney outlines the factors that have recently driven up premiums for homeowners insurance, adding pricing pressure to housing markets. Stoney is a senior research analyst on the Regional and Community Analysis team at the Richmond Fed.

When considering the outlook for future housing services prices, examining the ratio against home prices and new tenant rents might indicate what's to come. What might the data be telling us?

John O'Trakoun

Senior Policy Economist

The authors shed light on the role of competitive forces in how banks manage emerging risks and relevant supervisory challenges.

Dasol Kim, Luke M. Olson and Toan Phan

Winchester, Virginia, is known for its blend of history, culture and natural beauty, making it a popular destination for visitors and a vibrant community for its residents. The Winchester Metro Area is the fastest growing metro area in the state of Virginia, with its population growing at almost five times the rate of Virginia as a whole. In May, our Community Conversations team visited the Winchester area to learn more about their economic strengths and opportunities.

Evidence from Hurricane Irma suggests that weather events can significantly impact mortgage defaults.

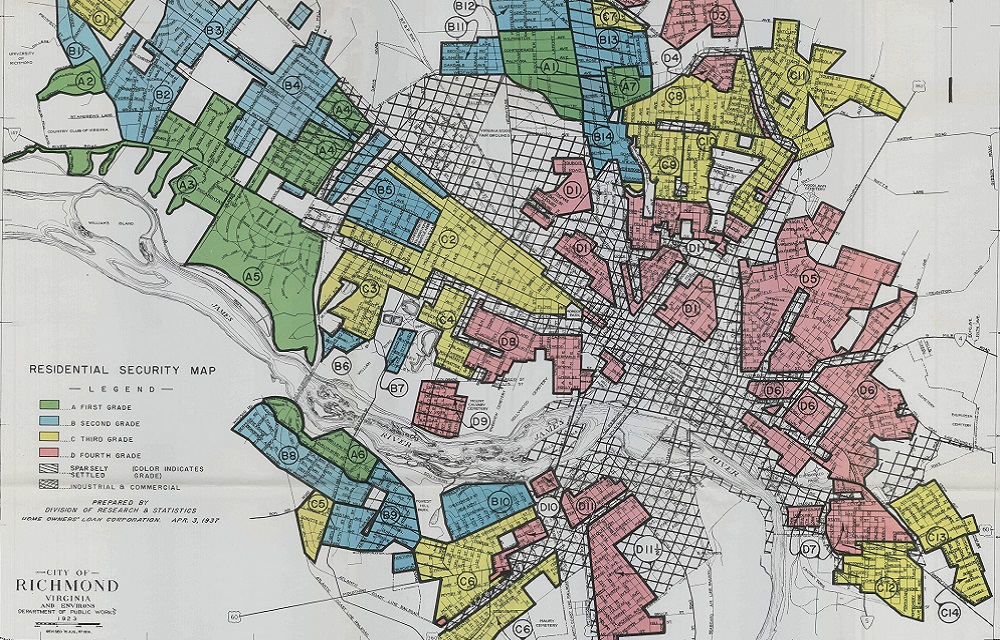

The effects of classifying neighborhoods by riskiness of home lending in the 1930s may still have modest effects on interest rates and fees today.

Andrew Ellul, David Marques-Ibanez, Horacio Sapriza, Alex Sclip and Jack Taylor

This post looks into the components of private fixed investment and discusses what recent monthly data could be telling us for the outlook of this piece of GDP.

John O'Trakoun

Senior Policy Economist

Borys Grochulski and Zhu Wang discuss the compensation structure of real estate agents and how that has shaped the homebuying process and the housing market in general. Grochulski is a senior economist and Wang is vice president for research in financial and payments systems at the Richmond Fed.

Would Fed rate cuts improve the outlook for homebuyers? This post examines the potential connection between policy rates and housing affordability.

John O'Trakoun

Senior Policy Economist

An increase in multifamily housing supply could be contributing to a softening in rents, but historical patterns suggest an upward pressure on rent growth could be in store.

John O'Trakoun

Senior Policy Economist

Taylor Bennett and Kim Reed describe how community development organizations in West Virginia use land banks to bring new economic activity to abandoned property. Bennett is executive director of the West Virginia Land Stewardship Corporation and Reed is executive director of the Nitro Land Reuse Authority.

There's a diverging trend in the recovering housing market. While new single-family housing construction is increasing, multi-family housing unit construction is on the decline.

John O'Trakoun

Senior Policy Economist

An a la carte compensation model could improve the performance of the housing brokerage sector.

Adopting a cost-based commission system could raise social welfare by nearly $40 billion annually through improved home search efficiency and reduced rent-seeking by agents, according to a working paper on buyer agent commissions.

Differences in permitting activity, land use regulation, and land availability contribute to variation in how rapidly the local housing supply is growing in communities throughout the Fifth District.

Kartik Athreya, the Richmond Fed's research director, answers questions submitted by listeners about housing, the Fed's bond purchases, interest rate targeting, and artificial intelligence.

Rental housing has become less affordable across the country, but rural markets face additional difficulties.

Tim Sablik, host of the Speaking of the Economy podcast, reviews the five most popular episodes of 2023 that explored topics beyond inflation and monetary policy.

Richmond Fed president Tom Barkin and Federal Reserve Board Governor Michelle Bowman will lead a discussion about the lingering impact of the pandemic on the economy and the workforce. The general public is invited to listen in, via livestream, as Barkin, Bowman and several special guests explore the challenges and opportunities that exist as the region served by the Richmond Fed continues the transition to a new normal.

Andy Bauer and Danny Twilley discuss the research they are doing to better understand gaps in the housing markets of rural communities and small towns and the unique challenges they face in addressing these gaps. Bauer is vice president and regional executive for the Baltimore branch of the Federal Reserve Bank of Richmond. Twilley is assistant vice president of economic, community and asset development for the Brad and Alys Smith Outdoor Economic Development Collaborative at West Virginia University.

In addition to differences in housing affordability, rural Fifth District households experience differences in housing quality by tenure and income.

Agents for homebuyers are typically paid a percentage of the final sale price, so the more their clients spend on a house, the more money they make.

While the recent decline in rural homeownership affordability has challenged prospective buyers, many existing rural homeowners and renters are also burdened by their housing costs.

Population loss and aging homes have left the city of Baltimore with an abandoned housing problem that policymakers and community leaders continue to address.

Many use mortgage spreads as a gauge of market stress, but they actually seem to gauge something else.

Large metro areas aren't the only places to see recent declines in homeownership affordability. Home prices have grown faster than household income in nonmetropolitan areas, too, contributing to affordability challenges in these communities.

Local jurisdictions in the greater Richmond area have collaborated to develop a Market Value Analysis (MVA) of Richmond's housing market.

The Fed's monetary tightening over the past year has had an immediate effect on the housing market. But if the Fed didn't act to bring inflation down, we could expect lenders to charge high rates simply to break even in real terms.

The modern mortgage is the result of a complicated history. Local, state, and national actors all competing for profits have existed alongside an increasingly active federal government seeking to make the benefits of homeownership accessible to more Americans.

Greta Harris and Jim Tobin offer their perspectives on the housing market, from the impacts of the COVID-19 pandemic and recent increases in mortgage rates to the continuing challenge of building affordable housing. Harris is president and CEO of the Better Housing Coalition and Tobin is executive vice president and chief lobbyist for the National Association of Home Builders.

Following two years of tight housing market conditions in the Fifth District, indicators suggest that markets are cooling although affordability remains an issue.

Among the topics discussed were income growth volatility, AI's impact on productivity and how housing price changes affect young businesses.

In this paper, we provide novel theoretical predictions and empirical evidence on how climate risks, specifically the increased risks of coastal flooding due to SLR, affect the mortgage market.

Laura Bakkensen, Toan Phan and Russell Wong

University of Chicago economist on remote work, changes in recruiting, and business startups after the pandemic.

David A. Price

As revealed through data and academic literature, historical inequity in credit access still affects minority borrowers today.

Monetary policy, marriage, college admissions, and discrimination and socioeconomic outcomes were among the topics discussed at our recent conference.

With assistance programs winding down, evictions are on the rise but have not surpassed pre-pandemic levels.

Stephanie Norris

Associate Director, Community College Initiative

For homebuyers who are still in the market despite higher prices and borrowing rates, their options may be limited as homebuilders focus on clearing backlogs rather than starting new construction.

John O'Trakoun

Senior Policy Economist

Renee Haltom offers an overview of economic conditions in Virginia, based on her recent conversations with local contacts and analysis of the data. Haltom is a vice president and regional executive at the Richmond Fed, with responsibility for engagement with businesses and communities in Virginia.

Matt Martin provides an update on economic conditions in North Carolina and South Carolina, based on his recent conversations with local business contacts and analysis of the data. Martin is the regional executive based at the Richmond Fed's Charlotte office.

Numerous factors — including population growth, education, housing, transportation, child care, health, and broadband availability — are shaping the differences in employment outcomes between rural and urban communities.

Since last summer, rising home prices have threatened to push up rent prices, adding pressure to overall inflation. How have actual rents fared and what do the most recent numbers imply for rent inflation going forward?

John O'Trakoun

Senior Policy Economist

Evidence highlights the nuanced ways in which participants in the financial markets may be strategically adapting to climate change.

Sierra Latham and Peter Dolkart discuss their work on the availability of affordable housing in small towns and rural communities. Latham is a senior research analyst at the Federal Reserve Bank of Richmond and Dolkart is a community development regional manager based in the Richmond Fed's Baltimore office.

Although people often associate high housing costs with urban areas, many households in rural areas also struggle with costly housing

John O'Trakoun discusses the factors that have increased the cost of single-family and multi-unit housing in recent months, as well as what shapes overall supply and demand for housing over the longer term.

This survey of climate finance research literature highlights key findings and their policy implications.

Harvard University economist on urbanization, the future of small towns, and "Yes In My Back Yard."

David A. Price

A decreasing-rate mortgage wouldn't increase its interest rate, but would decline when rates dropped, potentially saving significant refinance costs.

Peter Dolkart discusses what is happening with renters in the Fifth District as state and national moratoriums on evictions wane and COVID-19 infections surge.

The housing market has boomed during the pandemic, but data over the past few months have been more mixed. Is this bumpiness the result of weaker demand or lower supply?

John O'Trakoun

Senior Policy Economist

A recent Richmond Fed conference covered housing, Social Security claiming, savings and labor supply related to older households.

John Bailey Jones and David A. Price

The economic fallout of the pandemic has been highly uneven. Low-wage workers were the most severely affected at the outset, and their employment recovery since then has been comparatively sluggish.

Bernie Mazyck and Mark Fessler discuss how the pandemic is contributing to ongoing high volumes of renter evictions in certain parts of our country.

For the housing market, the coronavirus recession in 2020 was unusual: Demand for homes was strong and price growth remained solid.

Roisin McCord

The COVID-19 pandemic has depressed housing security and increased eviction risk for renters in the Fifth District. Although helpful for tenants, some federal pandemic-response provisions are ending in December.

The COVID-19 pandemic has caused severe economic distress in the Fifth District, but the regional housing market has proven remarkably resilient.

Benjamin Lukas

Intern (2020)

The Federal Reserve's purchases of agency mortgage-backed securities — launched in response to financial disruptions caused by COVID-19 — appear to have restored smooth market function supporting the continued flow of credit to mortgage borrowers.

The COVID-19 pandemic has put housing stability at the forefront of public policy discussions, and home repair is a critical piece of that conversation. What were total home repair costs in Baltimore prior to the pandemic, and how might COVID-19 impact home repair?

Benjamin Lukas and Eileen Divringi

Researchers and policymakers are wondering whether the economic losses associated with the COVID-19 pandemic will prove temporary or persistent. Examining the housing crisis of 2006—09 may provide some clues.

Young adults have been buying houses at lower rates. This gap between young and older adults is particularly high in Fifth District rural counties.

Sam Storey

Ten years after the housing market collapse, activity in the single-family market remains somewhat subdued. Despite rising prices and low inventories, single-family construction has increased very gradually. Are there impediments to new housing supply?

R. Andrew Bauer

Vice President and Regional Executive

Richmond Fed President Jeffrey M. Lacker addressed the Global Interdependence Center in Sarasota, Florida.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey Lacker addressed the Greater Richmond Chamber of Commerce.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey M. Lacker addressed business leaders during a luncheon hosted by the Rotary Club of Charlotte in Charlotte, N.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

On November 25, 2008, the Federal Open Market Committee (FOMC) announced it would begin purchasing debt issued and MBS guaranteed by GSEs Fannie Mae and Freddie Mac to provide monetary stimulus to the housing sector and broader economy.

Renee Haltom and Robert Sharp

Richmond Fed President Jeffrey M. Lacker spoke about the economic outlook Jan. 17, 2014, in remarks to the Richmond chapter of the Risk Management Association.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Jeffrey Lacker, president of the Federal Reserve Bank of Richmond, addressed the Council on Foreign Relations on May, 9, 2013, as part of the C. Peter McColough Series on International Economics.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Richmond Fed President Jeffrey Lacker speaks with students and faculty at Franklin & Marshall College in Lancaster, Pa.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

This Economic Brief highlights the impact of non-occupant-owner mortgages on the housing crisis.

Karl Rhodes and Breck Robinson

Lacker Addresses Dulles Regional Chamber of Commerce, Chantilly, Va.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Ross Lawrence and Brent C Smith

Breck Robinson and Richard M. Todd

Allen C. Goodman and Brent C Smith

Wayne R. Archer and Brent C Smith

Cover Story: The Price is Right? Has the financial crisis provided a fatal blow to the efficient market hypothesis?

Reviews the Bank's operations and includes the article entitled "Systemic Risk and the Pursuit of Efficiency"

Cover Story: House Bias

The economic consequences of subsidizing homeownership

Reviews the Bank's operations and includes the article entitled "The Financial Crisis: Toward an Explanation and Policy Response"

Cover Story: Downtown is Dead. Long Live Downtown.

America is busy rebuilding its downtowns. But these are not the downtowns of yesterday.

Reviews the Bank's operations and includes the article entitled "Inflation and Unemployment: A Layperson's Guide to the Phillips Curve"

Richmond Fed President Jeffrey M. Lacker spoke December 21, 2005 at the Charlotte Chamber of Commerce Annual Economic Conference in Charlotte, N.C.

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Cover Story: Homeward Bound

Housing markets work just fine for most people. But certain markets in the Fifth District aren't producing homes and apartments that working families can afford.

Reviews the Bank's operations and includes the article entitled "Borrowing by U.S. Households"

It is a pleasure to be with you this evening. Most of the speeches I make deal with national economic outlook and Fed monetary policy, and it is refreshing to have an opportunity to talk about something else.

J. Alfred Broaddus

President