Did a Hurricane Hinder Housing in July?

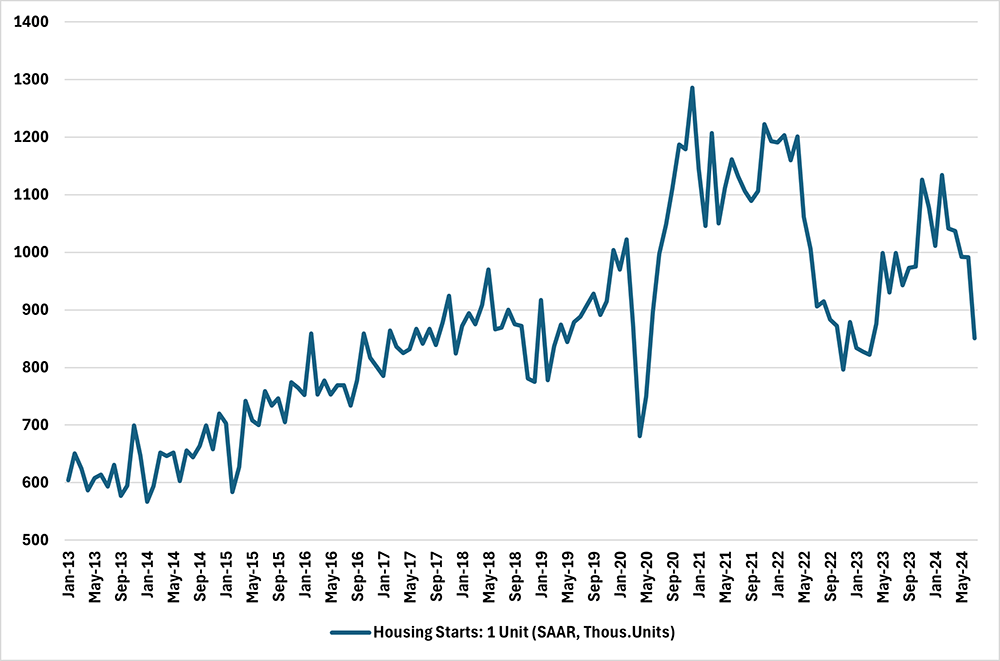

Housing starts were weak in July, falling 6.9 percent month over month after a 1.1 percent increase in June. If July's pace were sustained over 12 months, 1.24 million housing units would be built in a year, the slowest pace since May 2020. The single-family housing segment was particularly weak, falling 14.1 percent monthly and registering a fifth straight monthly decline. July's annualized pace of single-family housing starts was 851,000, the slowest since March 2023. (See Figure 1 below.) Building permits — a less volatile indicator than starts — also fell in July, dropping 3.3 percent monthly to an annual pace of 1.4 million units. Could weather be to blame? Hurricane Beryl made landfall in Southern Texas on July 8, causing severe disruption. In this week's post, we look for signs that July's slump in housing starts was attributable to weather.

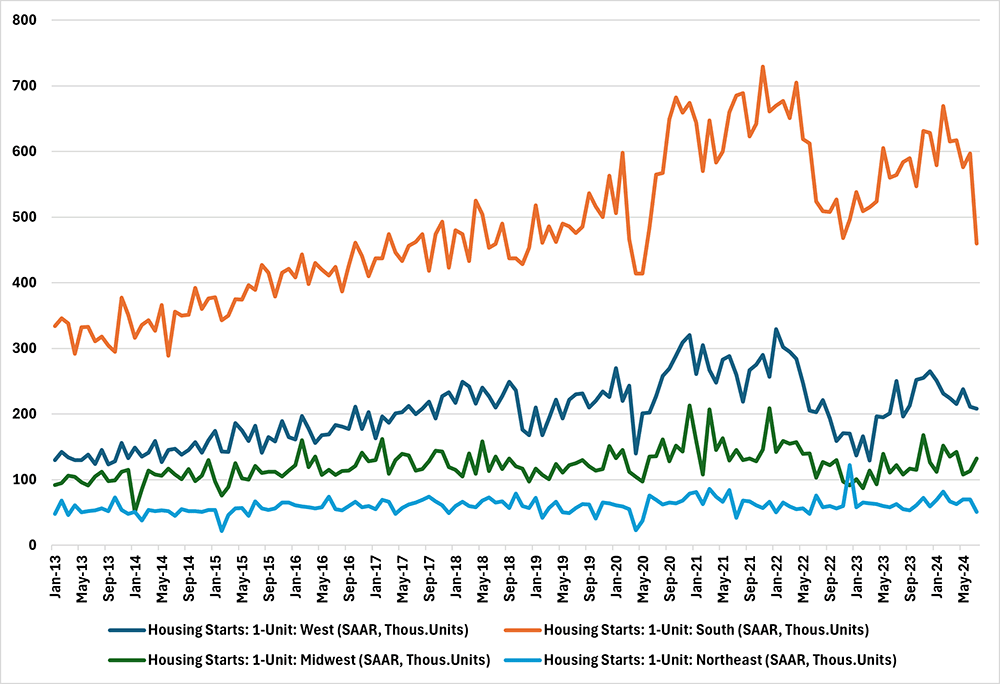

One indication that weather played a role in depressing housing starts in July can be seen in the geographic breakdown of single-family starts. As shown in Figure 2 below, single-family housing starts in the hurricane-affected South fell sharply in July, falling by 137,000 units on an annual basis (or 23 percent) to its lowest level since May 2020. In comparison, single-family starts rose 17 percent in the Midwest and fell by only 1.4 percent in the West. Single-family starts fell even more sharply (by 27 percent) in the Northeast, although the drop occurred on a much smaller base, with starts falling from a pace of 70,000 annual units in June to a 51,000-unit pace in July.

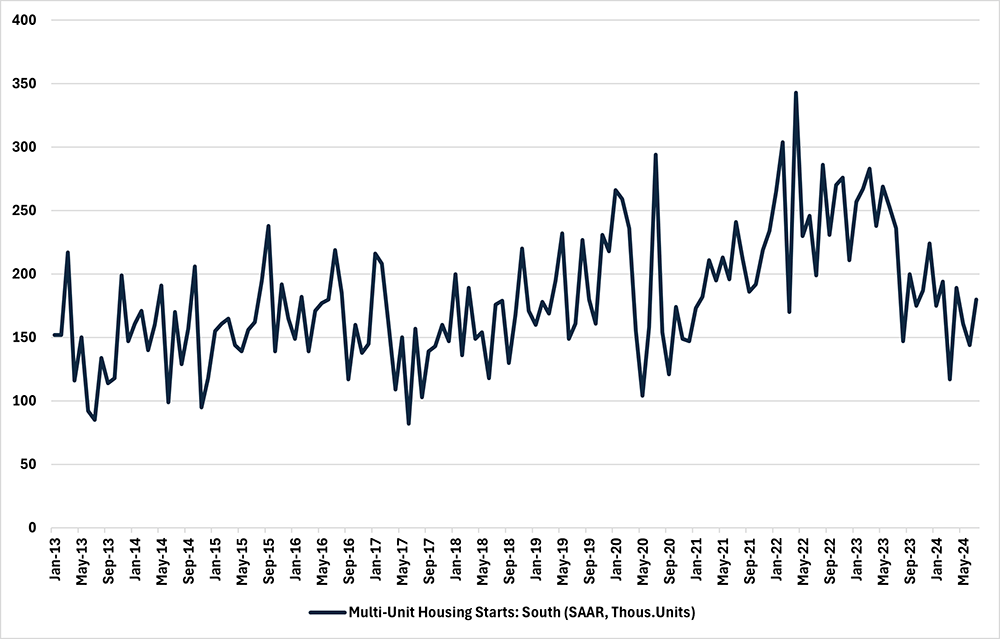

However, other sections of the report cast doubt on weather being the sole culprit. In particular, bad weather should have disrupted multifamily starts as well as single-family starts. However, multifamily housing starts in the South rose 25 percent month over month to a 180,000-unit annual pace in July. (See Figure 3 below.) This suggests that other factors may have played a more important role in depressing single-family starts in July.

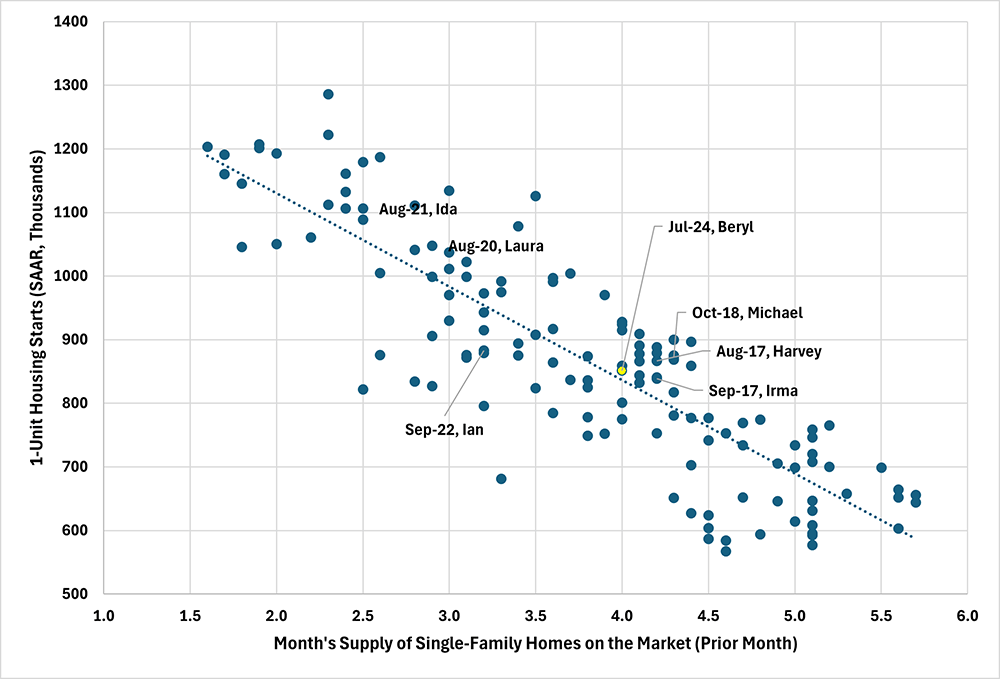

The most important headwind to homebuilding activity may be falling demand relative to supply. According to the National Association of Realtors, the pace of existing single-family home sales has declined for four straight months (from 4.0 million in February to 3.5 million in June) while the supply of single-family homes on the market has risen for six straight months (from 0.86 million in December to 1.16 million in June). As a result, months' supply of single-family homes has risen for four straight months, from 2.8 months in February to 4.0 months as of June.

Higher inventory is associated with a lower level of starts. Figure 4 below plots the annualized pace of single-family housing starts on the vertical axis against the prior level of months' supply of single-family housing on the horizontal axis for the period January 2013-July 2024. July's reading is highlighted in yellow, showing that July's level of housing starts is almost exactly in line with what would be expected given June's reading — the last reading before Hurricane Beryl — for month's supply of single-family housing.

Figure 4 also identifies several significant hurricanes, including:

- Least-severe Category 1 hurricanes Ian in September 2022 and Beryl in July 2024

- Very-severe Category 4 hurricanes Harvey in August 2017, Irma in September 2017, Laura in August 2020 and Ida in August 2021

- Most-severe Category 5 Hurricane Michael in October 2018

Interestingly, in most of the selected months with hurricane activity, housing starts are higher than would be expected based on the previous month's supply of single-family homes on the market. These results suggest that hurricanes — despite possessing severe consequences for local affected communities — leave only a small imprint on the national housing starts figures.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.