The Economic and Human Impacts of Hurricanes

Key Takeaways

- Hurricane damages in the U.S. are highly sensitive to storm intensity and economic conditions, with inadequate adaptation exacerbating the high costs.

- Hurricanes result in long-term economic damage and excess mortality, particularly among vulnerable populations.

- Outdated official floodplain maps and flood insurance subsidies hinder effective adaptation.

Hurricane Helene brought large destruction to parts of the Fifth Federal Reserve District, most notably western North Carolina.1 Helene was the deadliest hurricane to hit the mainland U.S. since Hurricane Katrina in 2005, and Helene's impact on both metro and rural areas was devastating. Then, less than a week later, Hurricane Milton made landfall in Florida as a Category 3 storm.

Such powerful storms not only have immediate effects but can have lasting ones as well. There are recent advancements in the research literature that help us better understand what more or stronger hurricanes might mean for our future. These recent advancements include relating economic effects of hurricanes to physical measures of hurricane strength (such as maximum wind speed) and looking at the longer-term impact of hurricanes on mortality. Recent research also indicates that the economic and human cost of hurricanes is likely much larger than prior estimates suggest, but also that adaptation matters. This article summarizes what we know about the mortality and economic impacts of hurricanes, both in the immediate aftermath and years later.

The Formation and Severity of Hurricanes

Hurricanes (or tropical cyclones) form over warm ocean waters, driven by heat and moisture. Depending on their location, they are called hurricanes, typhoons or, if wind speeds are below 74 mph, tropical storms. Despite these naming differences, the underlying physics are the same: As explained by the National Oceanic and Atmospheric Administration, rising warm air creates low pressure, drawing in moist air that spirals inward and forming the cyclone.

The 2024 hurricane season has been unusually intense, with major hurricanes like Helene and Milton underscoring this year's severity. There are two critical issues when measuring the impact of a hurricane: how strong the hurricane is and where it hits.

Strength and Location ... and Mitigation Efforts?

In 2010, Nobel Laureate William Nordhaus argued that damages from U.S. hurricanes are extremely sensitive to hurricane intensity.2 He also argued that Hurricane Katrina was one of the most intense storms to make landfall in the U.S. and that it hit one of the most economically vulnerable regions in the country. Thus, the destruction was particularly costly, in both human and economic terms.

More recent research has highlighted that the economic impact of a hurricane might differ across countries. Economists Laura Bakkensen and Robert Mendelsohn used data from 1960-2010 to estimate the relationship between tropical cyclone damage and fatalities and storm intensity (either sea level barometric pressure or maximum sustained wind speed upon landfall), as well as population density and per capita income where the storm landed.3 They analyzed countries that are members of the Organization for Economic Cooperation and Development (OECD, which includes the U.S.) as well as a sample of non-OECD countries.

They found that the U.S. is significantly different from the rest of the world: In the U.S., damages scale at least proportionately with economic growth. As with Nordhaus's findings, Bakkensen and Mendelsohn find that damage in the U.S. is much more reactive to cyclone characteristics, such as pressure and windspeed. For other countries, however, damage does not necessarily increase as incomes rise. As economies grow, the dollar value of damage increases, but adaptation also grows with income, mitigating the impact of damages. For non-U.S. higher income countries, the increase in adaptation that accompanies income growth provides protection from hurricane-inflicted damage.

In the end, the U.S. accounts for approximately 60 percent of global annual damages despite only receiving an average of two landfalls per year and only 4 percent of global cyclones, according to another work by Bakkensen and Mendelsohn.4 The rest of the OECD countries combined suffer 14 percent of damages, and the 86 non-OECD countries and territories sampled by the authors account for the remaining 26 percent.

Any measure of hurricane damage will be dependent on where the hurricane hits. The deaths and economic destruction of Hurricane Katrina, for example, was connected not just to the storm's high winds but also the flooding that hit the area (including New Orleans) when the storm surge breached the levees. The economic and human impact of Hurricane Helene will be less than that of Hurricane Katrina because it flooded a less populous area.

On the other hand, Bakkensen and Mendelsohn find that fatalities do not scale with population density: Cities actually protect human lives — and, in some cases, mitigate other damages — more effectively than rural areas. This could reflect better building codes or higher resilience in cities relative to more sparsely populated rural regions.

There are things that countries and communities can do to adapt to cyclones and mitigate damage. For example:

- They can engage in flood protection such as levees or beach nourishment.

- They can change building codes to increase the resilience of dwellings to winds and floods.

- They can create zoning ordinances to keep people and buildings away from high-risk locations.

Bakkensen and Mendelsohn attribute the impact of hurricanes on the U.S.'s limited adaptation to tropical cyclones compared to other countries. They find evidence that the lack of adaptation to damage in the U.S. led to a damage function 14 times higher than in other OECD countries.

The Persistence of the Economic Impact

While there is a long-standing literature on the economic effects of hurricane damage, there are noteworthy developments in the more recent literature. For example, researchers used to look at the persistence of economic impact in a more limited way. A 2008 paper finds that there is an immediate decrease in employment and increase in earnings when a U.S. county is directly hit by a hurricane — with larger effects from higher category hurricanes — but these effects dissipate over time.5

On the other hand, a more recent working paper uses meteorological data to reconstruct every country's exposure to the universe of tropical cyclones during the period 1950-2008 and finds that national incomes of both rich and poor countries decline relative to their pre-disaster trend and do not recover within 20 years.6 The authors find that income losses arise from a small but persistent suppression of annual growth rates spread across the 15 years following a disaster — a 90th percentile event reduces per capita incomes by 7.4 percent as much as two decades later.

Similarly, a 2024 paper evaluates the long-term effects of tropical cyclones on human mortality in the contiguous U.S. between 1930 and 2015 and finds that the increase in excess mortality persists for 15 years after each event.7 It also finds that the average tropical cyclone generates 7,000 to 11,000 excess deaths, well exceeding the average of 24 immediate deaths reported in government statistics.

One key dynamic is the impact that a hurricane has beyond damage to infrastructure and property: Hurricanes can lead to population relocation, social and economic disruption, ecological changes, reduced access to basic services, pollution, crop damage, and changes in insurance or political action. For example:

- Individuals may use retirement savings to repair property damage and thus reduce future health care spending to compensate.

- Public budgets may meet the immediate disaster needs at the expense of longer-run health investments.

Another impact could be related to relocation as family members move away, removing critical support. The population of New Orleans, for example, remains 25 percent below its pre-Katrina level.

Other recent studies also show that hurricanes significantly lower long-term economic growth by depressing productivity and slowing recovery, leading to lasting economic scarring.8 Vulnerable populations — such as coastal communities and racial minorities — are especially at risk, underscoring gaps in current adaptation policies.

Flood Zones, Insurance and Mortgage Default

Insurance is another highly relevant discussion. Fair insurance can facilitate a clear understanding of expected risk, while subsidized insurance may reduce adaptation by effectively understating the risk to policyholders.

Specifically, one major adaptation gap in the U.S. is inadequate flood insurance. Hurricanes cause flooding through storm surges and heavy rainfall, and flood insurance is predominantly provided in the U.S. through the National Flood Insurance Program (NFIP). One paper and the references it cites find that the NFIP relies on outdated flood maps, classifies many high-risk homes as low-risk, and vastly underinsures homes (particularly those misclassified as being outside floodplains).9

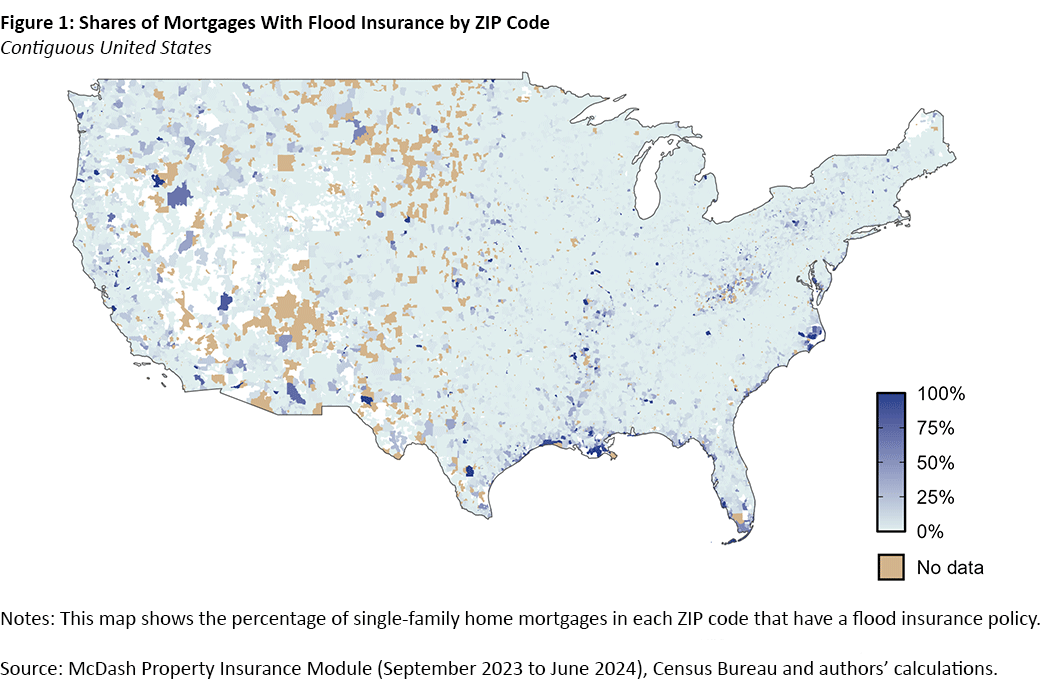

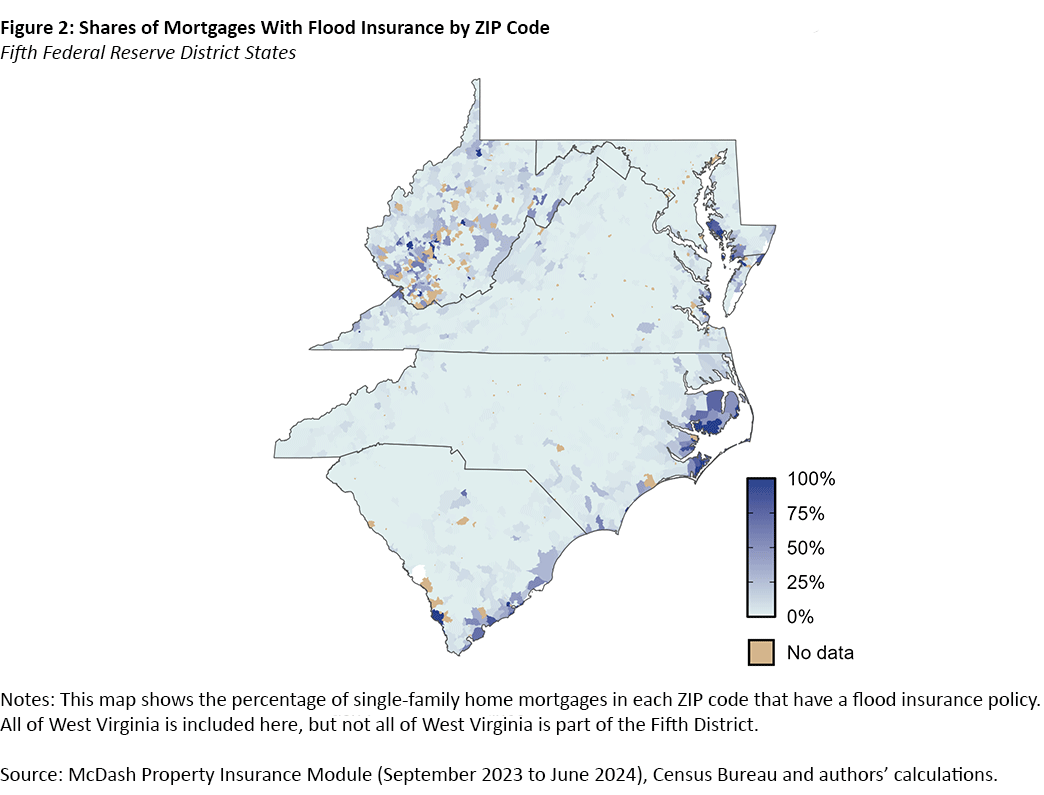

In particular, not having adequate insurance can present considerable issues not only for homeowners, but for entire communities and their surrounding regions as well. Underinsured homeowners are much more likely to default on their mortgages after flooding, exacerbating financial strain and contributing to the slow recovery often seen after hurricanes.10 Figure 1 shows flood insurance uptake around the country by ZIP code, and Figure 2 shows the same specifically for Fifth District states.

Another reason why the U.S. is less adapted to hurricanes may be due to NFIP subsidies reducing incentives for migration away from real estate investment in flood-prone areas. NFIP subsidies lower premiums for properties in high-risk areas, reducing the financial burden and encouraging people to stay rather than relocate to safer locations. This, in turn, inflates property values and concentrates population and assets in flood-prone regions.11 This distorted investment and reduced migration hinder effective adaptation to climate risks, ultimately undermining resilience.

There is some support that the NFIP discourages gradual retreat away from high-risk areas. For example, a 2024 paper shows that population increases in flood-prone areas as a direct response to community enrollment in the NFIP and that the NFIP causes larger population increases in historically riskier areas.12 In other words, the private benefit households receive in the form of a reduction in potential risks produces adverse behavior, imposing significant external costs.

Conclusion

The availability of increasingly granular data has provided new opportunity to understand the impact of hurricanes on the immediate and long-term trajectories of affected communities. It is clear that the strength of the weather event matters, as does the income and population density of the location it hits. As income increases, fatalities from storms decline, but damage only declines to the extent that the region has the infrastructure in place to withstand events. Countries and communities can also mitigate damage by promoting adaptation in more hurricane-prone or flood-prone areas. Encouraging households to appropriately price risk is important as we negotiate future weather events, especially given what we now know about the long-term consequences of severe hurricanes.

Toan Phan is a senior economist and Sonya Ravindranath Waddell is a vice president and economist in the Research Department at the Federal Reserve Bank of Richmond. The authors thank Sara Harrison for her assistance in generating the figures.

The Fifth Federal Reserve District includes the District of Columbia, Maryland, North Carolina, South Carolina, Virginia and most of West Virginia.

See Nordhaus' 2010 paper "The Economics of Hurricanes and Implications of Global Warming."

See Bakkensen and Mendelsohn's 2019 book chapter "Global Tropical Cyclone Damages and Fatalities Under Climate Change: An Updated Assessment."

See Bakkensen and Mendelsohn's 2016 paper "Risk and Adaptation: Evidence From Global Hurricane Damages and Fatalities."

See the 2008 paper "How Hurricanes Affect Wages and Employment in Local Labor Markets" by Ariel Belasen and Solomon Polachek.

See the 2014 working paper "The Causal Effect of Environmental Catastrophe on Long-Run Economic Growth: Evidence From 6,700 Cyclones" by Solomon Hsiang and Amir Jina.

See the 2024 paper "Mortality Caused by Tropical Cyclones in the United States" by Rachel Young and Solomon Hsiang.

See, for example, the 2018 working paper "Climate Shocks, Cyclones and Economic Growth: Bridging the Micro-Macro Gap" by Laura Bakkensen and Lint Barrage.

See the 2023 paper "Risk Rating Without Information Provision" by Philip Mulder and Carolyn Kousky.

See the 2020 paper "Flood Damage and Mortgage Credit Risk: A Case Study of Hurricane Harvey" by Carolyn Kousky, Mark Palim and Ying Pan.

See, for example, the 2022 paper "Going Underwater? Flood Risk Belief Heterogeneity and Coastal Home Price Dynamics" by Laura Bakkensen and Lint Barrage and the previously cited paper "Risk Rating Without Information Provision."

See the 2024 paper "Does the National Flood Insurance Program Drive Migration to Higher Risk Areas?" by Abigail Peralta and Jonathan Scott.

To cite this Economic Brief, please use the following format: Phan, Toan; and Waddell, Sonya Ravindranath. (December 2024) "The Economic and Human Impacts of Hurricanes." Federal Reserve Bank of Richmond Economic Brief, No. 24-38.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.