Housing Starts: A Tale of Two Markets

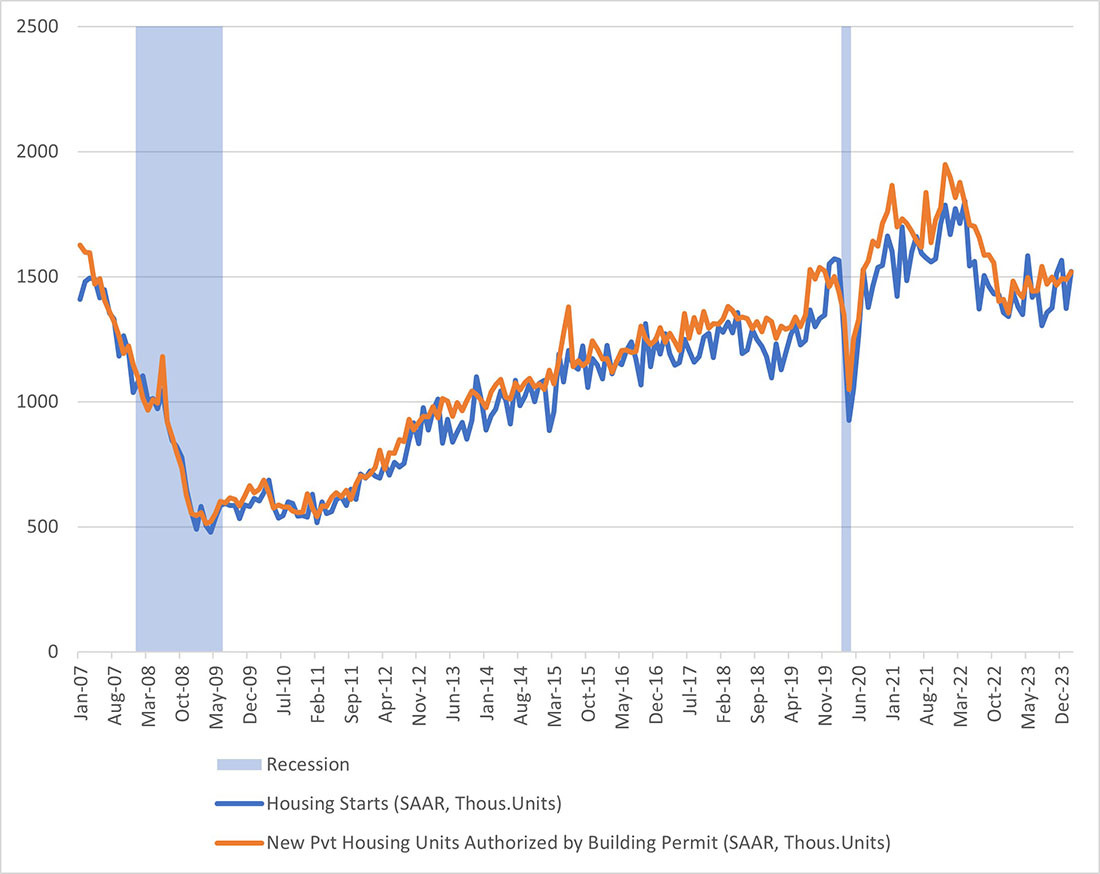

Total housing construction is recovering after hitting recent lows in 2023. Housing starts rose 10.7 percent monthly to a pace of 1.5 million units in February, and building permits — a related but less volatile metric — rose 2.0 percent monthly to a pace of 1.5 million units. Figure 1 below shows that both starts and permits are up following sharp declines from 2021 through 2023, with both series now roughly at their pre-pandemic levels.

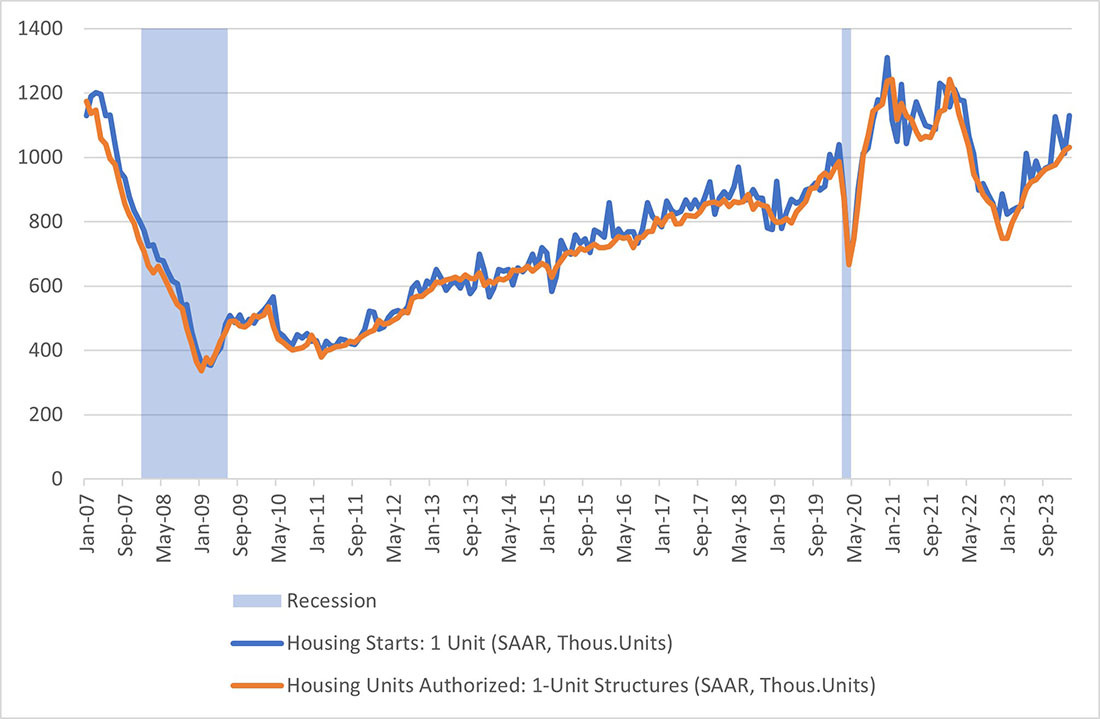

Beneath the headline figure, there's a tale of two markets: diverging trends of single-family housing units versus multifamily housing units. In February, single-family starts rose 11.6 percent after a 4.9 percent decline in January, and single-family permits rose 1.0 percent after a 2.2 percent increase in January. (Unlike permits, starts may have suffered from cold and rainy weather in January.) Looking through monthly volatility, the pace of single-unit starts and permits have bounced back from their recent lows in late 2022 through early 2023 and are currently above pre-pandemic levels, as seen in Figure 2 below. One factor supporting strong construction activity for single-family homes has been a decline in existing home sales, as high mortgage rates disincentivize existing homeowners with low-rate mortgages from moving and selling their properties.

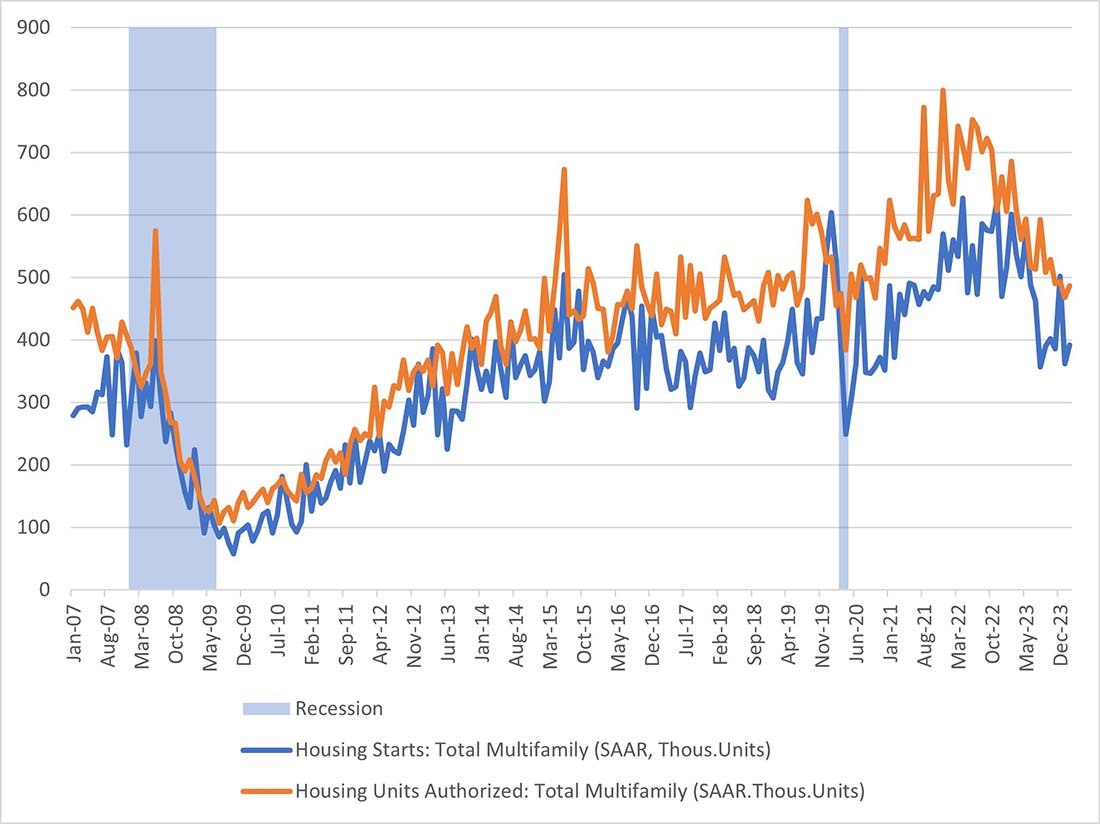

In contrast, multifamily starts and permits currently look much weaker. Although the monthly data are noisy, the overall trend of multifamily starts and permits has been negative since summer 2022. Permits are down 28.3 percent year over year, and starts are down 34.8 percent versus a year ago. Figure 3 below shows that we have yet to see clear evidence of a turnaround in prospects for either multifamily series.

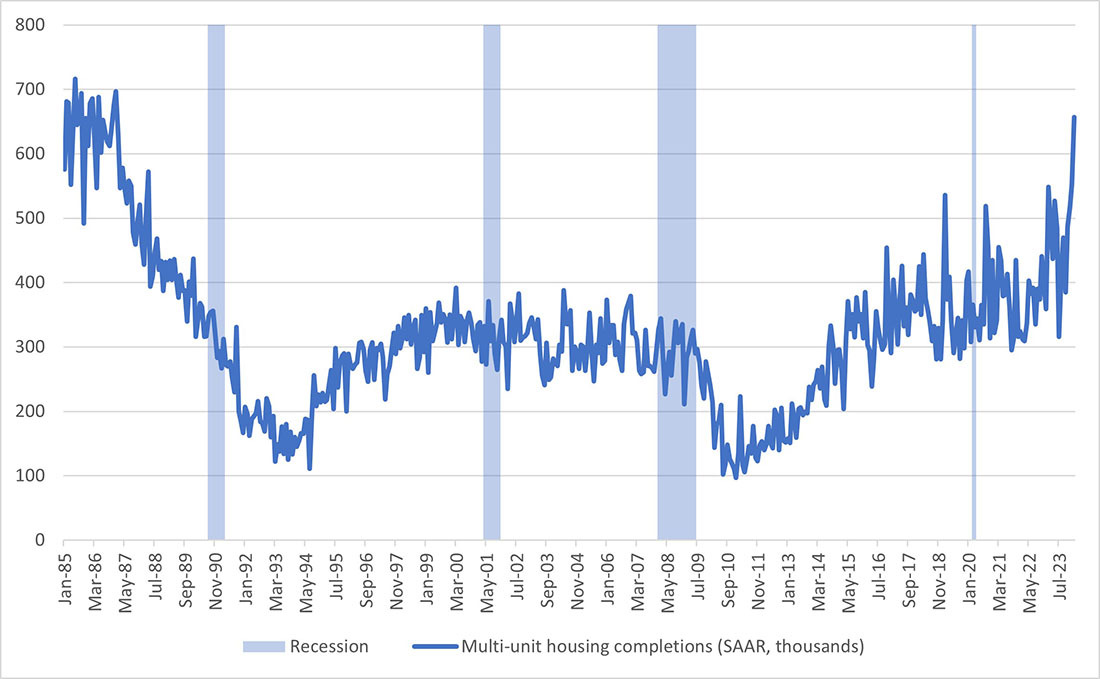

The earlier pandemic surge in multifamily starts and permits beginning in 2021 and lasting into 2023 is contributing to the current weakness in construction activity. Properties started during that surge are now being completed, driving multifamily completions to their fastest pace since 1987, as seen in Figure 4 below. In February, completions of multifamily housing structures rose 18.8 percent to a 657,000-unit annual pace, the fastest since January 1987. With so much supply coming into the multifamily housing market, builders now seem to be pulling back until demand comes back into better balance.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.