Buyers vs. Sellers: Whose Housing Market Is It Anyway?

The housing market has boomed during the pandemic, but data over the past few months have been more mixed. Although new home sales rose 1 percent monthly in July to a 708,000 seasonally adjusted annual rate, it was the first increase after three straight months of declining sales, and the pace of sales was 27.2 percent slower compared to the same month last year. Existing home sales increased in June and July, after dropping 13.2 percent between January and May of this year, but are below the pace we saw at the end of 2020. Is the bumpiness in the housing market the result of weaker demand or lower supply? In this post, we'll take a look at the evidence on both sides and what it means for the housing market ahead.

"On the supply side, the news is filled with stories about home prices spiraling out of control."

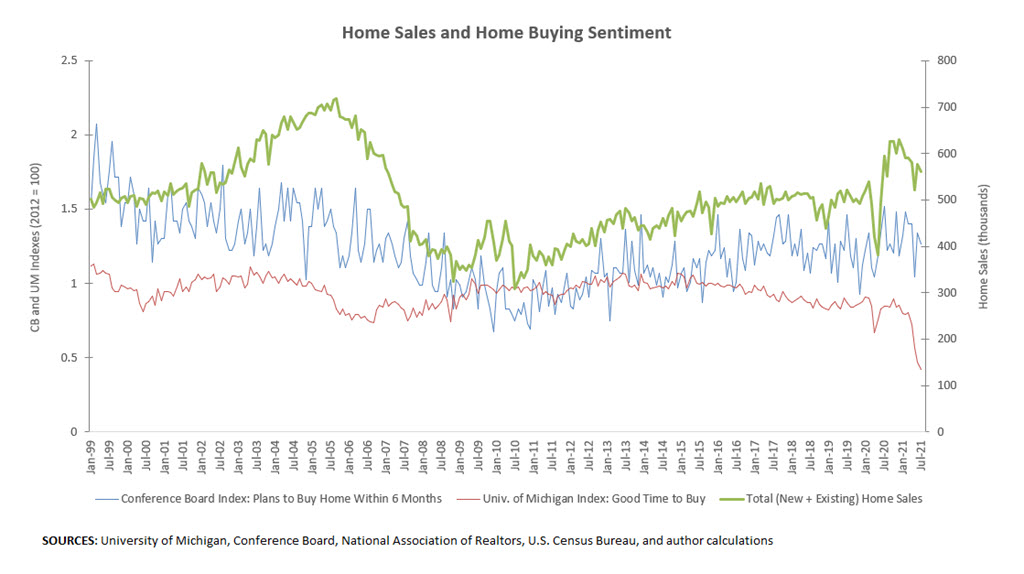

On the demand side, it's possible that buyers are becoming more discouraged in their home searches. The University of Michigan's Survey of Consumers found that in August, 65 percent of respondents indicated it was a bad time to buy a house because prices are too high, compared to 4 percent who held the opposite view. (In contrast, a record high 83 percent of respondents believed it was a good time to sell a home). However, in a separate survey of consumers' homebuying sentiment from the Conference Board (CB), 6.2 percent of respondents in August planned to buy a home within the next six months, which is in line with the 6.1 percent average during the five years before the pandemic (2014-2019). The figure below plots the Michigan and CB homebuying sentiment indices against total home sales since 1999. Over the sample period, the correlation between the CB index and total home sales has been 0.58, versus a correlation of -0.06 between the Michigan index and total home sales. (Both indices missed the housing boom preceding the Great Recession.) With sentiment surveys giving mixed signals, it's uncertain at this point whether softening demand will become the main headwind to the housing market in coming months.

On the supply side, the news is filled with stories about home prices spiraling out of control. From a basic economics perspective, rising prices and falling quantities suggest supply-side factors are mostly at play — and supply issues have clearly vexed the housing market. According to the National Association of Realtors, as of July, there are 2.6 months' supply of single-family homes on the market, versus 2.9 months' supply in July 2020 and an average 3.9 months' supply in 2019.

Limited supply has led to soaring prices and hampered affordability, especially for new home buyers. The S&P/CoreLogic Home Price Index rose 23.8 percent on a three-month annualized basis in June, the fastest growth rate for home prices since data series began in 1975. According to the National Association of Realtors, the median sales price of an existing single-family home was $367,000 in July, up 18.6 percent from the same month a year ago.

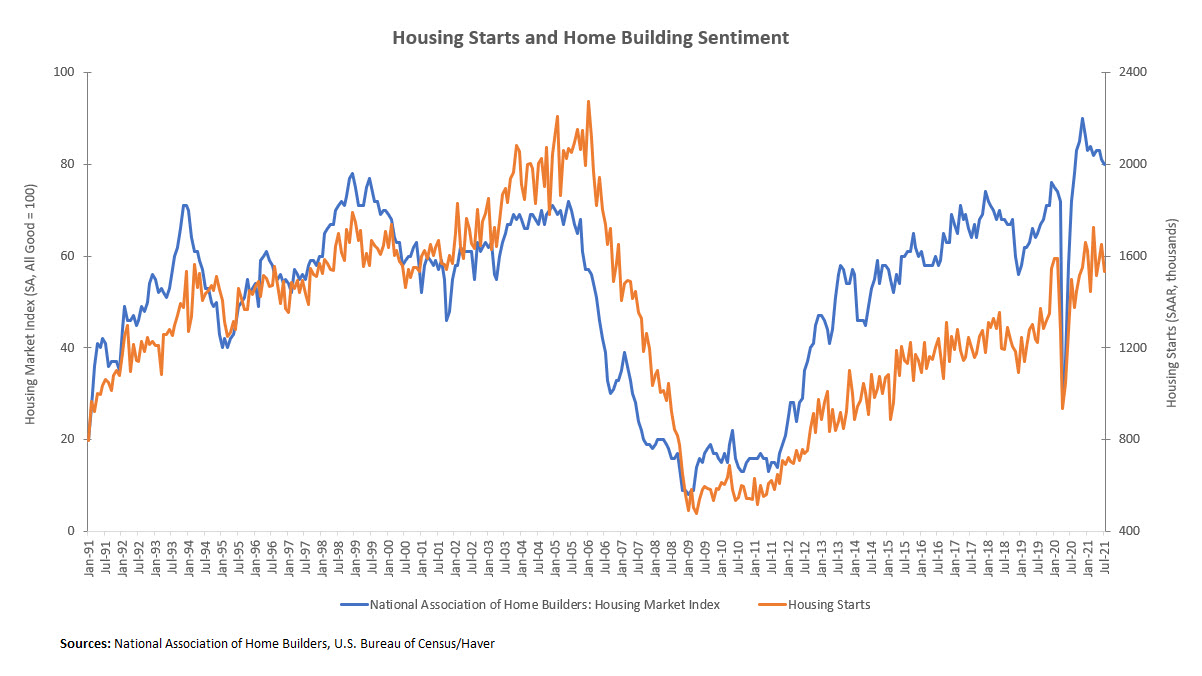

More housing supply could ease this pressure and lift sales. Although July's housing starts fell 7 percent monthly to a 1.5 million unit seasonally adjusted rate, homebuilders are still on track to complete 1.6 million homes this year, which would be the best year for housing starts since 2006. Home construction has been hampered by higher costs and slower delivery times for materials. A measure of construction costs from the U.S. Census Bureau rose to a 12.2 percent year-over-year pace in July 2021, the fastest 12-month growth rate since April 1980. But that pressure may ease as commodity prices fall — for example, today's lumber prices are less than a third of the peak hit in early May.

Finally, although homebuilder sentiment measured by the National Association of Home Builders has fallen for the fourth consecutive month, dropping to 70 in August versus 80 in July, this index is closely tied to home sales and remains at strong levels historically. (See figure below.) If tight housing supply is alleviated by an infusion of newly constructed homes, the strong housing market may last longer than some recent data points suggest.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.