What Has Driven Recent Multifamily Rent Growth in Major Fifth District Metros?

Earlier this year, our colleague John O'Trakoun authored posts examining the rise in multifamily unit completions nationally and the potential impact of that increased supply on multifamily rents. In this post, we'll look at multifamily housing markets in the Fifth Federal Reserve District's largest metros to discern what has driven recent multifamily rent growth.

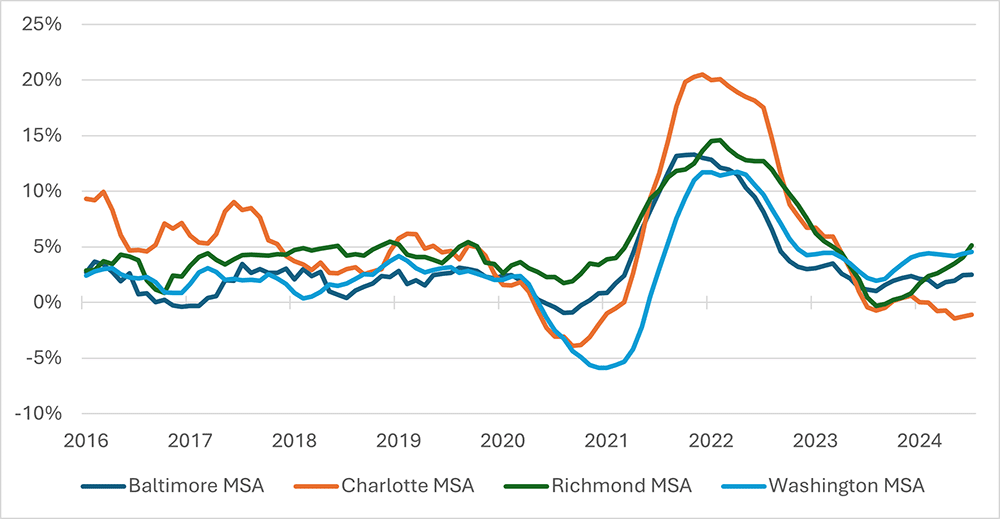

After comparatively modest (and negative, in some instances) growth in multifamily rents between mid-2020 and mid-2021, rent prices started to climb in the Fifth District's four largest metro areas: Baltimore; Charlotte, N.C.; Richmond, Va.; and Washington, D.C. Figure 1 below shows that Charlotte experienced the highest growth rate in multifamily rents between mid-2021 and mid-2022 among the four metros.

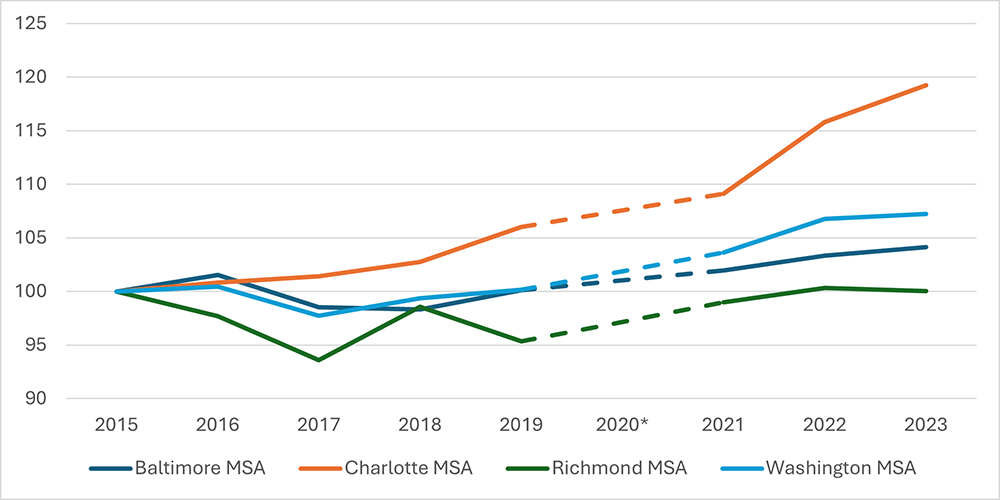

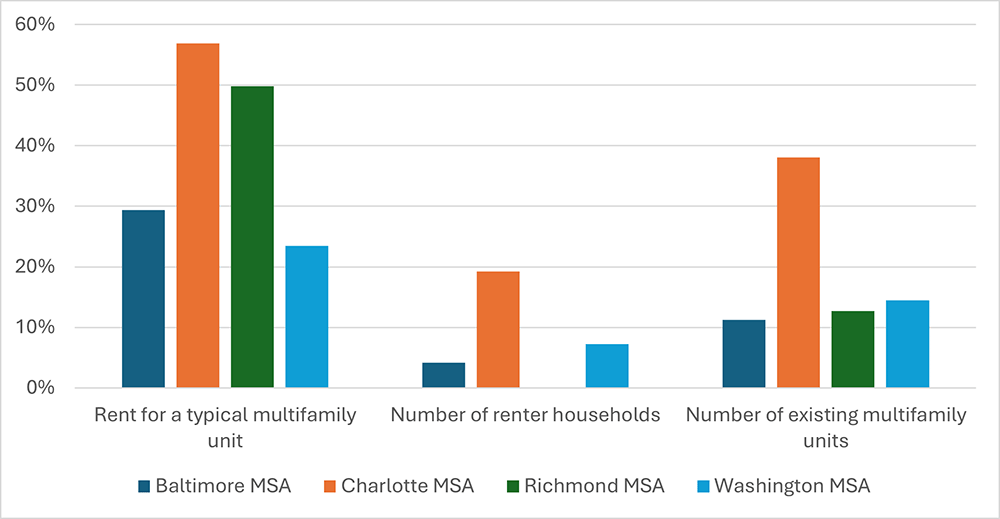

Differences in how demand for rental housing shifted across these four metro areas can help explain how rent prices have fluctuated. As seen in Figure 2 below, the number of renter households in Charlotte grew by over 19 percent between 2015 and 2023, nearly triple Washington's 7 percent growth rate and five times that of Baltimore over the same period. (The number of renters in Richmond stayed about the same.) This higher demand for rental housing in Charlotte — mostly from increasing domestic migration — can help explain the higher rent growth over the same period.

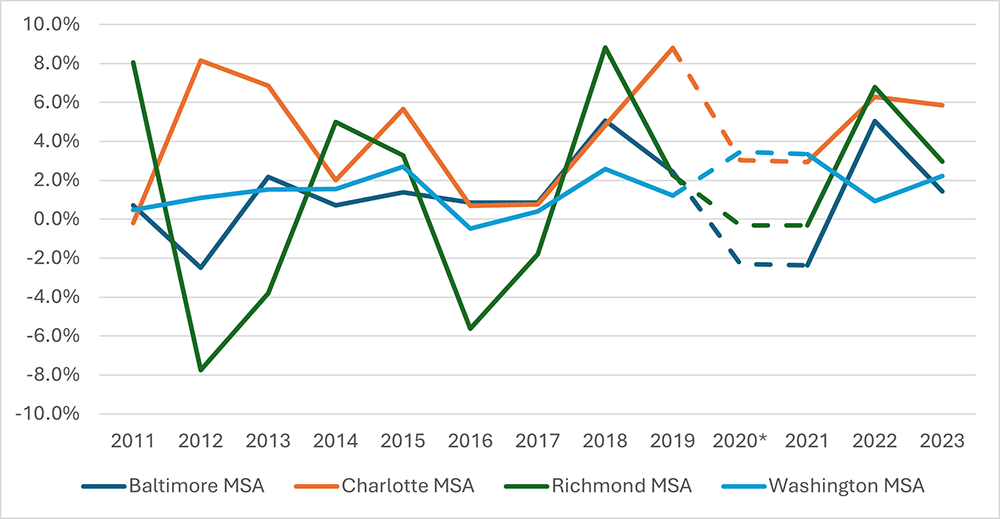

While growing demand puts upward pressure on rents, rising rents can in turn incentivize builders to increase supply. For this reason, multifamily building tends to be cyclical in response to market forces. This cyclical nature is apparent in Figure 3 below, which shows that growth in multifamily units fluctuated between low-growth and high-growth periods over the past decade, especially in Richmond and Charlotte.

The most recent upturn in multifamily unit growth for Baltimore, Charlotte and Richmond occurred in 2022. This rise in multifamily building followed 2021's postpandemic rise in nationwide housing demand, rents and overall inflation. Charlotte's faster growth in multifamily supply from 2019-2022 (as seen in Figure 3) seems to have resulted in cooler rent growth in 2023-2024 (as seen in Figure 1).

Taking a longer view, Charlotte has experienced the fastest rent growth among the four metro areas from 2015 to 2023, driven in part by the fact that Charlotte also experienced the largest increase in renters. But compared to the other largest metros in the Fifth District, Charlotte's rent growth appears modest relative to the growth in demand.

Notably, while the number of renters in Charlotte grew by 19 percentage points more than Richmond over this time, its multifamily rent grew by only 7 percentage points more than Richmond. This is because Charlotte responded to increased demand by building, expanding the supply of multifamily units by 25 percentage points more than Richmond. Had this level of development not occurred, rents would have likely risen much faster, potentially discouraging further in-migration to the area.

In summary, in the past couple of years, Charlotte's high multifamily rent growth appears to be driven by differences in demand via renter household growth, but this growth has been moderated by growth in multifamily supply.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.