Homebuilders’ Backlogs Could Befuddle Buyers

Homebuilders have soured on the idea of building more homes, which will limit options for buyers who are still shopping despite high prices and borrowing rates. And this limitation could persist for a while.

Last week, the National Association of Home Builders announced that its Housing Market Index fell for the ninth straight month in September to 46, its lowest level since May 2014. The index is based on a survey of NAHB members' views on market conditions in the present, members' expectations for the next six months and forecasts for the traffic of prospective buyers of new homes.

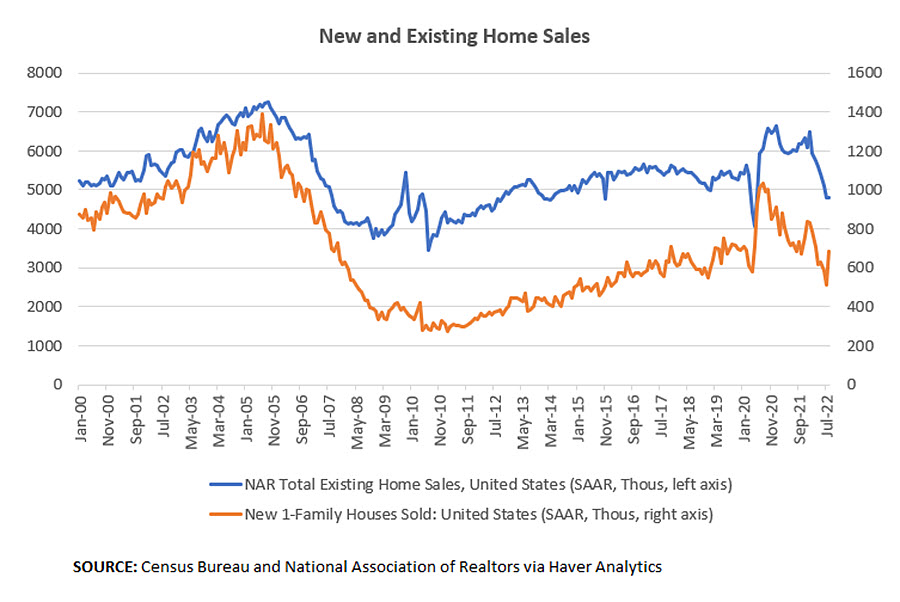

Homebuilder sentiment is trending down at the same time monthly home sales reports have been deteriorating, as seen in Figure 1 below. New single-family home sales have fallen from a pandemic-high pace of 1.0 million seasonally adjusted annualized sales in August 2020 to a 685,000 seasonally adjusted annualized rate in August 2022. Sales of existing homes have fallen from a pandemic-high annualized pace of 6.7 million in January 2021 to a seasonally adjusted annualized rate of 4.8 million in August 2022, the seventh straight month of slowing existing home sales.

Home prices are beginning to decline as well, although some of the major home price indexes are released with a significant lag. According to a national home price index published by S&P and CoreLogic, home prices fell 0.8 percent in July 2022, though they remain up 16.1 percent versus a year ago.

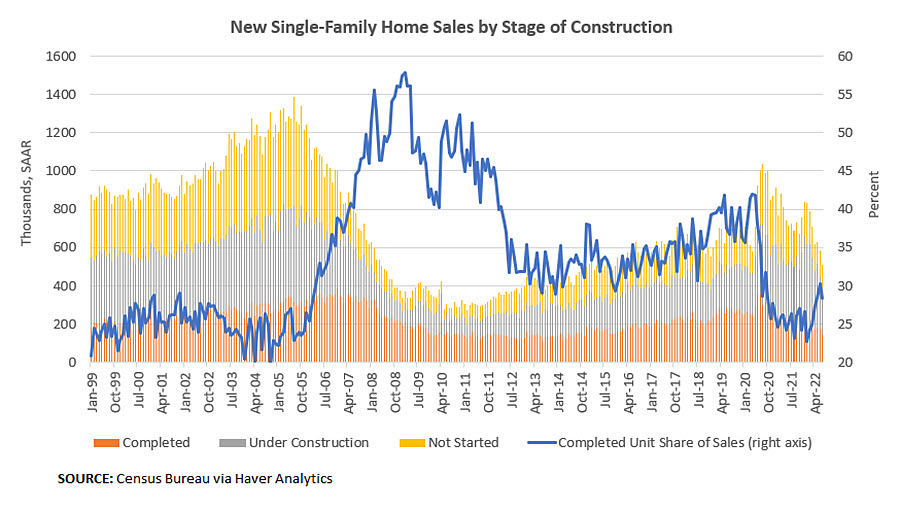

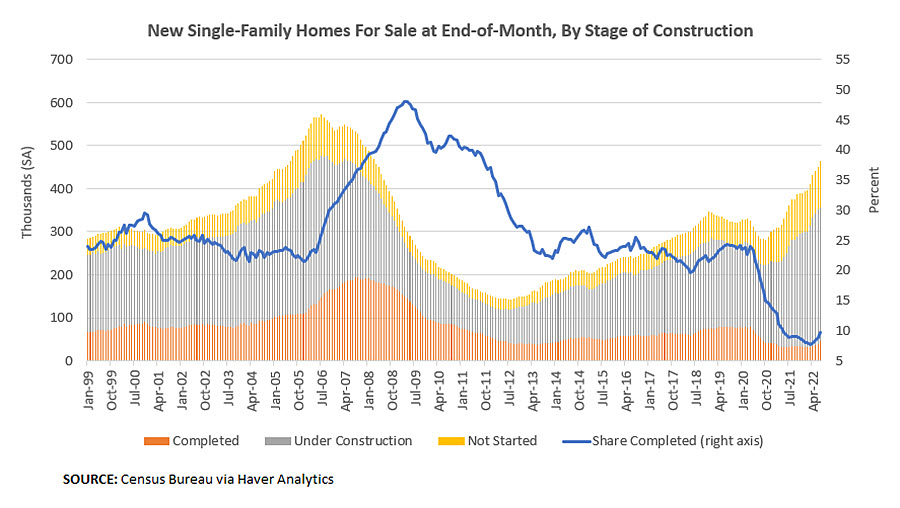

In an environment of weakening buyer demand, homebuilders will probably turn their attention to clearing out a backlog of unfinished homes. As shown in Figures 2 and 3 below, there is a backlog not only in the construction of homes for sale at the end of each month but also of homes that have already been sold.

Figure 2 shows that, among new homes sold in July, only 28.4 percent were completed with the remaining under construction or not started, compared to an average completed share of 38.7 percent in 2019.

Figure 3 shows that, among new homes for sale by month-end, the share of homes completed was 9.7 percent as of July, compared to a 2019 average of 23.5 percent.

With the "finished" share of already-sold houses and for-sale houses looking depressed relative to their pre-pandemic benchmarks, homebuilders are grappling with particularly challenging backlogs at this time. This suggests it's unlikely we'll see the housing market quickly switch to a world where new homes are back in abundant supply.

For prospective buyers who remain undeterred by high interest rates and home prices, the homebuilder pivot towards clearing out backlogs instead of starting new builds could prolong an environment of limited inventories and housing options. Builders dealing with a backlog of uncompleted projects will likely prioritize those jobs in Figure 2 that already have committed buyers. If homebuying sentiment deteriorates further, some of the incomplete or not-yet-started builds shown in Figure 3 could even be cancelled altogether.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.