The Housing Market and the Pandemic

Housing construction and sales activity matter a great deal to the U.S. economy as a whole, as they account for 4 percent of gross domestic product (GDP). On an individual level, too, the housing market is economically important; the largest asset holding of many Americans is their house. Thus, economists and policymakers at the Richmond Fed and other institutions closely track housing market activity through a variety of indicators.

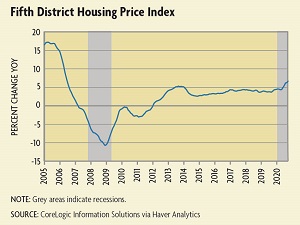

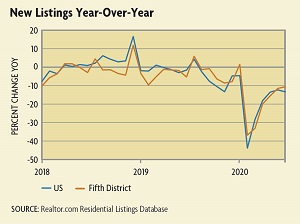

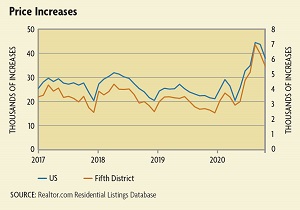

While the housing market is integral to the economy, it does not perform the same way in every economic downturn. For example, weakness in the housing market was a major contributor to the Great Recession of 2007-2009, but that was not the case for the current pandemic-induced downturn. In addition, while the housing market continued to weaken throughout the Great Recession, it has remained relatively strong this year despite the significant decline in overall economic activity and the spike in unemployment in the spring. Both in the United States as a whole and in the Fifth District, the housing sector has done better than other industries, such as leisure and hospitality, that were more directly affected by the virus (such as through shutdowns). There were some negative effects on the housing market early in the downturn in terms of new construction and home sales, but both quickly bounced back in the summer. Demand for homes has been strong through most of 2020, and house price growth has remained solid throughout the year.

As it does in other times, the Richmond Fed has been monitoring how the housing market has fared in the pandemic. Measures of housing prices are among some of the best gauges of the strength of the residential real estate market; they reflect demand and supply in the market and underlying influences such as interest rates and access to mortgages. Housing construction can be examined in terms of its contribution to economic growth and employment. Data on new permits and housing starts provide insight into housing supply. With respect to selling a house, there are also data available on the current number of listings and the average time it takes to sell. The Richmond Fed also relies on observations from real estate agents within the Fifth District for a better understanding of what buyers and sellers are experiencing in the market and expect to see in the future.

"Mortgage and Student Loan Forbearance During the COVID-19 Pandemic," Economic Impact of COVID-19, August 2020

"Federal Reserve MBS Purchases in Response to the COVID-19 Pandemic," Economic Brief No. 20-08, July 2020

Residential Investment

The economic situation in the United States in the second quarter of 2020 was marked by shutdowns and uncertainty, and the housing market naturally was affected. According to the Bureau of Economic Analysis, residential fixed investment at the national level (spending on new construction, improvements, and activities related to sales transactions) fell by 35.6 percent at an annualized rate in the second quarter of 2020. During that time, spending and investment weakened in many industries, as overall GDP in the second quarter fell 31.4 percent at an annualized rate. The decrease in construction spending led to a decrease in employment in the construction market as well. Employment in the construction industry fell by 13.4 percent in the United States and 5.8 percent in the Fifth District in April. A large share of this came from the residential side, as employment nationally in residential contracting fell 14.9 percent (11.5 percent for single-family homes) and employment in residential specialty trade fell by 14.7 percent in April.

The third quarter saw economic recovery, as GDP rebounded by 33.1 percent, although it remained below its first-quarter level. Contributing to this overall GDP recovery was recovery in the housing market, which was evident as residential fixed investment increased by 62.3 percent at an annualized rate, surpassing its first-quarter value. Much of the rebound observed in the data can be attributed to broker's commissions and ownership transfer costs, reflecting the significant increase in home sales activity over the summer.

On the employment side, the construction industry rebounded quickly and has seen an overall gain of jobs, both nationally and in the Fifth District, every month since April. In November, employment in residential building and specialty trades was nearly back to pre-pandemic levels. November employment in the residential construction industry was up 17.2 percent since April in the United States. The story of weakening and rebounding employment in construction has also been echoed by the Richmond Fed's business contacts in the Fifth District.

Starts and Permits

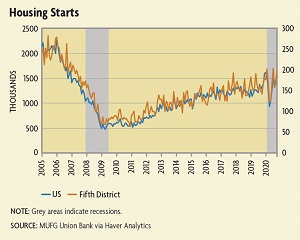

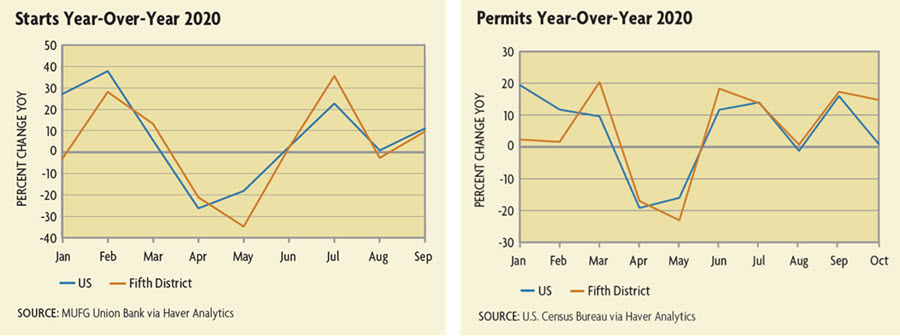

Spending on residential construction depends on houses being built, which is why market observers look at residential permitting data. The U.S. Census Bureau releases monthly data on the number of housing permits issued at the national and state level and the number of housing starts nationally. State-level data on the number of housing starts — actual construction — are published by MUFG Union Bank.

Data on both starts and permits show early or anticipated demand for housing and are indicative of what home supply will look like in the coming months. Permits can be viewed as leading indicators for starts and starts as leading indicators for completions. For an idea of a typical lag from this time until a house is on the market, according to the U.S. Census Bureau, in 2019 the average time between issuing a housing permit and the start of construction was just over a month and the average time between a start and completion of the home was seven months.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.